Today, I’m standing in a secure location, 35 minutes from Oxford.

This area is protected by military-grade surveillance systems and a dedicated 24-hour armed guard.

And although it doesn’t look like much…

What you see behind me will soon be ground zero of a £39 billion investment in what I call “Britain’s new AI railroad”.

And it’s drawing in big money too…

Amazon is investing £8 billion.

Microsoft is in for £2.5 billion.

And two other major tech companies, that aren’t yet household names, have invested a combined £14 billion.

In fact, since July 2024, private capital has flowed into what I call Britain’s new AI railroad at a truly incredible rate – an average of £200 million a day.

This investment will create tens of thousands of new jobs…

Give the economy a much-needed boost…

And create tremendous wealth for the companies involved.

I’m not the only one saying this…

The International Monetary Fund estimates Britain’s new AI railroad will grow the economy by £47 billion per year, and every year, for the next decade.

Carsten Jung, head of AI at the Institute for Public Policy Research, predicts it could lift the UK economy by up to £306 billion a year.

And the government predicts the economic impact will be even bigger…

Adding £400 billion by 2030.

That makes Britain’s new AI railroad the biggest financial opportunity I’ve ever seen… in any market… in any asset… and in any sector.

And it all starts in the secure location you see behind me.

Now, as I mentioned this place is teeming with security and CCTV, so I’m going to get away from here so I can explain more clearly exactly what’s going on.

So let me go inside a studio to give you all the details.

Britain’s growing AI economy

Artificial intelligence is driving the fastest scientific and technological revolution in human history.

And it’s already improving our lives…

Now, I know there is some negativity around AI. But later, I’ll explain why I believe that negativity is unfounded.

But let’s look at the positives first.

Because it’s the positives that are the driving force behind Britain’s emergence as an AI leader.

From spotting cancer twice as fast as doctors, or facial recognition software helping the police catch violent criminals, or fraud detection making online shopping safer, AI has become critical to the future of our country.

Now Britain is taking two giant steps to become a global AI leader.

This means building some of the world’s most powerful supercomputers.

In fact, Britain’s new AI supercomputer will launch with 100 megawatts.

That’s enough power for 285,000 homes, or the equivalent of every house in Bristol.

It’s also double the power of Elon Musk’s Colossus supercomputer in Memphis in the US.

A facility that Nvidia CEO Jensen Huang says is “easily the fastest supercomputer on the planet.”

Yet Britain’s new AI supercomputer could be twice as fast from day one.

And already, plans are in place to make it five times more powerful.

Fast enough… and powerful enough… to make Britain an AI superpower.

Those aren’t my words.

Mustafa Suleyman, Teo Blidarus and Matt Clifford

They come straight from the founder of DeepMind and the CEO of Microsoft AI, Mustafa Suleyman.

Suleyman believes Britain has “every chance of becoming an AI superpower.”

Teo Blidarus, CEO of FintechOS, says, “if the true potential of AI in the UK is unlocked,that this is how we’ll power an AI-driven economy – not just for today but for the future.”

Tech entrepreneur and chair of the UK’s Advanced Research and Invention Agency Matt Clifford says this could make Britain a global hub for AI.

As exciting as that sounds…

That’s only the first step Britain is taking right now to become a global AI leader.

The second step is much harder to achieve… and much more important.

To show you why, we need to go back to Memphis – to Elon Musk’s Colossus.

Source: x.com/techAU

Colossus consumes 50 megawatts a day.

That’s a lot of power.

Enough for every house in Cambridge.

Now, to win approval for Colossus, Elon was forced to make some BIG energy promises.

First, he installed Tesla Megapacks to help the city smooth out power spikes.

Megapacks are similar to a Tesla Powerwall battery – except they’re about the size of a double-decker bus. And cost around one and a half million dollars.

Elon has also promised to pay for a new power station…

And most controversially, he’s installed a number of portable gas power turbines.

All to get 50 megawatts of power.

Half the power of Britain’s first AI supercomputer.

But that’s not the end of the story…

He has much bigger plans for Colossus.

But the city of Memphis doesn’t have the power.

So for now, the world’s richest man is forced to put his AI ambitions on ice.

And that’s what makes Britain’s second AI leadership step so important.

You see, Britain’s next AI supercomputer will launch with DOUBLE the power of Colossus…

And within two years…

It could have TEN TIMES the power of Colossus.

To achieve this will require a lot of power.

That’s why Britain is becoming an energy pioneer…

And in the process, seizing control of two of the most critical technologies of our time.

AI and clean energy – including nuclear power.

These technologies are deeply interconnected.

This is why I refer to this innovation as Britain’s AI railroad.

It was the development of the railways in Britain and the railroads in the US that led to the biggest advances in mankind during the 19th century.

It enabled the standard of living to improve. It enabled greater mobility, allowing people to move and travel.

It enabled an increase in trade between far-flung towns, cities, countries, and even continents.

And it was the driving force behind the greatest economic growth of all time. It powered Britain towards building the greatest political and economic empire the world had seen to that point.

And afterwards, it powered America towards becoming the greatest economic empire of all time.

That makes AI today similar to how the public greeted the railways and railroads of the 1820s. They were greeted with a mixture of scepticism and fear.

People didn’t know what to expect.

So they thought the worst.

It may seem unbelievable, but people thought trains would prevent cows from grazing, hens from laying eggs, and that poisonous fumes would kill birds and blacken the fleeces of sheep.

It was even feared that speeds of up to 15 miles an hour would vaporise passengers.

Yet for those who saw the railroad as the future of transport, communication and commerce…

Well, they made a fortune.

In America, men like Cornelius Vanderbilt, Jay Gould and James Hill became multi-millionaires…

And their investors made big profits every step of the way.

Today, I believe we’re about to see a new technology create a wave of wealth for early investors.

Britain’s AI railroad is about to help our country regain some of the lost ground. And like the railways and railroads of the 19th century, it will create immense opportunities.

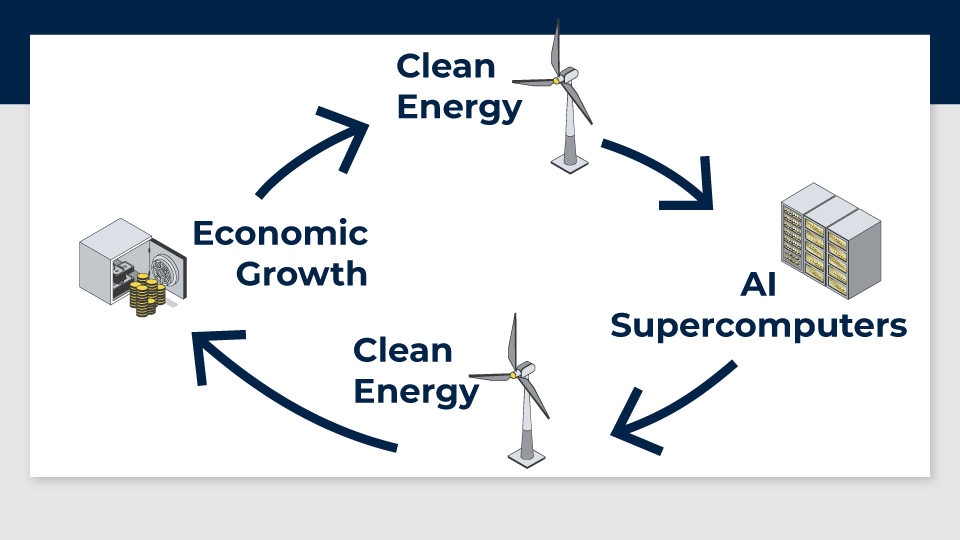

Best of all, with more clean energy… we’ll build more supercomputers. Which will require more energy, which will power more economic growth…

Which will create demand for more supercomputers.

It’s a virtuous cycle of growth. And it’s happening right now.

I don’t know anyone that’s connected the dots on Britain’s new AI railroad.

Not the media. Not trade magazines. Not banks or consulting firms.

But before we go any further…

I should properly introduce myself

James Allen

My name is James Allen.

