Paolo Cabrelli,

Publisher, Southbank Investment Research

Dear Friend,

Imagine there’s a map on the table in front of you.

It depicts the financial world…

But the financial world as you’ve NEVER seen it before.

Everything important is on there. Stocks, bonds, property, commodities, gold… every asset class you can think of.

It’s all there.

Except, this map does something unusual with it.

It turns those THOUSANDS of data points… conflicting information… and market noise… into something simple and elegant.

More than that… it shows you exactly where the big money could be going to go next.

It reveals what to buy, what to avoid like the plague, and how to predict the next major market trend – before it takes off.

Sitting there, looking at the map… the world of finance has never felt so SIMPLE.

Instead of chaos… you see order.

And instead of noise… you see opportunity.

I’m writing to you today because – as strange as it sounds – this map exists – and you can use it to maximise your chances of making money all the way through 2021 and into 2022…

Forecasts are not reliable indicators of future results.

In short, it answers the big question every investor in Britain has today:

With the Covid-19 fallout… money printing… global debt…and inflation rising…

Where on earth do YOU put your money right now?

I’d like to send you a valuable document that contains the answer.

It’s been put together by a man with twenty years’ experience managing $3 billion in client capital in the City.

Forecasts are not reliable indicators of future results.

And if you want the chance to make returns in 2021 and beyond– potentially BIG returns – I believe you need to read it right now.

I won’t mince words…

Not since 2008 have we seen this much potential for instability and volatility in the markets.

The financial decisions you make over the coming weeks and months could still be impacting your financial situation in years to come.

We still have no idea what the eventual impact of Covid-19 will be on our economy…

Britain’s debt is growing at a rate of £5,170 per second …

And all that printed money hitting the financial system has finally caused the sleeping inflation giant to wake.

I believe that you need the right hand guiding you through what’s about to happen. To have the right information and insight, helping you take control of your financial future…

And find the opportunities that will, potentially, help you profit from these big swings in the market.

That’s what this man’s “Money Map” can do…

Forecasts are not reliable indicators of future results.

A word of warning: This “money map” does not contain any “big picture” political analysis. Whatever your political views… whether you’re worried or excited about the future… it doesn’t matter.

You want to make a good return on your money.

Frankly, if you don’t… you should stop reading now, go stash your capital in a bank account, and accept you may never grow your money significantly (or maybe even at all).

Still with me? Good. Because this is for people like you: people who want to grow their wealth regardless of the “big picture”, regardless of the political situation.

Of course, as any right-thinking investor knows, no investing is without risk which is why even with the help of this “money map” you should only invest money you can afford to lose.

If you don’t have capital to invest, this is certainly not an opportunity for you.

It’s about being able to look at the financial world and know where you need to put your money to get the best possible returns…

Being able to take anything the world of politics, economics and – of course – “Mr Market” throws at you and still improve your chances to come out ahead of most average investors.

Which brings me back to the map I’ve been telling you about…

It’s one of the most unusual – yet simple – ways of understanding and looking to profit from big market moves I’ve ever come across.

Just keep in mind: The man who developed it is a true city legend with a remarkable track record of getting big calls right.

He bought gold in 2001, before its meteoric rise…

He got into emerging markets in 2002… made a fortune in agriculture in 2006…

…bought oil before the super spike in 2007…

…called the top in Asia in November 2007...

…and he bought bitcoin in 2015, before its incredible 20,000% rise.

Past performance is not a reliable indicator of future results.

All by following what his ‘money map’ was telling him. Like his own personal ‘sat nav’ for the financial markets.

Not only that, for the past four years he’s been showing private investors how to make money while many investors have been losing out, hand over fist.

And even though past performance isn’t a guide to future results, he did it all without using options, currency trades or leverage.

Once again, he did it by following his own 'money map', and helping other investors to do the same:

Updates and analysis are first class

James Murray.

Invaluable… In a nutshell I trust the man.

Andy Franks.

I simply trust his judgement more than any other investment expert.

C.Q.

Intrigued? You should be.

Because following this master investor and his “Money Map” could be one of the best financial decisions you ever make.

I’m going to show you just how successful his group of private investors have been in a moment…

And I’m going to show you how to grab your copy of his “money map”.

Just say the word and it’s yours.

Follow the moves in it and I believe you’ll finish up 2021 far better than most.

Ignore it and you could come to regret it.

When the world changes,

big money changes hands – FAST

The events of 2020 prove it beyond all doubt:

The world is at a critical turning point – not just politically, but financially and socially.

I’m expecting big moves in the remaining months of 2021—moves that could generate real profits, or real losses—depending on what you do today.

Whatever your views of lockdowns… money printing…. Inflation…

It’s very clear that we are living in an age of “outliers”.

The idea of “normal” investing strategies are dead, bleeding out on the floor.

As my friend and colleague, million-dollar fund manager Tim Price says, it’s “investing through the looking glass.”

The idea of being able to just buy bonds and live off a comfortable 5%? Those days are long, long gone.

Is that fair on you as an investor? No. But you know as well as I do that ‘fair’ has nothing to do with it.

And unfortunately, the markets could get more dangerous to your financial wellbeing than ever before.

Before the end of the year, the smoke should clear and we’ll know in real terms just how much Britain’s businesses have suffered from lockdown.

We’ll find out just how big national debt has grown…

We’ll see what the consequences are of the White House’s new era of “Bidenomics”…

And we’ll find out just how much inflation is on the horizon.

The only thing that is certain is that no-one knows what will happen in Britain over the coming weeks…

…Let alone the coming months.

I can’t promise you any predictions in this letter, but I can promise you something better…

A plan.

A simple and powerful way of approaching the markets for maximum profit this year and next year – without using ultra high-risk strategies like spread-betting or other leveraged trading.

The political and financial landscape is changing.

And I can tell you that to experienced investors that means one thing:

Opportunity.

When key market trends reverse and power off in a new direction, there is ALWAYS money to be made.

And that’s EXACTLY what this man’s “money map” helps you do.

Once you understand the strategy, you can take the sound and the fury of the markets… and turn them into specific, actionable opportunities.

It doesn’t matter if the markets are soaring or falling… whether they’re highly volatile or calm… this map helps you find the very biggest opportunities and risks to your money.

In fact, when you claim your own copy of it today you’ll find five specific investments you can action right away, from his number one stock in the world to buy right now… to the two assets he believes you need to sell right now if you want to avoid potentially crushing losses in the coming weeks and months.

But first, you should know – the man behind this is an extremely experienced fund manager… and he’s used this map to build portfolios that have not only crushed the nearest benchmarks in the good times…

Past performance is not a reliable indicator of future results.

But avoided the huge losses.

How do I know that?

Because I persuaded him to share his analysis DIRECTLY with a small group of private investors – who followed his money map strategy to comprehensively out-perform the closest benchmarks for four years.

