John Butler

Founder, Southbank Wealth Advantage

Hi, I’m John Butler.

I’m a former hedge fund manager, and financial adviser to elite financial institutions.

Seventeen years ago, the chairman of the Russian Central Bank, Sergey Ignatyev, invited me to Moscow.

In their ornate neoclassical building, just off Red Square, he confessed that Russia was considering holding a third reserve currency.

Russia already held dollars and euros in reserve.

Ignatyev wanted to know if Russia should hold the British pound or the Japanese yen.

I told him an American banking collapse was around the corner, so Russia should put its money in yen, a safe-haven currency.

In 2016, I predicted Brexit and Donald Trump’s presidential victory.

Both times I positioned myself to profit from the political fallout.

And banked a big enough profit to never worry about private school fees again – for all four of my children.

Five months ago, I predicted the market crash that’s playing out right now.

And showed the members of my investment community how they could protect their wealth from the market panic – and even how to potentially profit through it.

Today, I’d like to show you how to do the same.

I reference my success and experience in predicting such global financial crises because I believe we’re right at the start of an even bigger crisis. The likes of which we haven’t seen in a generation.

My research indicates the coming crisis will be bigger than 2020… bigger than 2008… bigger than 2000.

Five specific economic indicators tell me this is a make-or-break moment to protect your wealth.

I’ll share them with you in a moment.

First, I’d like to show you the specific causes of this recent market selloff so you understand the deeper problem at the centre of global finance.

Then I’ll show you why this week's share price drops are just the start of a much deeper and much more dangerous market panic than we’ve seen in a generation.

Believe me, I don’t make this prediction lightly and I have no interest in trying to scare you.

I’m simply following my research to its logical conclusion.

I did the same when I looked at the booming British and American housing market in 2007.

Investment banks such as Goldman Sachs, Merrill Lynch and Morgan Stanley paid me and my team huge fees to identify the big far-reaching events that will shape the markets for months or even years to come.

Yet, they didn’t believe me when I warned the housing market was in a bubble.

They were making far too much money creating the bubble to worry about the consequences of it bursting.

And let’s be honest…

I think they knew they were too big to fail.

With a potentially unlimited government bailout…

They could easily dismiss the terrifying future my research showed was just around the corner.

But, that’s exactly what happened.

Today, I believe the global economy is at the edge of another financial precipice.

This time, I’m warning more than just the financial elite.

That’s why I’m sending you this urgent message.

Let’s take a look at the causes of today’s market crash.

On Friday 2 August stock markets around the world saw their worst selloff since the Covid crash in 2020.

For one simple reason…

The $4 Trillion-Dollar Yen Carry Trade Collapsed…

To show you what the yen carry is and why it suddenly collapsed last week…

Let’s say I’m going to give you my car for free.

You can use it as much as you like.

As an ambitious entrepreneur, you decide to start making money from the car as an Uber driver.

Making money is easy because you’ve got a car for free.

Until I say, I want you to pay me £1,000 to use my car.

Suddenly, it’s a lot harder for you to make money as an Uber driver.

That’s exactly what’s happened with the yen carry trade.

Since 2010, the Bank of Japan has kept interest rates at zero… or less than zero.

Almost unbelievably, since 2016, you literally paid the Bank of Japan to hold your money.

This set up the perfect opportunity for savvy traders.

Because traders could borrow money in Japan at ZERO or less than zero.

Just like me giving you my car.

Traders then put that money to work in countries with a higher interest rate or in the stock market.

Just like making money on Uber is easy with a free car.

Making big profits in the stock market is easy when you can borrow an almost unlimited amount money for free.

Japan has $15 trillion in savings.

And some analysts estimate the total yen carry trade was worth $4 trillion.

With Japanese interest rates at zero or less than zero for almost 15 years, it looked like the safest bet in global finance.

That all changed on Wednesday 31 July when the Bank of Japan raised interest rates to 0.25%.

That doesn’t sound like a huge rate hike.

But the impact on global markets told a different story.

Two days later, the rate hike triggered the biggest market selloff since 2020, as hedge funds sold assets around the world to raise cash.

The Nasdaq tumbled more than 4% in two days.

The S&P 500 fell more than 3%.

But that’s nothing in comparison with the Nikkei, falling more than 12%. It’s worst one-day drop since the crash after Black Monday in 1987.

The selloff in Japan was so severe that trading was halted several times throughout the day to try and stop panic selling.

What was the impact on big tech?

Apple’s market cap dropped by $161 billion in two days.

Investors in Nvidia and Meta saw the value of their shares fall 9%.

Now, the big question is…

What’s Coming Next…

Several pieces of economic data, including manufacturing, durable goods and jobs indicate that the US economy is already in recession.

That’s because it’s triggered the highly respected “Sahm Rule”.

The Sahm Rule is a recession indicator developed by economist Claudia Sahm. It identifies the onset of a recession based on changes in the unemployment rate.

This rule has held for the last three recessions.

That means we’re likely to see a lot less consumer spending, which will punish manufacturing around the world.

Simply put, if Americans aren’t buying T-shirts and trainers, Chinese factories fail.

But here’s the thing…

There’s a proven playbook for falling employment and a falling stock market.

Central banks cut rates.

We’ve already seen the Bank of England cut rates for the first time in four years.

It’s only a matter of time before the Fed does the same.

When the Fed cuts rates, I think we’ll see a rally in stock markets around the world.

But here’s the problem…

I believe this will be the first of many bear market rallies that will punish investors over the next two years.

We’re not about to see a quick recovery like we saw in 2020, and to a lesser extent in 2008.

Because we don’t have a normal stock market right now.

In a normal market situation, business profits and company valuations rise and fall with consumer spending.

But that’s not the case with big tech.

Company valuations are based on a promise that may take years to fulfil.

Since 2023, all the gains in the S&P 500 have come from just seven companies. The aptly named magnificent seven.

The problem is that 493 of the world’s largest companies were flat or falling, while the gains from just seven companies were so great that the overall market ran up into bull market territory.

But here’s the thing…

Nvidia’s share price has already fallen over 25% in less than two months.

Wiping almost a trillion dollars off their market cap.

Which brings me to…

The Biggest Prediction of My 40-Year Career

I believe we’re going to see big tech underperform by 50% or more, versus basic, traditional industries, over the next two years.

And just like in 2000 when the dot-com bubble burst…

When it took two years for the Nasdaq to lose 78% of its value.

Along the way, I think we’ll see several bear market rallies. Just like the six we saw between 2000 and 2002.

Each time, investors rushed back in believing they were “buying the dip”...

Only to see the value of their savings plummet a few weeks later.

It’s 24 years since we’ve seen a situation play out like this in the market.

I believe most UK investors will get crushed.

It won’t only be tech that takes a hit…

I believe several other sectors will see dramatic underperformance.

The good news is that there is a way to help protect and even grow your wealth through the coming panic.

Using a lower-risk strategy that I developed over 20 years ago.

A strategy that cuts your risk to the bare bone – with a Nobel Prize-winning formula – without reducing your upside potential.

This approach worked so well that Institutional Investor Magazine crowned me Europe’s #1 investment strategist.

After receiving that prestigious award…

All my elite financial clients were desperate to get their hands on it.

They didn’t blink at the £50,000 price tag.

I’m talking about investment banks like Goldman Sachs, Merrill Lynch and Morgan Stanley.

They all raced to get it. Start profiting from it. Attract wealth clients with it. And for two decades, they’ve kept this powerful approach a closely guarded secret.

Today, more than 15 years later, hedge funds are still using a version of my strategy to rake in huge profits... in any market.

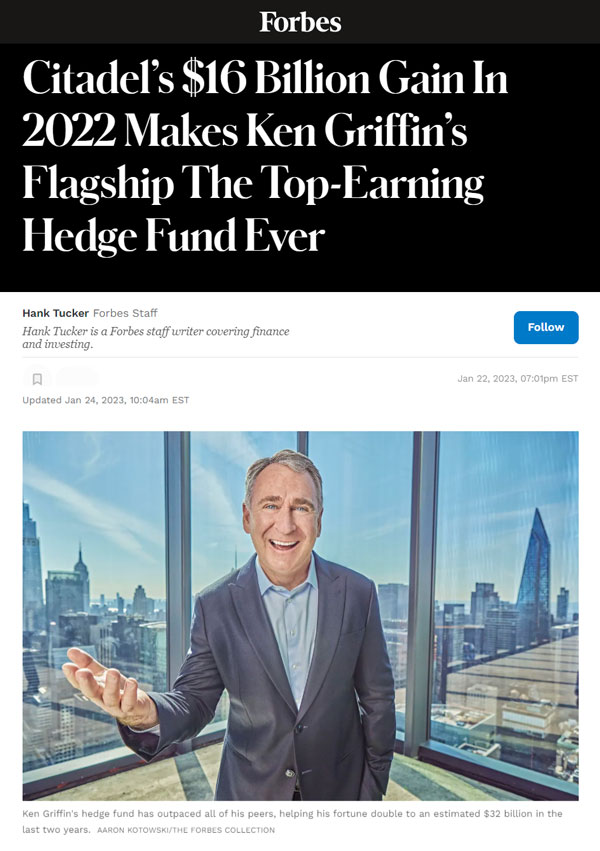

In the 2022 bear market, when the S&P 500 fell -19%... and the Nasdaq plummeted -33%...

Citadel set a new Wall Street profit record – raking in $16 billion in profits.

That's why Forbes crowned Citadel CEO Ken Griffin the new “hedge fund king”.

Source: Forbes

Today, I’d like to give you the opportunity to profit from this elite financial secret… without paying the hefty hedge fund fees.

So you can enjoy the peace of mind that comes with consistent profits… in any market.

That’s why I’d like to share with you a recording from a recent workshop where I reveal how I turn the FTSE from a flat market into bull market with ONE adjustment.

“Watch as I turn the FTSE 100 from a flat market into a bull market with one powerful adjustment”

Here you can see the UK stock market…

To be more specific…

The blue line shows the movement of the 100 biggest UK companies.

Over the last 14 years – good news, it’s gone up.

71% to be precise.

Nothing to sniff at.

If you tracked the market, you’re in the black.

Let’s put that into hard cash…

Let’s say in 2009, you put £50,000 into a FTSE 100 index fund.

Then you wait 14 years.

A lot of big money-making opportunities have happened since then.

The rise of Tesla and electric vehicles…

The emergence of Netflix and streaming…

The dawn of bitcoin and other cryptocurrencies…

The arrival of ChatGPT and surging AI stocks…

Today, your £50,000 FTSE stake would have grown to £85,000.

It’s gone up. That’s good. You haven’t lost money.

But are you happy with that return?

Are you happy making 35 grand over 14 years?

Will that 35 thousand see you through retirement, build that extension, or buy your dream car?

Not likely.

Yet owning a FTSE 100 index fund is the number one recommendation from most high-street wealth managers.

That means a lot of people are relying on that to come good for them.

Now, if you’d reinvested your dividends and compounded your gains…

Your return would be marginally better.

Your £50,000 investment would have doubled to £120,000.

Not bad.

But that’s still not great.

Today, I’m here to show you a way to invest in the same FTSE 100 companies…

With a much more powerful effect.

It’s the same system I’ve used for 20 years to grow my family’s money.

The same system that put all four of my kids through private school.

The same system I have passed onto my son to invest his entire life savings.

The same system I built for Deutsche Bank to grow its capital by billions.

And for a very good reason.

That a look at the chart below.

This time I want you to pay very close attention to the orange line that’s appearing above the FTSE 100.

Calculated using back testing. Simulated past performance is not a reliable indicator of future results. Figures do not take into account any investing costs or taxes.

THIS is what you could have made with my approach.

As you can see, in historical testing…

You’d have absolutely crushed the performance of the UK stock market by a factor of 13-to-1.

After just three years your £50,000 would have more than doubled…

After eight years it would have turned into £421,000…

Today, it would have run up to £1.1 million…

Simulated past performance is not a reliable indicator of future results. (before costs or taxes)

Without leverage. Without day trading. Without anything complicated or risky.

I apply one special adjustment that completely changes the wealth-building power of FTSE 100 stocks.

Plus – and this is a rather BIG plus…

This approach is safer – much safer – than tracking the FTSE.

Over the last 14 years, the FTSE 100 has crashed four times, by as much as -12%.

While in historical testing, my approach has never had a down year.

Just think about that for a moment. During the Covid crash, the FTSE 100 plummeted -25% in three months. A fall that outstripped even the 1929 Wall Street crash.

Shares across Europe suffered the worst sell-off on record.

The Dow Jones dropped -37%... and the S&P 500 plummeted -34%.

Yet, through the fastest global market crash in history. My simple approach would have still made a modest profit.

In the bull market that followed...

Profits from this simple process shot up almost twice as high as the FTSE 100.

Simply put...

It doesn't matter who is prime minister... whether we've got a Labour or Conservative government... if we’re in a recession or a booming economy... if the market crashes or suddenly surges higher...

This strategy beats the FTSE by a huge margin.

Simulated past performance is not a reliable indicator of future results.

In the next 15 minutes, I’m going to show you how investing in big, blue-chip British companies – with one special adjustment – means I don’t have to worry about having enough money to retire.

And I’d like to show you how you could benefit from it too.

Before we get into any of that…

I should properly introduce myself

Like I said, my name is John Butler.

You may not know my name, but you've heard of the investment banks I've worked for.

I started my career on Wall Street working for Bankers Trust and then Lehman Brothers.

There I advised elite financial institutions about macro trends.

I'm talking about the big, far-reaching trends that shape the markets for months or even years to come.

My clients included the investment banks Goldman Sachs, Merrill Lynch and Morgan Stanley.

The ultra-conservative Harvard Endowment. That manages the university’s $50.9 billion wealth fund.

The world’s largest insurance company – Allianz – with $2.14 trillion in assets under management.

And the hedge funds Moore Capital Management, Brevan Howard and Tudor Investments.

In 2007, Sergey Ignatyev, chairman of the Russian Central Bank, invited me to Moscow.

In its beautiful, 200-year-old, central bank building just off Red Square, he confessed that Russia was considering holding a third reserve currency.

Russia already held dollars and euros in reserve. Now, it was debating adding the Japanese yen or the British pound.

Ignatyev asked me which currency I thought Russia should hold.

I told him an American banking collapse was around the corner. And they should put their money in yen. A safe-haven currency.

After advising the Russian Central Bank, Deutsche Bank head-hunted me to build an investment system for its asset managers.

The system I built combined my macro models with a Nobel prize-winning risk formula.

The result was an investment process that beat the market by a huge margin. While also lowering your risk.

It worked so well that Institutional Investor magazine crowned me...

“Europe's #1 investment strategist”

After receiving that prestigious award...

All my elite financial clients were desperate to get their hands on my award-winning strategy.

They didn't blink at the £50,000 price tag.

Today, more than 15 years later, hedge funds are still using a version of my strategy to rake in huge profits... in any market.

In the 2022 bear market, when the S&P 500 fell -19%... and the Nasdaq plummeted -33%...

Citadel set a new Wall Street profit record – raking in $16 billion in profits.

That’s why Forbes crowned Citadel CEO, Ken Griffin, the new “hedge fund king”.

Source: Forbes

I left Deutsche Bank to start my own hedge fund.

For five years straight, my fund generated returns at the gold standard benchmark. Using a version of the strategy I'm going to share with you today.

Simulated past performance is not a reliable indicator of future results.

In a moment, I’ll show you how to use my simple process.

So, you can join a growing number of British investors who are taking the chance to beat the market by 13-to-1... while only investing in FTSE 100 companies.

It all starts with one powerful adjustment.

One powerful adjustment turns

a flat market into a bull market

Let me show you a specific example...

2015 was a white-knuckle ride for most UK investors…

Starting with a big celebration as the FTSE 100 blew past 7,000 for the first time.

The market surged after Greece’s creditors approved more funding. Effectively bailing Greece out of imminent default… and removing all fears of a second global financial crisis.

Then Federal Reserve chief Janet Yellen signalled a slower path for interest rate rises.

The promise of lower interest rates for longer pushed the FTSE even higher.

Everything looked rosy until undeniable evidence showed China's economic growth would stumble.

This triggered a crash in commodity prices.

In just four days…

Copper tumbled -25%. Gold fell -10%. Oil dropped to just $37 per barrel. Less than half its 2013 price.

The value of big, seemingly safe British companies fell like a stone.

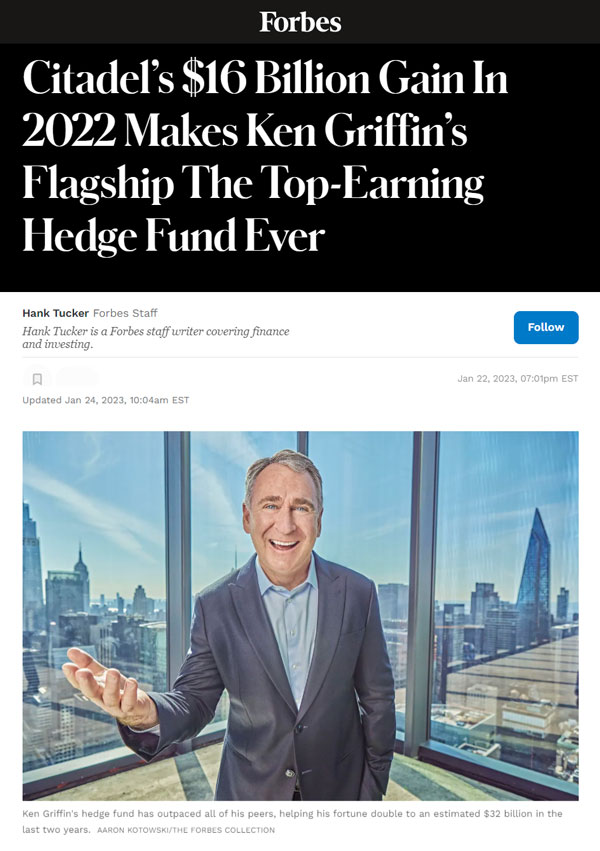

A £50,000 stake in platinum, copper and nickel miner Anglo American would have crumbled to just £12,500…

Five-year performance of Anglo American Plc: 2019 +29.5% | 2020 +14.3% | 2021 +38.22% | 2022 +15.14% | 2023 -35.93%

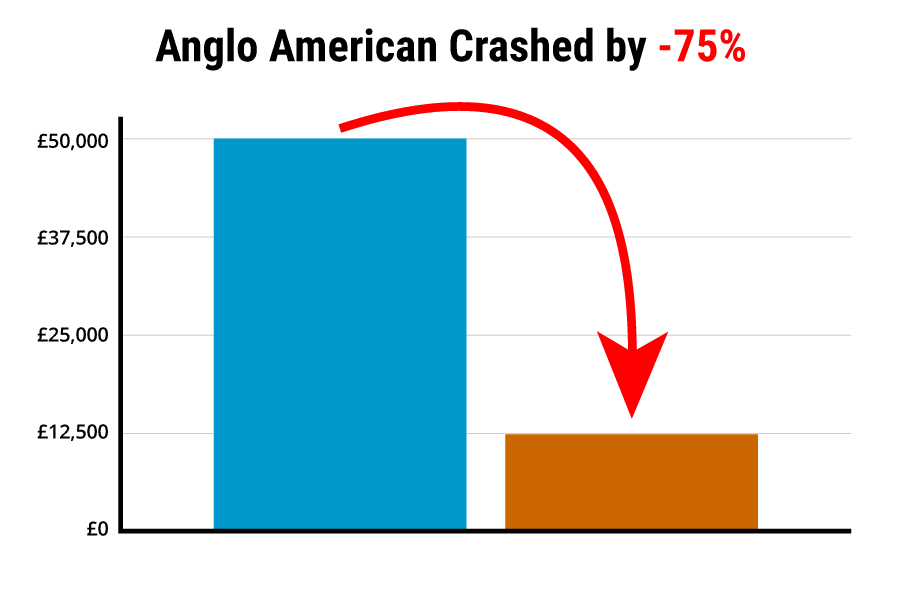

The same investment in commodity trader Glencore would have collapsed to £15,500…

Five-year performance of Glencore Plc: 2019 -13.78% | 2020 -1% | 2021 +65.87% | 2022 +55.68% | 2023 -6.99%

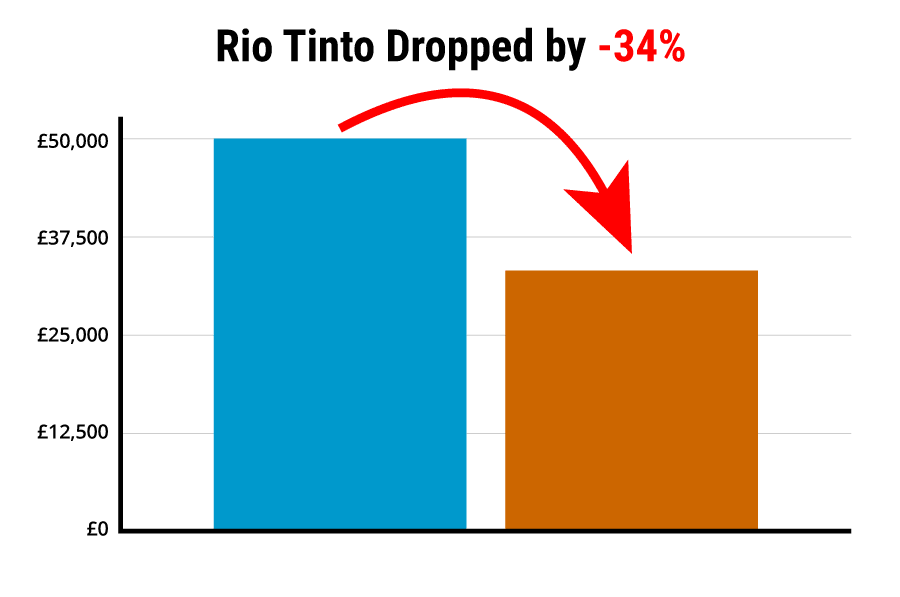

Your position in mining giant Rio Tinto dropped to £33,000…

Five-year performance of Rio Tinto Plc: 2019 +33.93% | 2020 +28.07% | 2021 +2.08% | 2022 +30.25% | 2023 +6.33%

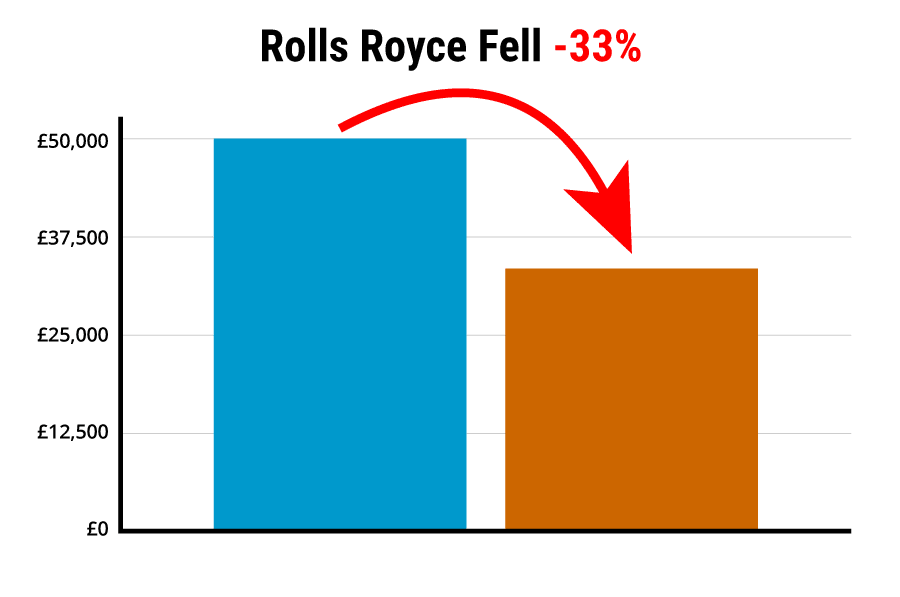

Even your stake in Rolls-Royce would have fallen to £33,500.

Five-year performance of Rolls-Royce Holdings Plc: 2019 -16.28% | 2020 -52.55% | 2021 +10.45% | 2022 -24.15% | 2023 +221.57%

Traders called it “The Great Fall of China”.

It seemed to come out of nowhere.

Simulated past performance is not a reliable indicator of future results.

Yet, if you used my one powerful adjustment…

Over the exact same period… you could have grown your portfolio to £60,500…

Turning a falling market into a bull market.

How is that possible?

That ’s what I ’m going to show you now.

It all starts with

one critical economic marker…

Economists at the Office for National Statistics will debate this critical marker for weeks.

Politicians will dispute their findings adding confusion and mystery to something we all feel.

Let ’s face it…

You don ’t need the prime minister or the governor of the Bank of England to tell you when the economy is booming.

You feel it because you have more money in your pocket.

With more money in your pocket, you book nicer holidays and start thinking about upgrading your car.

On the flip side, when high interest rates, high inflation and high taxes are squeezing your standard of living…

You tighten your belt.

As an investor, paying attention to your changing spending habits can give you a huge edge in the market.

Let me show you why…

The economy is either growing or contracting. Rising or falling, just like the tides.

These changes in the health of the economy are what economists call the “business cycle”.

This is the driving force behind the fortunes of almost all the world’s leading investors.

I’m talking about billionaires like…

Ray Dalio, the founder of the world’s largest hedge fund – Bridgewater Associates.

Ken Griffin, the founder of Citadel. The man Forbes crowned the “hedge fund king” after Citadel set a new Wall Street profit record, raking in $16 billion.

Stan Druckenmiller, George Soros’ former right-hand man. An investor whose family office has more than $6.2 billion in investment capital.

And Paul Tudor Jones, one of the world’s most respected investors. With more than $12 billion in assets under management.

These elite investors use the four stages of the business cycle to beat the market.

In each stage, some types of business will struggle, while others thrive.

By investing in the types of business that have proven to thrive in a specific economic climate...

And getting out of the businesses proven to struggle…

You could consistently beat the market by 13-to-1.

This chart shows what would have happened assuming you invested in the top five industry groups since 2009.

Calculated using back testing. Simulated past performance is not a reliable indicator of future results. Figures do not take into account any investing costs or taxes.

The orange line shows a £50,000 investment growing into £1.1 million.

Assuming you reinvested your dividends and gains over that period.

The green line shows a £50,000 investment plodding up to £85,000.

So after 14 years, your investment has grown a little.

But are you happy?

Probably not.

If you reinvested your dividends and compounded your gains…

Your £50,000 investment would have climbed to just to £120,000.

Not bad. But…

That’s still a million pounds LESS than you could have made by investing in the right sectors.

That’s the difference one adjustment can make to your returns.

Simply put…

By identifying the correct stage of the business cycle…

You could outperform the market by 13-to-1

Let me show you how I identify the different stages of the business cycle.

We’ll look at the housing boom and bust from 2004 to 2008.

The first stage of the business cycle is Expansion.

This is the part we all love and remember because the economy is growing.

As cash registers start ringing more often, businesses can pay higher wages.

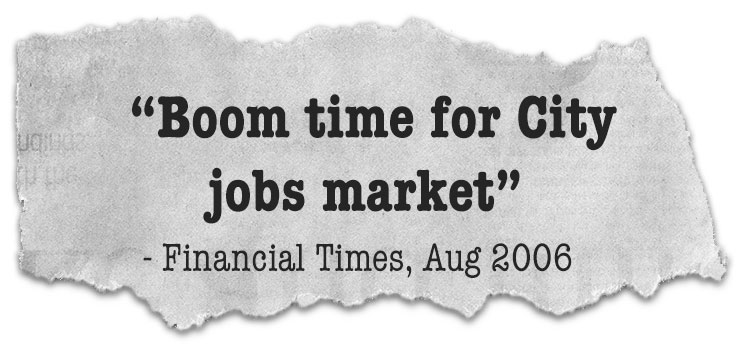

It’s not long before you start seeing newspaper headlines like this...

As the economy takes off, people start spending more.

So it's no surprise that technology and consumer discretionary stocks take off.

The most obvious discretionary spending is on watches, holidays and cars.

In 2004, the Swiss watch industry had a record year... they set a new sales record in 2005... and broke their record again in 2006.

Holiday company Thomas Cook enjoyed the same success... with three consecutive years of record-breaking sales.

BMW set new sales records across all its brands – BMW, MINI and Rolls-Royce.

What impact did these recording-breaking sales have on share prices?

Take a look…

Past performance is not a reliable indicator of future results.

Five-year performance of The Swatch Group: 2019 -7.13% | 2020 -6.43% | 2021 +15.8% | 2022 -8.06% | 2023 -5.

This chart shows the Swiss watch conglomerate, The Swatch Group, share price surging 171% higher.

In the easy money days of a booming economy, many investors fall into the trap of believing the party will never end.

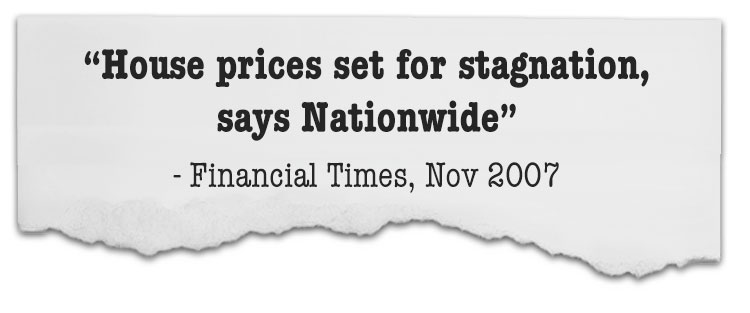

Eventually, the music slows. Prices rise ahead of salaries and growth stumbles. This is the peak of the business cycle. When we see headlines like this...

Even the governor of the Bank of England, Mervyn King, confirmed that house prices were cooling.

Now, just to be clear, we saw these headlines a year before Lehman Brothers went bust.

As consumers, we know when the economy is contracting because the price of everything starts to feel high. So you may start tightening your belt. Cutting back on tech, luxury clothes and posh restaurants.

This is your “canary in the coal mine”. Letting you know it’s time to move your capital out of discretionary sectors and put it in defensive sectors.

This sets you up to profit in tough times. In fact, over the last 12 years, of historical testing, this business cycle adjustment would have grown your wealth every year… even as the FTSE 100 crashed on four separate occasions.

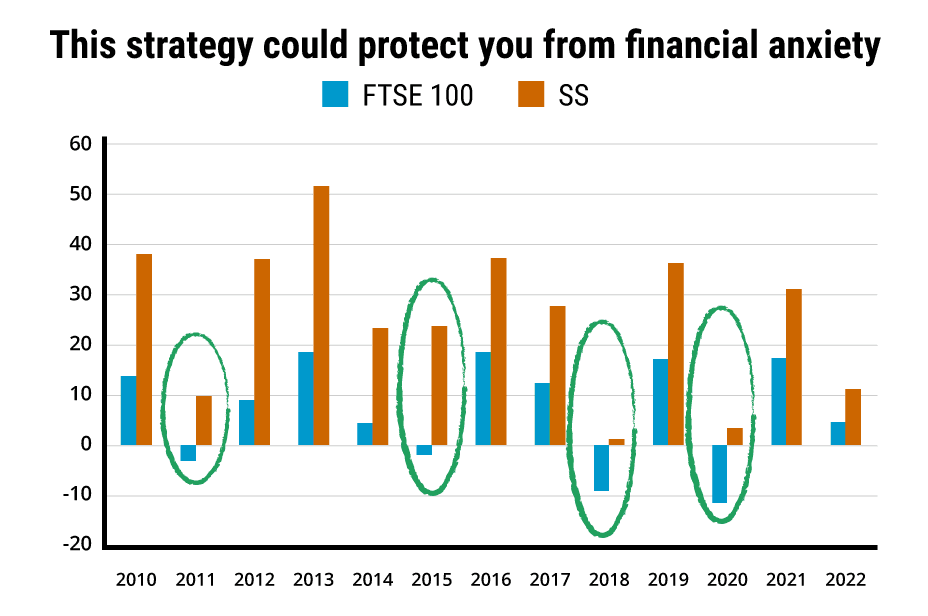

Take a good look at this chart…

Calculated using back testing. Simulated past performance is not a reliable indicator of future results. Figures do not take into account any investing costs or taxes.

Circled in green are the four years when the FTSE 100 fell.

As you can see in orange, this business cycle adjustment would have grown your wealth every year for more than a decade.

Impressive, right?

That’s the peace of mind this one adjustment can give you.

Compounding your wealth year in and year out. Through both good times and bad.

Now, let me quickly tell you about the final stage of the business cycle. Recession.

This is the terrifying part of the cycle we all remember because unemployment is rising…

House prices are falling...

And share prices are plummeting.

Yet even in a recession, you still need to heat your home. Put food on the table. Clothes on your back. When you get sick, you still visit a doctor.

That’s why defensive sectors could grow your wealth through a recession.

Just a look at Unilever.

It makes all the “boring” products we can’t live without: shampoo, washing powder, toothpaste and toilet paper.

Its share price climbed 31% through the Great Recession.

So, there you have it…

One powerful adjustment can grow your wealth in any market.

Forecasts are not reliable indicators of future results.

If you adjust your portfolio when the business cycle changes…

You could dramatically change your financial future.

Yet, there are two additional adjustments that can kick your returns into overdrive.

The same additional adjustments that I used to create a new investment strategy for Deutsche Bank.

A strategy so powerful that Institutional Investor magazine crowned me Europe’s #1 investment strategist.

And investment banks such as Goldman Sachs, Merrill Lynch and Morgan Stanley happily paid £50,000 to use.

Let me show you how my second adjustment lowers your risk and sets you up for greater potential gains…

Megatrends could set you up for gains as high as 4,500%

Back when I worked for Lehman Brothers, I advised Harvard Endowment, Moore Capital Management and even the Russian Central Bank about macro trends.

I ’m talking about the big unstoppable developments that will shape the markets for months and possibly years to come.

One example is the ageing population in the Western world.

For the last 30 years, this megatrend has pushed healthcare stocks up, almost in a straight line.

Just take a look at this chart…

Past performance is not a reliable indicator of future results.

Five-year performance of AstraZeneca plc: 2019 +33.25% | 2020 -0.88% | 2021 +21.25% | 2022 +31.82% | 2023 -3.42%

This chart shows the incredible performance of Cambridge-based pharmaceutical giant AstraZeneca.

Since 1993, the stock is up over 4,588%.

For comparison, the FTSE 100 is only up 154% over the same time.

Which means AstraZeneca would have handed you 30 TIMES greater gains.

AstraZeneca isn’t a cherry-picked healthcare company either. Since 1990, Pfizer is up 3,166%.

Past performance is not a reliable indicator of future results.

Five-year performance of Pfizer Inc: 2019 -6.94% | 2020 +1.12% | 2021 +64.66% | 2022 -10.52% | 2023 -40.61%

Here ’s another megatrend example…

Since the pandemic, the world has become an increasingly dangerous place.

It ’s over two years since Russia invaded Ukraine.

The conflict in the Middle East shows no sign of ending.

And although the bullets haven ’t yet started flying in Taiwan…

The US-China Cold War keeps ratcheting higher.

Today, the British Army is at its smallest size in centuries.

So, it ’s easy to see why defence spending could dramatically increase for at least a decade.

Former Shadow Home Secretary Sir David Davis says Britain must increase the size of our reserve army by at least 100,000.

General Lord Dannatt, the former head of the Army, says “Within the next three years, it must be credible to talk of a British Army of 120,000.”

With the army currently at 75,000…

General Lord Dannatt is calling for the army to almost double in size in only three years.

How are we going to achieve that?

Rishi Sunak has just announced the biggest boost to military spending in a generation.

Pushing the defence budget up from £45.9 billion to £75 billion per year.

That giant 50% spending leap could double BAE Systems sales.

And it could more than double Rolls-Royce’s annual revenue.

So, the only question on my mind is…

How high will their share prices rise?

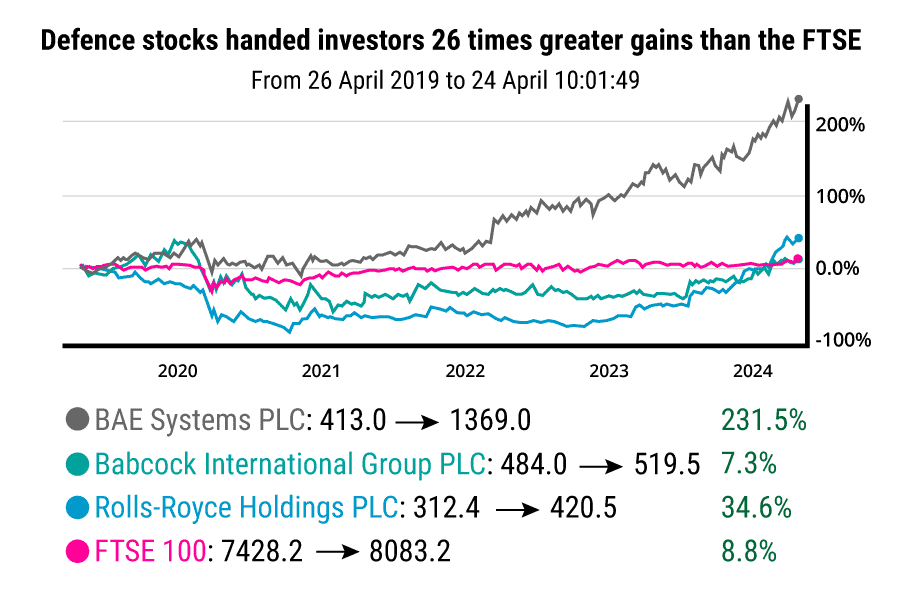

Just take a look at this chart…

Past performance is not a reliable indicator of future results.

As you can see, over the last five years, defence companies handed investors 26 TIMES greater gains than the FTSE.

If this megatrend plays out like pharmaceutical companies…

Investors could see long-term, recession-proof gains, of over 3,000%.

Past performance and forecasts are not a reliable indicator of future results.

Now, here’s the interesting part…

By layering the megatrends analysis onto the business cycle adjustment, you lower your risk and increase your profit potential.

Because megatrend companies tend to grow in any type of economic climate.

By overlapping these two powerful wealth adjustments, I can pinpoint the perfect medium and long-term investment opportunities.

Let me show you exactly what I mean…

The blue circle represents the business cycle adjustment.

An economic marker that you’ve seen outperform the market by 13-to-1 in backtesting.

The yellow circle represents the megatrends adjustment.

You’ve seen the ageing society megatrend crush the market by 30-to-1.

Where the two wealth adjustments overlap is the investment sweet spot.

This is where I uncover five perfect medium and long-term investment sectors.

Then I choose the top stocks within each sector.

To do that, I select the businesses that best match the characteristics of the sector.

Let me show you a specific example…

When it comes to defence, there are only two big UK firms: BAE Systems and Rolls-Royce.

Rolls-Royce makes 26% of its revenue from defence.

BAE Systems is entirely focused on defence.

That makes BAE Systems the most suitable defence investment for my strategy.

I repeat this process for each of the five sectors.

This gives you the perfect stock selection to outperform the FTSE by a huge margin.

Then you just need to decide how much capital to allocate to each company.

You might think you should divide your savings equally across each business.

But that would be a huge mistake.

To show you why, I need to take you back to 1952. When a 25-year old PhD student changed investing forever.

Here ’s what happened…

“The Most Famous Insight in the History of Modern Finance”

In March 1952, the Journal of Finance published an article called “Portfolio Selection”.

The article explained that to maximise the value of your portfolio, you only need to invest in a single stock.

The only reason why investors buy multiple stocks is to reduce their risk.

That’s why the performance of an individual stock is not as important as the return of the entire portfolio.

To improve your overall portfolio return. You need to calculate the risk of each company in your portfolio.

The author – Harry Markowitz – then gave the world the greatest ever investment gift.

The tools to calculate the ideal level of portfolio risk and reward.

Simply put, diversification means not putting all your eggs in one basket.

Markowitz’s formula shows you how many eggs to put in each basket.

Markowitz won the Nobel Prize with that formula.

The Nobel Committee called it...

“The first pioneering contribution to the field of financial economics.”

Economist Peter Bernstein described the formula as...

“The most famous insight in the history of modern finance.”

Follow Nobel laureate Paul Samuelson captured the significance of this formula by saying...

“Wall Street stands on the shoulders of Harry Markowitz.”

Samuelson is absolutely right.

Back in the early 2000s, I used Markowitz’s formula to build a new trading strategy for Deutsche Bank.

That new system was so powerful that Institutional Investor magazine crowned me Europe’s #1 investment strategist.

Today, I use Markowitz’s formula to help individual investors just like you beat the market by a huge margin.

Because Markowitz’s Nobel prize-winning formula is my third wealth adjustment.

The Nobel Prize-winning formula

My third and final wealth adjustment reveals how many eggs to put in each investment basket. To give you the perfect risk-optimised portfolio.

Now, it might sound simple to run a stock selection through a Nobel prize-winning formula. But this isn’t as easy as plugging numbers into a spreadsheet.

That’s why this risk optimisation tool is only used by elite financial institutions.

Back when I worked for Deutsche Bank, I ran investment teams that cost £50,000 a month. Just to crunch the numbers to produce risk-weighted recommendations.

It’s a lot of work. As you’ve seen, the rewards are huge.

That’s why wealthy clients pay hedge funds such high fees.

Today, I’m going to give you the opportunity to profit from this Nobel prize-winning formula... without paying the hefty hedge fund fees.

So you can beat the financial elites at their own game...

Enjoy the peace of mind that comes with consistent profits… in any market…

And make your capital work 13 times harder for you.

That’s why I’d like to invite you to join a growing number of British investors who use my powerful strategy that in back tests crushed the market by 13-to-1... while taking less risk than an index fund.

Here’s what some members of this exclusive community are saying…

Albert from Brighton took the time to say…

“Hi John, I’m very pleased you have established this portfolio approach which makes a great deal of sense for most investors.

Although I am fully aware of the approach and process (I am a former CEO of both Banks and an Asset Management business), I don’t have the time and more importantly the patience to do the heavy lifting so it was a no-brainer to join.”

AlbertClive from Leamington Spa wrote…

“I relish having some knowledge of the best and most resilient stocks to buy at this time of the economic cycle.”

CliveThen there’s Michael from Colchester who let us know…

“The strategy is logical, sensible and easy to follow – in a word “comforting” as John Butler also puts his money in alongside.”

MichaelThis straightforward, yet incredibly powerful approach, gives you a reliable way to help compound your wealth for decades.

Year in and year out. Through all the ups and downs in the economy.

And as you’ve seen…

The long-term backtested returns are spectacular.

Seven times greater profits than a tech ETF... 15 times bigger gains than gold... and 13 times more money than property.

Simulated past performance is not a reliable indicator of future results.

That’s why this is the greatest long-term wealth strategy I know.

It requires the same “time commitment” as a standard buy-and-hold investment.

Because when you join a growing community of savvy UK investors, I do all the heavy lifting for you.

I’ll tell you exactly what to buy and the specific allocation for each stock.

When the macro environment changes, I’ll tell you exactly how to adjust your portfolio.

So you’ll always own what I believe are the strongest sectors. The best companies within each sector. So you’re positioned to profit in every type of market.

Through good times or bad, you’ll have the hedge fund-level recommendations to make consistent profits.

How am I going to hand you all that?

With a monthly research service called Southbank Wealth Advantage.

My mission with Southbank Wealth Advantage is simple...

To show you how to compound your wealth for decades, using my award-winning investment strategy.

To help you start using this hedge fund-level investment approach. I ’d like to send you a special report called “Your 13-to-1 edge on the market”.

Inside, you’ll discover what stocks to buy for today’s economic environment. And the specific allocation for each company.

Simply put, this report shows you which investment baskets to put your eggs in… and how many eggs to put in each basket.

So you can build your own risk-optimised portfolio to Nobel prize-winning standards.

Now, of course, how much you decide to invest is completely down to you.

Only you know how much capital you can afford to put down.

With investing your money is always at risk – there are no guarantees. Not all investments can be winners. You should always invest within the comfort of your personal circumstances. If you are relying on money for something, simply don’t invest it.

Whether you have £1,000… £10,000… £100,000… or more to invest.

Today, I’ve shown you how in historical testing, this approach pumped out consistent profits every year for more than a decade. Even as the FTSE 100 crashed on four separate occasions.

Because this is essentially a supercharged buy-and-hold process.

We only change our positions when the business cycle or macro environment changes.

Outside of big economic or political upheavals….

You can sit back and let this powerful process compound your wealth year after year.

Forecasts are not reliable indicators of future results.

Now, if you’re like me, then you’re a stickler for detail.

That’s why I’ve outlined how I use each of my wealth adjustments in a collection of special reports.

The first report is: “The Wealthmaker Rulebook 1 – Supersectors”.

Inside you’ll discover why the FTSE 100 is not a fully diversified index. This shocking truth explains why over the last 14 years, the FTSE 100 has crashed four times, by as much as -12%. And why my strategy is lower risk than simply investing in a FTSE index fund.

You’ll see the monetary, credit and activity data I use to calculate each stage of the business cycle.

Why some sectors outperform others by 51%… 62%… 77%… and even 108%.

And the proven, high-performance sectors for each stage of the business cycle.

The second report in this collection is: “The Wealthmaker Rulebook 2 – Megatrends”.

This report reveals the three megatrends I expect to develop for a decade or longer.

And why they could give you recession-proof gains that have the potential to outperform the market by 30-to-1.

Forecasts are not reliable indicators of future results.

The third report in this collection is: “The Wealthmaker Rulebook 3 – Risk-weighted optimisation”.

Here I pull back the curtain on how I use a Nobel Prize-winning formula to create a risk-optimised model portfolio.

These three reports won ’t just improve your understanding of financial markets. They will improve your understanding of the way the world works. And set you up to compound your wealth year in and year out… for decades.

They’re all yours when you accept my invitation to try a no-obligation trial subscription to my top-rated financial research letter, Southbank Wealth Advantage.

Here ’s your 13-to-1 edge on the FTSE 100

Start your trial subscription today and you’ll get immediate access to these four reports.

You’ll also enjoy unrestricted access to my model portfolio. This shows you the perfect stocks to buy and the specific allocation for each company. Everything you need to build a risk-optimised portfolio.

Every month you’ll receive a new newsletter. Each issue gives you the type of economic insights asset managers at Goldman Sachs, Merrill Lynch and Morgan Stanley paid a fortune for. Here I’ll reveal the economic changes I see on the horizon. I’ll explain their likely impact on our portfolio. If necessary I’ll give you specific stock adjustments to profit from the coming economic shakeup.

You’ll be able to access all these materials through the exclusive members area.

It’s a password-protected portal where you can access all the issues, special reports and updates in Southbank Wealth Advantage.

Plus, you can speak with me personally every month.

Because I run a monthly Ask-Me-Anything live event exclusively for the Southbank Wealth Advantage community.

As the name suggests, you can ask me anything…

If you want to know what I predict the Bank of England will do next with interest rates. How the election could impact the FTSE. Or what infrastructure projects the government is bankrolling.

Then let me know what’s on your mind and I’ll show you what my research and experience are telling me.

If you have any questions between these Ask-Me-Anything live events. You’ll also have a dedicated email address to contact me.

I want to do everything I can to ensure you make the most out of this service.

So you can earn the full profit potential of this incredibly powerful strategy.

You’ve seen how in 14 years of historical testing this strategy transformed a flat market into a bull market.

Turning £50,000 into £1.1 million.

That’s a million pounds MORE than the FTSE 100.

Simulated past performance is not a reliable indicator of future results.

You’ve seen this process is so powerful that Institutional Investor magazine once crowned me Europe’s #1 investment strategist.

And that elite financial institutions happily paid £50,000 to get their hands on it.

I’m talking about investment banks like Goldman Sachs, Merrill Lynch and Morgan Stanley.

They all raced to get it. Start profiting from it. Attract wealth clients with it. And for two decades, they’ve kept this powerful approach a closely guarded secret.

On a personal note, for the last 20 years, this buy-and-hold strategy has delivered for me. Putting all four of my kids through private school. Giving me the peace of mind that comes with compounding your wealth for two decades.

I’m confident in its wealth-building potential. And I’d like to help you use it to make a lot of money in the years ahead.

The kind of money that could give you real peace of mind.

So, it’s natural to ask…

Is it expensive to join Southbank Wealth Advantage?

I’ve arranged a special deal for you…

Usually, access to this sort of investment intelligence comes with a heavy price tag.

While working at Deutsche Bank, I ran investment teams that cost £50,000 a month... just to crunch the numbers... and produce the level of risk-weighted recommendations I’ll be sharing in Southbank Wealth Advantage.

When I ran a hedge fund. The minimum investment was £250,000.

Those barriers to entry have kept this powerful strategy a secret of the wealthy elite.

That changes today.

I’m breaking down the walls to the ivory tower.

So membership is not six figures… five figures… or even four figures…

In fact, I’ve priced this service much lower than all our other premium research services.

Something that I personally insisted on.

You see, when I joined Southbank Investment Research I had one driving ambition above all others…

To share this award-winning strategy with as many of our readers as possible.

Today, I want to help you build a solid, growing, foundation of wealth in the stock market.

Something that aims to compound your hard-earned savings for a decade or two. Through all the ups and downs in the economy.

Forecasts are not reliable indicators of future results.

That’s the goal that I’ve set myself. That’s my commitment to you.

To make this proven wealth-building process accessible for you and every single person reading this today.

I’ve kept the membership fee as low as possible.

That’s why the annual membership to Southbank Wealth Advantage comes in at just £379.

That’s not per month… that’s per year.

Considering some money managers charge that for just an hour’s consultation, I think it’s a fair price.

Just £379 for the same wealth-building strategy that hedge funds such as Moore Capital Management, Brevan Howard and Tudor Investments happily forked out £50,000 for when I was at Deutsche Bank.

The same strategy that has become the backbone of the City, Wall Street, and my own prosperous investing life.

The same simple-to-follow-strategy that could have turned an initial investment of £50,000 into £1.1 million. Since 2009 – according to my extensive backtesting.

Simulated past performance is not a reliable indicator of future results.

That’s great value, I hope you agree.

But that’s NOT what you’ll pay if you can move quickly.

Today, for the first 100 people only, you can join Southbank Wealth Advantage for just £279.

That’s a saving of £100 off the full price…

A special deal for those who take decisive action right now.

Forecasts are not reliable indicators of future results.

That could make their capital work 13 TIMES harder for them. While taking less risk than investing in an index fund.

What’s more, I’d also like to make membership available to you without any financial commitment.

Join today and you’ll have a 30-day grace period.

An entire month to read my special reports. Check out my library of newsletters. Inspect my model portfolio. And attend my Ask-Me-Anything live events.

If after delving into all my research and asking me any questions you have about my recommendations,you then decide this isn’t for you…

No problem. Just call our Customer Care Team and they’ll give you all your money back.

No questions. No hassles. And we’ll depart as friends.

Plus, you can keep all the special reports you receive free today as a thank you from me for giving Southbank Wealth Advantage a try.

If that sounds like a great deal – don’t delay.

This discount is only available for the first 100 savvy investors who join today.

Click the button below to claim your discount.

Join Southbank Wealth Advantage nowThis will take you to our secure order form, where you can review everything I’ve promised you today.

If that sounds good, then…

Here’s a recap of everything you’ll receive today…

- Special Report #1: “Your 13-to-1 edge on the market”

- Special Report #2: “The Wealthmaker Rulebook 1 – Supersectors”

- Special Report #3: “The Wealthmaker Rulebook 2 – Megatrends”

- Special Report #4: “The Wealthmaker Rulebook 3 – Risk-weighted optimisation”

- 12 Monthly Issues of Southbank Wealth Advantage. Giving you the same type of economic insights once reserved for Goldman Sachs, Merrill Lynch and Morgan Stanley. Now my research and expertise can help you outperform the market by a wide margin.

- Instant access to my Model Portfolio. You’ll immediately see the stocks to buy. The specific allocation for each company. So you can build the perfect risk-optimised portfolio.

- Monthly Ask-Me-Anything live events. This is your chance to ask me any questions you have about the economy and my recommendations.

- Dedicated Customer Care Team. If you ever have a question about your membership you can reach out to our UK-based team for help.

All this wealth-building material is yours when you take a 30-day trial of Southbank Wealth Advantage.

Remember, you don’t risk a penny in joining fees today because you’re covered by my 30-day money-back guarantee.

If that sounds good to you, lock in your savings now.

This £100 discount is only available for the first 100 people who join today.

I’m confident it won’t be available for long.

Click on the button below to claim your deal.

Join Southbank Wealth Advantage nowSo, the way I see it, the next step is up to you.

You can choose to ignore everything I’ve just shown you today.

You can pretend a FTSE 100 index fund is the safest, lowest risk, and hassle-free way to grow your wealth.

And you’ll see how that works out for you.

If history is our guide, your hard-earned savings will barely keep pace with inflation. Much less grow your wealth in a meaningful way.

And that’s only if you can hold your nerve when the FTSE crashes.

Or you can take action right now.

And set yourself up to grow your wealth in both bull and bear markets.

Today, I’ve shown you how you can make your savings work much harder for you. With my award-winning strategy.

You’ve seen how over the long term…

This approach crushes every other asset class by a huge margin…

I’m talking about seven times greater profits than a tech ETF… 15 times bigger gains than gold… and 13 times more money than property.

Simulated past performance is not a reliable indicator of future results.

You’ve seen how this powerful process pumped out consistent overall gains over the last 14 years... while the FTSE 100 crashed four times.

If that low-risk, low-stress wealth accumulation appeals to you. Then I ’d love to welcome you into the Southbank Wealth Advantage community.

To get started, just click the button below.

Join Southbank Wealth Advantage nowIt will take you to a secure page where you can lock in your £100 savings. And review everything you get with your no-obligation trial of Southbank Wealth Advantage.

The ordering process is completely secure and privacy-protected.

Within minutes, you’ll get full access to all four special reports we talked about today. Our model portfolio and asset allocation. Everything you need to start growing your wealth, every year for the next decade.

As a reminder, here’s everything coming your way…

Just click the button below and you’ll hear from me soon.

I’m John Butler and I thank you for your time today.

Join Southbank Wealth Advantage nowBest wishes,

John Butler

Founder, Southbank Wealth Advantage

Backtesting:

The backtesting for The Southbank Wealth Advantage is conducted using total return data sourced from Koyfin.

FTSE100 constituent companies are sorted into their respective sectors.

The average total return for each company in each sector is calculated for each calendar year, and ranked.

The average total return for the top five best-performing sectors is calculated for each calendar year.

The cumulative total return of always and only holding the top five sectors in each calendar year—20% allocated to each—is calculated and then reinvested accordingly each year.

This is then compared to the ishares FTSE100 tracker ETF (CUKX.L) total return reinvested for each calendar year.

Back tested results |

FSTE100 Tracker |

John’s system |

2023 |

£120,524.90 |

£1,124,286.55 |

2022 |

£114,350 |

£885,265 |

2021 |

£108,935 |

£793,465 |

2020 |

£92,730 |

£604,360 |

2019 |

£104,515 |

£583,020 |

2018 |

£89,155 |

£427,465 |

2017 |

£98,025 |

£421,275 |

2016 |

£87,175 |

£329,765 |

2015 |

£73,405 |

£240,370 |

2014 |

£74,725 |

£194,335 |

2013 |

£71,570 |

£157,595 |

2012 |

£60,380 |

£104,105 |

2011 |

£55,375 |

£76,015 |

2010 |

£57,035 |

£69,140 |

2009 |

£50,000 |

£50,000 |

Important Risk Warnings:

Advice in Southbank Wealth Advantage does not constitute a personal recommendation. Any advice should be considered in relation to your own circumstances, risk tolerance and investment objectives.

Before investing you should carefully consider the risks involved. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

Your capital is at risk when you invest, never risk more than you can afford to lose. Simulated past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: John Butler. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure, privacy policy and terms and conditions can be found at www.southbankresearch.com.

Southbank Wealth Advantage contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629 7287 94. Registered office: Basement, 95 Southwark Street, London SE1 0HX.

Contact Us

To contact customer services, please call us on 0203 966 4580, Monday to Friday, 9.00am - 5.30pm.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Limited.

Sources:

- Koyfin

- Morningstar

- Yahoo Finance

- The Guardian - FTSE 100 posts largest quarterly fall since Black Monday aftermath – 31 March 2020

- Forbes - The Coronavirus Crash Of 2020, And The Investing Lesson It Taught Us – 11 February 2021

- CNBC - One year ago stocks dropped 12% in a single day. What investors have learned since then – 16 March 2021

- Reuters - Wall Street ends 2022 with biggest annual drop since 2008 – 30 December 2022

- Forbes - Citadel’s $16 Billion Gain In 2022 Makes Ken Griffin’s Flagship The Top-Earning Hedge Fund Ever – 22 January 2023

- The Guardian - FTSE 100 rises above 7,000 for the first time – 22 March 2015

- The Guardian - FTSE 100 ends 2015 among world's worst performing markets – 31 December 2015

- Business Insider - Britain's stock market just had its worst year since the financial crisis – 30 December 2015

- Investopedia – Who is Ray Dalio?

- Financial Times - Boom time for City jobs market – 18 August 2016

- Wilkerson – Record sales for Swiss Watches in 2006 – 2 February 2007

- Travelmole - Third year of record profits for Thomas Cook UK&I – 1 February 2007

- BMW Group - BMW Group sets new sales record in 2006 – 8 January 2007

- Financial Times - House prices set for stagnation, says Nationwide – 16 November 2007

- The Telegraph - Public face call-up if we go to war because Army is too small, military chief warns – 23 January 2024

- The Telegraph - Army Reserve must expand by 100,000 – 18 February 2024

- The Telegraph - Downing Street rules out UK conscription as Russia war threat rises – 25 January 2024

- The Telegraph - Invest in defence giants to protect Britain, Sunak urges City – 24 April 2024

- The Telegraph - War footing as Sunak ramps up defence spending – 23 April 2024

- House of Commons Library – UK Defence Spending – 3 May 2024

- BAE Systems - Preliminary Results Announcement 2023

- Rolls-Royce – Full Year Results 2023

- Investopedia - Harry Markowitz: Creator of Modern Portfolio Theory

- Land Registry – UK House Price Index

- World Gold Council - Gold Spot Prices & Market History

WSUA4904