For the last 18 years, I’ve helped UK and European investors understand and profit from world-changing trends in the tech and energy markets, across different research publications.

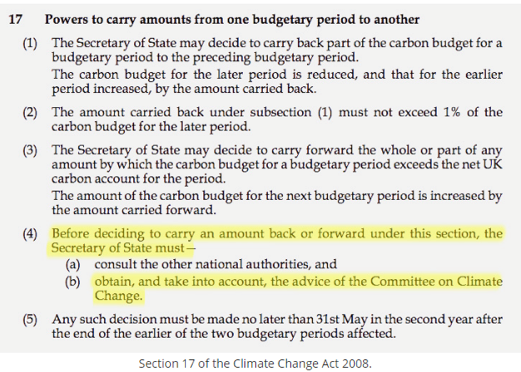

For example, in 2019, I discovered the department for Business, Energy & Industrial Strategy had a big problem.

It was going to miss its carbon reduction target.

The government’s self-imposed legal penalties made that impossible.

So I knew it was going to throw money at the problem – as all governments tend to do.

The only question was – where?

Turns out the government was required to consult an obscure panel, the Committee on Climate Change, to find a path forward.

You can see this in the snapshot from the relevant government document below.

By studying the committee’s recommendations, I noticed that one specific fuel source was mentioned 141 times.

Its plan was to use hydrogen for power, heating and transportation. As part of an entirely new hydrogen economy.

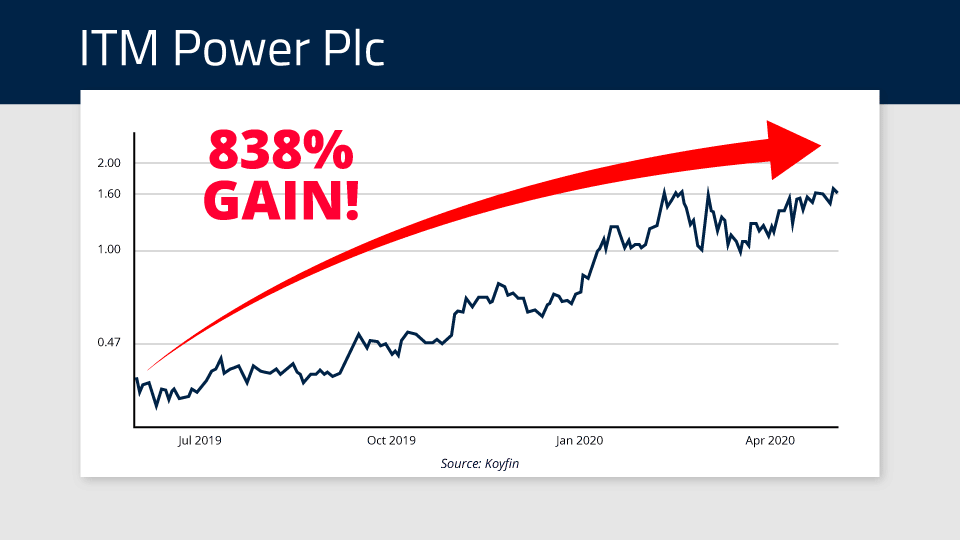

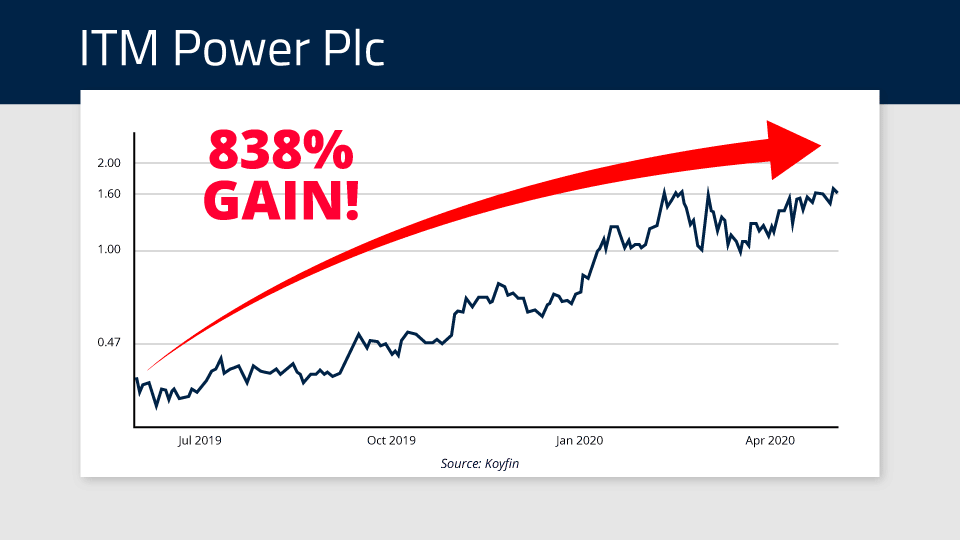

So, I recommended a hydrogen pioneer with several production sites throughout Britain.

Thirteen months later, it had risen 838%.

Past performance is not a reliable indicator of future results.

Five-year performance for ITM Power: 2020 +626.11% | 2021 -23.64% | 2022 -35.18% | 2023 -39.9% | 2024 +2.97%

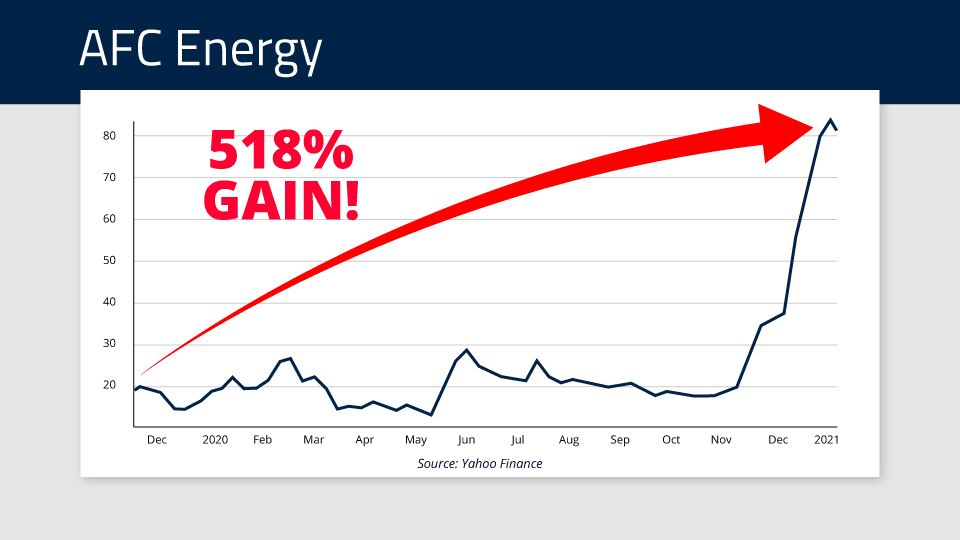

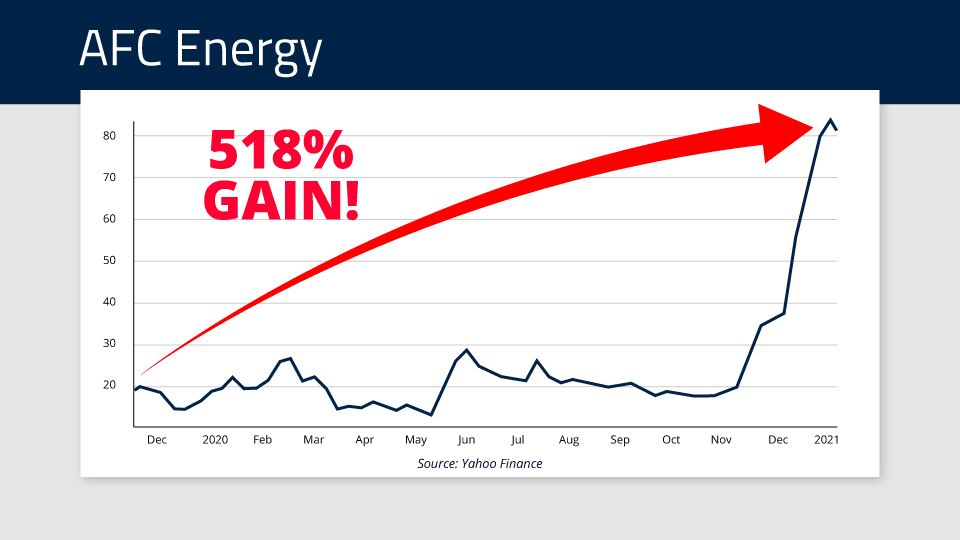

That’s not all, a second hydrogen recommendation gained 518% in about the same time.