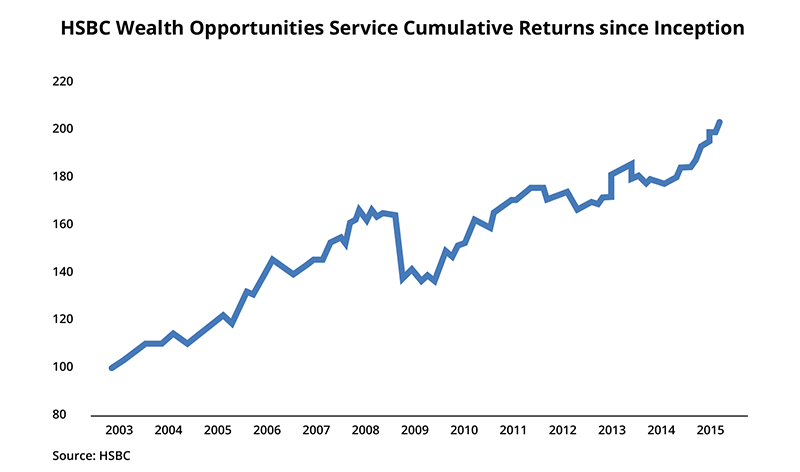

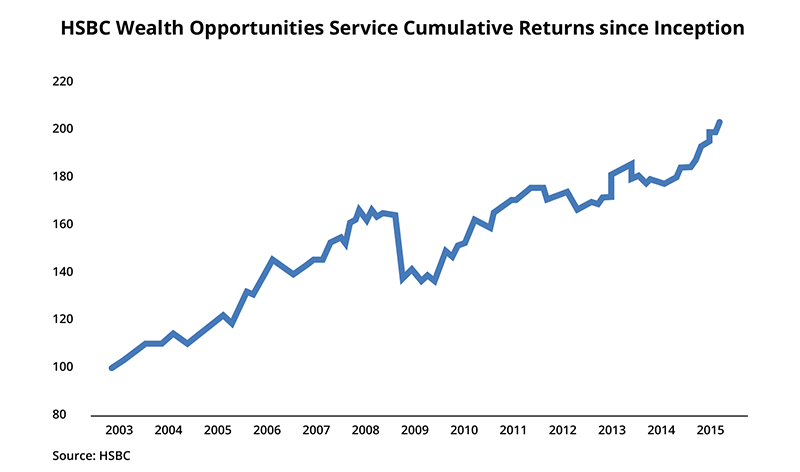

He managed $3 billion in the City and doubled his clients’ money…

In 2021 and beyond, he wants it to work for you

Let me level with you…

With the world in such flux – and markets so sensitive and volatile – every money manager out there has an idea about what you should do with your money.

Some of them will try to scare you.

They might tell you to run for the hills… go super defensive…

Quite frankly, that’s because it’s easy to scare people.

Most people don’t like change, and right now the world is changing faster than anyone wants to handle.

This means that you have a choice.

You can be passive like most of the world. Sit at home on the sofa and hope that everything works out… leaving your money at the mercy of events…

Or you can get on the front foot and do something about it that could make you a richer and more successful investor.

It’s said that 95% of investors fail to make any money.

Today, I want to give you the chance to become part of the 5%.

See, in reality there are some major opportunities for you to profit in 2021.

Many of them are hidden in plain sight.

That’s a claim that comes directly from the man behind this money map, a man with a long, proven track record of managing people’s money – billions of pounds of it.

Premier League footballers. A-list actors. Entrepreneurs.

You name it, they trust this man.

His name is Charlie Morris.

And he didn’t just manage billions…

He grew his fund. Massively.

In fact he doubled his clients’ money during one of the most turbulent decades in history, as this chart shows…

Past performance is not a reliable indicator of future results.

Charlie did what the best fund managers do: he made money for his clients.

Lots of it.

Did he make money on every trade? No. No one does. And of course past performance is no guarantee of future results.

But the City is a cut-throat industry. And Charlie didn’t just survive for 17 years… he rose to the very top.

I don’t say this lightly, but Charlie is the best investor I know.

And there’s never been a better time to see what he could do for you.

I want to be very clear… this is your chance to have one of the finest investors in Britain help guide your money.

That probably sounds like hype and hyperbole. I promise it’s not.

Let me show you.

