It’s the oldest law in finance.

When demand is much greater than the supply of a product, service or commodity…

The price must go up.

And that is the exact situation happening in the uranium market right this second.

In fact, I think we’re standing in the middle of a perfect storm that could send the uranium price soaring.

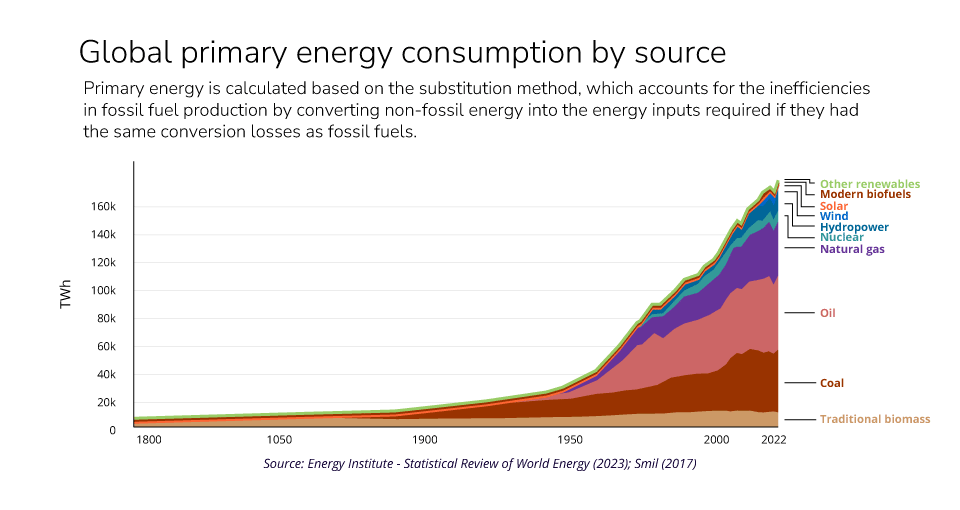

First, you’ve got the demand side of the equation.

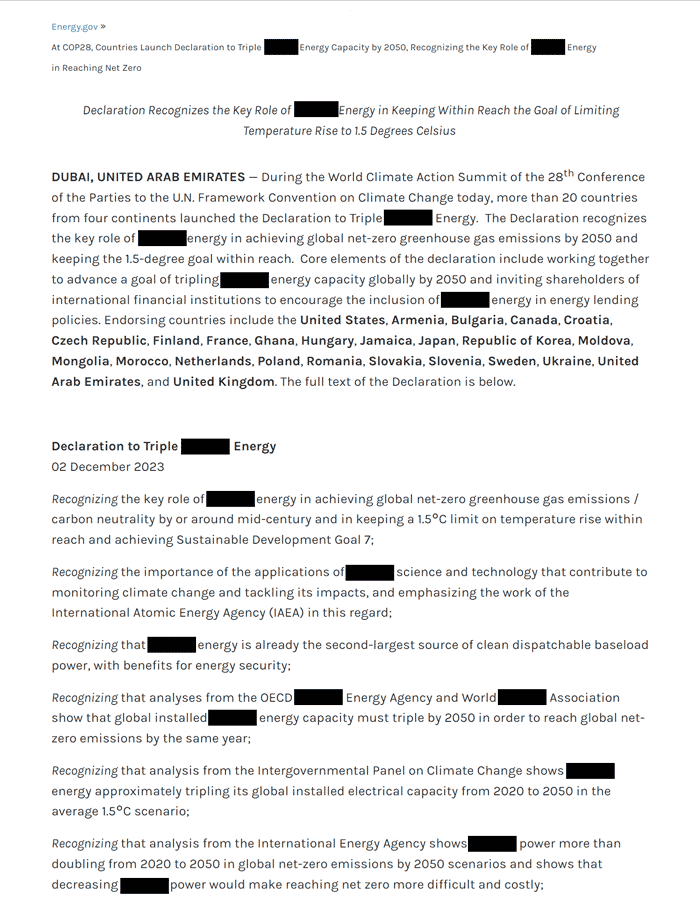

As you’ll recall, more than 83 countries around the world have made building out nuclear capacity a strategic national interest.

As we speak, more than 500 nuclear reactors are in development pipelines.

Just those projects alone equate to a uranium demand DOUBLING in the years ahead.

But where things get really exciting is when you look at the supply side of this opportunity.

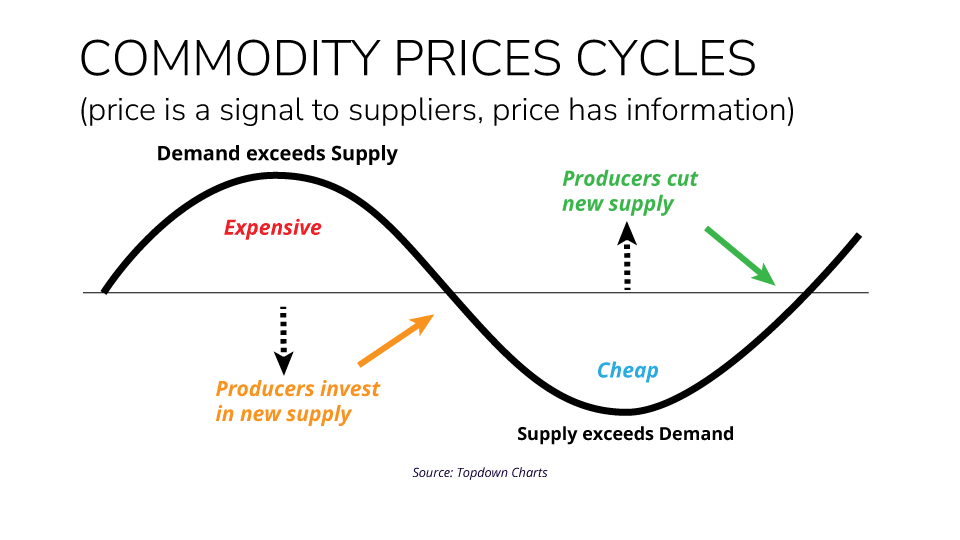

Because when it comes to supply and demand, there’s something that most people completely miss.