Past performance is not a reliable indicator of future results.

Five-year performance for AFC Energy: 2020 +385.63%| 2021 -37.91% | 2022 -62.47% | 2023 +10.81% | 2024 -48.2%

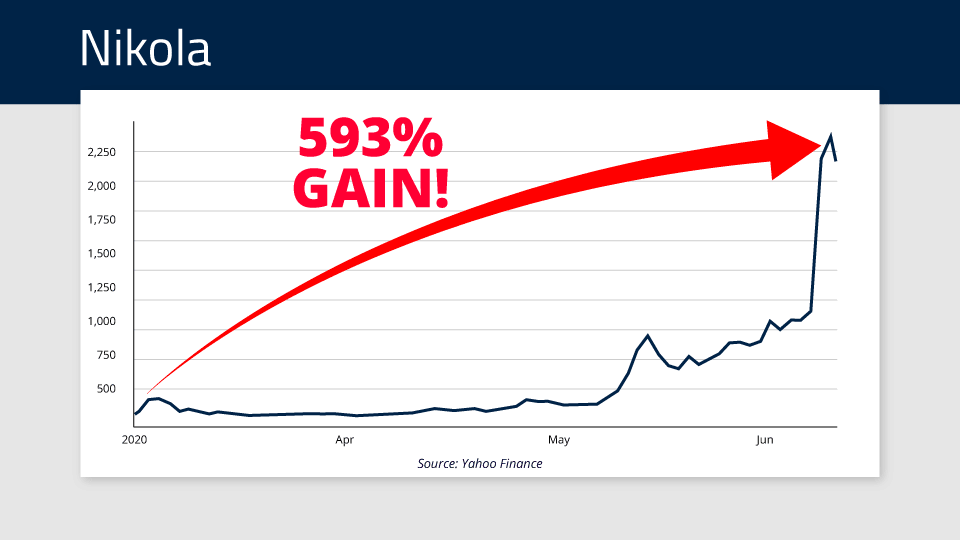

Then again in 2020, I spotted another potential high-profit opportunity to front run government spending.

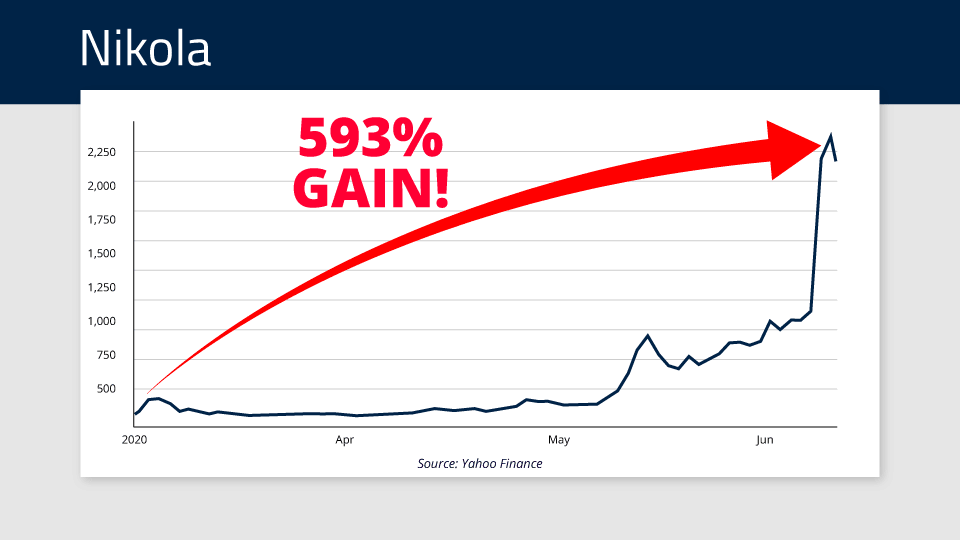

Sure enough, clean energy subsidies pushed EV maker Nikola Corp’s share price up 593%...

Past performance is not a reliable indicator of future results.

Five-year performance for Nickola Corp: 2020-23 unavailable | 2024 -94.87%

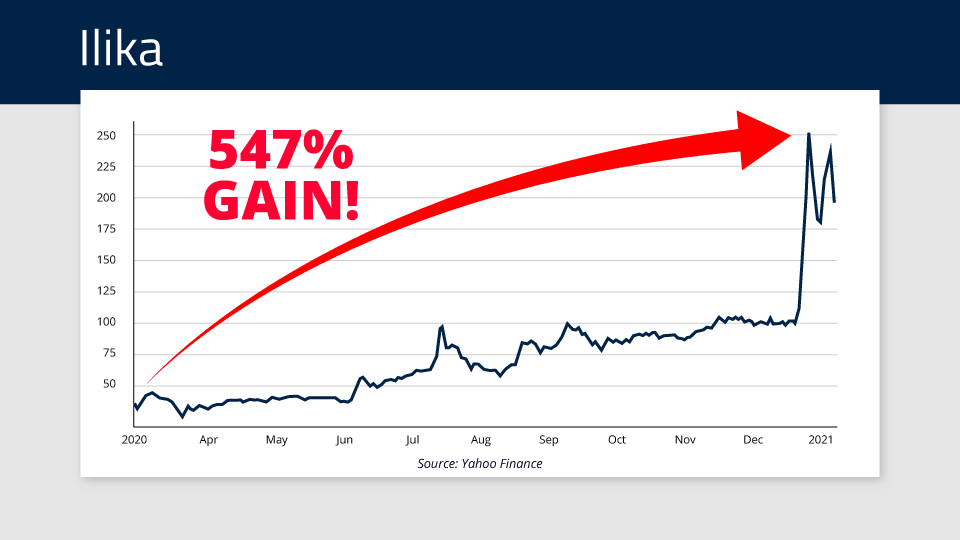

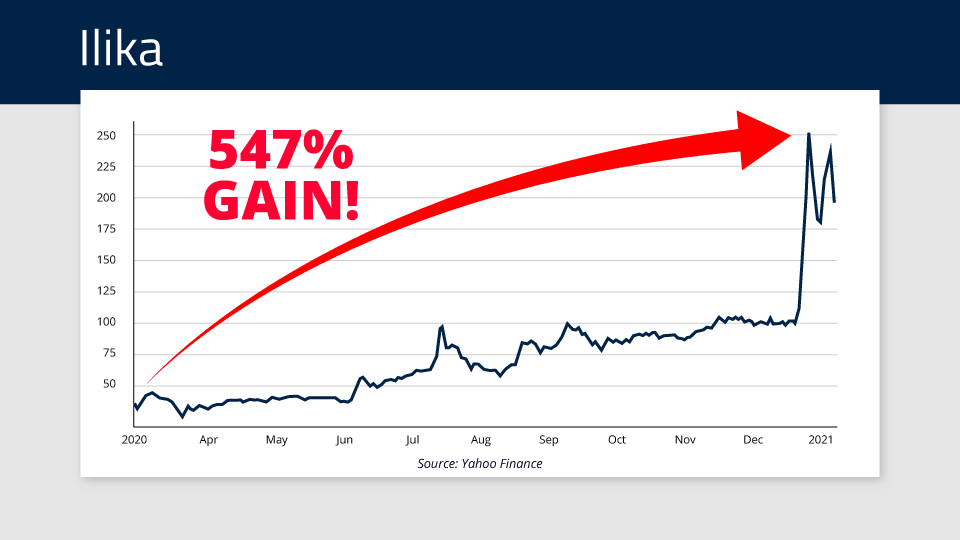

EV battery maker Ilika, ran up 547%...