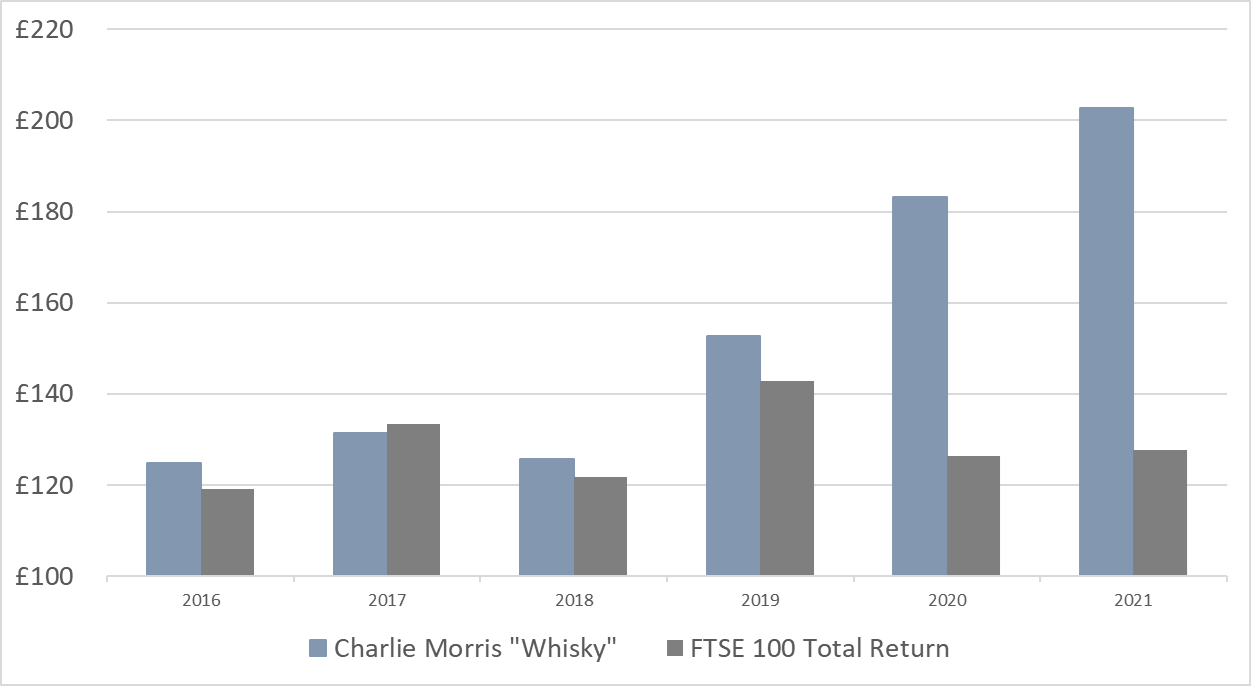

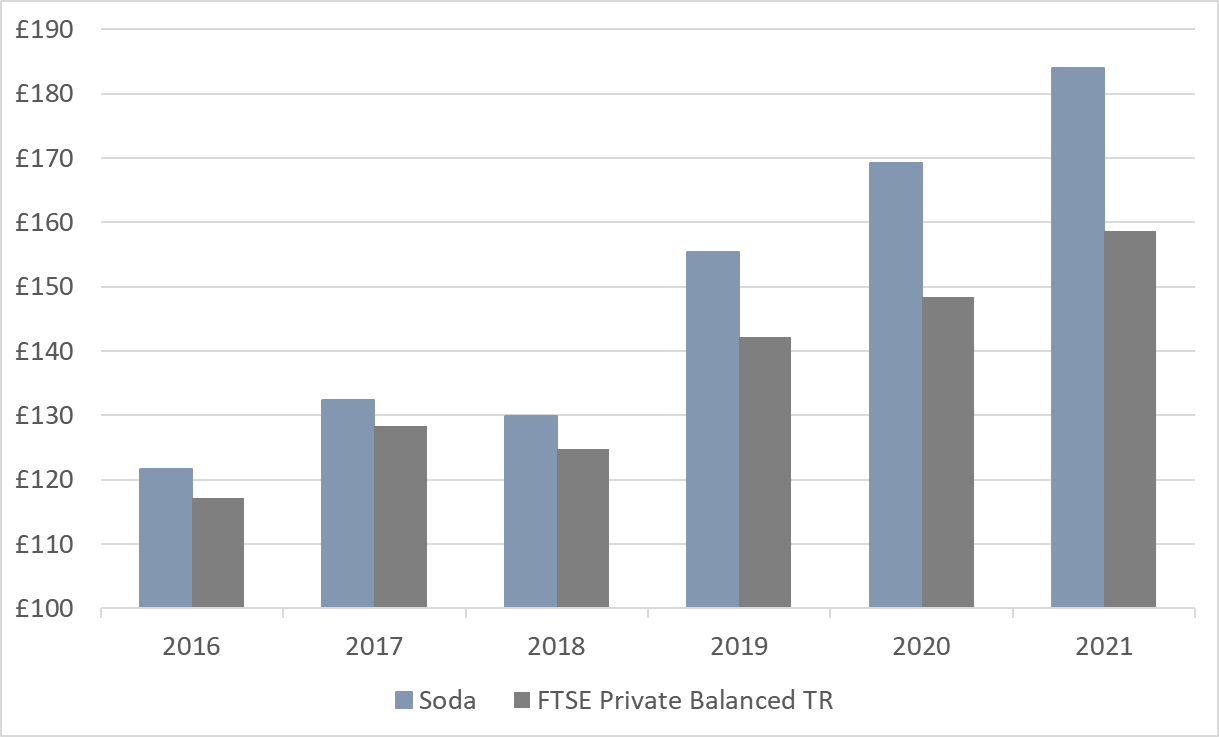

Since late January 2016, when Charlie first started to work with his exclusive group of private investors, his results speak for themselves.