You see, when demand for something increases, it actually entices business and entrepreneurs to create more of it.

Or in other words, an increase in demand automatically triggers an INCREASE the supply.

The knock-on effect of this is for the price to naturally be brought back into equilibrium.

In economics, this is called the supply and demand curve.

It makes intuitive sense, doesn’t it?

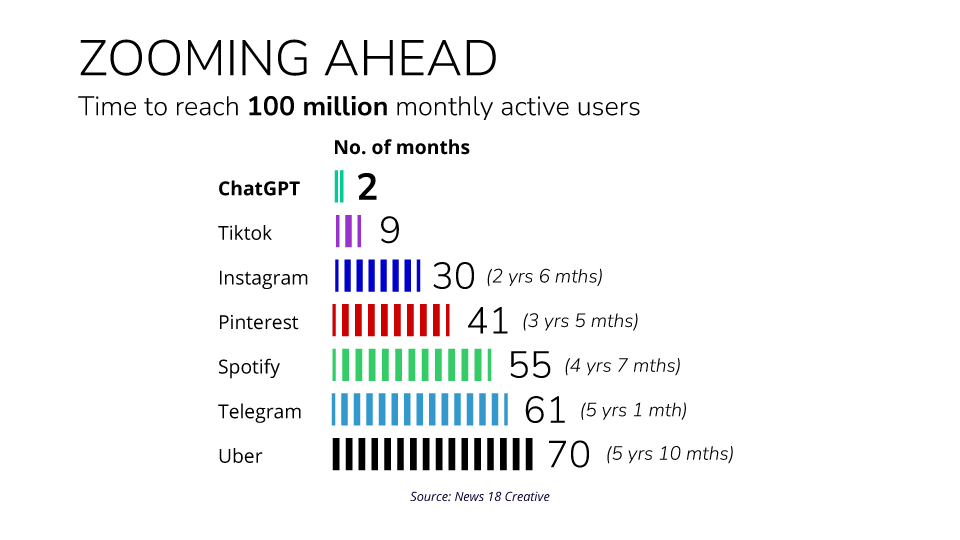

After all, when the iPhone debuted in 2008, it was the first smartphone on the market.

But then other tech manufacturers saw its meteoric rise in sales numbers. And they decided to get in on the game. Samsung, LG, HTC and a host of other manufacturers raced to release their own versions.

As a result, Apple may have been able to charge more for their iPhones as demand for them has exploded. But not an extortionate amount. When the first iPhone was released in 2008, Apple charged an inflation adjusted $733.

The price of an iPhone today is $799.

There are numerous other examples of this.

Be it fashion designers racing to copy the latest trend…

Or coffee shops scrambling to fill demand for oat milk lattes…

But I can tell you the uranium market isn’t and won’t be one of them.

It is a special case.

And that is because, on average, it takes 15 years to build a uranium mine.

That means, no matter how many mining site feasibility studies are undertaken…

No matter how many mining applications are submitted…

No matter how many holes are dug…

It will be over a decade before ANY of that supply comes online.

And that means you have a rare window of opportunity to claim your stake in the uranium boom – before the price REALLY takes off.

Forecasts are not reliable indicators of future results.

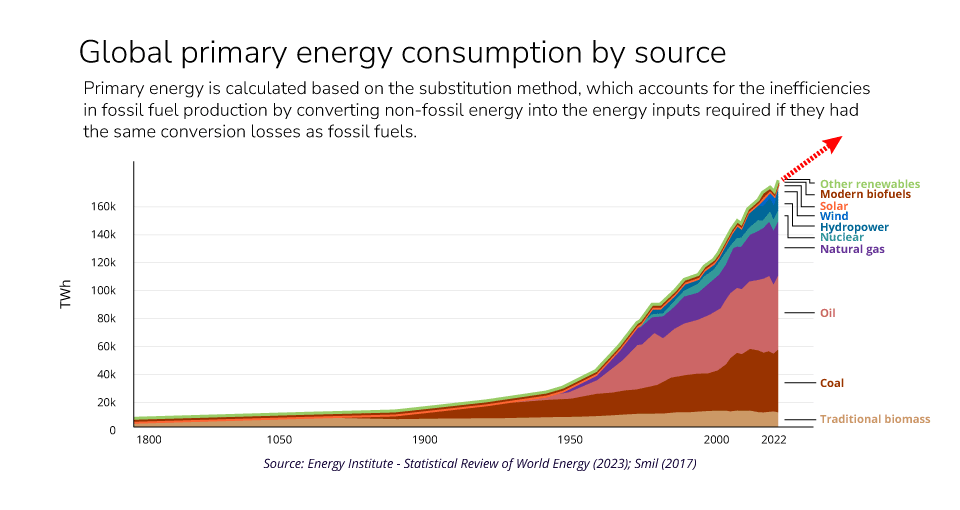

Now, full disclosure: the uranium price is already moving higher.

Since October of last year, the price has already increased 35% from $70 per pound to $95 per pound.

But if my analysis is correct, this is just the beginning.

In fact, analysts at Bank of America recently released a note saying “the uranium market is only getting hotter”…

Legendary resource speculator Lobo Tiggre’s average return outstrips the S&P 500 by more than 5-to-1. He says we are entering a “multi-decade bull market” which he is putting “a lot of money into”…

And perhaps the most iconic living investor in the resource game, Rick Rule, recently released a note saying, “Uranium… is now firmly in bull market territory and we believe this will continue”.

So what’s the best way to play the uranium bull?

In your second report, The Uranium Bull Market Playbook, I will show you.

First off, I want to give you my #1 uranium stock for 2024.

It’s a way to track the price of uranium as it moves higher. And a way to do so, without the risks that come along with exploration, mining, developing or processing of uranium.

Now, for obvious reasons, you can’t buy uranium on the spot market.

So the first uranium investment I want to send your way is what I consider the gold standard uranium trust.

This company’s business model is two pronged.

First, it has navigated the regulatory hurdles to be able to buy up physical uranium oxide.