Past performance is not a reliable indicator of future results.

Five-year performance for Ilika plc: 2020 +596.06% | 2021 -11.25% | 2022 -86.64% | 2023 +48.45% | 2024 -40.2%

And lithium producer Neo Lithium Corp handed readers a 400% win.

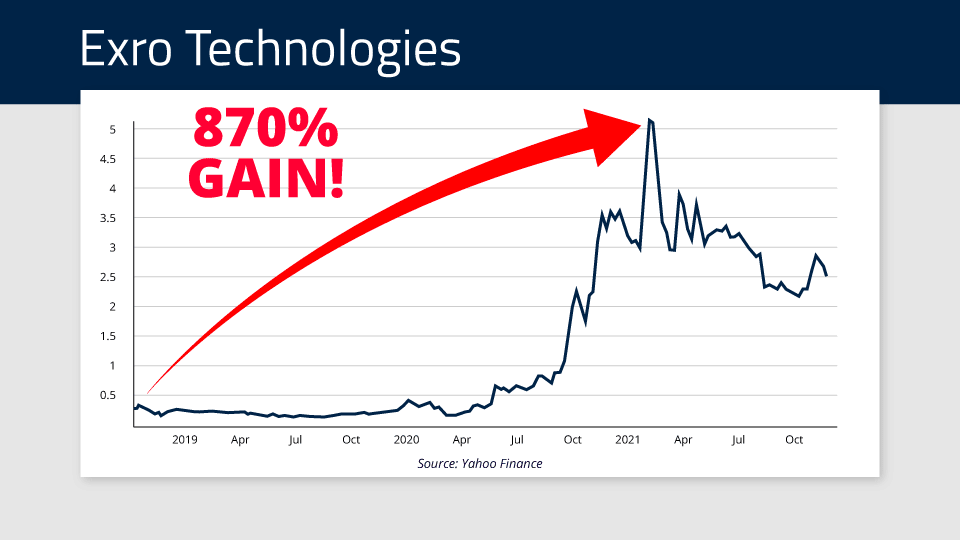

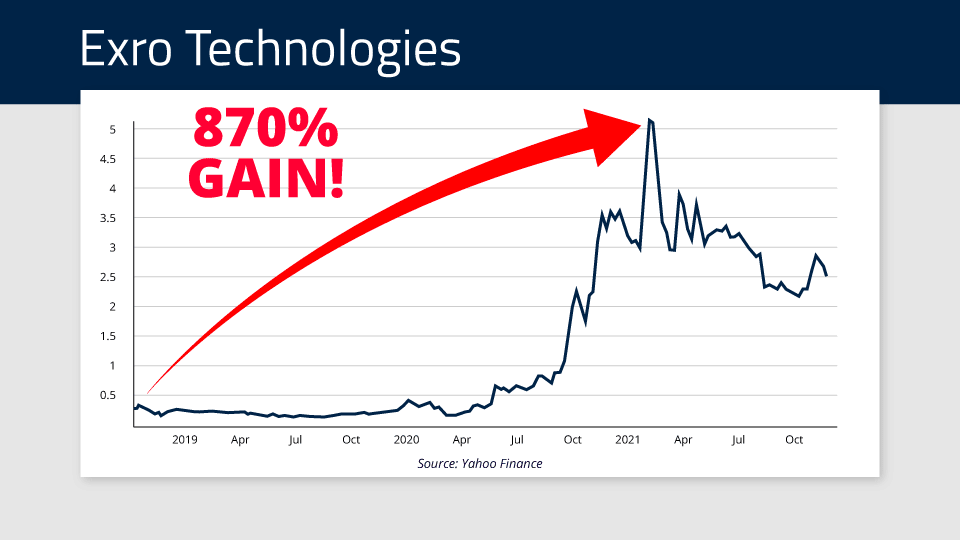

Before all that, in 2018, I uncovered a company using AI to dramatically improve the electricity generated by wind turbines.

That resulted in a 870% gain in just three years.

Past performance is not a reliable indicator of future results.

Five-year performance for Exro Technologies: 2020 +1,207.46% | 2021 -33.56% | 2022 -27.84% | 2023 -39.05% | 2024 -89.84%

I don’t say any of this to brag. I simply say it to show that I know what I’m talking about when it comes to helping folks build their wealth through investments.

Now, before we go on, you may be thinking one thing: renewables are a hoax…

That’s fine. I’m not here to argue the point on that.

That’s not my job. My job is to do the best I can to identify the biggest investment opportunities in Britain and the world today.

It’s a singular role, and I enjoy it with a passion.

The fact is, I know where the opportunities are, and I know how much money you could make from them.

That’s what I’m here to do for you. Not to score political points and get into debates. I’m here to help you profit from emerging trends and technologies wherever I find them.

Of course, when it comes to investing, no one is perfect…

Sometimes, I’ve been early – and sometimes flat-out wrong. We’ve closed out some losses along the way. Like battery maker AMTE Power which closed out for a -42% loss… and Advanced Oncotherapy which took at -42% hit… and Stellantis fell -29%.

But when you’re investing in exciting companies and trends, and if you want the chance to make big investment gains, those are inherent and unavoidable risks.

These can be small companies, so share prices can swing wildly down and up.

If you can accept the risks – and you’re willing to follow our risk-management rules – I’m confident you’ll come out of this with far more wins than losses.

In fact, my whole career has been about managing, dealing with and understanding risks.

Before I joined the UKs largest independent research company, I ran an energy bureau in New York.

That put me in contact with people like BP CEO Bernard Looney… Secretary of State for Energy and Climate Change, Chris Huhne… and US Energy Secretary Ernest Moritz.

These business, political and financial connections enable me to dig deeper into an emerging opportunity than what you can find in trade publications, a balance sheet or earnings calls.

That deeper understanding gives me a unique edge.

For example, back in 2018, renewables were the most hated corner of the energy market.

The Financial Times reported:

The Telegraph said:

The Guardian wrote, “UK summer ‘wind drought’ puts green revolution into reverse.”

It wasn’t only the press that hated renewables…

In the glass cube at the Brussels SQUARE Convention Centre, overlooking the colourful French-style landscaped gardens, I spoke to the head of one of Germany’s largest utility companies.

He predicted that renewables would never gain a significant foothold in Germany and the wider European market because they were too expensive, too intermittent, and far too reliant on government subsidies.

Thanks to my meetings with connected insiders, I knew that billions of dollars were about to flow into the sector.

I used that insight to help my readers position themselves to potentially profit ahead of this big money flow.

Sure enough, in 2019, America invested $55.5 billion in onshore wind.

And two years later, my readers banked an 870% winner… precisely because of my deep knowledge and connections.

My investigation of the emerging hydrogen economy took me to Paraguay to meet with Carlos Zaldivar, Paraguay’s vice minister of mines and energy, and Gustavo Cazal, Paraguay’s director of alternative energy.

That’s me on the right.

They gave me chapter and verse on the green hydrogen and ammonia opportunity at hand.

Turns out, by converting their excess hydroelectricity into hydrogen, they would make $380 million per year.

More than double what they make selling their spare electricity to Brazil.

Meetings like this have helped my readers get in on multiple triple-digit winners, including:

- 838% on ITM Power plc

- 518% on AFC Energy

- 547% on Ilika

- 251% from Ballard Power Systems Inc

- 192% from McPhy Energy S.A.

Again, not everything I touch turns to gold.

Today there’s another opportunity I’m here to tell you about.

Thanks to my experience… my business, banking and government contacts… I’ve been able to connect the dots on a once-in-a-generation opportunity.

A £39 billion wave of private finance that’s about to flow into a secure location just a 35-minute drive from Oxford… the secure location where I was standing just a few minutes ago.

In a moment, I’ll show you not one, or two, but three companies that could make you a BIG windfall in 2025 – all due to Britain’s AI railroad.

But before I get to that, let’s backup and show you why Britain’s new AI railroad is set to remap our economy.

I need to take you back to the secure location, 35 minutes from Oxford.

A location protected by military-grade surveillance and a 24-hour armed guard.