Let me show you…

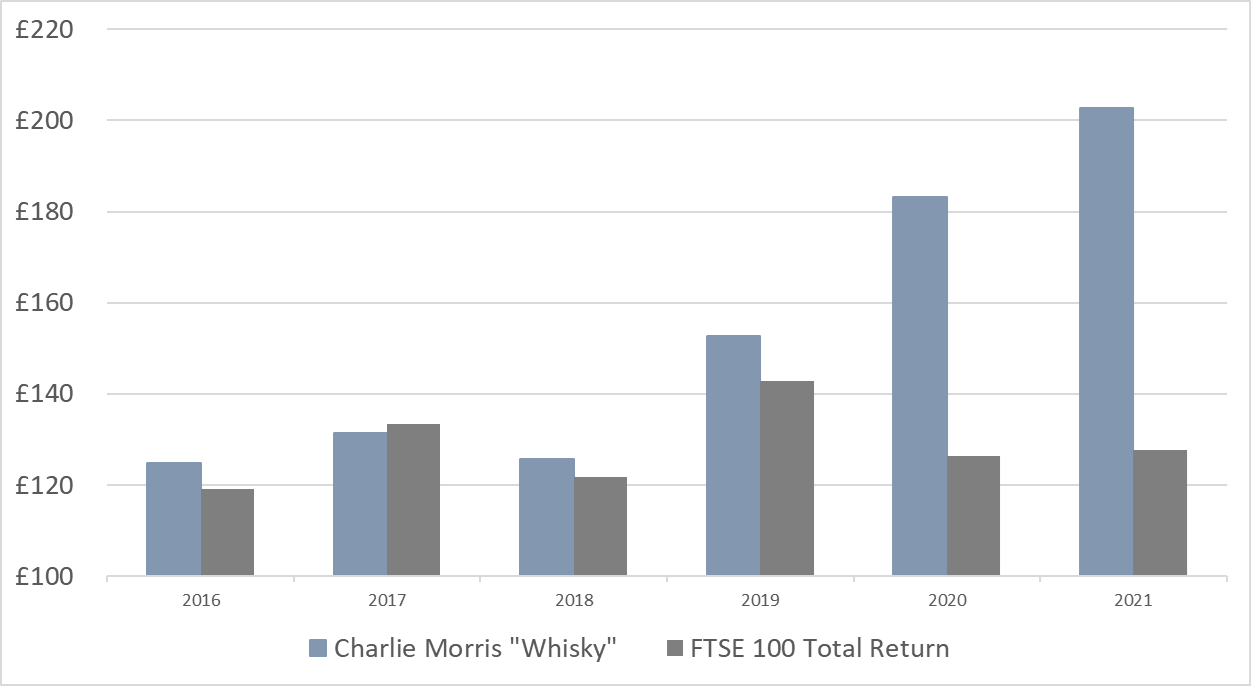

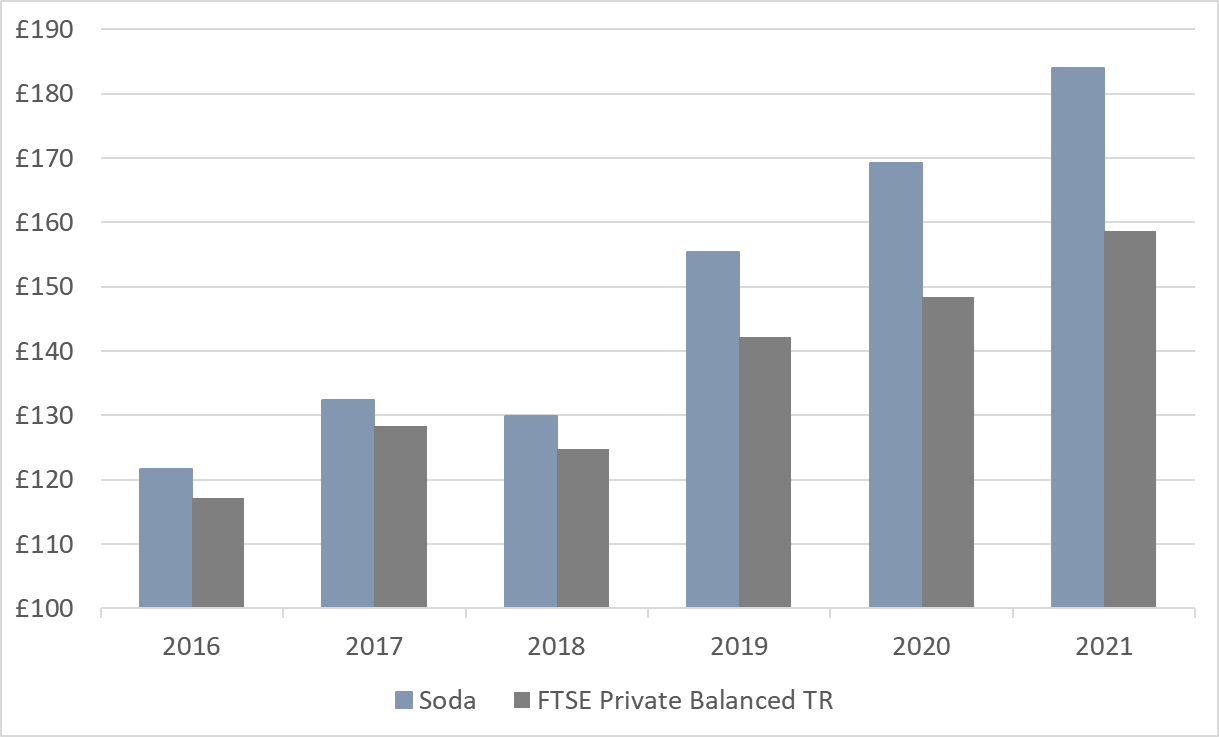

Take a look at these two charts:

(From portfolio inception to 13/07/2021).

Past performance is not a reliable indicator of future results. For a full breakdown of performance see the end of this page.

This shows Charlie’s performance against the benchmarks since he put his “Money Map” into effect.

They show how an investment of £100 into Charlie’s ‘Whisky’ and ‘Soda’ portfolios would have done compared to £100 invested into the respective benchmarks. (Charlie is the blue columns.)

What does this really mean in monetary terms for serious investors, though?

Let me explain…

Imagine that four years ago, when Charlie first put his Money Map to work, you had £200,000 to invest .

But instead of following Charlie, you invested it equally across the two benchmarks.

Past performance is not a reliable indicator of future results.

As I write this, you’d be sitting on a pot of £286,450 . Not bad returns by any stretch.

But what if you’d followed Charlie’s money map?

Your pot would have grown to £386,740.

Before fees and costs, you’re £100,290 better off – more than a hundred thousand pounds ahead of anyone relying on benchmarks!

And that’s without using spread-betting, leverage or any other ultra high-risk investments.

This is pure elite investing from one of the best in the world.

But it’s more than numbers on a chart…

Really think about what the past four years have been like.

Brexit…

Trump…

Corbyn…

The Italian bond crash…

Covid-19…

It’s been nothing but volatility and uncertainty all the way, and you’d expect it to be torrid for investors.

But anyone following Charlie Morris’ advice?

They’ve just carried on making great returns.

Past performance is not a reliable indicator of future results.

That’s the power of making decisions with the backing of a truly great investor.

And the power of following his money map.

Imagine not feeling stuck and uncertain.

Imagine, instead, being able to make decisions quickly and decisively, knowing that you’re making them with the backing of a man like Charlie.

Of course, Charlie’s results speak for themselves.

However, I do want to make it very clearly that no investing is risk-free. You should only ever invest with capital you can afford to lose.

You should take investing very seriously, and treat it with respect. It’s not about never losing money, it’s about taking risk seriously and making the right investment decisions over time.

It’s about getting an edge over other investors.

It’s about getting access to information and wisdom that most investors will never get their hands on…

Today you have the chance to gain that elusive investment edge. And give yourself an advantage over most other investors out there.

Charlie’s investment ideas and expertise are highly sought after, and his numbers speak for themselves…

Will you be next to write

Charlie a letter like this?

As I said… Charlie spent the last four years sharing his ideas, analysis and recommendations – not to mention the secrets of his money map – with a small group of UK investors.

He’s helped them build a portfolio using his “money map”, and they’ve been benefitting from his knowledge and expertise.

Don’t take my word for any of this… I asked them what they thought of Charlie’s work...

And I got a wave of replies. Here are just a few…

Charlie Morris understands the big picture, or he has a crystal ball. Just go with his recommendations.

M.A.

I have a high degree of confidence in Charlie’s wealth of knowledge, track record and market experience.

D.B.

I find Charlie’s analysis really useful and helps to make my own mind up about what to buy. His experience and knowledge often highlights things that I would never have thought of and is therefore invaluable.

Chris Pett

It’s also obvious that Charlie has good contacts and respect from peers in his industry. In a nutshell I trust the man.

Andy Franks.

Very down to earth, practical analysis – makes it easy to make decisions on my investments.

Steve Carter

I simply trust his judgement more than any other investment expert.

C.Q

Charlie’s insight and strategy for the recovery from the March crash is the best I have seen. His timing on big market calls are always worth paying attention to.

R.P.

Outstanding, and more importantly honest. There is no BS. If he is not sure, he says so… He’s the best, well done.

Douglas Pike.

It’s great to hear from so many happy investors.

These are people who’ve followed Charlie’s advice… and you can see for yourself what they think of the man.

His admirers aren’t limited to readers, of course. Even our own editors are fans:

Charlie is a top person as would be expected from an ex-army officer. He would be a good person to look after one’s pension plan.

Robin Griffiths, legendary city analyst and editor of Dynamic Investment Trends Alert.

One of the smartest men I've ever had the pleasure of meeting, with an investment track record to match . He's principled in his approach but creative in applying it, and is always happy to explore areas of the market where your average fund manager fears to tread. It's a compelling combination. Above all, he's a bloody good Brit.

Boaz Shoshan, editor of The Fleet Street Letter Monthly Alert.

Charlie managed to do the impossible. Be a contrarian fund manager within a large mainstream bank. I suppose they couldn't ignore the returns he delivered. Our subscribers probably shouldn't either. Especially now that he's released from many of the constraints of his fund manager days.

Nick Hubble, author of How the Euro Dies and editor of Fortune & Freedom.