Second, it buys uranium through its deal with largest producer of uranium in the world, in anticipation of the rising price.

This company has no debt.

It recently received $150 million worth of outside backing from investors.

And I reveal the full details about it – along with its name and ticker symbol – in your second free special report, The Uranium Bull Market Playbook.

I don’t think there’s a smarter financial move in the world today than investing in this company.

It should form the core of any uranium stock portfolio.While no investment is without risk, I believe this is the safest, most sure-fire way to take advantage of the uranium boom. Of course, as with all investing, your capital is always at risk when you invest. There is no such thing as a guaranteed return and it’s possible to lose money. You should always understand the risk of any investment, and be comfortable with them, before you take the plunge.

The second stock I want to introduce you to has a vastly higher risk profile.

Because of that it has some of the highest upside potential I’ve ever come across.

At less than £100 million, its market cap is extremely small.

And that makes it so price sensitive that even a small influx of capital could send it soaring multiples higher. It will experience volatility in price, which means large swings up and down, and it could also be illiquid, which makes it harder to buy and sell than larger stocks. It’s not for the faint hearted. This type of higher risk won’t be for everyone…

It also means that I have to be extremely careful about what details I reveal about it in a public forum.

To do otherwise would risk letting the cat out of the bag. And send this company racing higher before any of my readers had managed to move on it.

So with that said, here’s what I can tell you about it…

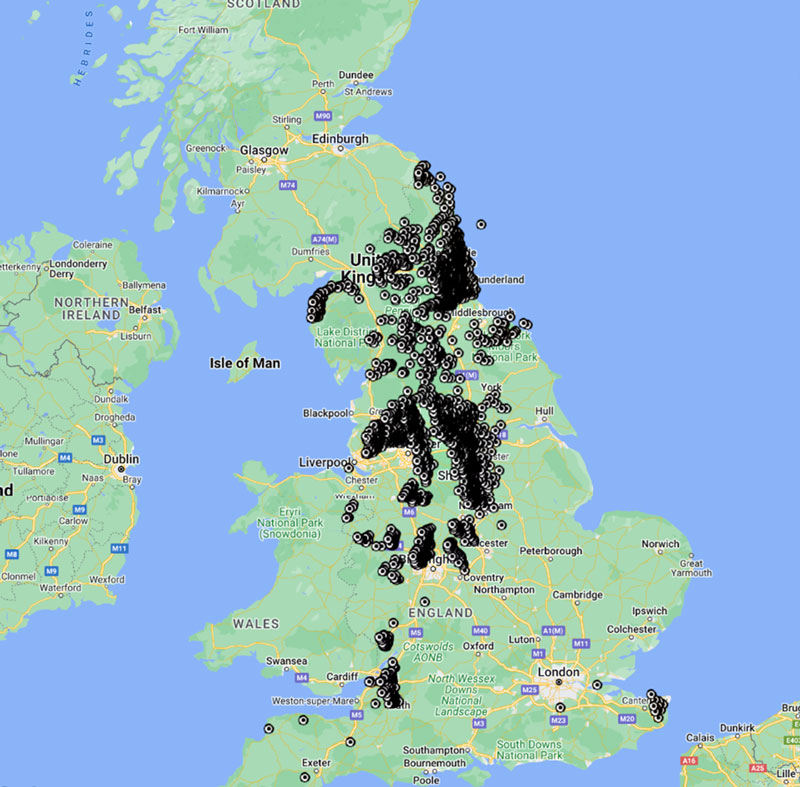

Firstly, this stock is a uranium explorer.

Its modus operandi is to find places where uranium is hidden underground. Once they find a good spot, they can dig and collect the uranium.

What’s great about uranium explorers is that they have built in leverage to the uranium price. Put simply, for every dollar rise in the price of uranium – a quality uranium explorer can shoot far higher.

And this stock has three specific qualities that make it a top-tier explorer:

- It has a blockbuster management team with a proven track-record of successfully taking several uranium companies from explorer to producer status.

- It’s in possession of a large, proven, deposit of uranium. In fact, at 12.4 million pounds, this company is sitting on the lion’s share of deposits in one of the largest uranium rich areas in the world.

- It has a very low break-even point. This company becomes profitable when the price of uranium moves above $29.81/pound. With uranium prices hovering above the $90/pound mark at the moment, this company stands to make some very healthy margins.

But above all of that it has a fast-approaching catalyst.

An upcoming government decision that could instantly make the deposits this company is sitting on EVEN MORE profitable.

When that happens, it could send its share price VERTICAL.

Forecasts are not reliable indicators of future results.

Frankly, I think this stock is about to become a major new player in the uranium industry.

And when it does, it will surprise the investing world.

But it won’t surprise you. Not if you grab my brand new free report: The Uranium Bull Market Playbook.

The two resources I’ve just told you about will give you all the information you need to take maximum financial advantage of the shift to nuclear.

And these are the first two free reports I want to send you when you take a no-obligation trial to my technology stock advisory service, called Southbank Growth Advantage.