An area I call…

Ground zero of Britain’s AI railroad

This is where an unnamed private company will build Britain’s next AI supercomputer.

A supercomputer with twice the power of Elon Musk’s Colossus.

Jensen Huang, CEO of Nvidia

Source: Wikimedia

Remember, Nvidia CEO Jensen Huang says Colossus is, “easily the fastest supercomputer on the planet.”

Yet, Britain’s next supercomputer will be twice as powerful…

And within two to three years, it’s expected to become five times more powerful.

And it can do that because this location has a high-capacity grid connection.

It also has easy access to the clean energy technologies of the near future.

Plus, the space to expand, as AI creates new jobs and a wave of economic prosperity.

All told, these innovations will supercharge the rollout of AI in our daily lives.

And it’s already happening…

AI is already used in hospitals up and down the country to deliver better, faster and smarter care.

Spotting pain levels for people who can’t speak.

Diagnosing breast and lung cancer faster than doctors, and getting people treated and discharged quicker.

AI is also unlocking new scientific breakthroughs. Google DeepMind researchers recently discovered 2.2 million crystal structures, including 380,000 new materials that could power future technologies such as batteries, computer chips and solar panels.

At the World Economic Forum in Davos this year, the CEO of Google DeepMind, Sir Demis Hassabis, said AI-developed drugs will be in trials by year-end.

It takes, on average, five to ten years to discover a new drug.

Google hopes to cut the drug discovery time to just one year.

This would be an incredible life-saving and life-changing revolution in human health.

And it’s not the only AI breakthrough we could see this year.

Sam Altman,CEO of OpenAI

Source: Wikimedia

Sam Altman, the man behind ChatGPT, and now OpenAI CEO, says by the end of 2025 “we may see the first AI agents ‘join the workforce’ and materially change the output of companies”.

OK. Big deal. But just what is an AI agent?

You can think of them as personal assistants that can handle complex tasks.

For example, imagine asking ChatGPT to book the cheapest flight to Rome next Thursday.

An AI agent wouldn’t just find the cheapest and most convenient flight.

It would also book your plane tickets, airport parking and arrange for a taxi to meet you in Rome.

And it would do it all in seconds…

Without any extra input from you.

OpenAI, the company behind ChatGPT, plans to launch this type of virtual assistant this year.

Microsoft has already launched its own AI agents…

And it’s giving early adopters a competitive advantage.

McKinsey, the global consulting giant, has cut client onboarding time by 90%.

Pets at Home, Britain’s largest pet care business, expects to save seven figures a year.

And Nvidia CEO Jensen Huang is already calling AI agents a “multi-trillion-dollar industry.”

This wave of AI adoption will be powered by Britain’s new AI railroad.

And it’s not only programmers and engineers who will benefit.

We’ll see a surge in construction jobs too...

That’s why, I believe Britain’s new AI railroad will create the biggest British wealth boom in half a century.

Now, let me tell you why this is all happening now.

Britain’s second Big Bang

It’s no secret the government is broke.

So broke it had to abandon plans to build a supercomputer in Edinburgh because it couldn’t find £800 million.

That’s why the changes unfolding today are entirely funded by an ambitious private sector.

The government's only role is to cut through seven years of red tape and then get out of the way.

This is, in effect, similar to the Big Bang that happened in the financial markets in 1986.

That resulted in a 64% increase in trading through the London Stock Exchange... after only one week.

By 2006, London was arguably the world’s most important financial centre.

Thatcher’s Big Bang also earned Britain a seat at the G7.

I believe the economic growth and the impact of Britain's AI railroad could be even greater.

And I’d like to help you profit from it.

By becoming part of a group of investors who sees what’s happening and get in early to the three companies building Britain’s new AI railroad.

In a moment, I’ll show you how to join us.

But first, let me tell you about…

Britain’s AI boom

You’ve already seen ground zero of Britain’s new AI railroad.

And let’s face it… one new supercomputer won’t make Britain a global AI leader.

That’s why we could soon see these AI factories popping up all over the country.

From Oxford to Wales… and from Essex to Liverpool.

Big Tech is in a race to build them as fast as possible.

And in the process, breathe new life into Britain’s industrial wastelands.

The Skelton Grange power station was torn down on 12 November 1995.

For the last 30 years, it has sat empty.

Until Microsoft gained approval to build a new AI supercomputer.

Now, Microsoft is keeping its cards close to its chest.

So I can’t tell you much about the project.

What I do know is it’s building a hyperscale facility. So it’ll be twice as powerful as Elon Musk’s Colossus.

But that’s not all…

Microsoft is installing a 100-megawatt battery.

So this AI supercomputer could be almost entirely powered by green energy.

And this isn’t the only manufacturing graveyard that’s about to get a new lease of life.

The Ford factory in Bridgend closed in 2020.

Destroying 1,700 jobs.

And bruising all the 49,000 residents in the town.

Local pubs, restaurants and hairdressers all took a hit.

As families cut back just to pay the mortgage.

Now this abandoned town is getting a face-lift of up to £12 billion.

It’s all thanks to a private company, which I’ll tell you about in a moment, that’s turning this derelict factory into one of Europe’s largest supercomputers.

A new ten-building campus will take up over 46 acres.

And will create thousands of new jobs.

The new owner predicts the site will be fully powered by renewables by 2030.

And it looks like it’ll break ground next year.

Then there’s a site near Epping Forest in Essex…

A London-based AI hyperscaler is building a supercomputer that’s also twice as powerful as Elon Musk’s Colossus.

Remember, Nvidia CEO Jensen Huang says Colossus is “easily the fastest computer on the planet.”

Well, this new British AI beast is about to steal the crown…

Because of what’s under the hood – 45,000 of the newest Nvidia GB200 chips.

This new British supercomputer is set to switch on next year.

Finally, there’s one more industrial wasteland that’s getting a second lease of life.

The power station in Didcot, Oxfordshire, was torn down in 2020.

Source: Wikimedia

Now, it’s being transformed into a £1.9 billion AI supercomputer.

And it could fire up next year with a 100-megawatt power capacity.

Work is due to start on each of these sites this year.

The money is already in place… all legal and government approvals are granted… we’re just waiting for the bulldozers to start rolling.

To get in on this opportunity, I recommend you make a small investment in each of the companies I’ll introduce to you now…

Before we get into it, just a quick reminder… These are higher risk than your average blue chip. You can expect higher volatility in the share prices.

All investing carries risk, even a small investment should only be capital you can afford to lose.

Here’s the first step I recommend you take immediately…

AI Railroad Stock #1:

invest in Britain’s Number One AI Chipmaker

The first thing you have to realise is the sheer size of Britain’s new AI railroad.

We’re about to see a £39 billion investment…

In new hyperscale data centres.

These will be some of the fastest AI supercomputers in the world.

Potentially twice as fast as Elon Musk’s Colossus supercomputer in Memphis.

An AI data center that Nvidia CEO Jensen Huang says is “easily the fastest supercomputer on the planet.”

And this £39 billion investment in Britain’s new AI supercomputers will need the world’s fastest AI chips.

Today, that’s the Nvidia GB200.

A superchip that combines two Nvidia Blackwell GPUs with a CPU from Britain’s Number One Chipmaker.

A Cambridge company that’s right at the heart of the AI revolution.

A company you’ve likely never heard of.

Because they don’t make a consumer product.

But every day, you use products that rely on Britain’s Number One Chipmaker.

Take the phone in your pocket. It’s almost guaranteed to use their chips. Because, almost unbelievably, this Cambridge company powers 99% of all smartphones.

What about the computer you’re using right now?

If it’s a Mac with Apple Silicon - it’s using their chips.

Same story with Microsoft’s new CoPilot laptops.

And what about your car?

If you’ve got any of the new safety systems such as lane warning, breaking alerts, adaptive cruise control and parking cameras…

Then I’d bet it relies on Britain’s Number One Chipmaker.

Because 94% of car makers use its chips.

This Cambridge company holds a dominant position in every major tech market.

Smartphones. Laptops. Cars. AI data centres.

And you’ve likely never heard of it.