Charlie Morris is someone I seek out when I want an opinion other than my own. He has a rare talent to see the market as it is rather than how we might like it to be, and his record stands for itself.

Eoin Treacy, Hard Metal Council member for Gold Stock Fortunes

Past performance is not a reliable indicator of future results.

You’ve seen what his readers say and what his peers think of Charlie’s advice.

Now, let me show you how you can potentially profit from it…

Invaluable investment analysis from one of the best in the world

Like I said, for 17 years Charlie worked in the heart of the City at HSBC, as Head of Absolute Return.

To get his advice then, you needed a pot of £500k to even talk to him.

Then you paid a minimum management fee of £5,000… every single year.

You don’t charge fees like that unless you’re in demand.

And you’re only in demand if you consistently make money for your clients.

But here’s the thing…

We’re at such a critical turning point in world markets, I think you and every other investor in the country needs someone like Charlie in your corner, giving you help on what to buy and what to avoid.

So I’ve asked him to lay out – in precise detail – where he thinks you should be investing your money to profit in 2021.

And Charlie’s put everything into this document:

It’s called “Your 2021 Money Map: Where to invest (and where to avoid) for the next 12 months”.

And it explains everything, right down to the ticker symbols of the stocks Charlie’s recommending.

If you’ve ever made a trade before, you can follow Charlie’s “Money Map” and you can reap the potential rewards.

Forecasts are not reliable indicators of future results.

And to be frank, I believe when you see what having an investor like Charlie on your side could do for your investment returns… you’ll have one question:

“How do I KEEP Charlie in my corner for the coming years?”

I’ll answer that in a moment.

But first:

How you can predict where the big money will go – and move ahead of it – using the 2021 “Money Map”

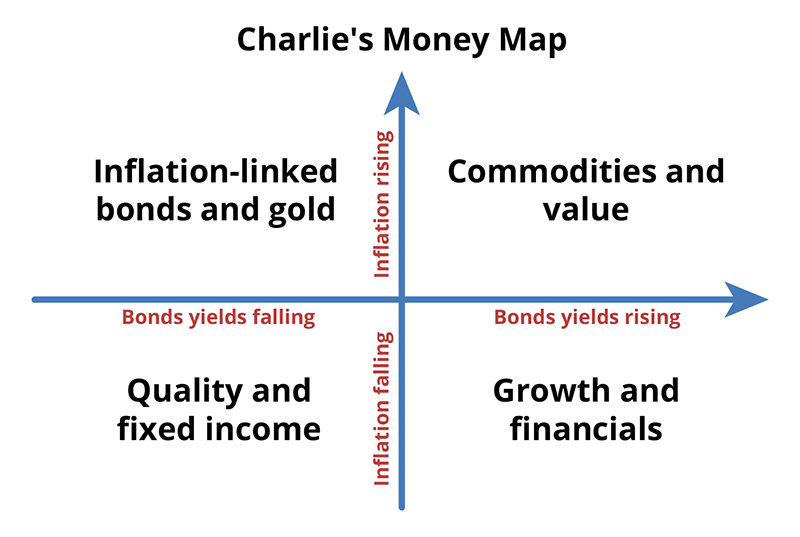

It looks nothing like a regular map…

That’s because it doesn’t give you the location of a specific place you can go.

It shows you precisely where your money needs to be for the biggest potential returns next year.

Once you understand it, you’ll not only see where the big money is moving right now… you’ll see and understand how you can move ahead of it to potentially profit.

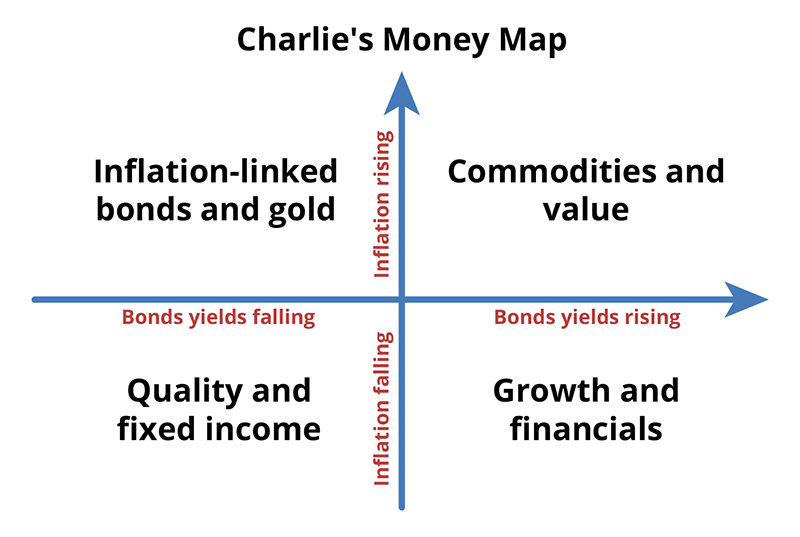

Instead of geographic co-ordinates, it has two key economic indicators. These influence everything from the interest rate the government pays on its debt to what a pint of milk costs at Tesco – and everything in between.

Those two vital indicators are: inflation and interest rates.

Understand if they’re rising or falling and the “Money Map” does the rest – showing you where to look (and then Charlie does the rest, showing you PRECISELY what to buy and what to avoid).

Take a look…

If it’s all Greek to you, don’t worry. It’s simple, once you understand it…

One axis – running from left to right – charts whether bond yields are falling or rising.

The other – from top to bottom – shows whether inflation is rising or falling.

Here’s the important point: If you put those two key data points onto the Money Map… it tells you where your money should be invested under any market conditions.

And Charlie takes it a step further, showing his followers exactly what to buy, when to sell, and what to avoid.

Can you see how valuable this would be in 2021?

He’s also revealing a number of key plays you can start making immediately to help you to potentially excel in the next 12 months.

Including:

- His number one focus right now, the “bond backed by God”…perfect for the current inflation-fearing investment environment…

- A lesser known “trust” with a pure focus on long-term capital growth…one of Charlie’s KEY holdings in 2021.

- A single investment that can help you tap into invaluable resources all over the world at once….

- Why Covid-19 isn’t the biggest threat to your money right now… and which “invisible” danger is…

- Which 2 assets he thinks you need to get out of right now

- The “one-click” asset that offers stability, cheap buy-ins and incredible growth potential… and could give you a huge head-start over other investors by tapping into the lucrative billion-dollar energy market…

Keep in mind: Charlie has done all of this work on your behalf already.

He’s picked out investments he believes will deliver great returns for you, and he’s provided full analysis on the picks so you can decide whether or not you choose to take action.

For instance,

Charlie believes there are two assets you need to get OUT of. These are areas of real risk for investors right now in his view.

If you take one thing away from this letter – take heed of that warning.

Your money map report will explain why, but know this:

Delaying your investment moves just means you’re at risk of being further behind the curve as the global financial system reorders itself.

Do you see why I’m writing to you with such urgency? I believe it is vital you read about and understand Charlie’s ‘Money Map’ as soon as possible.

As I said, you’ll discover precisely where he believes you need to put your money right now.

Right down to the ticker symbols you need to give your broker or type into your online brokerage.

If you’ve invested before, the “Money Map” is the most simple way to get started investing like a true city legend.

This report is yours – today – if you want it.

Just say the word and I’ll give you all the details you need to access it.

There’s NEVER been a more important time to have a master investor on your side

If 2020 proved anything, it’s that the stakes just keep getting higher in the financial markets…

Think back to how you felt during the Covid-19 crash.

Whatever you thought about the lockdown, the markets were hugely volatile for weeks.

Enough to make even experienced investors ask themselves “Christ, what does this mean for my money now?”

Nobody knows how the markets will react throughout the rest of 2021, because we don’t know what the world will look like.

But one thing is very clear…

The decisions you make over the coming weeks could decide your financial future for a long time.

The world is changing. The idea of being able to safely make good returns with a few sensible investments?

That world has gone, and I can’t see it coming back.

Investing in 2021 is the wild west, and the price you’ll pay if you make a mistake with your money could be huge.

If you don’t believe me, let me illustrate the difference this opportunity could mean to you.

2020 was devastating to many investors.

Let’s say at the start of the year you’d been faced with a choice:

Invest in the benchmark funds I described earlier, as many investors might…

Or choose to trust in Charlie’s “Money Map” strategy?

Right now, your portfolio would be better off with Charlie’s research.

In fact, depending on how much you invested… Charlie could have helped you become thousands of pounds better off in a matter of months.

Past performance is not a reliable indicator of future results.

What I’m offering you today is more than just a way of positioning your money.

It’s the chance to have a seasoned and experienced investor on your side, guiding you and your money through the financial markets and helping you make better decisions with your money.

See, when Charlie left his post at HSBC he did something pretty unusual…

Rather than become a “talking head” on the TV… or write the odd article for the mainstream press… he decided to take on a new project…

80 years of crisis, capital and change

Charlie took the helm as Investment Director of The Fleet Street Letter Wealth Builder in January 2016.

It’s a big responsibility.

For one, it’s the oldest investment letter in Britain.

Its esteemed predecessors include founder Patrick Maitland, the 17th Earl of Lauderdale… Nigel Wray, the £50 million British business tycoon… and the late Lord William Rees-Mogg, former editor of The Times.

Since its foundation in the 1930s, The Fleet Street Letter has a track record of pinpointing the big “turning points” in history… and helping British investors navigate their wealth through them.

In 1938, for example, after a fact-finding mission inside Germany, Patrick Maitland predicted war in Europe within a year, while everyone else was in denial.

“Appeasement will not work,” he warned… “War is coming to Europe, but not until September at the earliest.”

On the first of September 1939, Hitler invaded Poland. Two days later the Second World War began, exactly as Maitland foretold.

It was the first major world event The Fleet Street Letter correctly anticipated. And by no means the last.

For instance, I read an issue from the mid-1980s talking about the fastest-growing economy in the world: China.

At that time, nobody was talking about China.

In September 1999, while the world piled into tech stocks, Fleet Street Letter readers received this simple warning: “CRASH IMMINENT.”

The FTSE peaked four months later, falling into a three-year bear market.

It also predicted the fall of communism, the 1980s property boom and 1987’s Black Monday where UK stocks plummeted 27% in a fortnight, and the boom in Taiwanese shares in the mid-90s.

My point is, The Fleet Street Letter Wealth Builder explores ground the mainstream doesn’t. It’s been doing this for its readers for the last eight decades. And by doing so, you gain an advantage.

I don’t mean that in a general sense, either.

I mean you’ll be able to measure just how valuable Charlie’s work is by the results in your investment portfolio!

The Fleet Street Letter Wealth Builder couples “big picture” political and economic analysis with detailed and fully researched investment recommendations.

Charlie shows you EXACTLY where he recommends you put your money… how much of your portfolio you should consider investing… and then precisely when it’s time to sell up and move into something else.

To be rather blunt, this is the same set of ideas he gave his City clients for 17 years.

His fees came in at thousands of pounds and you needed a pot of half a million pounds to qualify.

But now he offers that very same level of analysis to you, for a fraction of that.

The only difference is, you’re still in control – Charlie gives you specific advice, but it’s your choice whether you act on it.

- That means detailed, fully researched investment recommendations

- Weekly updates and analysis on the markets and specific companies or funds Charlie recommends

- Two separate portfolios – a safer, more risk averse one called “Soda”… and a risk on, aggressive portfolio called “Whisky”.

- Buy AND sell advice – Charlie will get you in and out of positions when he believes the time is right, helping you take profits and cut losses. This is a huge advantage – it means you can rely on Charlie’s judgment to help time your investments rather than guessing.

- Detailed research into the key issues affecting the macro-economic outlook for investors – that might be political (Brexit), economic (lockdown) or financial (QE). Whatever Charlie chooses to write about, you can guarantee it’ll make you a better, more informed investor.

There’s much more, but to be frank you’d probably rather SEE what The Fleet Street Letter Wealth Builder is all about yourself, rather than have me tell you about it.

I know I would.

That way, you can take a look at what Charlie does week in, week out and decide for yourself if it’ll be valuable to you.

On that front I have good news.

When you download your report, “Your 2021 Money Map: Where to invest (and where to avoid) for the next 12 months” I’ll also give you a 30-day trial of The Fleet Street Letter, so you can review it for yourself.

You don’t have to commit a penny to take a trial. And whether you like Charlie’s work or not, you can keep your free report with all its recommendations and analysis. It’s on the house.

Before you grab a copy, there’s another part to Charlie’s strategy you should understand.

Everything you need to make your move on it is in your report, “Your 2021 Money Map: Where to invest (and where to avoid) for the next 12 months”

You’ll discover FIVE opportunities you can move on today, including:

- The “one-click” asset that Charlie believes offers stability, cheap buy-ins and fast growth…

- The high street “mini-Apple” that Charlie’s spotted trading well below it’s true value…

- The “God-Backed Bond” that’s Charlie’s number one focus with the threat of inflation looming.

It should be clear as day: I believe you need to get this report in your hands right now.

If you’d like to see the full details of these recommendations — without committing to anything, I’ll send them to you today.

If you don’t think your wealth will benefit from this information, tell me.

All I ask in return is that you take a no-obligation trial to one of Britain’s most respected financial newsletters.

Keep in mind, Charlie has a great track record of getting the big calls right – and cashing in on them. He got his clients:

- Into emerging markets and gold in 2003 ahead of the boom, which pushed these sectors up five times over…

- Into Apple in 2005 at $5 per share. As of July, one share of Apple stock will set you back around $140…

- Into crude oil in September 2007 at $60 per barrel ahead of the super spike to $140…

- Out of gold in Jan 2013 ahead of the crash…

- And into global brands in mid-2011 — capitalising on a leadership switch to high quality stocks.

Like I said, it was his City clients who benefited from those trades.

And since he joined us at The Fleet Street Letter Wealth Builder, he’s helped some of his readers make a profit, giving them the opportunity to make tens of thousands of pounds, depending on how much they invested at the start…

Past performance is not a reliable indicator of future results.

Your chance to invest alongside

a 17-year City pro

If you’ve read this far, you’re an investor who cares about the wealth you’ve created.

You also know factors beyond your control can quickly take your wealth away from you.

But you can do something today.

You can have what I believe is the best possible advance warning of what could lie ahead… and practical investment moves aimed at protecting you, your family, your money, your assets, and your future.

Rarely is information and advice like this available to the individual investor.

But today, if you choose, it’s yours.

It’s a private, intimate advisory service exclusively for a certain type of individual… a direct line to the kind of investing strategy that few private investors will ever experience.

This is real wealth-building intelligence — from a real, professional who’s truly been there.

I’ve already told you about Charlie’s brand new investment briefing “Your 2021 Money Map: Where to invest (and where to avoid) for the next 12 months”

It’s yours free, if you send for it today.

And you’ll have access to the archive of all back issues since Charlie took the helm five years ago. Thousands of words of wisdom and market analysis from a true city legend.

These back-issues alone are a complete education in investing from one of Britain’s finest minds.

And when you sign up, you’ll have immediate access to the “Money Map”…

To Charlie’s “Whisky” and “Soda” portfolios

I should talk about those portfolios for a moment.

Soda is more conservative…

And since Charlie launched Soda, until 13th July it’s out-performed the benchmark FTSE Private Balanced fund by more than 25%!

Whisky, meanwhile, is focused on riskier assets with an aim for greater return…

And since inception also 13th July, it’s crushed its benchmark, the FTSE 100 by 75%.

Past performance is not a reliable indicator of future results.

In the end, that’s what The Fleet Street Letter Wealth Builder is all about…

It’s about having one of the best investors in Britain on your side, guiding your investments.

It’s about Charlie Morris doing what he does best… excelling and helping you do the same.

What will you be investing in?

Charlie’s portfolios include a mix of investments, including stocks, funds and bonds.

There are different risks for each. The value of stocks can go up or down, and there’s no guarantee that they’ll pay a dividend. Fund performance relies on the performance of the underlying investment. And a fund or bond can be at risk of default. Some of the recommendations may be listed overseas, which means the value can be affected by currency moves.

Outside of the Whisky and Soda portfolios, Charlie also covers cryptocurrencies for those who are interested. Cryptocurrencies are high risk and unregulated, which means you don’t have the protection of the Financial Services Compensation Scheme or the Financial Ombudsman Service.

Given those risks, I think it makes MUCH more sense to have someone as experienced as Charlie on your side. Charlie will explain the risks to you. But it’s up to you whether you act on them and how much you’re comfortable risking. You should never invest more than you can afford to lose.

If you wanted to hire Charlie to teach you everything he’s revealed in the pages of The Fleet Street Letter Wealth Builder, you’d likely be looking at a six-figure sum!

And that’s before you start potentially profiting from his investment advice.

With that all in mind, how much does it cost for you to receive The Fleet Street Letter Wealth Builder?

Well, as I mentioned earlier, to have Charlie manage your money when he worked in the city would cost upwards of £5,000 per year.

And you’ve seen Charlie’s remarkable track record.

That considered, you won’t believe how little it costs to take out a year of The Fleet Street Wealth Builder.

I’ll give you the details in a moment.

However, I want to make this a real no-brainer for the serious investors out there…

That’s why I’ve also asked Charlie to do me the favour of delivering two other bonuses.

Firstly, I went to Charlie and asked him the question I think ALL investors would want to ask a man of his experience and skill…

“If you could only give investors 5 specific pieces of advice on profiting from the markets, what would they be?”

Charlie’s never satisfied with par, of course... he gave me six, and he put them into a single report that I’m going to send you today, as an additional bonus.

It’s called “The 6 most valuable lessons I learned from 17 years as a $3bn fund manager”, and it’s jam-packed with hard-earned knowledge and advice straight from the financial coal face.

You can use the advice in this report to potentially profit from the markets for the rest of your life.

Forecasts are not reliable indicators of future results.

In Charlie’s own words:

“This report condenses 17-years’ worth of hard-earned knowledge into one very important lesson and five other useful ones. Take these as general rules. You can be the smartest, most-skilled analyst in the world. But if you forget what I’m about to show you, it will cost you.

“My goal at the Fleet Street Letter is to give you great investment ideas and a clearer understanding of the world. There’s no better place to start than showing you what I learned over my professional career.”

Today, you get Charlie’s six most valuable lessons for any investor in a single document... And it’s yours to keep when you take me up on this offer to become a reader of The Fleet Street Letter Wealth Builder.

Picture walking up into the city, knocking on the door of a billion dollar fund manager and asking the same question… and imagine how much he might charge you!

Today, you get that advice from the best of the best, and you can start benefitting from Charlie’s knowledge and wisdom right now.

And what’s more, he’s also agreed to put together a guide that I think might be the most valuable read an investor can have on his shelf right now…

“Surviving the Next Bear Market – a field guide for investors”

Markets may be calm compared to the height of the pandemic…

But I think you’d have to be foolish not to at least prepare for the next time we have a major correction.

And let’s face it, with money printing…inflation….the consequences of lockdown and with Chancellor Sunak planning to end furlough support for businesses in September…

That major correction may come sooner than you think.

That’s why I’ve asked Charlie to spill the beans on everything he knows about surviving and thriving when the markets plummet…

And to put it all into one single document.

It’s called “Surviving the Next Bear Market - a field guide for investors”, and in your free copy, you’ll discover...

- Which type of assets command a premium during a bear market... and where you can buy them. (There are four specific “resilient” investments: Charlie tells you all of them.)

- Which investments you need to ditch in a bear market... and why you should dump them before the market comes under pressure.

- Why your gut instinct can be your worst enemy in a bear market... even if you’re an experienced investor. (And what you can do to prevent mistakes.)

- Why timing a trade perfectly led Charlie to make one of his biggest bear market mistakes... and how you can use his error to make the right investing decisions in 2021.

- Why investors fall into the trap as a result of “confidence tricks” in the markets... and how you can spot signs of this happening before it’s too late to cut your losses.

- Why the difference between a bull market and a bear market is far smaller than most investors think... and how you can learn to spot the “giveaway” indicators the average man on the street can’t.

- How studying Pearl Harbour and the 9/11 attacks can teach you how to spot the end of a bear market... and give you time to get your investments in line so you can look to profit from the returning bull.

- Which one principle Charlie uses to combat market downturns... no matter his portfolio allocation.

- The fundamental truth about bear market “havens” Charlie learned from legendary fund manager Anthony Bolton in 2008... and how it can help you preserve more of your wealth over the next 12 months.

- 2 key numbers that tell you which way the markets are likely to turn at any time. (That you’ll never hear a normal wealth manager or IFA talk about.)

And more. Two decades of distilled wisdom and experience from one of the best fund managers in the world, in a single document you can read today.

And it’s yours today, if you choose to join Charlie and take up this offer today.

Everything you need to thrive in 2021 and beyond…

So, to sum up, you’re going to get immediate access to all of this:

- Your 2021 Money Map – Charlie’s exclusive guide showing you where to put your money so you have the chance to maximise potential returns in 2021.

- Charlie’s exclusive “Whisky” and “Soda” portfolios, constructed to help you easily invest like a true city legend.

- “6 lessons I learned as a $3bn fund manager” Charlie’s most valuable lessons he’d teach any investor to lead them to success in the markets.

- “Surviving the next bear market: a field guide for investors.” Charlie’s step-by-step guide to investing when the worst happens.

- 12 full issues of The Fleet Street Letter over the next year. Every update... every issue... active buy and sell recommendations and portfolio management from a city legend.

- A free subscription to Southbank Investment Daily. The very best of Southbank Investment Research, delivered daily to your inbox.

- ADDITIONAL BONUS. E-mail Charlie with any questions you have about the portfolio, his strategies for the markets. He can’t give personalised investment advice, of course, but short of that – this is your chance to pick the brain of one of Britain’s best.

I hope you can see the incredible opportunity here.

They say 95% of investors fail to make any money. They might spend years trying to build up a nest egg and failing.

Today, I’m offering you the chance to join the 5% that succeed, under the guidance of a man that’s gave his subscribers the chance to make big returns.

And to do so for just £399!

I want as many investors as possible to access Charlie’s research… which is why I’m prepared to offer such a great price, it’s incredible value.

That’s the equivalent of less than £10 a week. Most people will decide to spend that on a takeaway or meal out each week…

But because you’re reading this, you have a chance to be different to most people.

This is your chance to have every investing decision you make for the next year guided by Charlie Morris, one of the best investing minds in the world…

For a remarkable price.

For two decades, Charlie has built up a level of knowledge, skill and wisdom that few in Britain can rival…

And today, if you decide to join us, that knowledge becomes your knowledge…

And in 2021 and beyond, you’ll have Charlie’s “Money Map” to guide you.

Yes! I want Charlie Morris on my side!

(You can review your order on the next page.)

Time to act

I’ve done everything I can for you…

I’ve shown you Charlie’s ideas… his track record… his experience in the City over nearly two decades…

I’ve shown you how the events we’re seeing in global markets now DEMAND you respond to them.

And I’ve shown you how to respond, by claiming a FREE copy of “Your 2021 Money Map: Where to invest (and where to avoid) for the next 12 months”

Understand and capitalise on it and you could grow your wealth month on month, year on year, decade on decade.

Forecasts are not reliable indicators of future results.

That’s how people get rich from the stock market.

And that’s what Charlie wants to help you do.

But now it’s over to you.

If you want to see Charlie’s work, understand it and capitalise on it… you have to act now.

And I mean now.

Inflation is rising. So are bond yields. The tectonic plates of the economic world are shifting beneath your feet…

Move with them.

And capitalise on the forces at work – don’t take a backward step; profit from what’s happening.

Now it’s up to you if you want in. I think you’d be mad not to try this out.

I’m making you a great, money saving offer today.

But it’s not on the table for long. You’ll need to act before Tuesday 24th August at 2pm if you want to grab this opportunity.

Grab it while you can.

Sincerely,

Paolo Cabrelli

Publisher, Southbank Investment Research

Yes! I want my “Money Map” now.

(You can review your order before it is final)

Important Risk Warnings:

Advice in Fleet Street Letter Wealth Builder does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Funds – Fund performance relies on the performance of the underlying investments and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Overseas shares – Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Dividends from overseas companies may be taxed at source in the country of issue.

Bonds – Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future.

Investment Director: Charlie Morris. Editors or contributors may have an interest in shares recommended. The information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms & conditions can be found on our website, www.southbankresearch.com.

The Fleet Street Letter Wealth Builder contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: 2nd Floor, Crowne House, 56-58 Southwark Street, London, SE1 1UN.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2021 Southbank Investment Research Ltd.

5 year performance of product and benchmarks used:

FTSE 100: 2015 -4.45% / 2016 +14.43% / 2017 +7.63% / 2018 -12.48% / 2019 +12.1% / 2020 -11%

FTSE Private Balanced Fund: 2016: +17.1% / 2017: +9.7% / 2018: -2.8% / 2019: +14% / 2020: +4.4%

Whisky Portfolio (Since inception): 2016 +24.7% / 2017 +5.4% / 2018 -4.3% / 2019 +21.4% / 2020: +20.1%

Soda Portfolio (Since inception): 2016 +21.7% / 2017 +8.8% / 2018 -1.8% / 2019 +19.6% / 2020 +8.9%

Sources:

- Southbank Investment Research – “What is the Fleet Street Letter?” – 09/08/2017

- Amazon – “Investing Through the Looking Glass: A rational guide to irrational nancial markets” – 10/11/2020

- Yahoo Finance – “Apple Inc (AAPL) – 17/03/2021

- Tradecity - “Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics” - 13/11/2020

- Financial Times – “US stocks and Treasury yields rise as Biden and Trump battle for victory” – 03/11/2020

- Financial Times – “UK ination rises to 0.5% as economy braces for new restrictions” – 21/10/2020

- Federal Foreign Oce – “Brexit has arrived: Where are we now? What happens next?” – 09/10/2020

- Gov.uk – “New National Restrictions from 5 November” – 09/11/2020

- [Company Name] – Strategy – about us” – 10/11/2020

- Southbank Investment Research – “Biden and the magic money tree” – 27/10/2020

- Southbank Investment Research – “The Fleet Street Letter Wealth Builder Portfolio” – 10/11/2020

- FTSE Russell – “FTSE Private Investor Index Series – Fact sheet” – 20/10/2020

- FTSE Russell – “FTSE Private Investor Index Series – Presentation” – 18/09/2020

- Reuters – “Italian bonds suer worst day in more than 25 years” – 29/05/2018

- CNN Money – “Oil settles at record high above $140” – 27/06/2008

- International Business Times – “Why Did Gold Crash In April 2013? Computerized Trading Is One Explanation” –28/03/2014

- The United Kingdom National Debt Clock 2021 Counter __ nationaldebtclock.co.1. uk

- U.S. bonds_ Treasury yields rise after Fed forecasts jump in inflation

- Business big shot_ Nigel Wray _ The Times

- Lord Rees-Mogg obituary _ The Times _ The Guardian