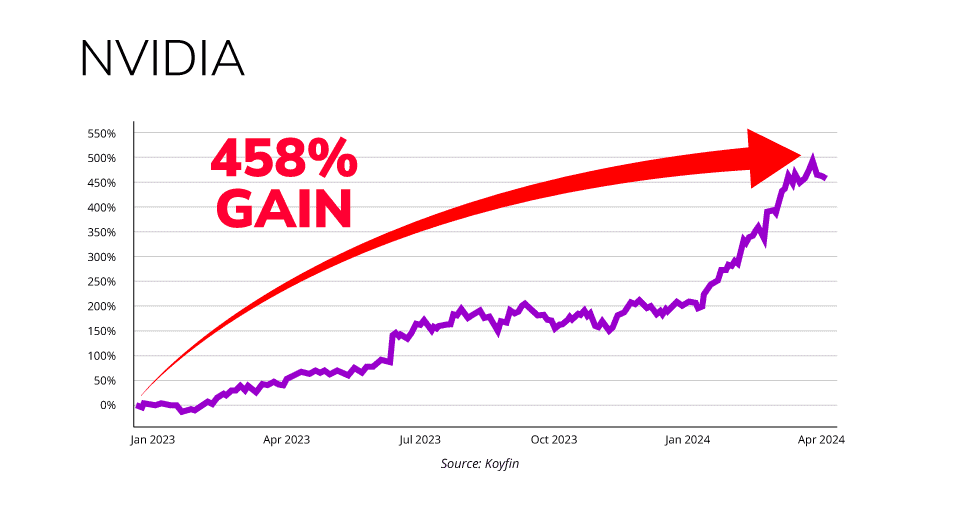

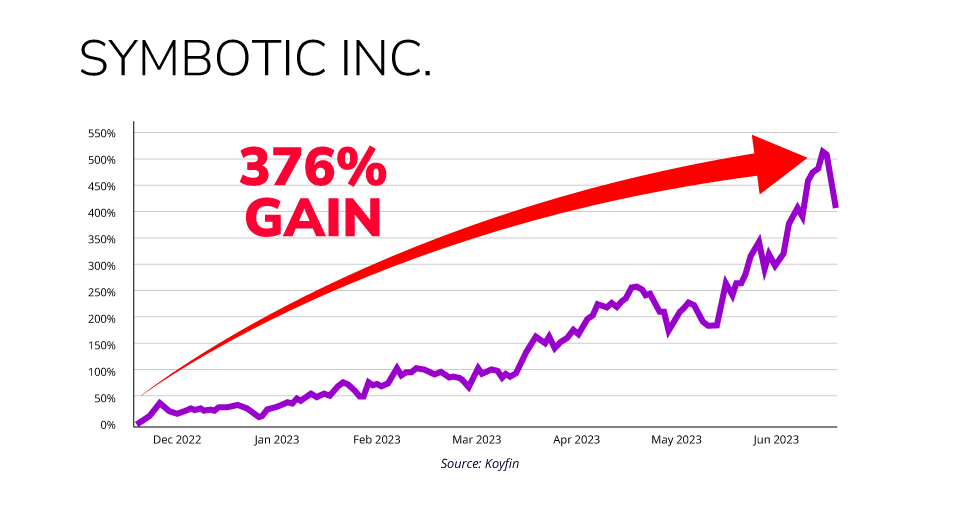

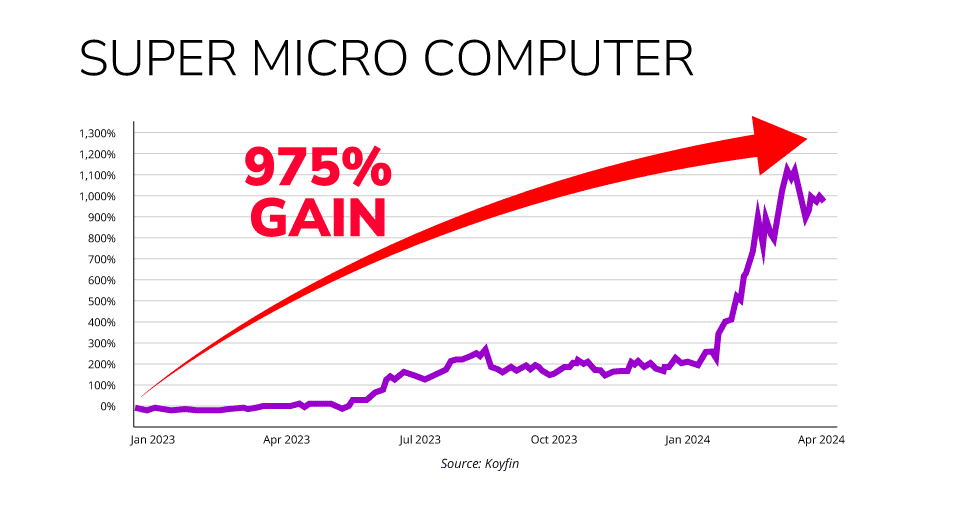

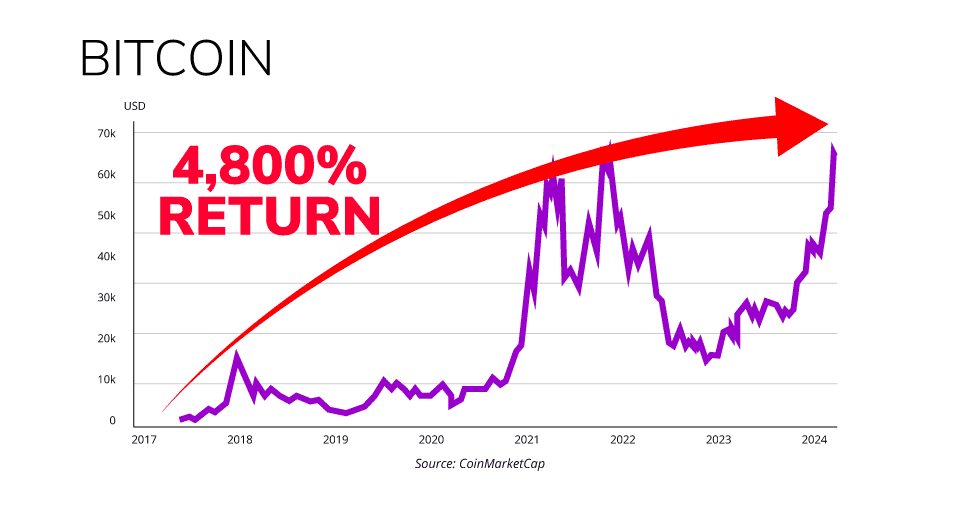

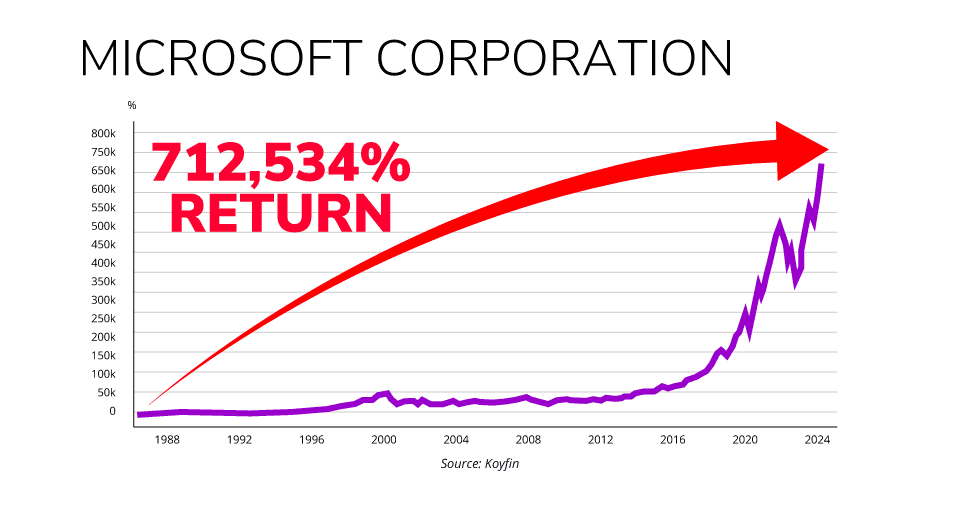