But, that’s about to change…

Because this Cambridge company is about to go head-to-head with Nivida…

Launching its own range of AI chips.

A move that could change the AI landscape as much as DeepSeek.

Because just as DeepSeek has created a ChatGPT competitor at a cost of less than five million dollars…

Twenty times less than the cost to develop ChatGPT…

Britain’s Number One Chipmaker is about to launch an AI chip that’s likely to be faster and much more energy efficient than Nvidia’s GB200.

You see, there’s one reason why 99% of all smartphones use this Cambridge company’s chips…

Power.

Its chips are much more power efficient.

So, smartphone makers like Apple, Samsung and Google can boast about their new higher power and better battery models.

It’s the same story with laptops.

The new 16-inch Macbook Pro has a 24-hour battery.

Now this Cambridge company is applying its power-saving expertise to AI supercomputers.

Today, you get the chance to stake your claim before this company launches its new AI chips and becomes a household name.

My research indicates that investing in Britain’s Number One Chipmaker right now…

Is like investing in Nvidia five years ago.

Back when it traded for a split-adjusted price of four bucks a share… and Nivida was a $168 billion company.

Back then, the idea of a $1 trillion valuation was crazy.

Let alone a market cap of over $3 trillion, which is where it is today.

But here’s the thing…

Most investors don’t appreciate the speed AI is rolling out… and pushing up share prices.

Of course, Britain’s Number One Chipmaker isn't immune from the wild fluctuations in the tech market.

DeepSeek’s release wiped $600 billion off Nvidia’s value in a single day.

The Nasdaq dropped by over $1 trillion.

And Britain’s Number One Chipmaker was also hit…

But I believe Britain’s Number One Chipmaker could become the first British company to reach a trillion-dollar valuation… in the next five years.

Although there are no guarantees, it could hand today’s investors a 550% gain.

I’ve put all the details on this extraordinary company in a special report called “Britain’s Number One AI Chipmaker – Cambridge’s Trillion-Dollar Secret”.

Inside this private briefing, you’ll discover why this virtually unknown British chipmaker could see a huge profit surge with its new AI supercomputer chips.

You’ll get a detailed look at its financial position (written in plain English) so you can see for yourself why this is the best AI investment you could make right now.

You’ll understand why hedge funds and billionaires are piling into this company.

And of course, there’s much more in the report.

In a moment, I’ll show you two more ways you could profit from Britain’s new £39 billion AI railroad.

But first, there’s one more critical piece to this story…

Clean tech 2.0

A new technology is going to change the global balance of power – for the next half-century.

And Britain is poised to become the world’s first nation to integrate it with artificial intelligence.

In a pioneering move that will kick off at the secure location, that’s a 35-minute drive from Oxford, which I showed you earlier.

Ground zero of Britain’s new AI railroad will be the test-bed for a new clean energy.

This new zero-carbon energy technology is a reliable source of power, providing a stable and uninterrupted supply.

And it could soon change how we heat our homes, how we build our homes, and how we power AI supercomputers.

Governments around the world have made commitments to start using this new clean energy technology.

Including the United States, Canada, Japan, France and the Czech Republic.

But the big, exciting developments in clean tech aren’t being taken by governments.

This new clean energy technology is being pioneered by AI companies.

Companies like Microsoft, Amazon and Google seeking hundreds of megawatts of clean energy to power hyperscale AI factories.

I’m talking about nuclear power.

But not nuclear power as you know it.

I’m not talking about big projects like Hinkley in Somerset or Sizewell in Suffolk.

These gargantuan builds take decades to complete and cost billions of pounds.

The new type of nuclear energy that I’m talking about is smaller, cheaper, faster to build, and much safer.

In fact, it’s not just smaller…

It’s one-tenth the size of Hinkley.

And unlike Hinkley Point C, that's likely to take 20 years to complete…

The new smaller nuclear plants could be up and running in just 48 months.

That’s because we can build them in a factory, just like a car.

Where production lines can cut cost and production time while also delivering a safer solution.

One small modular nuclear reactor, or SMR, could power one million homes… or one of Britain’s new AI supercomputers.

This is still an emerging technology.

But that’s not stopping Big Tech from making big moves…

A new nuclear energy revival

Google has just ordered seven SMRs from Kairos Power.

Becoming the first tech company to commission new nuclear power plants.

Michael Terrell, Google's senior director of energy and climate, said the agreement was “a landmark for us at Google in our 15-year clean energy journey”.

This new deal shows the urgency of Google’s AI power ambitions.

Kairos only received approval for its SMR design in December 2024.

And that was the first approval for a new type of reactor in the US for half a century.

Google isn’t the only AI company jumping on SMRs…

Amazon has just inked three deals to deploy SMRs across the US.

And Oracle has committed to building three SMRs to power a gigawatt-scale data centre.

Early investors are already making mega profits.

NuScale soared over 1,000% in less than a year…

Past performance is not a reliable indicator of future results.

Five-year performance for NuScale Power Corp: 2020-22 unavailable | 2023 -74.48% | 2024 +695.8%

But here’s the thing…

SMRs have not yet been approved in the UK.

But that could change any day now.

The government has already unveiled plans for an SMR to power Britain’s next AI supercomputer.

The SMR designs from four companies have been shortlisted by the government.

Based on 18 years of experience… and conversations with energy market insiders, I’m convinced there’s one clear winner.

In a moment, I’ll show you can get the info to position yourself to potentially profit before an official announcement from the government…

So you too could bank a NuScale-size 1,000% profit, in less than a year.

Now, we’ve just covered a lot.

There’s a lot to process here, and I don’t want you to miss a thing.

So, let’s keep it simple and re-cap…

Britain is building what I call a new AI railroad… and it’s set to remap our economy.

In the process, we’re taking critical steps to become a global AI leader.

We’re building some of the world’s most powerful supercomputers.

And we’re about to use small modular nuclear reactors to power our new AI supercomputers.

The combined impact of this could be unmatched.

You see, as AI energy demand speeds up the clean energy transition…

New, cheap, clean energy production will fuel tech innovation…

Unleashing new investment in AI supercomputers and clean energy technologies.

Creating a virtuous cycle of innovation and wealth creation.

These massive changes are about to kick off at the secure location I showed you that’s just a 35-minute drive from Oxford.

Which is why I’m urging you to take action immediately.

Because as I’ve shown you here today, this could present the rare opportunity to turn a modest investment into a fortune.

If there’s one thing I’ve learned about this business, it’s that a chance like this doesn't come around often.

And when it does, 99% of people do nothing… they simply sit on the sidelines and get left behind.

But for the small 1% of investors who see what’s coming and take action, it can make a real difference.

I’ve already shown you the first step I recommend you take immediately.

And now I’ll introduce you to a second…

AI Railroad Stock #2:

grab an early stake in Britain’s AI

energy answer

There is little doubt that the AI era will increase the need for power.

But in the eyes of Big Tech, not all energy is created equal.

So, alongside a growing demand for power, there is a greater demand for clean power.

Let me show you what I mean…

Microsoft has the most ambitious climate goal I’ve ever seen…

To be carbon negative by 2030.

Then by 2050…

To remove all the carbon Microsoft has emitted since 1975.

That’s a gigantic goal.

And, it’s more than just words.

In May 2024, Microsoft announced the purchase of 10.5 gigawatts of clean power from Brookfield Renewable Partners, the largest-ever such deal announced.

Microsoft isn’t the only company honouring its climate commitments…

Google is committed to achieving net zero across all operations by 2030.

That means, every office, research facility and AI supercomputer will run on carbon-free energy by 2030.

That’s why Google is one of the biggest investors in clean-tech projects.

As of 2022, Google had invested $3.5 billion in renewable energy.

And it continues to invest in new projects.

Such as a newly finished, first-of-its-kind geothermal power project in Nevada. In Texas, it’s building one of the world’s largest solar projects. And Google expects to spend $16 billion through 2040 globally to buy clean energy.

Simply put, Big Tech wants clean energy.

And that’s what makes my next recommendation so valuable.

While also addressing the biggest renewable energy concern.

Wind power may have its benefits, but what happens when the wind stops?

