I want you to take a good look at this…

Source: Visual6502.org

It might look like someone trying to hack into the matrix…

But it’s actually a blueprint for an AI chip that Barron’s reports is a “linchpin” for the $1 trillion AI boom.

The Verge says it has already “conquered the chip market”...

And the former Executive Editor at The Evening Standard says it has “changed the world”.

I call it “The Britannia Chip”.

Why?

Because it’s a British creation…

Designed by two Cambridge graduates in an industrial estate three miles down the road from Cambridge University.

Yet, despite its modest beginnings, The Economist says it’s now “a keystone in the £380 billion chip industry”...

And that “everyone wants this” chip.

They’re right…

Silicon Valley AI giants – including Nvidia, Apple, and Microsoft – are already paying an average of £7 million every day to use this chip in their next-gen AI projects.

For example, Nvidia’s new Blackwell superchip, Apple’s Apple Intelligence and Microsoft’s new AI PCs…

Are all reliant on the Britannia Chip.

It’s already positioned to power up to 99% of “AI 2.0” devices.

Even the British government invested £225 million in a “groundbreaking” AI project reliant on this chip.

In fact, it’s so valuable politicians even talked about taking a “golden share” of this chip’s profits for themselves.

Yet, right now, the Cambridge-based company that owns the exclusive rights to this chip is still flying under most people’s radars…

The Independent calls the company an “unknown tech giant”...

The Guardian said it’s “Britain's most successful tech company you've never heard of”...

And even its CEO says it’s “one of the best kept secrets in the industry”.

Maybe that’s because it was off limits to investors for eight years.

But this company’s unknown status is about to change…

An imminent announcement it’s set to make could see it propelled from the shadows into public awareness…

And – if I’m right – send its stock price up 1,500% over the next 10 years…

Hell, maybe even the next five years.

Forecasts are not reliable indicators of future results.

That’s the chance to make 16 times your money.

And I’ve been right before…

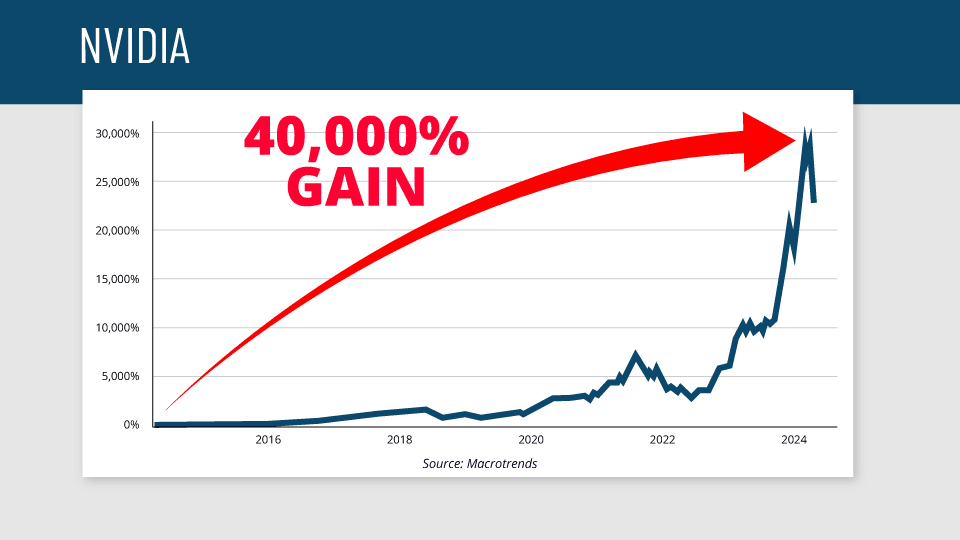

I recommended getting in on Nvidia 11 years ago – well before the mainstream press was talking about it.

Since then – and taking into account stock splits over the years – it’s gone up 40,000%.

I helped my readers lock in 1,440% of that.

Past performance is not a reliable indicator of future results.

Not to mention other companies in the AI chip ecosystem have done very well recently too…

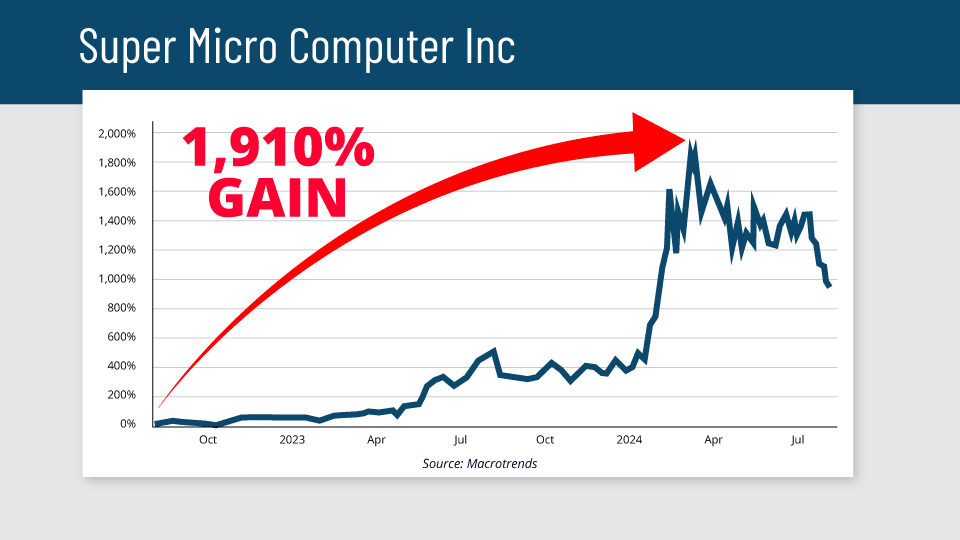

For example, AI infrastructure company Super Micro Computer soared 1,910% in the last two years…

Past performance is not a reliable indicator of future results.

Five-year performance of Super Micro Computer Inc (SMCI): 2019 74.06% | 2020 31.81% | 2021 38.82% | 2022 86.80% | 2023 246.24% | 2024 (YTD 31/07) 146.83%

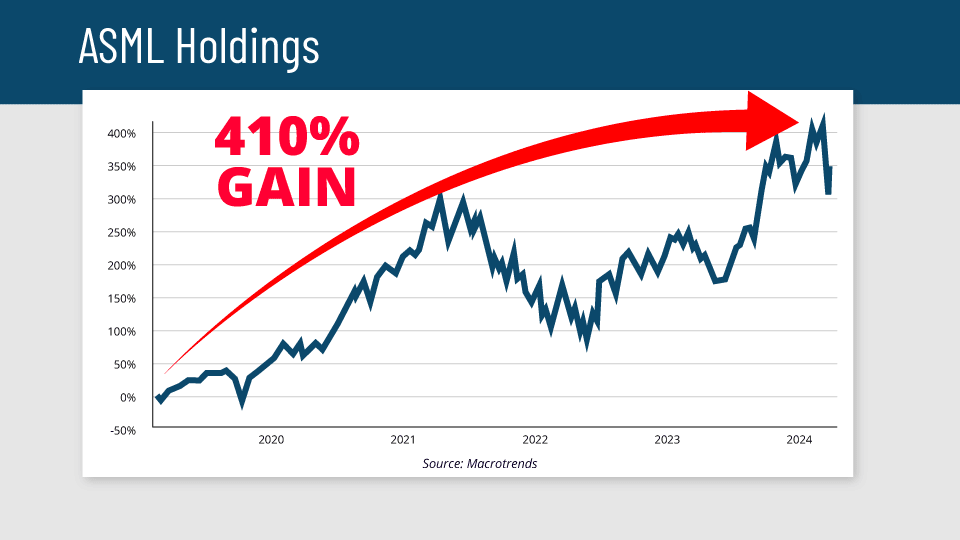

AI chip toolmaker ASML Holdings soared 410% in the last five years…

Past performance is not a reliable indicator of future results.

Five-year performance of ASML Holdings (ASML): 2019 92.43% | 2020 65.77% | 2021 64.05% | 2022 -30.54% | 2023 39.72 | 2024 (YTD 31/07) 24.43%

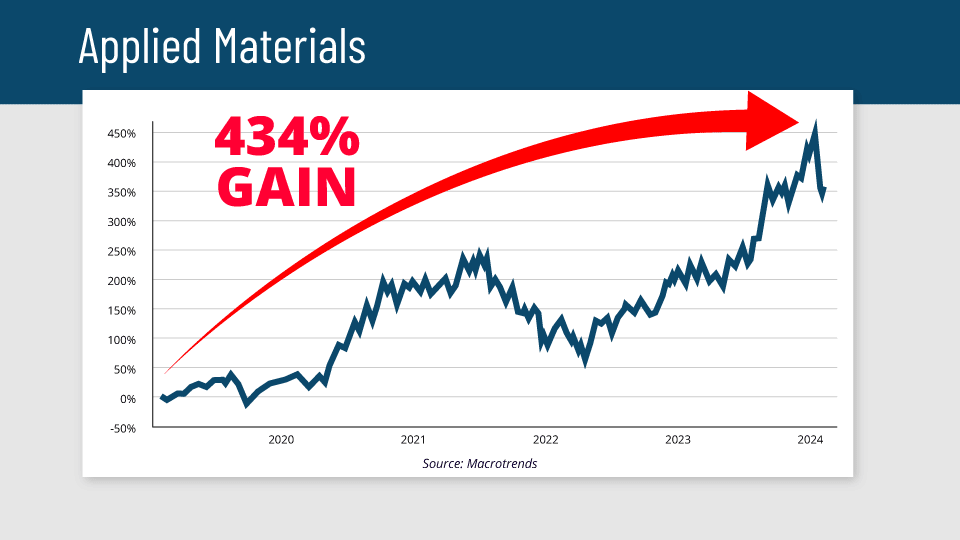

AI chip “wafer fabrication” specialist Applied Materials soared 434% in the last five years…

Past performance is not a reliable indicator of future results.

Five-year performance of Applied Materials (AMAT): 2019 88.97% | 2020 42.81% | 2021 83.43% | 2022 -37.47% | 2023 67.68% | 2024 (YTD 31/07) 31.38%

And looking a bit further back…

Chip manufacturer Taiwan Semiconductor soared 4,648% in the last 20 years…

Past performance is not a reliable indicator of future results.

Five-year performance of Taiwan Semiconductor (TSM): 2019 62.86% | 2020 90.64% | 2021 12.06% | 2022 -36.57% | 2023 42.08% | 2024 (YTD 31/07) 60.47%

And Nvidia’s biggest chip rival AMD soared 5,067% in the last 10 years…

Past performance is not a reliable indicator of future results.

Five-year performance of Advanced Micro Devices (AMD): 2019 148.43% | 2020 99.98% | 2021 56.91% | 2022 -54.99% | 2023 127.59% | 2024 (YTD 31/07) -1.99%

I helped my readers get in on AMD back in 2018.

To be clear: These kinds of stocks are VOLATILE…

Many companies like these went to zero.

Hunting for companies like this is high-risk, high-reward stuff.

If you’re happy with that, listen up….

Because right now, there’s a similar opportunity on the table…

In the next few minutes, I’m going to answer all of your questions about the “Britannia Chip” – and the mysterious Cambridge-based firm behind it…

So you can get in on this opportunity at – what I believe – is still the ground floor.

Let me be clear:

If you buy one AI stock in 2024, make it this one.

And get clued up on it ASAP… because I believe this British company is about to become a household name like Nvidia.

I haven’t had this feeling about a stock since I first tipped Nvidia back in 2013…

Meet your Head of

Moonshot Research

Sam Volkering

Editor, Southbank Investment Research

My name is Sam Volkering.

I’m the self-proclaimed Head of Moonshot Research here at Southbank Investment Research.

And I’ve been helping ordinary investors get in at the ground floor of era-defining tech trends for 11 years now…

You can see some of their feedback on the screen now…

“My subscription has been one of the best investments I have ever made. Thank you for your & team's great work.”

P.F“Thanks, Sam. I definitely earned more after 40 weeks in crypto than I did after 40 years in business.”

M.W“I am delighted with the amazing increase in value (approx. +450% overall, at the moment) of your recommendations.”

P.D“...my shares in Skywater are up 40%, OnTo 12%, Indie 13%. In addition, from Small Cap Investor, Hut8 is up 27% and Cleanspark is up 12%.”

Past performance is not a reliable indicator of future results.

I write a twice-weekly AI investment newsletter called AI Collision that goes out to 2,000 people…

And my book, Crypto Revolution, has been read by 40,000 people around the world.

But what is any of that if it doesn’t result in real returns?

Well, I’ve delivered those too…

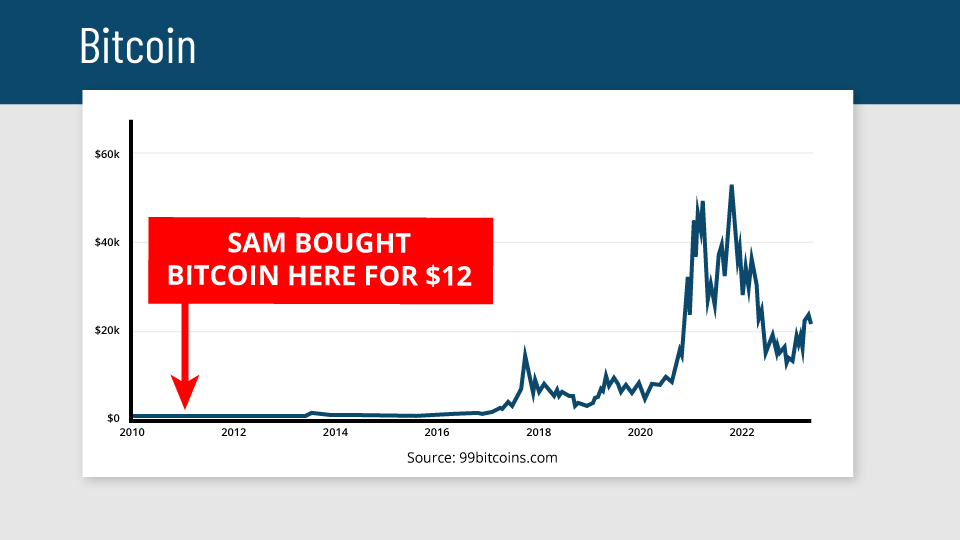

I first bought bitcoin in 2011 for $12… and Ethereum in 2017 for $8.

Past performance is not a reliable indicator of future results.

Bitcoin 5 year performance: 2018 -73.6% | 2019 +92.65% | 2020 +303.09% | 2021 +59.71% | 2022 -64.27%

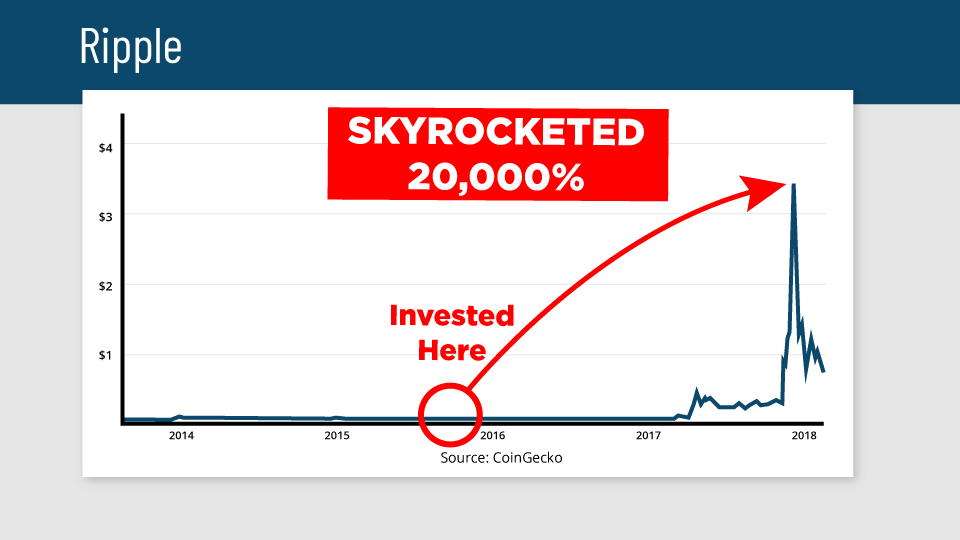

I traded Ripple for 20,000%.

Past performance is not a reliable indicator of future results.

XRP/USD Five-year performance 2019 -46.82% | 2020 +22.77% | 2021 +248.95% | 2022 -57.46% | 2023 +82.94%

I helped my readers make 1,875% in less than two years on quantum computing hardware firm Archer Materials…

I was early on crypto…

First buying bitcoin in 2011 for just $12… and Ethereum in 2017 for just $8…

I also traded the crypto Ripple for a 20,000% gain.

We’ve hit it big on AI stocks too…

Making 168% on AMD, 156% on Seeing Machines, and 175% on Brainchip.

Past performance is not a reliable indicator of future results.

Then there’s Nvidia…

As I say, I recommended the now AI king 11 years ago – back in 2013 – when it was virtually unknown and trading at just $0.39 per share…

Over the last year, it’s traded as high as $130…

That’s a 40,000% return over a decade…

Past performance is not a reliable indicator of future results.

Five-year performance of NVIDIA (NVDA): 2019 76.73% | 2020 122.20% | 2021 125.41% | 2022 -50.26% | 2023 238.98% | 2024 (YTD 31/07) 136.33%

Or – before costs or taxes – the power to turn a grub stake of £100 into £40,000!

Don’t get me wrong: We’ve had our share of losers over the years too…

That’s just the nature of the kind of moonshot stocks we target.

It’s a trade-off: You take on higher risk for the potential of higher returns.

So, this type of investing is simply not for anyone with a low-risk tolerance.

But, look… this isn’t a story about me.

This is a story about Britain…

And an opportunity of a lifetime for British investors.

Let me show you why…

Silicon Valley’s £3.2 billion British

AI secret

It’s no secret Silicon Valley is at war.

The world’s biggest tech giants – including Nvidia, Apple and Microsoft – are all fighting to win the AI arms race.

They’ve already spent tens of billions…

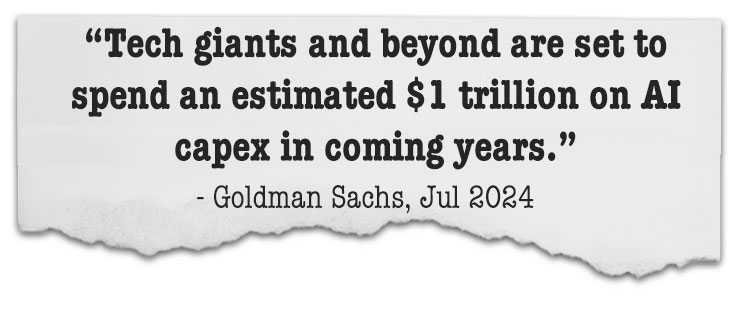

And – according to Goldman Sachs analysts – they’ll spend a whacking $1 trillion in the coming years.

Yet, behind the scenes, there’s already one big winner…

A company “quietly” taking money from all of these AI giants…

And selling them a “weapon” they all need to win the AI arms race.

I’m, of course, talking about the Britannia Chip.

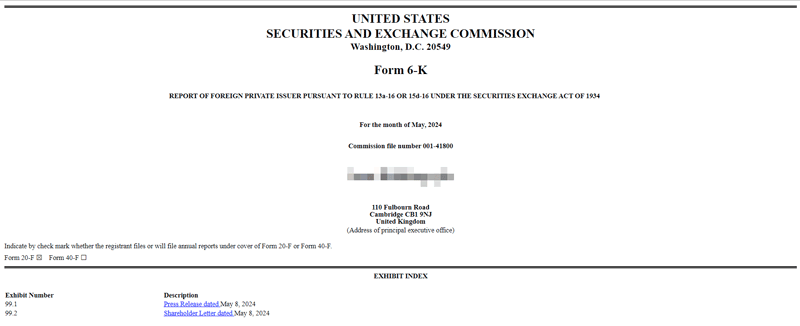

On 8 May this year, the creators of the Britannia Chip filed this document with the US Securities and Exchange Commission…

It’s a 6-K form – what foreign companies have to use to file their financials if they’re doing business inside the US.

And on page three it reveals something big:

Silicon Valley’s biggest tech companies – including Nvidia, Microsoft and Apple – are paying this “unknown” Cambridge firm £3.2 billion every year.

That’s an average of £208 million every month…

£48 million every week…

And nearly £7 million every day.

Those numbers have gone up over the last two years…

And Goldman Sachs analysts forecast even more growth.

Why are these American tech giants funnelling so much money into this British firm?

How is it – seemingly – holding them all to ransom?

And how could understanding this power-play potentially make YOU a lot of money?

Because much of the tens of billions they’ve already invested in AI…

And the $1 trillion they’re set to invest in the coming years…

Is dependent on the Britannia Chip.

That’s why this unknown firm is so valuable…

And why – if I’m right – it could go up as much as 1,500% in the next five to 10 years.

Forecasts are not reliable indicators of future results.

Again, the chance to make 16 times your money.

Nvidia’s silent British partner

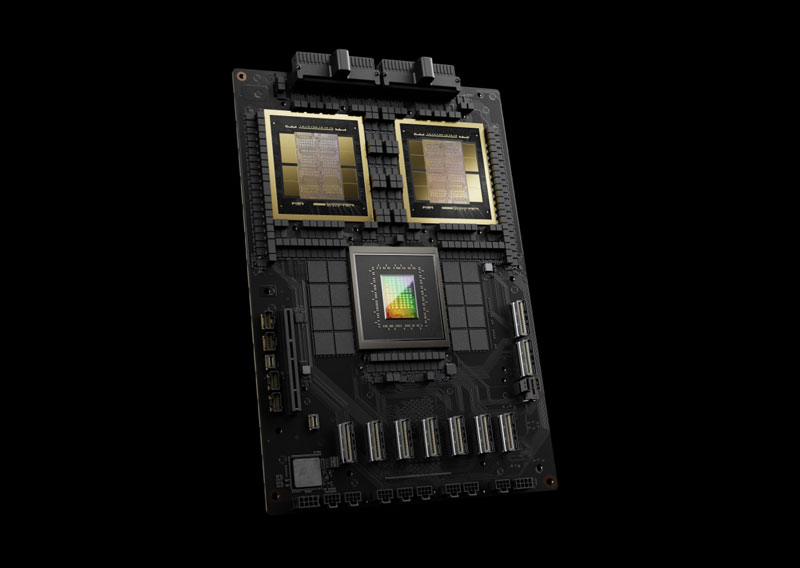

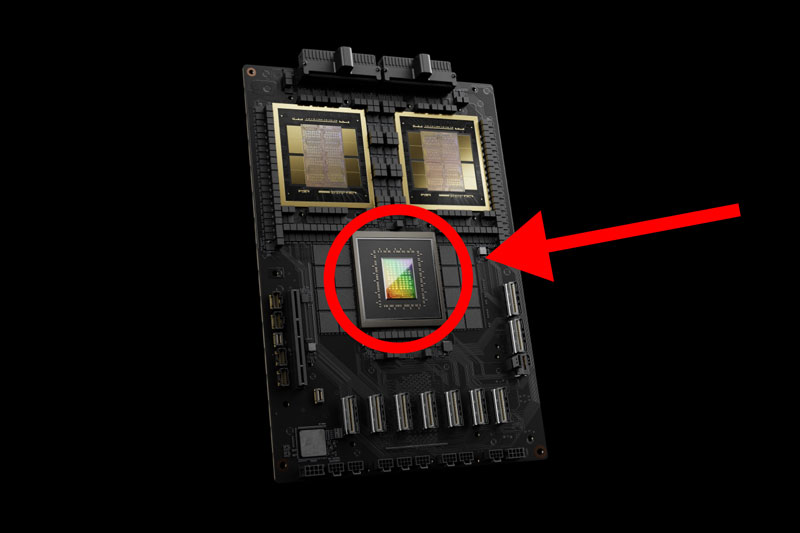

Take Nvidia’s new Blackwell AI superchip…

Source: Nvidia

It’s 30 times faster than Nvidia’s previous superchip – the Grace Hopper…

And 25 times more energy efficient.

Reports are saying this chip will “consolidate Nvidia’s stranglehold over the AI market”.

And Amazon, Google, Meta, Microsoft, OpenAI, Tesla – and other tech giants – are already lining up to buy it.

But Nvidia isn’t doing this alone…

The Blackwell superchip is actually made up of three chips.

Two Nvidia own the rights to…

And a third they don’t – you can see it right here:

Source: Nvidia

I’m sure you can guess what that is…

That’s the Britannia Chip.

In other words, Nvidia’s Blackwell superchip – that is set to “consolidate their chokehold” – is dependent on the Britannia Chip.

It simply wouldn’t be possible without it.

And when you dig into the technical details of other big tech companies’ upcoming AI projects it’s the same story over and over again…

The Britannia Chip will power…

- ALL of Apple’s new AI – Apple Intelligence – iPhones, iPads, Macs and MacBooks…

- ALL of Microsoft's new PC AI laptops and PCs – a trend Windows Central reports is triggering “a great reset in computing”...

- Google’s new AI chip that The Verge reports “will challenge Microsoft and Amazon in the AI race”...

- AMD’s new Versal AI chip – its answer to Nvidia’s new Blackwell superchip…

- Tesla’s self-driving AI technology – an industry forecast to 10X by 2033…

- And even the tiny new £54 AI board from DIY electronics company Raspberry Pi!

I’ll say it again: Without the Britannia Chip, none of these multi-billion-dollar AI projects would be possible.

Actually this British chip is foundational to two of the biggest upcoming AI trends too…

Britannia Chip to power up to 99% of “AI 2.0” devices

You might have heard the phrase “AI 2.0” knocking about…

It’s already got about 50 different meanings, like…

“The real-world manifestation of AI technologies through humanoid robots”…

Or a “singularity event” when AI becomes “more intelligent than humans”...

Or, you know, just Arnie’s Terminator coming to life and killing us all.

Those ideas are all very grand – like something out of a science fiction book…

But here’s the real next big leap in AI:

Getting AI everywhere.

That’s what big tech is really trying to do right now…

Get their AI projects in the hands and homes of everyone on the planet.

And that means two things:

Putting their AIs on your phone…

And in your computer – whether it’s a laptop, tablet or PC.

Generative AI is said to be “the next big thing for smartphones”...

And the AI smartphone market is forecast to be worth $114 billion by 2031…

In other words, it’s going to grow by 600%.

Here’s the incredible thing…

The Britannia Chip has already locked up 99% of the mobile AI market.

Samsung’s new mobile Galaxy AI…

Google’s new Google AI on Android…

Microsoft’s new Copilot AI app…

Apple’s new Apple Intelligence for iPhone…

They will all be powered – in part – by the Britannia Chip.

It’s the same story in what’s known as PC AI – the drive to bring AI to your computers…

Nvidia’s new PC chip – set to launch in 2025…

AMD’s new PC chip – also launching next year…

ALL of Microsoft’s new Copilot AI laptops and PCs…

ALL of Apple’s Apple Intelligence AI on their MacBooks, iPads and Macs…

Dell and HP’s new laptops too…

They’re all dependent on the Britannia Chip.

In fact, it’s forecast that by 2026 30% of the PC AI market will run on the Britannia Chip.

A move the CEO of one market analysis firm says is “an industry-changing event that simply has not been taken seriously enough”.

I know I’m starting to sound like a broken record here…

And I haven’t even mentioned how OpenAI – the creator of ChatGPT – is benefiting from the Britannia Chip too.

Don’t get me wrong: The Cambridge-based company behind this chip does have competitors…

And a new startup could come out of nowhere and challenge it.

But, right now, you can see why Morningstar calls this company “dominant”.

As you’ll see in a moment, this was no overnight success…

It’s been 39 years in the making…

And has given this British company a grip on the AI industry only comparable to Nvidia.

Is this the most valuable “unknown” company in the UK?

Try the entire global AI space – all $1 trillion of it!

And – if my analysis is right…

This could be THE STOCK to hold in your portfolio for the next five years.

Delivering as much as 1,500% in five to 10 years – and even kickstarting a new era of AI-driven growth in the UK.

Forecasts are not reliable indicators of future results.

Before I reveal why, I want to show you one more example of the Britannia Chip’s dominance…

Because – as I hinted at earlier – it’s not just big tech banking on this chip…

Britannia Chip powers new £225-million government super-AI

This is the University of Bristol’s National Composites Centre…

Source: National Composites Centre (NCC)

It doesn’t look like much from the outside…

But inside you’ll find the fastest AI supercomputer in the UK.

It’s called Isambard-AI.

Source: cryptopolitan.com

The government just spent an “unprecedented” £225 million building it.

It’s 10 times faster than any other supercomputer in British history…

And will be among the fastest supercomputers in the world.

The government says Isambard-AI will “turbocharge AI innovation in Britain”.

And already, scientists and researchers from around the world are flocking to use it.

Actually, Isambard-AI is also hooked up to Cambridge University’s new Dawn supercomputer…

And together they’re helping to automate breakthroughs in nuclear fusion, personalised medical care and climate change…

This supercomputer tag-team could bring hundreds of billions of investment and growth to the UK economy in coming years.

And guess what you’ll find when you look under the hood of Isambard-AI…

Yep: The Britannia Chip.

In fact, not just one… but 5,448 of them!

Actually, the Britannia Chip is also powering other countries’ supercomputers too, like…

Europe’s first ever supercomputer, which the EU and the German government are spending €273 million on…

And Japan’s $1 billion supercomputer called Fugaku, which was the fastest supercomputer in the world back in 2020.

So, just like much of Silicon Valley is dependent on the Britannia Chip for their multi-billion-dollar AI projects…

So are governments around the world.

But… why are they all so dependent on the Britannia Chip?

What exactly is this chip doing for them?

And why does this mean a potentially HUGE investment opportunity for YOU?

The answer lies in AI’s most valuable company…

How Nvidia became an AI King

To understand why the Britannia Chip is crucial for the AI boom…

And why I predict the Cambridge-based firm that owns the exclusive rights could see 1,500% gains in the next five to 10 years…

Forecasts are not reliable indicators of future results.

We need to look at Nvidia.

Goldman Sachs recently called Nvidia “The most important stock on planet earth”.

And one – witty – market strategist said, “Few things are more certain than death, taxes and Nvidia”.

The company hit a $1 trillion valuation in 2023…

And – even with the recent market sell-off – its market cap has more than doubled to $2.6 trillion this year.

Hell, get this: Nvidia is now worth more than the entire FTSE 100…

One company…

Bigger than the UK’s 100 biggest stocks.

Yet, none of this was by chance…

Nvidia has taken advantage of a market dynamic that’s created some of the most dominating companies in history – in Britain and around the world…

For example, this dynamic is at play in…

- Microprocessor giant Intel, who made investors 30,000% over 50 years…

- Computing titan IBM who made investors 1,800% over 30 years…

- British national treasure BT Group – who at its peak made investors 4,500% over 15 years…

- Google – who needs no introduction – who made investors 7,000% over 20 years…

- And even American commodity giant US Steel who made investors 4,500% over 30 years.

Past performance is not a reliable indicator of future results.

This market dynamic is simple…

And brutal.

It can be summarised in one word:

Monopoly.

All these companies had a stranglehold on their respective industries nobody else could compete with.

Which resulted in sky-high valuations and soaring stock prices.

In Nvidia’s case it has – as The Economist puts it – a “chokehold on chips”...

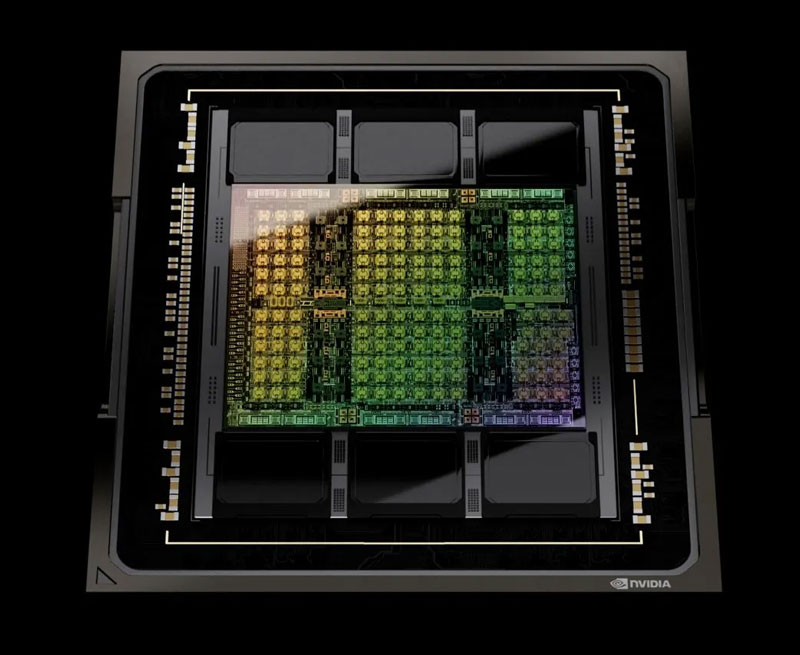

Source: Nvidia

Specifically, a type of chip called the Graphics Processing Unit – or the GPU for short.

I won’t get too technical, but you can think of this chip as the “muscle” powering the AI revolution…

Or the car engine, if you like.

AI needs a VAST amount of computing power…

And the GPU delivers it.

Nvidia spent the last 30 years building a monopoly in this market…

In part, simply by building chips that were more powerful and more efficient than the competition.

In June this year, one investment bank estimated that Nvidia controls between 70% and 95% of the GPU market…

And Yahoo Finance reports its competition is “still years from catching up”.

This is why Nvidia’s valuation has soared to $1 trillion…

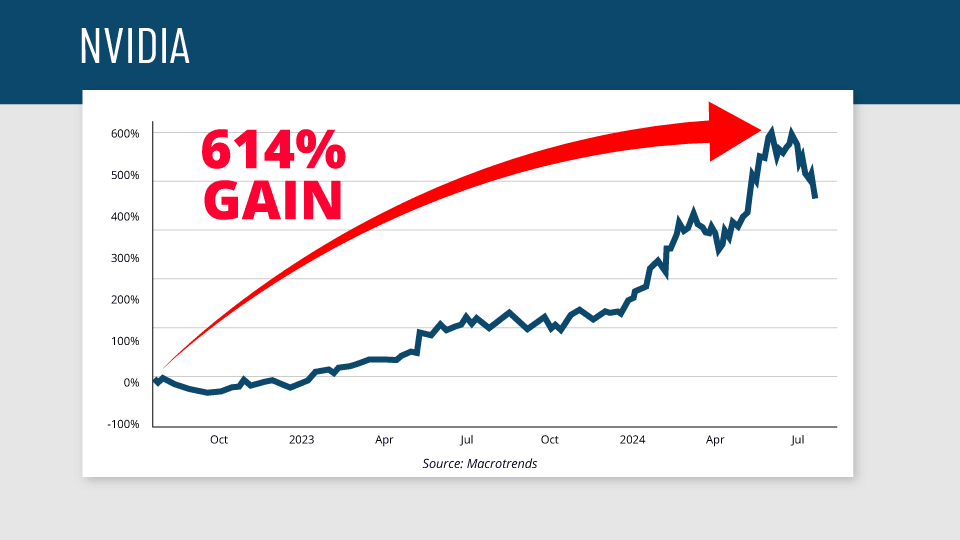

And its stock price has been up as much as 614% in the last two years.

Past performance is not a reliable indicator of future results.

Five-year performance of NVIDIA (NVDA): 2019 76.73% | 2020 122.20% | 2021 125.41% | 2022 -50.26% | 2023 238.98% | 2024 (YTD 31/07) 136.33%

Sure, we’ve seen a BIG sell-off in Nvidia and other tech stocks recently…

That’s just the nature of these volatile beasts.

But if you have a rock-solid investment case, sell-offs can be an opportunity to buy MORE of the stocks you like.

You’ve got to think long term…

Remember, I was one of the few to see the potential of Nvidia early on…

Past performance is not a reliable indicator of future results.

I recommended it to my readers 11 years ago – back in 2013…

And it’s been up as much as 40,000% since then.

And now I see a similar pattern playing out in the UK…

Meet Britain’s Nvidia

This is Trinity College in Cambridge…

The birthplace of some of Britain’s most important scientific and technological breakthroughs…

Like Sir Isaac Newton’s discovery of calculus and the laws of motion…

Stephen Hawking’s black hole and Big Bang breakthroughs…

And Francis Crick and James Watson’s discovery of DNA – announced in The Eagle pub over a few pints!

But there’s another world-changing breakthrough that happened in Cambridge that not many people know about…

It happened 38 years ago…

In this industrial-looking building three miles down the road from the university…

A team of eight computer scientists – including two Cambridge graduates – were hard at work…

Racing to redefine a technology that would later be called “the world’s greatest invention”.

They were competing with big international businesses with “hundreds of engineers and a massive amount of expensive equipment”.

One of the team even said, “We thought we were crazy.”

But in true British spirit they didn’t give up…

And after 18 months of blood, sweat and burnt fingers from electric soldering…

They put the finishing touches on that blueprint I showed you earlier…

Source: Visual6502.org

A brand-new, revolutionary design for a type of microchip called the Central Processing Unit – or CPU for short.

What I’ve been calling the Britannia Chip.

Here’s the first-ever manufactured one…

If Nvidia’s GPUs are the muscle powering the AI boom…

You can think of the CPU – and the Britannia Chip specifically – as the brains.

It does all the thinking and planning essential in AI.

As Ars Technica reports, the Britannia Chip was “years ahead of its competitors”.

It was – and still is – a true marvel of British innovation.

What makes this chip so special?

In one word: Simplicity.

While its main competitor’s chip required 357 “compute instructions” to work…

The Britannia Chip needed just 45.

So, overnight, it was 8 times more efficient than its rivals…

And – in speed tests – 10 times faster.

It was – and still is – as one tech journalist puts it a “speed demon”.

Three of the biggest tech firms at the time – including Apple – invested millions to get this chip out of the labs and into the world…

And over the last four decades, it’s powered some of the world’s best-known tech…

From early computers like the BBC Micro and the Acorn Archimedes…

Source: Wikimedia

Source: Wikimedia

To every major Nokia mobile phone – like the famous 3310…

Source: Wikimedia

Source: Wikimedia

All the way up to the latest AI iPhones and MacBooks.

280 BILLION chips shipped…

and counting

Today, 280 billion of these chips have been shipped…

In fact – believe it or not – more than 900 chips are shipped every single second.

Count to 10 and 9,000 chips have just flown out of the door…

That’s 77 million every day – mind-bending numbers.

To put this British company’s monopoly into perspective…

HALF of CPU processors are now based on the Britannia Chip design.

And 70% of the world’s population – that’s nearly six billion people – use devices powered by the Britannia Chip.

You’ll find this chip in:

- 99% of all smartphones… and 100% of Apple’s iPhones…

- 65% of connected at-home devices (also known as “Internet of Things” devices)...

- And up to 85% of chips in modern cars.

Yes, the Britannia Chip is probably already in your house!

Chances are whatever you’re watching this video on is – in part – powered by this chip.

And – as I’ve already shown you – this British chip is now powering massive chunks of the AI boom…

Including as much as 99% of mobile AI…

And 30% of PC AI in the next few years.

As one venture capital firm says, the Britannia Chip has built a “hidden monopoly”.

I know what you’re thinking:

If this company is so important to AI – and other tech booms – how has it stayed hidden for so long?

And why is it RIGHT NOW that its stock price could suddenly start on a 1,500% rise?

Forecasts are not reliable indicators of future results.

The answer to those two questions lies back in Cambridge…

Britain’s Silicon Valley is BOOMING

While the new Labour government has just declared “Britain is broke and broken”...

There is a small pocket of Britain that’s absolutely booming…

It’s known as “Silicon Fen”.

Source: 2024 Cambridge Science Park

It’s a tech hub full of innovation like California’s Silicon Valley…

Except found in the flat green fens around Cambridge.

For decades now, this cluster of companies has been known as a “phenomenon”...

While the rest of the country has struggled…

This cluster of innovation has put out economic winner after economic winner.

According to the University of Cambridge, it has produced 24 $1 billion companies…

And the 5,000 startup firms located here are contributing $30 billion every year to the UK economy.

The university is also number one in the world for producing successful tech founders.

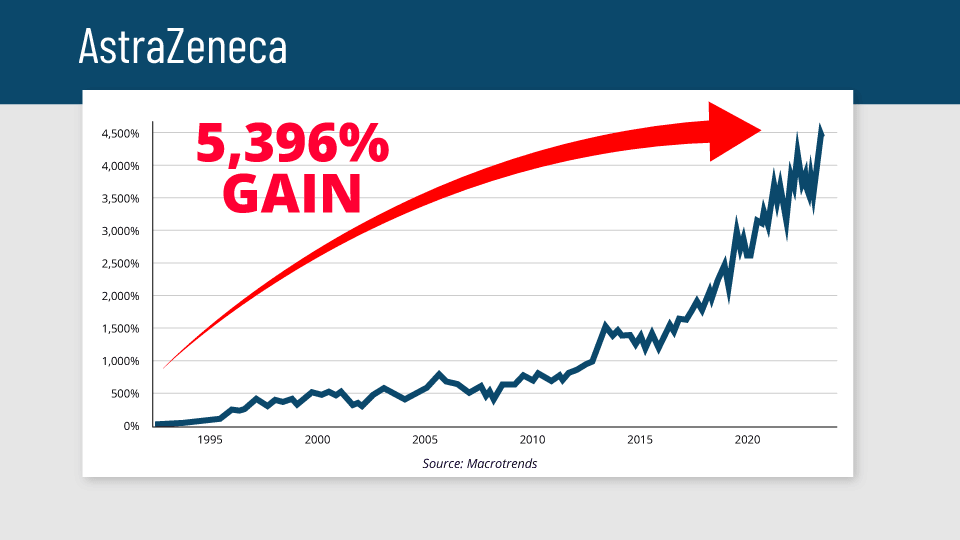

You might have heard of AstraZeneca – the firm behind the British Covid-19 vaccine…

It’s one of these Cambridge “phenomenon” companies.

Its stock over the last 20 years has done one thing: Go up… a whacking 5,396%...

Past performance is not a reliable indicator of future results.

Five-year performance of AstraZeneca (AZN): 2019 33.25% | 2020 0.88% | 2021 21.25% | 2022 31.82% | 2023 -3.42% | 2024 (YTD 31/07) 18.15%

And it’s now the biggest company in Britain.

Yet… for most Brits, investing in these Cambridge “phenomenon” companies is simply off limits.

Most of them aren’t listed on the stock market – here or abroad.

So, they’re only open to hedge funds or seriously wealthy private investors.

For example, private investors are set to make as much as…

- Two-and-a-half times their money on Featurespace – a tech firm focused on fraud and scam protection…

- Double their money on Cydar Medical – a company using AI to inform clinical decisions…

- And TEN TIMES their money on Evonetix – a biotech company using semiconductors to edit DNA.

Past performance is not a reliable indicator of future results.

While ordinary Brits still can’t invest a single penny in these companies.

To be clear: These are early-stage companies.

They are very high risk…

And many go to zero.

But it’d be nice to at least have the option, wouldn’t it?

It used to be the same story with the company behind the Britannia Chip…

Eight years ago this company was bought out and delisted from the London Stock Exchange…

So – even if you had been aware of its Nvidia-like value – it was simply impossible for you to buy a single share.

Even the British government talked about taking ownership to get a “golden share” of the profits…

But failed to do so.

This company remained impossible to buy…

Until last year.

It was relisted… this time on the American stock market, of all places.

That may seem strange because this is a British company through and through.

As I say, it started in Cambridge and still has its headquarters there.

And that’s where the chip itself was invented.

But the important thing about this strange new international dynamic is this:

It gives you the opportunity – for the first time in eight years – to buy this company.

And I recommend you consider doing so ASAP…

Britain’s Nvidia moment

As The Verge reports, this British company “conquered the chip market without making a single chip”.

Instead – as you’ve seen today – it licenses its designs to other companies…

And collects fat royalties – £7 million every day – for doing so.

This business model works very well for them.

It’s currently clearing £3.2 billion every year…

And has accumulated a fat war chest of cash.

Now it’s ready to use that money.

And it’s making a big, brave move…

One that will see the company step out of the shadows for good.

Before long, this “unknown” British firm won’t be “tech’s best-kept secret”...

They could be a household name in Britain – and globally – like Nvidia.

This could be Britain’s Nvidia moment.

And your opportunity to make an absolute killing.

Remember: We’re talking about the possibility of making 1,500% – 16 times your money – in the next five to 10 years.

Forecasts are not reliable indicators of future results.

What is this big move it’s making?

A recent press report reveals that – for the first time ever – this firm plans to manufacture its own chips.

And not just any chips: Chips specifically for the AI race.

This company is already making big profits selling the blueprints for the picks and shovels in this AI gold rush…

And now it’s about to start making and selling those picks and shovels itself.

And it’s the perfect moment:

The AI market is set to grow four times bigger – from $184 billion to $826 billion – by 2030…

Source: Photo by Igor Omilaev on Unsplash

And Tech Monitor reports “huge global demand” for AI chips…

CNBC echoes this, reporting there is “explosive demand”.

These new British-built Britannia Chips already have their first big AI gig lined up too…

The billionaire owner of the Cambridge-based firm is set to invest $960 million by 2025 in “computing facilities for generative AI”.

He wants to “be [in] the leading position for the AI revolution”.

And he’s already said the Britannia Chip will be the “centrepiece” for this new drive to dominate AI…

In other words, it will be the thousands of “brains” lining the data centres for this new – nearly $1 billion – venture.

And that’s just the first project…

You’ve already seen how pervasive this company was able to make the Britannia Chip design.

If its British-built Britannia Chip sees even half that adoption…

This company and investors will be laughing all the way to the bank.

Importantly: This company will still have its royalty business…

That’s going nowhere.

So, as far as I can see it’s a win-win.

To be clear: This new venture it’s setting out on…

And the market “dominance” it’s already established…

Is why I’m confident it can follow in Nvidia’s footsteps and hit a $2 trillion market cap over the next five to 10 years.

That’s where my 1,500% forecast comes from.

Forecasts are not reliable indicators of future results.

A $2 trillion market cap means 16 times your money if you invest today.

Yes, there are no guarantees…

As I say, stocks like this are VOLATILE…

I don’t see this going to zero any time soon… but it is a possibility.

And it’s important not to underestimate this company’s competitors…

Right now, it has a near-monopoly in many industries…

But we’re talking about disruptive tech here…

And a startup could come out of nowhere to challenge it.

Again: This is high-risk, high-potential reward.

If you’re happy with that…

And you’re ready to make one moonshot bet…

I say, make it this one.

And RIGHT NOW is the time to act.

This British firm is yet to make its official announcement about producing its own chips…

But that could happen at its next earnings briefing, which is estimated to take place on Thursday 24 October.

Or you could wait until it goes into production next year.

But ask yourself this: If you could turn the clock back before the world knew about Nvidia…

Back to 2013, when it was trading at just $0.39 a share…

When I first recommended it…

Would you wait?

Or would you fill your boots?

To be clear: This is not the exact same opportunity.

But I’ve already spelt out why THIS could be the opportunity of a lifetime for British investors…

And this imminent announcement could be the point of no return.

So, if you’ve heard the evidence today and you see even a tenth of the potential this British AI stock has…

You owe it to yourself to at least look over the full investment case I’ve prepared for you.

After all, if this stock does take off and you’re sat on the sidelines…

I guarantee you’ll be kicking yourself.

I’ve done all the legwork for you…

DOWNLOAD NOW:

The Britannia Chip: The British AI Stock Set to Make 1,500% in the Next Five to 10 Years

You’ve seen the overwhelming evidence for this opportunity…

Now it’s time to take action.

And I want to help you do that…

I’ve put everything you need to know about this unprecedented opportunity in a brand-new briefing.

It’s called: The Britannia Chip: The British AI Stock Set to Make 1,500% in the Next Five to 10 Years.

Inside this briefing, you’ll discover:

- The name of the “unknown” British AI firm behind the Britannia Chip…

- My exact buy price (you won’t want to buy above this)...

- The full story behind this historic British company – I’ve only scratched the surface of it here…

- And a full breakdown of all the risks involved – I want you to go into this with your head screwed on.

Again: The potential here is MASSIVE.

I believe this British company will soon become a household name like Nvidia…

And could go up 1,500% in the next five to 10 years.

Forecasts are not reliable indicators of future results.

Let me be clear: If you buy one AI stock in 2024, make it this one.

Look, you’ve listened to me this far…

So, I’d say you owe it to yourself to look through my full investment case…

That way, you can make an educated decision on whether this is an opportunity you want to grab with both hands… or you’re happy to miss out on.

As I say, I haven’t had this feeling about a stock since I recommended Nvidia to my readers back in 2013.

And since then, Nvidia has gone up as much as 40,000%.

Past performance is not a reliable indicator of future results.

Of course, this isn’t the exact same opportunity…

But I believe it’s certainly AS BIG in scope.

And if the next few years play out how I anticipate…

It’ll be no exaggeration to say this will be THE BEST British stock you’ve ever owned.

Hell, the best stock in your portfolio full stop.

Forecasts are not reliable indicators of future results.

This briefing contains everything you need to take action on this opportunity.

And – if you act quickly – you can be reading it within the next few minutes.

As well as another briefing I’ve prepared for you…

To help you profit from the Britannia Chip in a second way…

BONUS BRIEFING:

Three Britannia Chip Partners: Your Portfolio for the Next Gen of AI

Remember those AI chip companies I mentioned earlier?

Like ASML Holdings – up 410% in five years…

Super Micro Computer – up 1,910% in two years…

And Taiwan Semiconductor – up 4,648% over the last two decades…

Past performance is not a reliable indicator of future results.

Well, many of them are what is known as “silent partners” to Nvidia.

They’re involved behind the scenes in the process of designing or manufacturing – or even just being reliant on – Nvidia’s chips.

And when the world’s eyes turned on Nvidia…

They all benefited.

Right now, there’s a similar opportunity with the Britannia Chip…

It has many silent partners that stand to benefit from its continued growth…

But there are three in particular you should keep your eye on.

You’ll find the details of all of them in a briefing I’ve prepared for you…

It’s called: Three Silent Britannia Chip Partners: Your Portfolio for the Next Gen of AI.

Inside, you’ll discover:

- Silent Partner 1: One of the Britannia Chip’s “main competitors” who – behind the scenes – is using its chip to power a new venture targeting a $300 billion AI venture market…

- Silent Partner 2: TechRadar calls this firm the “$700 billion AI giant you’ve never heard of”... it’s in talks with OpenAI to make an AI chip to “challenge Nvidia”... and the Britannia Chip could play a crucial role…

- And Silent Partner 3: This firm is using the Britannia Chip to help Microsoft complete a 12-year “odyssey” to transform Windows into an AI superpower… forecasts say this could be worth $150 billion in the next five years.

You could invest in all of these companies to build a small Britannia Chip portfolio…

Or just use this briefing to deepen your understanding of the Britannia Chip’s reach and importance in the next leg of the AI boom.

Either way, we’d like to send you a copy of this briefing today.

Here’s how you can download both briefings immediately…

The British stock opportunity of a lifetime

I’ve been helping Brits make money from the stock market for 11 years now…

And – I don’t mind saying – I’m damn good at it.

So, yes, my research will cost you money.

How much?

Well, we’re not talking about the cost of a financial advisor here…

Three hours with one of them could set you back more than a grand…

And you definitely don’t need to give me a percentage of any profits you make!

Actually, considering the scope of the opportunity you’re about to discover…

I think you’ll be surprised by just how reasonable the price of my research is.

To get your hands on my main Britannia Chip briefing…

And the bonus Britannia Chip silent partners briefing…

Is just £199.

And that’s with a full 30-day money-back guarantee.

Personally, I’d say that’s already a pretty great deal…

But I want to make it even sweeter for you…

12 more BIG-IDEA stock recommendations

I’d also like to give you a full year of membership to the Southbank Growth Advantage newsletter.

This is where me and my colleague James Allen share our latest – and best – stock recommendations and research.

As I said earlier, you can consider me Head of Moonshot Research…

My focus is helping you get in early on world-changing tech trends like AI, crypto, VR…

I’ve already shown you how I helped some of my readers get in on AI and crypto early…

You can see some of their feedback on the screen now…

“My subscription has been one of the best investments I have ever made. Thank you for your & team's great work.”

P.F“Thanks, Sam. I definitely earned more after 40 weeks in crypto than I did after 40 years in business.”

M.W“I am delighted with the amazing increase in value (approx. +450% overall, at the moment) of your recommendations.”

P.D“...my shares in Skywater are up 40%, OnTo 12%, Indie 13%. In addition, from Small Cap Investor, Hut8 is up 27% and Cleanspark is up 12%.”

Past performance is not a reliable indicator of future results.

And I plan on doing it again and again in new tech trends on your behalf!

You can consider James as head of ENERGY Moonshot Research for the Southbank Growth Advantage newsletter…

He has over 12 years of experience as an expert energy analyst…

Reporting from the front lines in the US for one of Europe’s leading energy news bureaus, Montel News…

And before that, leading the power markets desk at a huge energy price reporting agency.

So when it comes to spotting hot energy stocks before the crowds, he knows a thing or two!

Your Southbank Growth Advantage membership includes:

- The monthly newsletter where me and James bring you our latest big-idea investment research… you’ll get a deep dive on a topic from both of us… and usually at least one stock recommendation…

- The FULL Southbank Growth Advantage portfolio, which is currently made up of 16 moonshot stocks that you can take advantage of…

- A library packed full of Special Reports, to help you take advantage of any urgent and unmissable opportunities we’ve uncovered – more on those in a second…

- The FULL newsletter archive, packed with mega-trend deep dives and stock recommendations from both me and James…

- And sell alerts as and when they’re needed – we won’t leave you guessing when to lock in profits or cut losses.

There are two Special Reports I recommend you start with – they are…

- The Uranium Bull Market Playbook – inside you’ll discover how a UK government policy could put Britain smack in the centre of a GLOBAL nuclear-power revolution… and send two London-listed uranium stocks flying…

- Two stocks to buy NOW – as the new crypto bull IGNITES – crypto is BACK in 2024… and with bitcoin getting scarcer by the second, these two top-tier bitcoin miners are getting ready for take-off.

I’m also going to give you a digital copy of my best-selling crypto book for free…

It’s called The Crypto Handbook…

And – I don’t mind saying – it’s the ULTIMATE guide to understanding and investing in digital assets, web3, the metaverse… basically EVERYTHING crypto!

Now, I want to be clear about our mission objective with Southbank Growth Advantage…

Both me and James are gunning for seriously BIG – hell, let’s just call them “moonshot” – plays on your behalf…

We’re not aiming for tens of percent over years here…

But hundreds in weeks or months…

Or – as with this opportunity today – even thousands of percent in coming years.

And, of course, that comes with risks…

Timing these stocks is HARD…

Many of them could go to zero.

So, these are NOT investments for your retirement portfolio.

As I say, we’re targeting high-risk, high-reward stocks.

They will be volatile… so if you’re risk averse this is simply NOT for you.

I’m serious: I only want you in on this if you understand the risks…

I don’t want you lying awake at night worrying about one of our stocks.

That also means you should only be investing money you can afford to lose.

There will also be currency risks as many of the stocks we look at are based overseas.

But here’s the thing…

Even with all those risks in mind…

I LOVE these types of moonshot stocks.

And – if you’re the right kind of person – you will too.

These plays are EXCITING to be a part of…

And if just a few of these stocks hit it big, a small grub stake could deliver you some serious gains.

That’s the trade-off: Taking on bigger risks for the potential of much bigger returns…

The kind your average blue-chip stock can only dream of.

Again, if the Britannia Chip opportunity plays out how I see it will… you could be looking at 16 times your money…

That’s turning £100 into £1,600.

Or £1,000 into £16,000 – of course, before any costs or taxes.

Forecasts are not reliable indicators of future results.

That’s the kind of big hitters we’re gunning for.

Again: You’re getting a full year of Southbank Growth Advantage membership…

AND my two new Britannia Chip briefings…

For just £199 per year.

I hope you agree that’s a bit of a bargain!

To unlock all of this right now:

Simply click on the button below and fill out your details.

Click this button to get started.When you do that you’ll also see I’ve prepared a special deal for you…

An exclusive 50% discount

Look, I’m not a fan of marketing gimmicks…

I think it’s easier just to put my best research in your hands and let you decide what you think for yourself.

That’s what I’m doing today.

Still, I know price can be a deciding factor for many people.

So, even though I’d say a year’s worth of mine and James’s best stock picks and deep-dive research for £199 per year is already a bargain…

I want to go one step further.

I had a word with my publishers at Southbank Investment Research and we’ve found a way to give you a hefty discount on the headline price…

A whole 50% off.

That takes the price of your first year from £199… down to just £99.

As I say, this discount isn’t a gimmick…

It’s not exclusive for a limited number of people…

And it won’t end on a specific date.

This is just my way of giving you the best value possible.

And I’m serious that this is a once-in-a-lifetime opportunity for British investors…

So, I’d hate for you to miss out over a few quid!

Of course, this deal won’t be around forever.

My publisher has been very generous to honour this discount because I believe so much in this opportunity.

So, exactly when this 50% discount comes offline is ultimately up to them.

That could be tomorrow… or a week from now.

The bottom line is this: If you’re at all interested in this opportunity…

ACT NOW.

Don’t sit on your hands and do nothing.

At the very least, take advantage of the 30-day money-back guarantee… and look through my main Britannia Chip briefing.

You’ll see the name of the British company and my recommended buy price.

Don’t wait any longer…

Hit the button below and download your copy of my Britannia Chip briefing now…

Click this button to get started.All of this for just £99

Here’s a recap of what you’ll gain immediate access to today…

- Briefing 1: The Britannia Chip: The British AI Stock Set to Make 1,500% in the Next Five to 10 Years…

- BONUS BRIEFING: Three Britannia Chip partners: Your Portfolio for the Next Gen of AI…

- And 12 months of membership to the Southbank Growth Advantage newsletter…

- This includes the TWO Special Reports I just outlined…

- The FULL 16-stock growth portfolio…

- 12 brand-new, big-idea investments from me and James…

- And our FULL archive of research and stock recommendations.

- I’m also sending you a copy of The Crypto Handbook – my ultimate guide to everything crypto.

You’re getting ALL of this for just £99 for your first year – 50% off the usual price.

Then you’ll renew at the usual price of £149.

And, remember, this deal comes with a 30-day, money-back guarantee – so you’re not really committing to anything today.

If that sounds good…

Hit the link below this video and fill out your details to immediately unlock everything I’ve just promised you…

It’s decision time

Look, I’ve done my part to showcase just how big this opportunity is today…

Now it’s up to you to decide what you want to do…

If any of what I’ve shared with you today has piqued your interest…

I recommend you ACT NOW.

Take advantage of the money-back guarantee…

And download your copy of my Britannia Chip briefing.

This really could be THE BEST British stock opportunity ever…

And it’s currently “unknown” by the mainstream.

Just like Nvidia when I tipped it to my readers 13 years ago.

To get immediate access to my Britannia Chip briefing…

And everything else I’ve promised you today…

At a MASSIVE discount…

Click on the button below.

Click this button to get started.You’ll land on a secure order form page where you can fill out your details.

Thanks for reading.

And I’ll hopefully see you on the inside as a new member of Southbank Growth Advantage.

Regards,

Sam Volkering,

Editor, Southbank Growth Advantage

5-year performance figures for mentioned stocks (Source: MorningStar)

Archer Materials (AXE): 2019 93.75% | 2020 235.48% | 2021 123.08% | 2022 -45.33% | 2023 -38.21%

Seeing Machines (SEE): 2019 18.10% | 2020 39.11% | 2021 51.59% | 2022 -41.20% | 2023 -12.20%

Brainchip Holdings (BRN): 2019 -51.75% | 2020 814.89% | 2021 58.14% | 2022 9.56% | 2023 -77.18%

Intel (INTC): 2019 30.22% | 2020 -14.55% | 2021 6.16% | 2022 -45.84% | 2023 92.92%

IBM: 2019 -14.30% | 2020 0.08% | 2021 -0.69% | 2022 5.01% | 2023 5.57%

BT Group (BT): 2019 -12.71% | 2020 -31.28% | 2021 29.95% | 2022 -29.37% | 2023 17.18%

Alphabet Inc (GOOGL): 2019 28.18% | 2020 30.85% | 2021 65.30% | 2022 -39.09% | 2023 58.32%

US Steel Corp (X): 2019 -57.79% | 2020 -7.07% | 2021 126.75% | 2022 -3.96% | 2023 29.90%

Important Risk Warning

Advice in Southbank Growth Advantage (previous name: Small Cap Investigator) does not constitute a personal recommendation. Any advice should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get back less that you paid. This makes them riskier than other investments. Small companies may not pay a dividend.

Overseas shares – Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Dividends from overseas companies may be taxed at source in the country of issue.

Taxation - Profits from share dealing are a form of capital gain and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future.

Editors: Sam Volkering and James Allen. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure, privacy policy and terms and conditions can be found at, www.southbankresearch.com.

Southbank Growth Advantage is issued by Southbank Investment Research Ltd. Registered in England and Wales No 9539630. VAT No GB629 7287 94. Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Contact Us: To contact customer services, please call us on 0203 966 4580, Monday to Friday, 10am - 5pm Southbank Investment Research Ltd is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Ltd.

Sources:

1 Barron’s - Intel Could Be Investor in Chip Designer's Blockbuster IPO – 13 June 2023

2 Goldman Sachs - A skeptical look at AI investment – 16 July 2024

3 The Verge - How the Company conquered the chip market and survived the chip shortage, with CEO Rene Haas – 27 September 2022

4 by Babbage - The Everything Blueprint– 16 July 2023

5 James Ashton – Homepage

6 The Economist - Why everyone wants this Company– 23 June 2022

7 University of Bristol - Ground-breaking moment for science – 13 May 2024

8 Magzter - Inside the unknown tech giant powering Apple's rise – 28 August 2023

9 The Guardian - Britain's most successful tech company you've never heard of – 29 November 2015

10 BBC News - We can do it by ourselves – 9 February 2022

11 Firstpost - Softbank completes its acquisition for $32 billion; Company to be delisted from LSE today – 6 September 2016

12 NVIDIA - NVIDIA Blackwell Platform Arrives to Power a New Era of Computing

13 Reuters - SoftBank dumps sale over regulatory hurdles, to IPO instead – 8 February 2022

14 Market Chameleon - Earnings Dates, Upcoming and Historical

15 MacroTrends - Super Micro Computer - 17 Year Stock Price History

16 Koyfin – ASML Holdings Performance

17 Koyfin – Applied Materials Performance

18 Koyfin - Taiwan Semiconductor Manufacturing Company Performance

19 Koyfin – Advanced Micro Devices Performance

20 Yahoo Finance – NVIDIA

21 Koyfin – NVIDIA Performance

22 The Washington Post - Big Tech is spending billions on AI. Some on Wall Street see a bubble – 24 July 2024

23 United States Securities and Exchange Commission – Form 6-K

24 SEC – Share Holder Letter 2024

25 Company Q4 Results Presentation

26 Long Port App - Goldman Sachs earnings preview: Bullish on AMD and Company, bearish on Intel – 30 July 2024

27 NVIDIA – Grace Blackwell Superchip

28 The Indian Express - Why the B200 Blackwell chip will consolidate Nvidia’s stranglehold over the AI market – 20 March 2024

29 Apple - Introducing Apple Intelligence for iPhone, iPad, and Mac – 10 June 2024

30 Reuters - Apple inks new long-term deal with Company for chip technology, according to filing – 5 September 2023

31 Microsoft - Introducing Copilot+ PCs – 20 May 2024

32 Windows Central - The Great PC Reset: AI and Company herald in a golden era of mobile computing – 20 May 2024

33 The Verge - Google’s new Company-based CPU will challenge Microsoft and Amazon in the AI race - 9 April 2024

34 Techradar - AMD teams up with Company to unveil AI chip family – 21 April 2024

35 Analytics India Mag - The AI Systems and Training Models of Tesla, Google’s Waymo – 15 December 2022

36 LinkedIn - Automotive Artificial Intelligence (AI) Market Size, Growth, Report By 2033 – 19 April 2024

37 Raspberry Pi - Buy a Raspberry Pi 5

38 Nasdaq - With Tesla Optimus and FigureAI, Big Tech Is Betting Big on AI 2.0. Here’s How You Can Invest in the Next AI Boom – 9 March 2024

39 Emeritus - What is AI Singularity and How Far are We from It? – 20 March 2024

40 Counter Point Research - GenAI – The Next Big Thing in Smartphones – 10 May 2024

41 SkyQuest - Mobile Artificial Intelligence (AI) Market Size | Report Analysis 2031 – June 2024

42 Financial Times – Company searches for growth beyond smartphones – 23 August 2023

43 Samsung - Galaxy AI | Mobile AI on Galaxy S24 & S24+

44 Android - Discover a new world of Android with Google AI

45 Copilot - Download the Microsoft Copilot AI Mobile App

46 The Verge - Nvidia and AMD plan to launch Company PC chips as soon as 2025, Reuters reports – 23 October 2023

47 Dell - Dell Laptops with Snapdragon X Series Next-Gen AI PC Technology

48 HP - HP Unlocks New Era of AI Experiences Powering Work and Creation – 20 May 2024

49 The Register - CEO aims to conquer half the Windows world in 5 years – 3 June 2024

50 Tom’s Hardware - SoCs to Grab 30% of PC Market by 2026: Analyst – 18 November 2022

51 Data Center Dynamics - Microsoft announces in-house CPU and AI accelerator chips, custom racks – 15 November 2023

52 Morningstar - IPO: Dominant but Very Expensive – 12 September 2023

53 University of Bristol - Unprecedented £225m investment to create UK's most powerful supercomputer – 1 November 2023

54 Cryptopolitan - Nvidia's Isambard-AI to Transform UK's Computational Power with £225M Investment – 2 November 2023

55 Gov.uk - Bristol set to host UK’s most powerful supercomputer to turbocharge AI innovation – 13 September 2023

56 University of Cambridge – The rise of dawn – 23 February 2024

57 Science Business - EU puts its weight behind home-grown processor for its new €273M supercomputer – 11 January 2024

58 Wikipedia – Fagaku (supercomputer)

59 New York Mag - Nvidia Gets Bigger As ‘Most Important Stock on Planet Earth’ – 21 February 2024

60 Fast Company - Nvidia's record 265% revenue growth is moving the whole stock market – 21 February 2024

61 Fortune - Nvidia will win the race to a $4 trillion market cap, experts say – 7 July 2024

62 The Telegraph - Nvidia now worth more than entire FTSE 100 – 31 May 2024

63 Koyfin – Intel Corp Performance

64 Koyfin – IBM Performance

65 Koyfin – BT Group Performance

66 Koyfin – Alphabet Inc Performance

67 Koyfin – US Steel Performance

68 The Economist - Could AMD break Nvidia’s chokehold on chips? – 31 January 2024

69 CNBC - Nvidia dominates the AI chip market, but there's rising competition – 2 June 2024

70 Yahoo Finance - Nvidia's rivals are circling, but they're still years from catching up – 22 January 2024

71 Capturing Cambridge - 110 Fulbourn Road, Acorn Computers

72 Ars Technica – History of Company

73 Jordan News – A brief history of the world’s greatest invention – 5 March 2022

74 Computing History – First Company processor powered up – 26 April 1985

75 Wikipedia - BBC Micro Front Restored

76 Wikipedia – Acorn Archimedes

77 Wikipedia – Nokia 3310

78 Company – Building the Future of Computing

79 Company Newsroom - Partners Have Shipped 200 billion Chips – 18 October 2021

80 Statista – Company technology market shares 2022

81 Financial Times – Chip designer targets car market for growth

82 Wing Venture Capital - The architect of innovation: Lessons from Company's recent IPO – 13 December 2023

83 Reuters - Britain is 'broke and broken', new government declares – 29 July 2024

84 Wikipedia – Silicon Fen

85 University of Cambridge – Cambridge innovation in numbers

86 WIRED - How the ‘Cambridge Phenomenon’ continues to drive innovation

87 Koyfin – AstraZeneca Performance

88 London Stock Exchange – FTSE 100 Constituents

89 Tracxn – Featurespace Company Profile – 4 August 2024

90 Tracxn – Cydar Medical Company Profile – 2 August 2024

91 Tracxn – Evonetix Company Profile – 4 August 2024

92 Investopedia - British Chip Designer Debuts on Nasdaq in Biggest US IPO Since 2021 – 14 September 2023

93 Yahoo Finance – Company Income Statement

94 Reuters – Company plans to launch AI chips in 2025, Nikkei reports – 12 May 2024

95 Statista – Global AI market size 2030

96 Tech Monitor – Company planning to launch AI chips next year amid huge global demand – 13 May 2024

97 CNBC – Company to launch AI chips by 2025 amid explosive demand – 12 May 2024

98 The New York Times - SoftBank Needs a Hit, and It’s Betting on a Company – 12 September 2023

99 Mordor Intelligence - PC Industry - Size, Growth, Analysis & Trends

100 EE Times - Broadcom takes two Company architecture licenses – 1 September 2013

101 The Verge - Qualcomm’s Snapdragon X CPUs make Windows on Company a viable platform – 5 July 2024

102 Reuters - Exclusive: Company aims to capture 50% of PC market in five years, CEO says – 3 June 2024

103 MoneyHelper - Financial adviser fees

104 Company Forecast