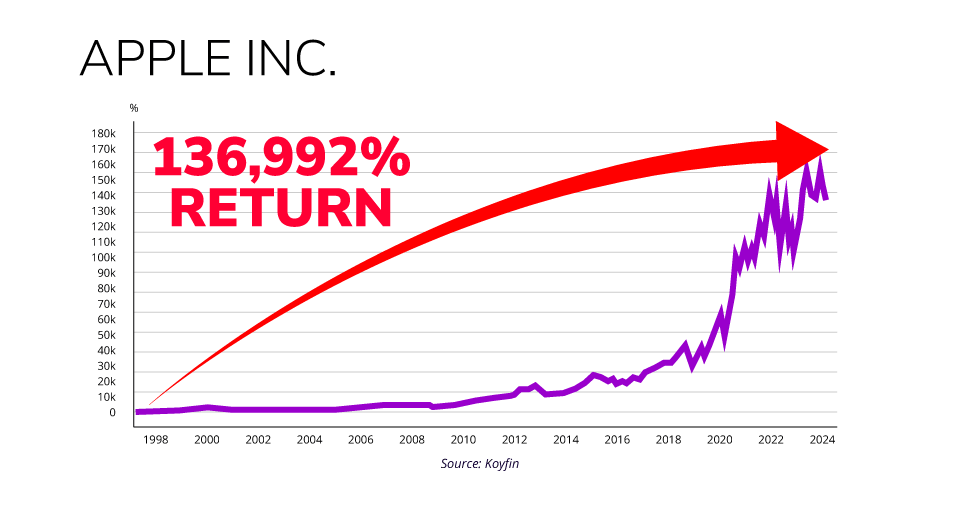

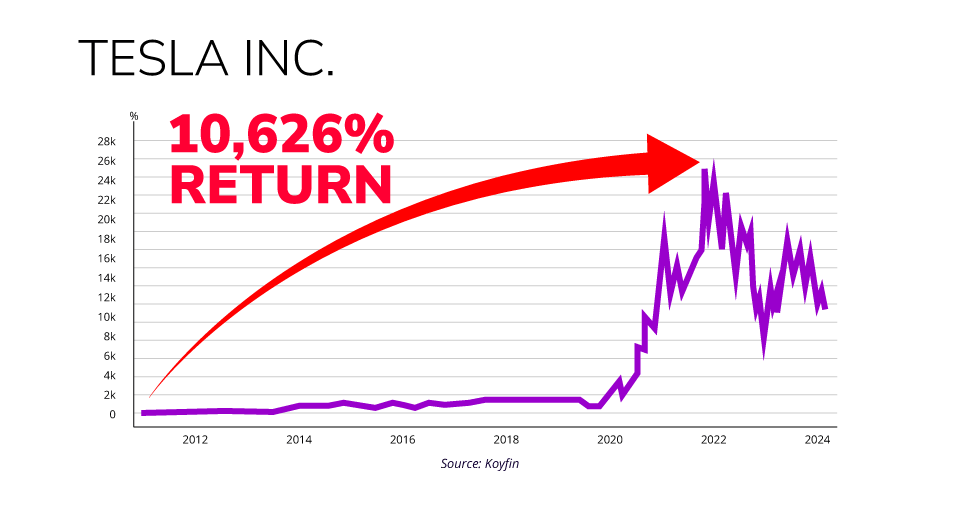

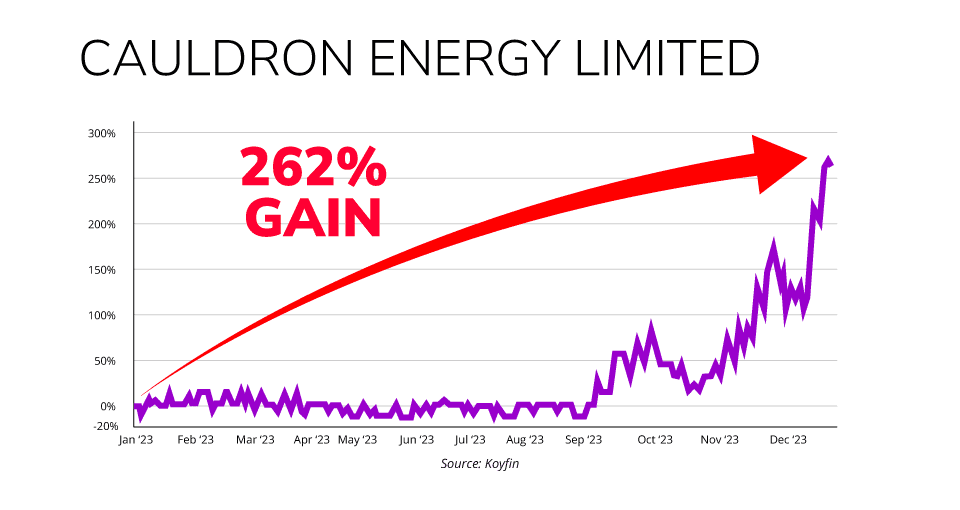

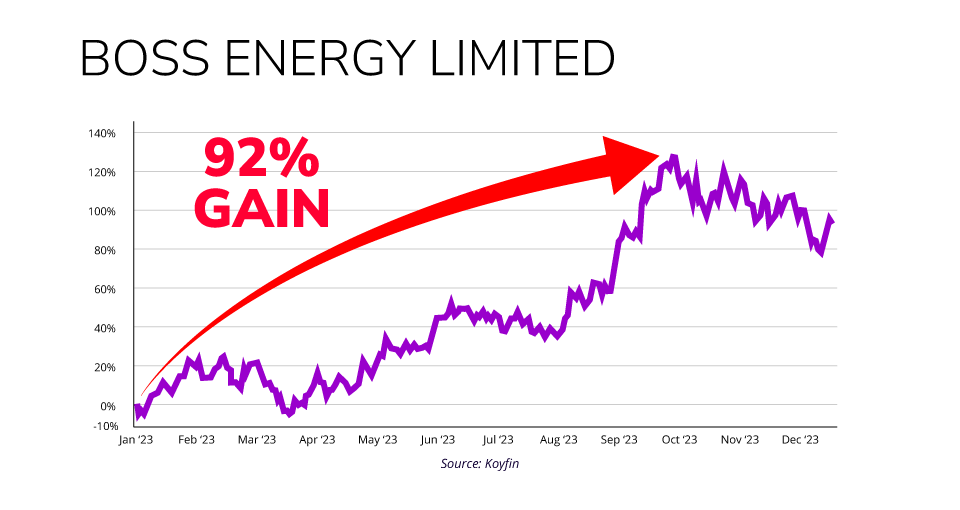

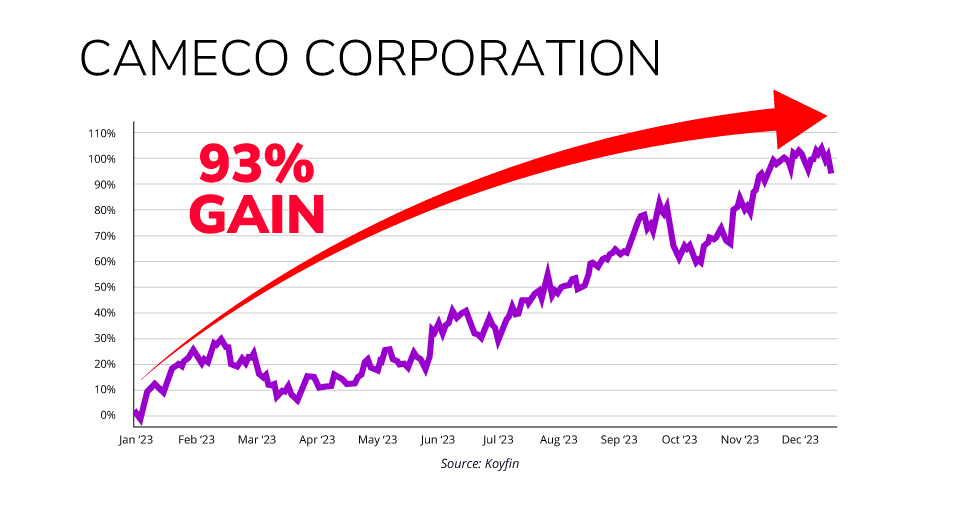

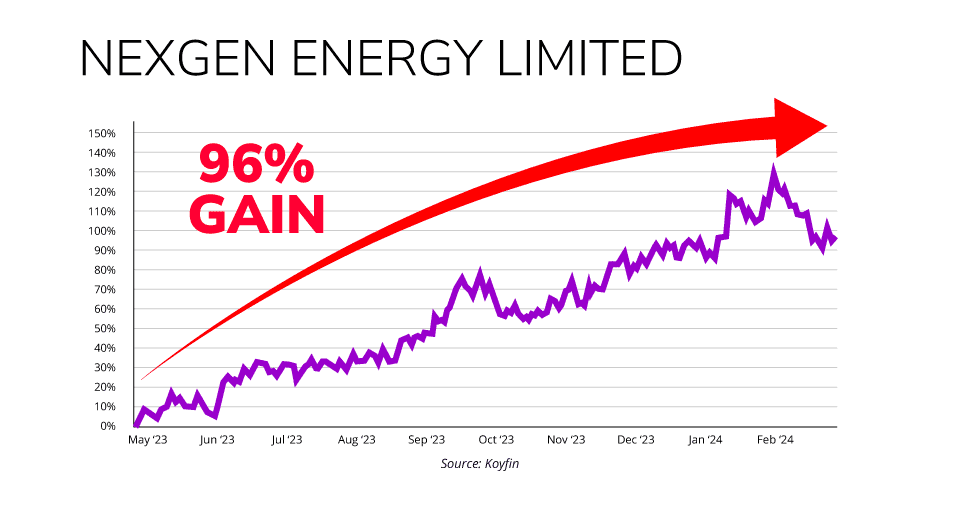

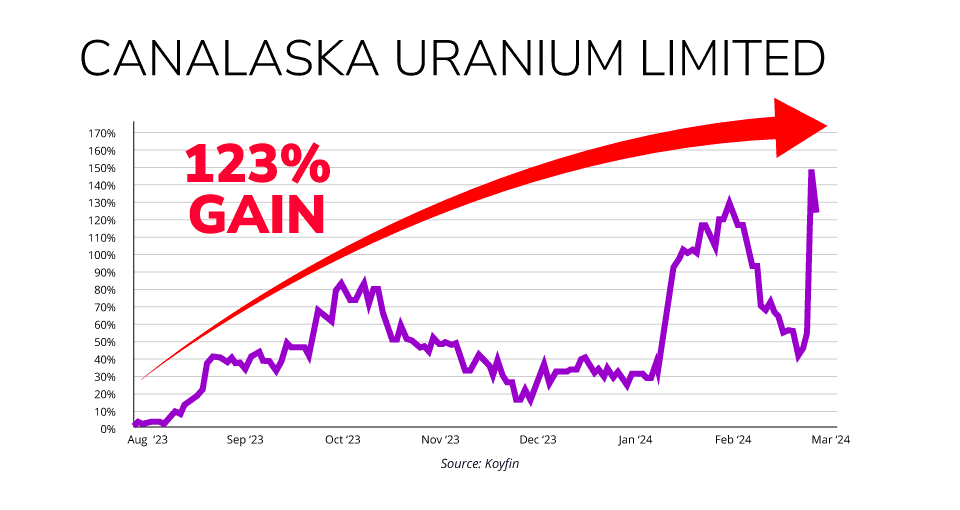

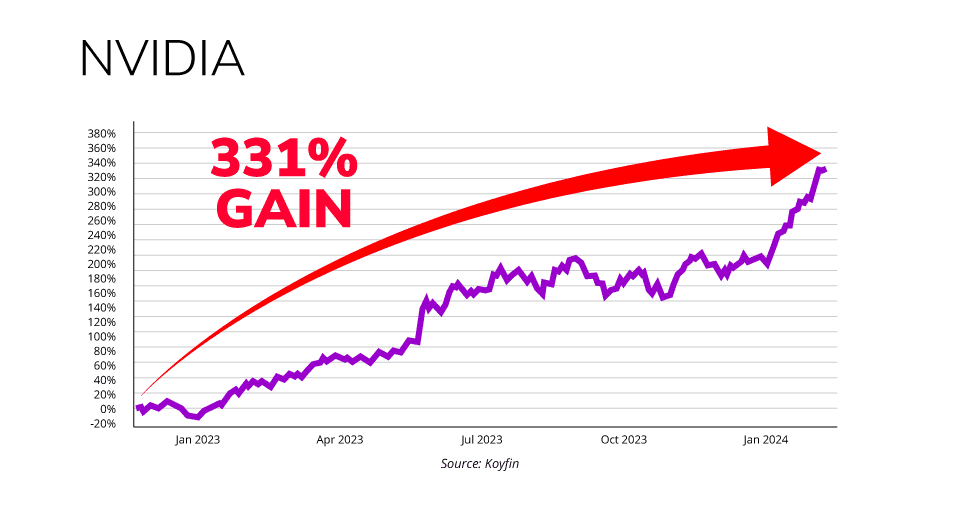

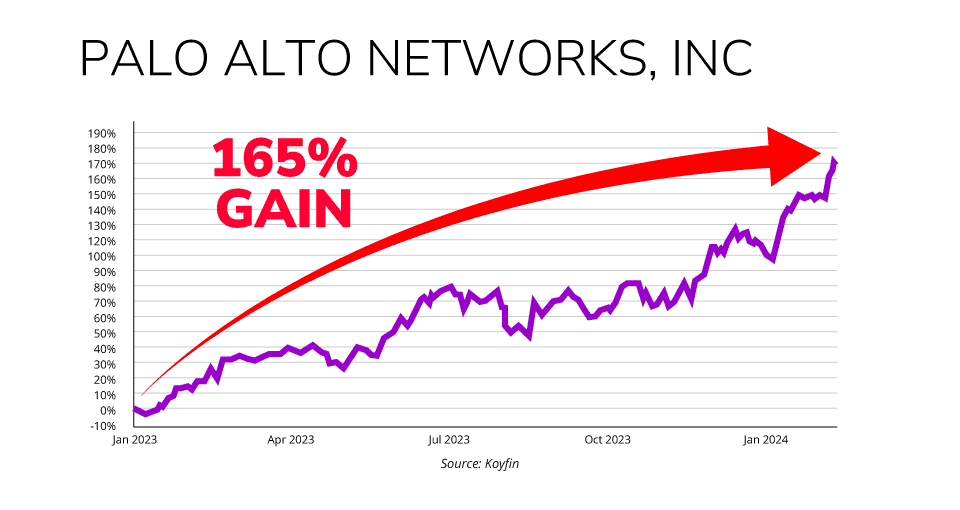