This particular one-gigawatt development isn’t just a wind farm, it also has battery storage.

Now, one gigawatt is enough energy to keep the lights on for two million homes.

But rather than sell its clean energy to the grid…

This company will sell its energy direct to data centres.

Its “Powerland” solution is considered to be the ultimate plug-and-play setup for data centres. Giving Google, Amazon or Microsoft what they want most – a fast and easy connection to high-capacity clean energy.

What’s more, over the last five years, it has increased energy production by 20 times…

From 75 megawatts in 2018 to an impressive 1,658 megawatts today…

And it achieved this growth without raising additional capital.

Plus, it already has 20 gigawatts under development. That’s enough power for 40 million homes – more than every house in Britain.

It’s an incredible story from an exceptional company.

I’ve put all the details on this extraordinary company in a special report called “Clean Power, Clear Profits – The Energy Pioneer Igniting Britain’s AI Future”.

Inside this special report, you’ll discover why TIME magazine ranks it the “world’s most sustainable growth company”.

You’ll also get a detailed look at its other wind and solar projects across Europe and America.

I’ll give you a full breakdown of its financial position (in plain English) so you can see for yourself why I believe this company could soon triple your money.

This report, like the other one I’ll send you on how to profit from Britain's new AI railroad, will be among the first things you receive when you take a trial membership to my investment research service, Southbank Growth Advantage.

Here’s how it works…

The best thing you can do with your money right now

Now, I don’t want to blow my own trumpet too much, but the truth is, I’m good at what I do.

I’ve been involved in this market for 18 years.

In 2019 I helped my subscribers profit from a niche hydrogen power play.

The stock I recommended took off to the tune of 838%.

Past performance is not a reliable indicator of future results.

Five-year performance for ITM Power: 2020 +626.11% | 2021 -23.64% | 2022 -35.18% | 2023 -39.9% | 2024 +2.97%

Another hydrogen recommendation ran up 518%.

Past performance is not a reliable indicator of future results.

Five-year performance for AFC Energy: 2020 +385.63%| 2021 -37.91% | 2022 -62.47% | 2023 +10.81% | 2024 -48.2%

Then in 2020, I spotted another potential high-profit opportunity to front-run government spending.

Sure enough, this stimulus sent EV maker Nikola Corp’s share price 593% higher.

Past performance is not a reliable indicator of future results.

Five-year performance for Nickola Corp: 2020-23 unavailable | 2024 -94.87%

EV battery maker Ilika climbed 547%.

Past performance is not a reliable indicator of future results.

Five-year performance for Ilika plc: 2020 +596.06% | 2021 -11.25% | 2022 -86.64% | 2023 +48.45% | 2024 -40.2%

Lithium producer Neo Lithium Corp handed readers a 400% win.

And in 2018 I uncovered a company using AI to dramatically improve the amount of power generated by wind turbines.

That recommendation resulted in an 870% win.

Past performance is not a reliable indicator of future results.

Five-year performance for Exro Technologies: 2020 +1,207.46% | 2021 -33.56% | 2022 -27.84% | 2023 -39.05% | 2024 -89.84%

Of course, when it comes to investing, no one is perfect…

Sometimes, I’ve been early – and sometimes flat-out wrong. We’ve closed out some losses along the way. Like battery maker AMTE Power which closed out for a -42% loss… and Advanced Oncotherapy which took at -42% hit… and Stellantis fell -29%.

So how do I uncover the big winners before everyone else?

And how did I find the right investments at the right time for my subscribers?

Well, it’s a combination of 18 years of “boots on the ground” know-how which has given me an intimate understanding of the forces that drive markets…

A black book of business, financial and political insiders that I’ve carefully cultivated along the way…

A “know everything” research ethic before I make any sort of recommendation…

And good old-fashioned fundamental analysis.

I can tell you, it’s a toolkit that I will use to get you in on the hidden and overlooked opportunities in the market.

Today, I want to help you profit from the biggest opportunity I’ve ever seen… in any market… any asset… any sector… ever…

Britain’s new AI railroad.

That's why I’m inviting you to become a member of my investment service, Southbank Growth Advantage.

Before I give you the specifics on how to join a community of investors looking to profit from asymmetric opportunities…

Let me tell you about one more critical investment idea I recommend you take right now…

AI Railroad Stock #3:

the best way to profit from Britain’s clean tech 2.0

As you’ve seen, Britain could soon become one of the world’s first nations to integrate nuclear power with artificial intelligence.

A move that would easily make Britain a global AI leader.

The rollout of small modular nuclear reactors can’t happen without the full support of the government.

Fortunately, Labour sees the urgency of the situation.

On 12 January 2025, the government unveiled a groundbreaking plan to integrate nuclear energy with AI.

By using small modular reactors to power our new AI supercomputers.

Now, the government hasn’t yet approved any of the 80 SMR designs in development.

That said, it has cut its decision down to four final contenders.

And I believe I know which company will win the approval to build Britain’s clean-energy future.

It’s a company with over a century of engineering innovation.

In fact, its engines helped us win the Battle of Britain in the Second World War…

Because it powered our most important fighter planes.

Today, it continues to build engines for the Royal Air Force, the Royal Navy and 400 other customers in 150 countries.

Simply put – it’s a safe pair of hands.

So safe in fact, that the Czech government has already ordered its SMRs.

Beating our government to the punch.

But I don’t think it will be long before the British government follows in its footsteps.

Because this is the only company on its clean-energy shortlist that can give Britain energy independence.

Now, this is where things get really exciting…

Once the government approves its SMR design, the share price could take off like a rocket.

Because just five SMRs would more than double its current turnover.

And its chief technology officer predicts that by 2050, production could reach more than a thousand.

That’s a £3 TRILLION revenue business.

Today you have the chance to position yourself to profit, before that historic announcement sends the share price soaring.

I’ve put all the details on this extraordinary company in a new special report called “Power & Pride - Britain’s £3 Trillion Nuclear Opportunity”.

Inside this private briefing, you’ll discover why this company’s clean energy division could soon dwarf its century-in-the-making engines business.

You’ll see details on the company’s operations – across 150 countries – and brag-worthy client list.

Most importantly, you’ll get a full breakdown of why this pioneering British company could soon make Britain energy independent. So you can see for yourself why its future is so much bigger than their current share price.

And, of course, there’s much more in this report.

These three reports make up my entire playbook to profit from Britain’s new AI railroad.

I believe anyone who invests in these companies right now will have the chance to make exceptional gains.

Turning every £100 you invest into a £1,000 or more is a real possibility here.

(Forecasts are not a reliable indicator of future results).

As Britain approaches this critical new turning point, it’s vitally important that you know how to navigate and profit from the coming changes.

That’s why I’m inviting you to become a member of Southbank Growth Advantage.

Here’s how you join us

When you take a 30-day trial subscription to Southbank Growth Advantage, you’ll get immediate access to the special reports I’ve told you about…

- Report #1: “Britain’s Number OneAI Chipmaker – Cambridge’s Trillion-Dollar Secret”

- Report #2: “Clean Power, Clear Profits – The Energy Pioneer Igniting Britain’s AI Future”

- Report #3: “Power & Pride – Britain’s £3 Trillion Nuclear Opportunity”

You’ll also get…

12 issues of Southbank Growth Advantage a year

Each month I’ll send you a hidden and potentially highly profitable investment opportunity – just like Britain’s new AI railroad.

While future recommendations might not be on the sale of a £39 billion British AI rollout…

They will bring you emerging opportunities you won’t find anywhere else. Complete with a full investment thesis, an entire breakdown of the risks, as well as the profit potential.

Simply put – I do all the heavy lifting.

All you need to do is read my research. Decide how much you want to invest. Then watch your potential profits pile up.

Now, it’s important to point out that this sort of shorter-term investing is not for everyone. It’s higher risk than parking your money in an index fund.

You need to be comfortable with that elevated risk and only invest money you can afford to lose.

Yet responsible, well researched, active investing gives you the chance to see a small stake swell into something much larger in just a few months.

Just like these community members managed to achieve…

Charles from Norwich took the time to say…

“On a personal note, this is the first time I have felt enthusiastic about saving in over 15 years…

“The service is wonderful, and in my opinion represents fantastic value for money. I just wish I had learned about it all ten years ago!

“I am living my best life, and it is only because of the wealth of information that you and your team have provided.”

CharlesGary from East Malling, wrote to us saying…

“The service is in a different league to everything I have seen previously, no hype, no hard sell, just quality information, foresight and assistance from the start.”

GaryTK wrote in to tell me…

“Even though, as a pensioner, I have been careful not to risk too much money on your recommendations, I am currently £25,000 in paper profit, which clearly will make a big difference going forwards. So many thanks and congratulations to you.”

TKThese are just a handful of the emails and calls that come in every week from the Southbank Growth Advantage community.

And I’d love for you to become our newest member… and to get a similar note from you as well.

My monthly research and investment recommendations are just the first of many benefits you get as a subscriber.

You’ll also get…

Full access to the Southbank Growth Advantage portfolio

So you can immediately position yourself to profit from the high-growth companies I believe are about to make a big impact on AI… robotics… renewable energy… and electric vehicles.

Each recommendation gives you a full write-up of the opportunity and risk analysis, as well as the stock ticker and buy-up-to price. Giving you everything you need to make an informed investment decision.

You’ll also get…

Trade alerts

I’ll send you real-time trade alerts by email when it’s time to sell a position. So you’ll never miss a big profit opportunity.

Plus…

My million-pound library

You’ll have access to my entire vault of special reports and investment resources. This includes every special report I’ve written over the years, newsletter archive and video library.

I want to keep talking to you about this, but maybe you’re already with me and want to try out Southbank Growth Advantage.

If so, click on the link below and join me – with a 64% discount.

Yes, I want to Join Southbank Growth Advantage with a 64% discountWhen you join the Southbank Growth Advantage community, you’ll also receive…

Bonus Report:

“Britain’s billion-pound AI unicorns”

Aside from the exciting companies you can invest in today, remember there are two private companies investing a combined £14 billion in Britain’s new AI railroad.

One company is making up to a £12 billion investment to turn the abandoned Ford plant in Wales into a new supercomputer.

A London-based company is building a £2 billion supercomputer near Epping Forest in Essex.

There’s one simple reason why I haven’t recommended any of these additional exciting companies…

They aren’t yet listed on the stock market.

In this bonus report, I’ll reveal all the details on these potentially profit-packed private companies.

You’ll see why I’ve put them at the top of my watch list… why I suggest you do the same… and why these are Britain’s AI unicorns.

A unicorn in an unlisted $1 billion company.

Two of these companies have already raised well over $1 billion from hedge funds and venture capital.

In fact, new funding in one company is set to drive $30 billion in new developments… across 25 sites in America and Europe.

The CEO said, “This new funding from the world’s leading technology investors is a game changer that uniquely positions [us] to capitalise on the incredible AI and cloud opportunity in front of us.”

Another company specialises in sustainable AI-ready data centres. In just the last year, it grew its greenfield compute by 333%, from 300 megawatts to 1.3 gigawatts.

And it just landed $155 million in Series A funding. The round was led by Sandton Capital Partners, alongside Kestrel, Bluesky Asset Management, and Florence Capital.

The new oversubscribed funding will accelerate the rollout of hyperscale supercomputers across Europe and America.

By combining its technology, sustainability, and strategic global expansion, this company is positioned to dominate the hyperscale AI market.

And of course, there’s much more in the report.

While they aren’t publicly investable right now, as soon as there’s news of an IPO, I’ll let you know. Complete with a full write-up of the risks and the potential size of the opportunity.

By now, you must be wondering…

What does it cost to join Southbank Growth Advantage?

I’ve arranged a special deal for you…

If we were to charge what most professional firms do for access to elite-level stock research…

It would price most people out.

That’s a fact.

You need a five- or six-figure budget to invest in the majority of places dotted around the City and Canary Wharf.

You’ll be relieved to know you don’t need anywhere near those sums to access my research and investment recommendations.

That’s because I believe in helping investors like you.

And that’s why the normal price of Southbank Growth Advantage is just £199.

Frankly, that’s a bargain.

You’re getting details of my number one stock recommendation emailed to you every month…

And you’ve seen the kind of gains members have experienced with them…

The £199 price tag is a drop in the ocean compared to the value you’re getting.

That’s without taking into account the £597 worth of special reports you get the moment you join.

Now, here’s the good news…

You don’t have to pay £199 today.

If you take me up on this special offer right now…

You can try a one-year membership to the Southbank Growth Advantage community… and claim your three private briefings to profit from Britain’s new AI railroad…

For just £79.

That’s right…

You can save yourself £120 if you act right now.

And get £597 worth of special reports at no additional charge.

I reckon it will be one of the best financial moves you ever make.

But I would say that, wouldn’t I?

So here’s how I’m going to prove it to you…

Right now, you can join Southbank Growth Advantage under no pressure, with £120 off the normal rate…

Because you’re covered by my 30-day, 100% money-back guarantee.

100% money-back guarantee

Here’s how it works.

Take an entire month to read all my special reports, my newsletter back catalogue and video library.

See for yourself the money-making potential of my research into companies leveraging emerging trends to achieve high growth.

Once you’ve looked under the hood of Southbank Growth Advantage… if you decide this isn’t for you.

You can cancel anytime within the first 30 days and receive a full refund of your membership fee.

No stress. No hassles. And we’ll depart as friends.

Plus, you can keep all of your private briefings to potentially profit from Britain’s new AI railroad, as a thank you from me for giving this a try.

You have nothing to lose…

So, the way I see it, the next step is up to you.

You can choose to ignore all the research I’ve shown you today.

You can dismiss the £39 billion of private investment building Britain’s new AI supercomputers.

You can push aside the £3 trillion opportunity in the century-old British company powering our AI future.

And you’ll see how that works out for you.

Or you can take action right now.

Put yourself in the running.

For the chance to profit from Britain’s new AI railroad.

Here’s what you need to remember…

AI isn’t a fad. It’s a mega trend that’s going to completely change the way we work, travel and transact.

Those who position themselves now, well…

They could see huge investment gains… and have the kind of life most people can only dream of.

That’s the kind of opportunity you’ll find as a member of Southbank Growth Advantage.

To get started, just click the button below.

It will take you to our secure order form, where you can review everything I’ve shown you today, and lock in your £120 first-year savings.

The ordering process is completely secure and privacy protected.

Within minutes, you’ll get full access to these special reports…

- Report #1: “Britain’s Number OneAI Chipmaker – Cambridge’s Trillion-Dollar Secret”

- Report #2: “Clean Power, Clear Profits – The Energy Pioneer Igniting Britain’s AI Future”

- Report #3: “Power & Pride – Britain’s £3 Trillion Nuclear Opportunity”

- Bonus Report #1: “The Two Private Companies Set to Reach Multi-Billion Pound Status”

As a reminder, here’s everything coming your way…

Just click the button below, and you’ll hear from me soon.

You have 30 days to check this out. If you’re not delighted with Southbank Growth Advantage, I don’t want your money. It’s as simple as that.

So, don’t miss this once-in-a-generation chance to get in early on Britain’s new AI railroad.

Click this button to get started.On behalf of Southbank Investment Research, I’m James Allen. Take care.

James Allen

Editor, Southbank Growth Advantage

Important Risk Warning

Advice in Southbank Growth Advantage does not constitute a personal recommendation. Any advice should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get back less that you paid. This makes them riskier than other investments. Small companies may not pay a dividend.

Overseas shares – Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Dividends from overseas companies may be taxed at source in the country of issue.

Taxation - Profits from share dealing are a form of capital gain and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future.

Editors: Sam Volkering and James Allen. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure, privacy policy and terms and conditions can be found at, www.southbankresearch.com.

Southbank Growth Advantage is issued by Southbank Investment Research Ltd. Registered in England and Wales No 9539630. VAT No GB629 7287 94. Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Contact Us: To contact customer services, please call us on 0203 966 4580, Monday to Friday, 10am - 5pm Southbank Investment Research Ltd is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2025 Southbank Investment Research Ltd.

Sources: