What you can see behind me is MONEY.

A three-trillion-dollar wave of money, FLOODING into the energy sector right now.

Oil, gas, solar, wind, hydrogen, you name it.

This tidal wave of money is crashing into the market at an average rate of almost six million dollars per minute.

And today, I’m going to show you how you could direct some of that money into YOUR pocket.

Across the world right now, ports are being built…

Pipelines are being laid…

Battery metals are being mined…

And new oil wells are being drilled…

This is creating a generational boom in the energy market.

In 2024, energy companies – from multiple corners of the market – had yet another blockbuster year.

Whether that’s power producer Vistra Corp ripping 277% over the last year …

Innovative Wave Harvester – Eco Wave Power Global – rising 429%...

Or Nuclear Microreactor Company – Nuscale – Soaring 624%...

The energy industry has continued to deliver blockbuster return after blockbuster return.

There’s no doubt about it in my mind:

This is the biggest opportunity on the stock market today.

For the past decade, driven by the Paris Climate Agreement's goal to limit global warming to 1.5°C, governments have poured trillions into clean energy initiatives…

Triggering the largest wave of renewable investment in history.

Then Russia invaded Ukraine, forcing a complete rethink of energy security.

Western nations responded with unprecedented investment in traditional energy.

Donald Trump, vowing to ‘unleash American energy,’ has doubled down on domestic oil and gas production.

His administration is now fast-tracking drilling permits, rolling back regulations, and reviving the ‘drill baby drill’ mantra…

Signalling a major boost for US fossil fuel investment.

Meanwhile, oil majors, reeling off the back of windfall profits are rerouting their capital back into the market.

This has created what I believe is the greatest opportunity in energy investing history.

Because instead of having to choose to invest between clean energy or fossil fuels…

We now live in what I call a two-pronged system.

One in which massive investment is pouring into both the energy sources that power our world today AND the technologies that will power our future.

The result?

On the one hand, fossil fuel investment is expected to have hit a multi-year high of more than $1 trillion in 2024.

And on the other… CLEAN energy is in the midst of receiving a $2 trillion influx of investment capital… it’s biggest ever… AT THE EXACT SAME TIME.

From where I’m standing, this massive injection of cash is about to send a handful of energy stocks vertical.

And if you’re on the hunt for steep, fast returns in 2025, I believe investing in high-potential energy stocks should be your number one priority.

Because we are only at the beginning of what could be an EPIC run-up in prices.

So the simple question is:

Which energy stocks should you be looking to buy today?

Well, stick with me. Because I’m going to share how you can get the key details on my top THREE energy “Power Plays”.

I believe each of these stocks has the potential to make a big move in the next 90-120 days. (Forecasts are not a reliable indicator of future results.)

My aim is to help you ride those moves right to their peak.

But why should you even care about what I think?

Or which stocks I’m picking in this erupting sector?

Well, I’ve been immersed in the energy sector for more than 15 years, in New York and back home here, in London.

I know some of the most influential people in the industry.

And, over the last five years, I have directed my subscribers to some very impressive energy stock returns.

In 2019, I was banging the table about hydrogen stocks – before my number one company in the space went vertical.

In 2020, I called the bottom in the clean energy market four days before the sector embarked on a huge bull run… at that time, the stocks I recommended made me the number one stock picker in the history of our business.

And just last year, I called the boom in Nuclear – with my subscribers currently sitting on a 126% return on a nuclear reactor company.

Of course, I don’t get every call right. That would be impossible. I’ve made my fair share of losses.

But let me tell you: in terms of raw profit potential…

Nothing compares to what’s happening in the energy market right this second.

In a moment, I’ll tell you about the next three big contenders.

But to get a sense of what I’m talking about, just look at some of the moves firing out of this market now...

I’m talking about price surges like 245% in just the last SIX months on biofuels manufacturer GEVO Inc.

Past performance is not a reliable indicator of future results.

GEVO Inc: 2020 +83.98% | 2021 +0.71% | 2022 -55.61% | 2023 -38.95% | 2024 +80.17%

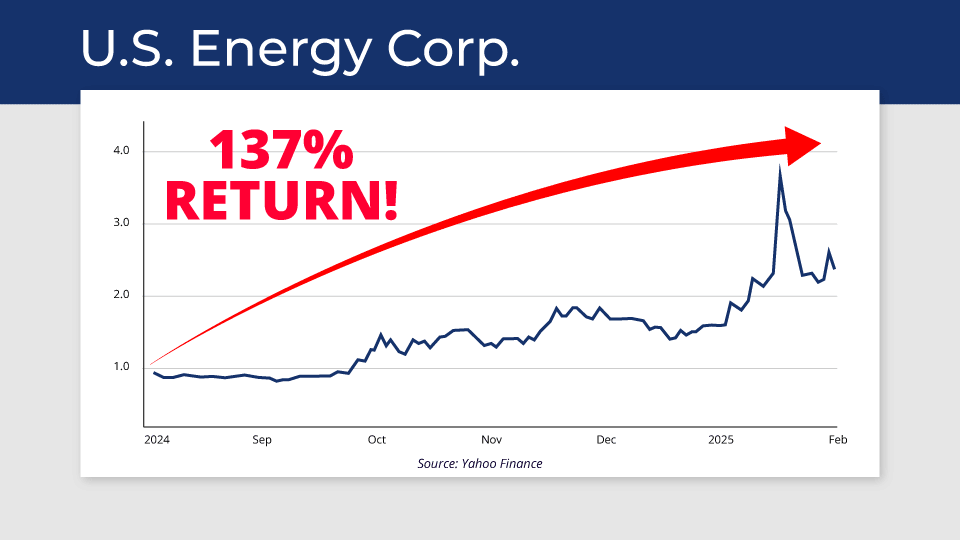

137% on Oil and Gas explorer U.S. Energy Corp…

Past performance is not a reliable indicator of future results.

Five-year performance figures for US Energy Corp: 2020 +21.85% | 2021 -11.14% | 2022 -27.6% | 2023 -54.56% | 2024 +62.98%

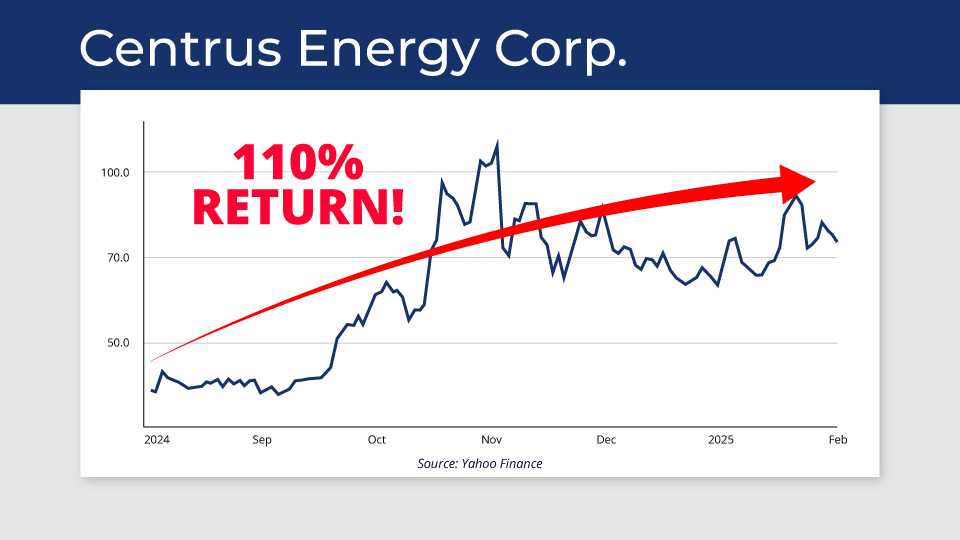

Or 110% on nuclear fuel supplier Centrus Energy corp.

Past performance is not a reliable indicator of future results.

Five-year performance figures for Centrus Energy: 2020 +236.19% | 2021 +115.78% | 2022 -34.92% | 2023 +67.52% | 2024 +22.42%

See that?

Of course, not every energy play will have performed like this, but looking at these examples…

This is incredible stuff.

If you can stomach the volatility and risk that comes along with trading this market…

It IS possible to make a very meaningful and positive impact on your financial life.

And I’m not the only who thinks so…

Right now, some of the world’s brightest financial minds are moving into energy stocks.

Warren Buffett has bought up $15 billion worth of oil giant Occidental Petroleum – now owning 30% of the entire company.

Carlos Slim, formerly the richest man in the world, has taken a $150 million position in petroleum refiner, PBF Energy.

And Cathie Wood, the CEO of ARK Invest who famously bet on Tesla in 2018 when it was trading under a split adjusted $25, has taken a large position in uranium producer, Cameco .

The smart money is positioning itself to potentially profit from something BIG brewing in this market.

And today you can position your money, too.

But if you want to put yourself in the best position to make the biggest possible returns, there’s no time to waste.

This is your chance to position yourself at the ground floor of this record-breaking inflow of capital.

And that time is NOW.

Now I’m going to make it incredibly simple for you to take this opportunity.

And claim YOUR stake in this red-hot market.

If you want to give yourself a chance to drastically improve your finances in 2025…

All you have to do is sit right there.

In just a moment, I’m going to run you through how to get details of my THREE top energy “Power Plays’”

But first, I want to leave you in ZERO doubt that the next 12 months could be even more lucrative for smart energy investors.

Because I believe the same forces that triggered the massive returns I just showed you are coming back EVEN stronger.

And to position yourself for a series of potential quickfire profits, you need to do just one thing:

“Follow the money flow”

It’s simple really.

Wait for the big money to start to move…

Then follow it in.

Doing just that has made me and my readers a hell of a lot of money over the years.

Let me show you what I mean…

In 2020, the pandemic led central banks to unleash the biggest wave of money printing the world had ever seen.

It spurred governments into a wave of stimulus packages, in which the like of Europe’s €250 billion Green Deal…

And Japan’s $157 billion green stimulus plan…

Pumped hundreds of billions into renewable energy companies.

And triggered a powerful clean energy bull market.

And it was this understanding of money flow that allowed me to lead my subscribers to some huge returns in the process.

One such subscriber was KT – who wrote in to tell me:

“Even though, as a pensioner, I have been careful not to risk too much money on your recommendations, I am currently £25,000 in paper profit, which clearly will make a big difference going forwards. So many thanks and congratulations to you.”

Another was AG, who said:

“All in all I've turned my spreading account from £15k to £130k - mainly on the back of your service.”

And then there was TP who told me they “can’t quite believe their luck” in finding my research.

Of course past performance isn’t indicative of future results.

Two years later in 2022, the investment winds begin to change.

This time… diverting capital BACK to the world of traditional energy.

As a result, energy prices sky-rocket.

Oil and gas majors reap some of the biggest profits in their history.

And once again, I was there to intercept that move – calling the gyrations of European natural gas spot on…

And that brings us to the present day…

Where you have an opportunity to take advantage of what Big Four consulting firm KPMG say are…

“massive investment opportunities emerging across multiple sectors.”

I’m talking about the chance to capitalise on over $3 trillion flooding into the entire energy investing spectrum.

You see, while renewables build out is STILL moving at a rapid pace…

Traditional energy is experiencing a renaissance as countries rush to secure their energy systems – in the here and now – away from that of hostile actors.

And that has meant that money is piling in to the market from every angle you can imagine.

Oil… coal… gas… solar… hydrogen… you name it.

It’s flooding in at a rapid clip.

And it’s being channelled in from the three KEY pillars of our economy.

First…

Governments are ALL IN.

There’s something I want you to know…

I love politicians.

Before you close out of this window, let me explain…

I don’t personally admire many world leaders. The vast majority, I’d never vote for.

I love them because they are about to flood the energy sector with hundreds of billions of dollars… and make all of us a lot of money, too – if we play it right.

I’ll start with government subsidies. In 2025, governments around the world are likely to flood the energy industry with hundreds of billions of dollars in subsidies. And these subsidies will make their way into oil, gas and renewable companies cash accounts.

Here in Britain, subsidies for renewable energies has been projected to rise to £2.4 billion – the largest sum ever – in 2024.

What’s more, it spent an estimated £44 billon to reduce the impact of increases in energy bills from 2022 to 2024.

Over in Italy it’s €35 billion on subsidies for renewables…

In France it’s €4 billion…

And then there’s Germany. It had to pay out $20 billion in renewable subsidies in 2024 alone.

But this government support is really just the appetiser.

The main course is the multi-billon-dollar wave of stimulus packages heading into clean energy this year.

First up, the German government is just beginning to enact the first phase of its €177 BILLION “climate and transformation” plan.

The EU itself is getting in the game, too. It’s in the midst of implementing its EU Green Deal – an initiative that will pump hundreds of billions of euros into renewables.

Then you’ve got Japan. According to research firm Wood Mackenzie, Japan will have invested more than $100 billion into wind and solar generation over the next five years.

Australia is also jacking up its renewable spending. It’s committed $20 billion to clean energy industries.

And then to top it all off, you’ve got the “Big Kahuna”…

China.

In 2025, the Chinese government plans to unleash $137 BILLION

into renewable energy.

It’s China’s biggest fiscal stimulus package EVER. With a reported $137 billion earmarked for green energy, electric vehicles, and other advanced manufacturing.

And believe it or not, that’s just the starter.

You see, the insane pace of development of renewable energy technologies in recent time now means the existing energy grid is no longer fit for purpose.

It cannot deal with the peaks and troughs in energy generation that the likes of solar and wind produce.

And that has meant China has just embarked on an $800 BILLION spending spree over the next 6 years to make its electricity grid fit for purpose.

You heard that right…

$800 BILLION.

If you’ve been keeping score, that already tots up to over 1.4 trillion in pounds sterling flooding into the energy markets in the coming months and years.

The record-breaking capital investment is creating opportunity everywhere.

And governments are just the start of the money flow…

The biggest financial institutions on the planet are ALL IN on energy.

Right now, investment bankers across Wall Street… Canary Wharf… and The City are tripping over themselves to funnel investment capital into the energy markets.

First, there’s BlackRock…

The world’s largest asset manager sees the direction of travel into energy. It’s in the middle of deploying capital from its $1.35 billion dollar energy fund. With hundreds of millions having made its way into solar and energy storage projects.

Blackstone – the world’s largest alternative asset manager – is diving into the market. It’s raised $3.24 billion for a new energy fund. It’s expected to be put to work across a slew of sectors, including: renewable electricity generation, home efficiency, and oil and gas.

Brookfield Asset Management – owner of much of the real estate in Canary Wharf – announced earlier this year that it’s raised $10 billion for its energy transition fund. It’s just started to put that capital to work into UK solar, renewable natural gas, carbon capture and a host of other projects.

Then you’ve got huge asset managers like Carlyle Group… last year it announced a $945 million investment in oil and gas projects in Italy, Egypt and Croatia.

Quantum Energy Partners, which raised over $10 billion to pile in to oil, gas, and renewable energy.

KKR, and Energy Capital Partners, which have announced a $50 billion partnership to support AI data centres and power generation.

Macquarie Asset Management, who’s ploughing $9 billion into the energy transition.

Real kicker: remember that government money I just mentioned? All $800 billion worth of it?

Well, the International Renewable Energy Agency (IRENA) estimates that for every dollar of capital the public sector invests into the market…

The private sector will not only match it…

But leverage it up by a factor of 3:1…

And turn that $800 billion… into $2.4 TRILLION!

This is a truly mind-boggling torrent of capital hitting the energy market over the coming months and years.

As a result, I think we’re about to see price surges the likes of which will stun the financial world.

In a moment, I’ll show you how to get in on the action… starting with my top THREE energy “Power Plays”.

If I’m right, EACH of these plays is approaching a MAJOR “lift-off point” – poised for a hard and fast rise over the next 120 days (Forecasts are not a reliable indicator of future results.).

But first, I want to show you the final piece to the puzzle… another enormous source of capital that’s about to splash land into the energy market:

I’m talking about…

Big Tech is ALL IN.

You’ve seen the headlines.

Whether it’s an AI generated song, mimicking the vocals of popular artists Drake and The Weeknd, going viral…

A digital art competition not being won by a human… but by an AI…

Or Deepfake videos of world leaders looking so real that even experts can’t make out their inauthenticity…

The sheer pace and scale of AI’s development is mind bending.

Case in point: global AI funding hit a record $100 billion in 2024. Almost DOUBLE that of 2023.

In fact, ChatGPT’s creator, OpenAI, expects to increase its user base from 250 million weekly active users, to 1 BILLION people in 2025 alone.

But even despite this insane growth…

There is a huge elephant in the room…

A problem which the world’s leading tech companies are scrambling to solve to fully integrate AI into their own infrastructure, systems, and products.

That is, AI’s insatiable demand for energy.

As you may know, the computing power needed to run AI is incredibly energy intensive.

In fact, according to the New York Times, by 2027, AI servers are predicted to consume as much energy as countries like Argentina, the Netherlands and Sweden.

And what’s more, that’s when AI adoption is, according to industry insiders, at just 1% of where it will be in the next two or three years.

The leaders of the AI revolution are already corroborating this.

Sam Altman, CEO of OpenAI, puts it bluntly: "If you really want to make the biggest, most capable super intelligent system you can, you need high amounts of energy."

Arijit Sengupta, founder of Aible, a cloud based AI tool, is even more direct: "The world is actually headed for a really bad energy crisis because of AI unless we fix a few things."

And Elon Musk predicts that by 2045 the power demand in the US will have tripled from current levels – largely driven by AI’s needs.

Bottom line: energy is now a strategic asset for the world’s largest corporations.

They simply cannot afford their energy to be held hostage by other companies… their own governments… or other nation states.

And that has led these mega corporations to take matters into their own hands.

They’re securing their own energy supplies – by generating their own electricity.

That’s right.

They’re building their own solar panels.

Erecting their own windfarms....

And even drilling their own natural gas.

And spending billions in order to do so.

Take Microsoft for example. It’s partnered with constellation energy to revive The US’s 3 mile Island nuclear plant. It’s investing a total of $1.6 billion to restore the facility.

Amazon has acquired a stake in SMR developer X energy. It’s signed a $650 million deal to purchase electricity directly from a nuclear power station.

Then you’ve got Elon Musk’s X.Ai. It’s constructing a massive supercomputer facility, known as “Colossus,” in Memphis, Tennessee.

To meet this supercomputer’s insane computational energy demands, its installed nearly 20 natural gas turbines – capable of generating 100 megawatts… enough to power 100,000 homes.

Google is investing in one of the largest solar projects in the US. In fact, Google calls it the largest electricity purchase ever made. It plans to spend $16 billion throughout 2040 purchasing clean energy.

Apple has built solar farms in California and Nevada. And it’s received regulatory approval to construct a landfill gas energy plant to generate electricity from methane omissions.

Okay, there’s a lot to process here and I don’t want you to miss a thing. So, let’s keep it very simple and re-cap:

Trillions of dollars in new money flow is expected to hit the market this year. And it’s coming from THREE separate directions:

- Every major government on the planet has made this restructuring of the global energy market a major priority. And they’re fast-tracking billions of dollars into the market to make it happen.

- Tech companies are rerouting their insane profits into their NUMBER ONE strategic asset right now – ENERGY.

- The biggest investment firms on the planet know an opportunity when they see one. And they are steering their capital into the market NOW in order to take advantage.

This is the perfect hunting ground for hard and fast returns in 2025. In my mind, that’s beyond all doubt. And if you’re still watching, you probably see it too.

Now, it’s important to say that this opportunity is not without risk.

A rising tide does not lift all boats evenly.

As this capital floods into the market I expect there to be winners… BIG winners… and losers, too. This is for your high risk capital – not for money that you are relying on for other things. As with all investing, you should only ever invest money that you can afford to lose.

I expect big money to flow IN and OUT of multitude of sectors over the coming years.

It’s gonna be volatile.

And if you can’t stomach that volatility, or can’t accept that there are no guarantees when it comes to investing, this won’t be for you.

But if you can and you want to turn what will look like chaos to most people…

Into not just order…

But serious financial opportunity…

GREAT!

You are in the perfect place.

Over the last five years, followers of my various services have sent me hundreds of messages. Messages telling me how my work has made them richer – both financially and intellectually.

Messages from people like Robert, who said his “portfolio doubled in a year when the FTSE went down 10%”…

PF, who said that they had more than “£300,000 of realised and unrealised profits”…

And AG, who turned “£15,000 into more than £130,000”, he says, “mainly on the back of my service.”

*Past performance is not a reliable indicator of future results.

On top of that, I have a proven track-record of anticipating the major shifts in the traditional energy market before they happened.

I predicted a western conflict with Russia – three years before tanks rolled into Ukraine…

I predicted that Putin would hold Europe to ransom via its natural gas pipelines… again… a staggering THREE years before it actually happened.

And in 2022, when every man and his dog was predicting European natural gas would continue on its upward trajectory, I was saying the opposite.

I said that the bubble was about to pop.

And that the price of natural gas would soon plunge.

That’s exactly what it did. Over the following months, it fell from €160 to under €50 today.

Source: Koyfin

Past performance is not a reliable indicator of future results.

So how did I get these calls right?

And how did I find the right investments at the right time for my subscribers?

Well, I don’t get it right every time. That would be impossible.

Frankly, it’s a combination of bloody hard work and years of experience.

A combination of the 15 years of “boots on the ground” know-how which has given me an intimate understanding of the forces that drive energy markets…

The black book of network insiders that I’ve carefully cultivated along the way…

A “know everything” research ethic before I make any sort of recommendation…

And good-old fashioned fundamental analysis.

I can tell you, it’s this tool-kit that I will use to get you in on the hottest opportunities in the entire market.

See, the fact is, we’re seeing a global restructuring of the world energy order.

One of the biggest levers in the global economy is being shifted.

In my view, the trajectory of this market over the coming months – and beyond – is only going one way: UP.

Of course, that doesn’t mean all my picks will be winners. You need to be comfortable with the risks of trading a volatile market.

This market is the ideal hunting ground for stock pickers with the nous to trade it the right way. The choice to trade is always yours. I will give you the information you need in order to make that decision in line with your own risk appetite and strategy.

But enough talking about what my strategy could have made you…

I want to show you which energy stocks could be next to go on a hard and fast climb.

I’ve got THREE “Power Plays” lined up that I’m ready to pull the trigger on.

And I want YOU in on each of them, alongside me.

Energy “Power Play” One:

The Ultimate Pick and Shovel “Power Play”

In the opening minutes of this presentation, I revealed a staggering number: $3 TRILLION flooding into the energy market.

But I haven't told you the full story.

You see, Schroders reports, the total investment required to meet net-zero targets by 2050 will amount to $120,000,000,000,000.

One hundred and twenty trillion dollars.

It’s the largest investment anyone has ever made.

As Deirdre Cooper, who runs the Investec Global Environment Fund, puts it:

"Decarbonisation is the largest investment the world has ever had to make in peacetime."

Let that sink in for a moment.

The California Gold Rush, adjusted for inflation, saw about $300 billion in today's money. The dot-com boom? About $1 trillion.

We're witnessing something 120 times bigger.

And here's the thing about gold rushes – while thousands of prospectors fought over scraps of gold, the real fortunes were made by the shrewd businessmen who sold them the tools they needed. Men like Levi Strauss didn't dig for a single ounce of gold, yet built an empire that still stands today.

The same principle applies to this $120 trillion tsunami hitting the market right now…

Invest in the companies selling modern-day picks and shovels – the absolute essentials that EVERY player in this space desperately needs.

And I've found one company that's perfectly positioned to be the ultimate "pick and shovel" play of the energy gold rush...

So what exactly does it do?

Think of this company as the NVIDIA of the subsea energy sector. Just as NVIDIA's chips and technology are the backbone of the AI revolution, this UK company provides the critical subsea equipment and solutions that EVERY offshore energy project depends on – whether it's traditional oil and gas or cutting-edge offshore wind farms.

And the numbers tell the story. Their order backlog has exploded from £33 billion to £74 billion. That's not just growth – that's a company that can't keep up with demand.

What’s more, some of the smartest money managers in the world are piling in. Fidelity Management & Research has taken a massive £36.3 million position.

JPMorgan Asset Management isn't far behind with nearly £23 million invested.

And BlackRock Investment Management has committed £22.5 million of their clients' money.

When you see institutional investors of this calibre taking positions this size, it tells you one thing: they see something big coming.

That's why I believe this company needs to be in your portfolio right now. This company is perfectly positioned to ride this $120 trillion investment wave to its peak.

Which is why I’ve detailed everything you need to know about this company in a special report for you.

It’s called: “Three energy “Power Plays” to buy NOW”.

I want to get this report in your hands right away.

It contains the name, ticker symbol and buy-up-to instructions for this cracking little stock.

It also contains my full investment thesis explaining why it could be on the cusp of a big, fast price surge.

You’ll also get a full run-down of the risks. After all, this market is not without its risks. Just as there is with any market. Whether that’s gold, bitcoin or blue-chip stocks.

And the same advice always applies: only invest money you can afford to lose. And, specifically for this market, make sure you have the stomach for the volatility ahead.

The energy market has seen some wild swings over the past few years. Oil went from negative to within $10 of its all-time high in 2021. And natural gas has gyrated up and down.

For some investors that volatility is too much to handle. For others – like me – it is a colossal profit opportunity. Only you know your limits around risk. Only invest if you understand the risks and are comfortable with them.

The first energy “Power Play” flashing “BUY” for me is just ONE of the opportunities I want to get you in on.

So let me tell you about the next stock we’ve got lined up…

Energy “Power Play” Two:

Profiting From The Largest Infrastructure Project in History

Imagine yourself dressed in a fine wool suit, seated in the private carriage of a Great Western Railway train, the rhythmic clatter of the tracks beneath you as you sip a glass of the finest port…

It’s 1850; the railways are expanding across Britain and beyond, stitching together cities, ports, and industry. And, although you don’t know it yet, the very steel rails beneath your feet will soon transform the nation... and your financial life.

Whether it was the British Railway Boom...

The Suez Canal...

Or The London Underground.

History is littered with examples of ordinary people making fortunes off the back of infrastructure projects.

Today, we are on the cusp of seeing each of those projects being completely eclipsed... in terms of scale... investment capital... and its ability to improve your financial life.

You see, despite the 116,000 wind turbines that are being manufactured every year…

The 1.79 million Tesla’s that are rolling off the production line every year…

And the 1.5 BILLION solar panels being assembled every year…

The energy transition has a fatal flaw.

One that threatens to bring this entire revolution grinding to a halt.

So what is the flaw?

Our electrical grid – the vast network of power lines, transformers, and substations that deliver electricity to our homes and businesses – is completely unfit for purpose.

It’s like trying to run modern streaming services through telegraph wires.

This aging system was built for a simple, one-way flow of electricity: from large power plants to end users.

But today’s grid needs to handle a complex web of renewable energy flowing from thousands of different sources, manage the massive power demands of AI data centres, and support millions of electric vehicles plugging in at night.

The solution isn’t a patch job or quick fix. We need to completely rebuild our electrical grid from the ground up.

We’re talking about the largest infrastructure project in human history – one that will make the British Railway Boom look like a model train set in comparison.

Case in point, as the International Energy Agency reports, achieving net-zero emissions requires 80 million kilometres of new or refurbished transmission grids by 2040 – essentially rebuilding the entire global grid.

To put that into perspective, that’s enough power lines to travel to the moon and back over 104 times.

And the cost to build these grids?

Bloomberg gives it a price tag of $21.4 TRILLION.

In my special report, "Three Energy Power Plays to Buy NOW," I'll reveal the company that I believe is perfectly positioned to capture a massive slice of that $21.4 trillion pie.

With 40% market share, this company is the undisputed market leader in transmission grid cables.

And they're already securing their piece of the action. They just landed a multi million pound contract with the National Grid, with 26 more similar projects in the pipeline. But that's just the start. They've also secured a project in Germany worth billions.

But what’s really makes this a blockbuster opportunity in my opinion…

Is that their customers are literally begging to pay premium prices for their products.

Don't take my word for it. Here's what their CEO recently said:

"Customers are in a kind of panic mode. They realise that if [they don't] move faster than the market, their capacity will be booked by someone else."

And it gets better. He added:

"We can price… with more headroom price-wise than we used to have in the last 10 years."

Let me translate what that means for investors: This company has customers desperately competing for their products, willing to pay premium prices, in a market that's about to see trillions in investment.

It's the kind of setup investors dream about. And it’s why this a screaming buy for me.

And everything you need to know about it is in your special report: “Three energy “Power Plays” to buy NOW”.

I want to put its capacity to make you a rapid windfall in your hands today.

I’ll share my full investment research, and all the information you need to make an informed decision. And that includes a level at which to place a STOP on your trade, to limit the higher risks. I’ll walk you through how to do that.

Everything is in your report.

I want to get it into your hands today.

But – and forgive me for being frank – I simply can’t give it away to you in an open forum like this.

I have spent too much time researching these opportunities to make them available for free.

Instead, I’d like to go one better…

Seeing as you’ve read this far, I know you are ambitious and you want to take FULL advantage of this opportune market situation.

So, as well as getting you in on my three most urgent energy trades today…

I want to give you the opportunity to receive my buy and sell alerts on a longer-term basis.

That way, you’ll be part of my inner circle. You’ll get all of my exclusive research, market intelligence and a regular stream of “Power Plays” to take maximum possible advantage of the energy sector eruption.

To make that happen, I’m officially inviting you to take up a 30-day trial to my flagship investing advisory.

It’s called…

And you can try it out, under no financial obligation.

Some people will make a bloody fortune as the multi trillion-dollar wave of money hits the energy markets.

And if you take away just one thing today, make it this:

You could be one of them.

That’s why I’m extending you this invitation today.

To root out the biggest, most explosive opportunities across the energy markets.

To give you the BEST chance to make a series of profits.

I’m willing to send you this valuable report right away if you’d like to try out my monthly newsletter Southbank Growth Advantage for 30 days – under no obligation.

This is a way I can talk to you “behind closed doors” and exchange my valuable report privately.

There’s no pressure to continue beyond your trial. You are free to take a look around, download your urgent energy report and see the other opportunities in my exclusive Southbank Growth Advantage portfolio.

In Southbank Growth Advantage I search for the best, leading-edge growth opportunities worldwide.

I scan the pages of every technology magazine and website. I read every academic white paper I can get my hands on. I follow every company announcement in the sector. I travel hundreds, sometimes thousands, of miles to talk to the people in markets who matter. And I’ve got the numbers of some of the most connected people in the industry stored in my mobile phone.

I relish finding new, cutting-edge growth stocks.

The moment you join Southbank Growth Advantage, you will get immediate access to your urgent investing report: “Three energy “Power Plays” to buy NOW”.

Each of the plays inside could be about to embark on a serious run-up.

Your report will give you a full investment analysis of the three energy stocks I’ve told you about today… a careful assessment of the risks involved on each trade… and, importantly, exactly what you need to buy into them immediately.

On that note, let me tell you about your THIRD energy “Power Play”:

Energy “Power Play” Three:

This secret supplier could soon go VERTICAL

The third stock I have in my gunsights is a doozie.

In fact, at a market cap of less than $50 million, it is so small… so unique… and as a result, so capable of short-term price spikes…

That I must be careful what I reveal in a public forum. To do otherwise would risk blowing up the stock – and thus ruining the opportunity for all my paying subscribers.

But this is such a mouth-watering set-up, that I do want to walk you through the highlights….

Put simply, this company has devised a breakthrough technology to extract one of the most sought-after energy transition metals on the planet.

I'm talking about lithium.

You'll find it in every electric vehicle battery, every grid-scale energy storage system, every smartphone, laptop, and tablet. Without lithium, there is no energy transition. Full stop.

And according to the International Energy Agency, to reach our net zero goals, the world requires a 42-fold increase in lithium production.... More than any other mineral.

Until recently, there have only been two ways to get lithium: either strip-mining it from hard rock (which devastates the environment), or...

Pumping up mineral-rich groundwater into massive evaporation ponds that can take up to two years to produce usable lithium (while wasting millions of gallons of water in the process).

Well, the company I want to send your way has developed a solution that's not only vastly less taxing on the environment than traditional extraction methods…

It’s far cheaper. In fact, it’s 100-times more efficient than traditional methods.

Its technology is commercially proven, after running a pilot project for a number of years.

And this has led the company to ink a $1.5 million agreement with an “unnamed major operator” – a development that has me incredibly excited about this stock's potential over the next 120 days.

You see, I believe we're approaching a critical inflection point. When their next earnings release comes around, I expect them to announce something that changes everything for a company this size: profitability. And not just squeaking by - I'm talking about significant earnings.

For a tiny $50 million company sitting on proven technology in one of the hottest sectors on Earth, that kind of news could send the stock price absolutely vertical.

Everything you need to know – including the name, ticker symbol, risk profile and specific buy instructions – is in your special report:

“Three energy “Power Plays” to buy NOW”.

I’ll send you a link to download it as soon as you sign up to my service: Southbank Growth Advantage.

But that’s just the start of what you get when you join the service.

Every time I uncover a hot new growth stock I believe could make mouth-watering gains for my readers...

You’ll receive an easy-to-read guide with all the details and risks laid out for you to digest.

So, all you have to do is sit back, relax, read and then decide if you want to invest.

Just like the readers of my services:

“On a personal note, this is the first time I have felt enthusiastic about saving in over 15 years...

The service is wonderful, and in my opinion represents fantastic value for money.

I just wish I had learned about it all ten years ago!...

I would like to take this opportunity to say that the service you have provided has already changed my life.

Having read almost all of the literature available, I have found myself a different man.

I am excited by the world of finance, not intimidated by it...

Now everything has changed.

I am living my best life...

To put it simply, my brain works differently now because of the lessons you have taught me, and for that I will be eternally grateful.

Be assured, I have recommended you service to countless others...”

C.C., March 2021Of course...

Nobody can (or should) ever guarantee you that they’ll get it right every time.

Which is why I prefer to say...

I’m in the business of helping investors – arming them with information, insights and know-how.

And I won’t tell you what to do with your money... I’m NOT a financial advisor.

Only YOU know what you can afford to lose – and what risks you are willing to take.

The stocks I’ll introduce you to are NOT run of the mill stocks that your friends and “experts” on social media talk about...

Many of these companies exist outside the mainstream...

They’re pioneering the technology of TOMORROW...

But...

Investing in these revolutionary, small-cap stocks in the early stages means they’re more illiquid, risky and volatile than mid-cap or blue-chip stocks.

They also don’t pay a dividend and it can take months or years for them to take off – with no guarantees of success.

Plus, these smaller, less established companies tend to be more vulnerable to negative market trends and threats from competition.

Which is why I can’t promise things will always go our way.

So... I understand why you might like to do more research before you commit...

That’s why...

I’d like to offer you a 100% commitment-free, trial to Southbank Growth Advantage.

That’s right...

Claim your membership today.

And if you DON’T love it – you’ve 1 full month to tell us – and we'll refund you, in full, no questions asked.

That’s my iron-clad 30-day money back guarantee.

But first...

HERE’S EVERYTHING YOU’LL GET TODAY WHEN YOU START YOUR NO-OBLIGATION TRIAL...

Take up a trial membership today...

And you’ll receive hundreds of pounds worth of expert investment insights, research and recommendations.

Let’s break it down...

- “3 Energy “Power Plays” to buy NOW”

Your exclusive report showing you the 3 stocks every investor needs to know about as $3 trillion dollars crashes into the energy markets.

- FREE BONUS 1: “The Britannia Chip: The British AI Stock Set to Make 1,500% in the Next Five to 10 Years ”

Goldman Sachs is forecasting a staggering $1 trillion in spending as tech giants like Nvidia, Apple, and Microsoft race to dominate the AI industry.

But one little-known company on the outskirts of Cambridge holds the key to it all – designing a critical chip AI simply can’t function without. These tech titans are already paying £7 million a day to access its technology.

And with a major announcement expected at Nvidia’s big conference in March , it could soon be making headlines in the Financial Times… and smart investors rich.

- FREE BONUS 2: The Uranium Bull Market Playbook

Inside you’ll discover how a UK government policy could put Britain smack in the centre of a GLOBAL nuclear-power revolution… and send two London-listed uranium stocks flying…

- FREE BONUS 3: The Crypto Handbook by Sam Volkering

Sam Volkering, who first bought Bitcoin for $10, has helped over 80,000 investors learn about – and profit – from the rise of cryptocurrency. This is his ultimate guide to understanding and investing in digital assets, web3, the metaverse and more…

- At least 10 NEW Stock Recommendations each year

I’ll introduce you to exciting new stocks at the prime time to buy. On average I aim to recommend around 10 new stocks per year.

Plus update you on stocks I’ve previously recommended, so you don’t have to keep track of those either.

All you have to do is click, read and invest!

- More than 25 hot stock recommendations for you to gather the latest intel on

You'll have exclusive access to my full list of active stock recommendations in my buy list. Some are active buys, some are trading over their buy limits, some are on hold, but you’ll get access to all the info, insight and intel on every one of them.

Along with simple indicators telling you when to buy and when to hold.

And you don’t even have check in every day - I’ll email you when it’s time to sell out or take any action.

- 100’s of updates full of market analysis

You’ll also get every edition of Southbank Growth Advantage published so far, crammed with years of expert analysis.

All included – for free. Available for you to read at your leisure.

- 24/7 access to the Southbank Growth Advantage Online Portal

Every recommendation, every report, every alert... will be at your fingertips.

Whether you want some inspiring reading on for the morning train or something to busy your mind in the evenings.

The Southbank Growth Advantage portal is open all day every day.

- A Dedicated Customer Care Team

A dedicated team of friendly folks who you can call or email with any issues you may have.

If you’re a technophobe, there’s no shame in that, these friendly folks are happy to guide you.

And everything I’ve outlined above is yours to keep… FOREVER.

Which might seem a bit mad in light of testimonials like these:

Charles from Norwich took the time to say…

“The service may represent the best value for money that I have ever received. I just wish I had learned about it all ten years ago!

I am living my best life, and it is only because of the wealth of information that you and your team have provided.”

Gary from East Malling, wrote to us saying…

“The service is in a different league to everything I have seen previously, no hype, no hard sell, just quality information, foresight and assistance from the start.”

GaryDan from Manchester said…

“The right sector at the right time with the right people who can uncover the gems. Very informative, friendly with stellar gains that keep rolling in.”

DanWHAT DO YOU THINK A WHOLE YEAR OF THIS ELITE INVESTMENT SERVICE IS WORTH?

If we were to change what most professional firms do, for access to elite-level stock research…

It would price most people out.

That’s a fact.

You need a five-figure budget to invest in the majority of the places dotted around the City and Canary Wharf.

That’s one of the reasons why I ditched my career as a financial adviser.

You’ll be relieved to know you don’t need a five-figure sum to access my research and investment recommendations.

No, I believe in helping investors like you beat the City to the punch.

That’s why the normal price of Southbank Growth Advantage is just £149.

Frankly, that’s a bargain.

You’re getting details of my number one stock recommendation emailed to you every month…

And you’ve seen the kind of gains members have experienced with them…

The £149 price tag is a drop in the ocean compared to the value you’re getting.

But here’s the thing…

You don’t have to pay £149 today.

If you take me up on this special offer right now…

You can try a one-year membership to the Southbank Growth Advantage community – and claim your Three Energy ‘Power Plays’…

For just £79.

That’s right…

You can save yourself £70 if you act right now.

I reckon it will be one of the best financial moves you ever make.

You can see if I’m right, under no pressure, when you join Southbank Growth Advantage with a £70 off the normal rate…

Because you’re covered by my 30-day, 100% money-back guarantee.

100% money-back guarantee

Here’s how it works.

Take an entire month to read all my special reports, my newsletter back catalogue and video library.

See for yourself the money-making potential of my research into companies leveraging emerging trends to achieve high growth.

Once you’ve looked under the hood of Southbank Growth Advantage… if you decide this isn’t for you.

You can cancel anytime within the first 30 days and receive a full refund of your membership fee.

No stress. No hassles. And we’ll part as friends.

Plus, you can keep ALL of the special reports I’ve prepared for you as a thank you from me for giving this a try.

You have nothing to lose…

So, the way I see it, the next step is up to you.

This is a private paradise for adventurous investors, if you know how to play it…

Or… if you have an expert in your corner who does.

By acting now, you are just reserving the right to get the best deal possible.

If that sounds good to you…

And you want to make a strategic raid on this white-hot market… following my lead… for the chance to reap some monster returns over the next few months…

If you want to get your hands on my special report detailing THREE energy “Power Plays” to buy NOW…

And you want to take advantage of this very special deal I have organised for you…

Let’s get you in!

Click here to take up my offer, nowThe most important thing, though, is that you don’t sit too long on your decision.

Because what comes next in this market could be about to blow everything we’ve seen so far CLEAN out of the water.

We’re bang in the middle of a critical juncture in the history of energy markets.

Wind and solar farms are being laid. Battery metals are being mined. Oil wells are being drilled. And of course our grid is being rebuilt from the ground up.

A warp-speed rebuilding of the global energy eco-system is taking place.

A record-breaking THREE trillion dollars in investment capital is flooding INTO the market to make it happen.

I’m not going to sit by and watch as some people get flat-out rich off the back of it.

And nor should you.

This is an energy stock-picker’s paradise.

And an opportunity for YOU to experience one of the best investing periods of your entire career.

I have three stocks ready to send you NOW.

The way I see it you have THREE options.

Option 1: If you have absolutely no interest in making money from the energy markets…

Then maybe you don’t want to find out the name of my THREE energy “Power Plays”.

But if you do want to raid this exciting market for the chance to make huge, fast returns…

Then you have option 2: Do it yourself.

Frankly, I think the only way to do that is to immerse yourself in the energy market 24/7.

By that, I mean get a job at an energy reporting desk. Or work your way up at an energy supermajor.

Spend years building up your network of contacts… and your knowledge base… so that you understand how this market truly works.

If you’re willing to work hard… and sacrifice everything else… it is entirely possible to find the big winners.

But what if you could have all the hard graft research handed to you on a silver platter?

That’s where option 3 comes in:

You let me do the work for you.

For starters, I’ll send you the details of the three energy stocks I think you should buy immediately.

And, going forward, you’ll be getting more strategic energy trades, on a regular basis… alongside my deep research and market commentary.

There’s a great deal on the table for you.

And if you want it – act fast to grab the BIG introductory discount I have arranged for you:

Click here right now to start your trial to Southbank Growth Advantage…You’ll be taken to our secure order form, which takes just a few minutes to fill out. Then I can send you all the valuable research and opportunities I’ve just told you about.

Now, I’ve said it before and I’ll say it again.

The energy market is teeming with opportunity right now.

But I think the three trillion-dollar wave of capital crashing into it is going to kick the returns into even headier heights.

If you want to ride that wave to its peak…

Then why not join me NOW – when your special deal saves you a bundle and comes with a 30-day moneyback guarantee?

It’s your decision.

I hope you have enjoyed my Power Play presentation. Simply by reading you’ve done more than most. You have sought out and investigated an opportunity most people will never know about in any real detail.

You’ve taken a positive step forward to gain a knowledge edge.

But if you’re ready to take the NEXT step, I believe it could lead you to the most lucrative period of your financial life.

Put me to the test. Join me now and save hundreds of pounds, by clicking the button below.

Many thanks for your time and for reading today.

James Allen

Chief Energy Analyst, Southbank Investment Research

Important Risk Warning

Advice in Southbank Growth Advantage does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General – Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get back less that you paid. This makes them riskier than other investments.

Overseas investments - Some shares may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Editor: James Allen. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

Southbank Growth Advantage contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: Basement, 95 Southwark Street, London, SE1 0HX. Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.

© 2025 Southbank Investment Research Limited.

Five year performance figures for the Southbank Growth Advantage newsletter:

2020 +10.42% | 2021 +121.67% | 2022 -31.89% | 2023 +64.49% | 2024 -1.71%

Five year performance figures of companies with gains mentioned not included above:

Vistra Corp: 2020 -12.14% | 2021 +18.87% | 2022 +5.07% | 2023 +69.57% | 2024 +260.19%

Eco Wave Power Global: 2020 - 2021 unavailable | 2022 -30.95% | 2023 -58.34% | 2024 +628.47%

NuScale Power Corp (SMR): 2020-2022 unavailable| 2023 -67.93% | 2024

+668.32%

WFTI5200