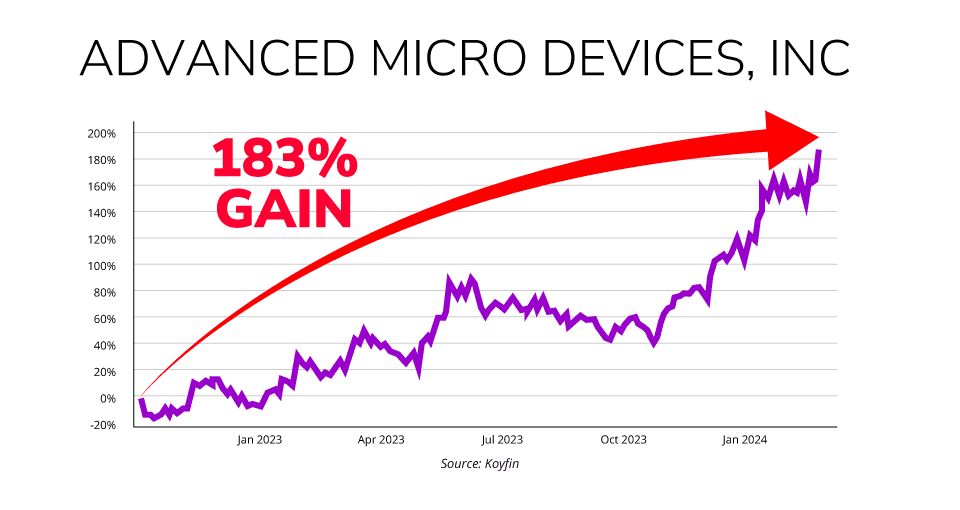

I’m not one to boast, but I hold the record at Southbank Investment Research for the largest investment return in the history of our business.

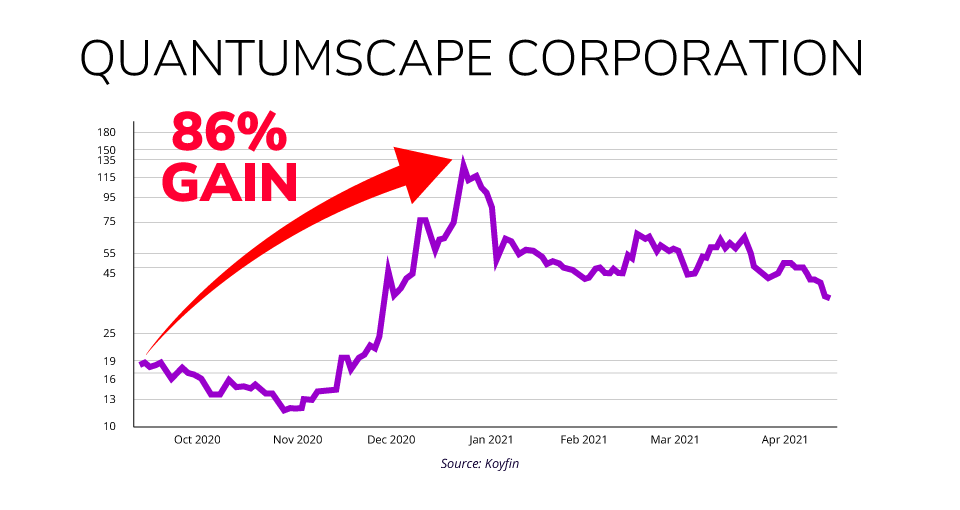

Through my investment services I’ve closed out no less than fourteen 100%+ returns…

And six 1,000%+ returns.

And as for the investments I’m still holding in model portfolios?

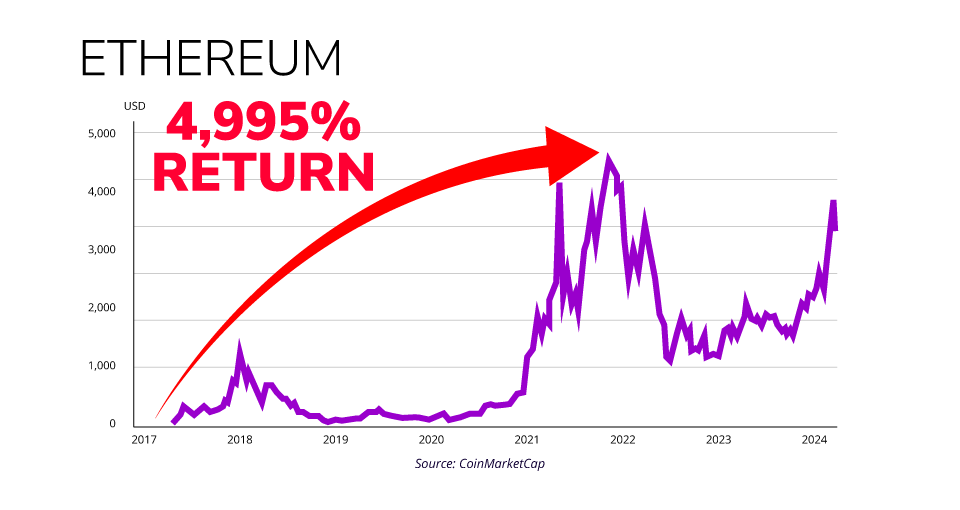

Two investments are sitting at more than 5,000% returns.

Past performance is not a reliable indicator of future results.

And in Southbank Growth Advantage you get to put my record-breaking expertise to work.

You see, I launched this service with one aim:

To help everyday investors – just like you – profit from the most lucrative growth opportunities on the market.

Here’s how it works:

On the last Thursday of every month, by email, I’ll send you my latest report and newest growth stock recommendation.

Each report is split up into two parts.

It starts with a deep dive on a tech trend that is in the process of repainting the world as we know it.

One week it may be augmented and virtual reality. The next it may be AI. The next it may be crypto or 3D printing.

Whatever the subject matter, by the time you’re finished reading, you’ll know more about it than 99% of investors.

The second part of your report is all about making money. I’ll give you a full run-down of the highest potential stock in the space. And why it could be on the cusp of a huge price rise.

The stocks I’ll be recommending to you come in ALL shapes and varieties. They tend to be on the smaller side. These stocks aren’t for the bulk of your money. They’re for the part of your portfolio that’s high risk… and high potential reward.

Because of their smaller size…. They’re subject to outsized price swings, both down and up. And they can be illiquid, which means they are harder to buy and sell when you want or need to. Risk appetite is a personal thing, and something you should consider carefully before taking the plunge with any investment. And always remember the golden rule to only ever invest money that you can afford to lose. Each report will have all the details and risks laid out for you to digest. You’ll have everything you need to make an informed decision.

So, all you have to do is sit back, relax, read and then decide if you want to invest.

Just like my current readers:

“Dear Sam,

On a personal note, this is the first time I have felt enthusiastic about saving in over 15 years...

The service is wonderful, and in my opinion represents fantastic value for money.

I just wish I had learned about it all ten years ago!...

I would like to take this opportunity to say that the service you have provided has already changed my life.

Having read almost all of the literature available, I have found myself a different man.

I am excited by the world of finance, not intimidated by it...

Now everything has changed.

I am living my best life...

To put it simply, my brain works differently now because of the lessons you have taught me, and for that I will be eternally grateful.

Be assured, I have recommended you service to countless others...”

C.C.

When it’s time to sell the stock – and all going to plan – bank a large profit, you’ll be the first to know about it.

I’ll send you a sell alert informing you to exit your position. You’ll also get access to the Southbank Growth Advantage Members' Area.

Here, you’ll find the entire archive of every report I’ve ever published. Plus this is where you’ll find the full buy list of open and closed positions.

Normally, access to my work costs £199 per year.

And at that price it’s an absolute steal – especially when you consider the potential returns you could see of the back of my recommendations.

But today, you can try my flagship service under no obligation whatsoever and at a special introductory discount.

Before I get into the details about that though, I need to tell you about the third – and final – step I advise you take: