Editors: Sam Volkering and James Allen. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure, privacy policy and terms and conditions can be found at, www.southbankresearch.com.

© 2024 Southbank Investment Research Ltd.

Sources:

1 A-Z Quotes - Top 25 Nuclear Power Quotes

2 Bloomberg - Generative AI to Become a $1.3 Trillion Market by 2032, Research Finds – 1 June 2023

3 TIME - Nuclear Power Is the Only Solution – 4 December 2023

4 Briefing - Max Altman Targets $200 Million in New Fund – September 2023

5 UNITED STATES SECURITIES AND EXCHANGE COMMISSION – Form 8-K AltC Acquisition Corp.

6 Investing.com - Sam Altman's Under-The-Radar SPAC Fuses AI Expertise with Nuclear Energy: Here Are the Others Involved – 24 March 2024

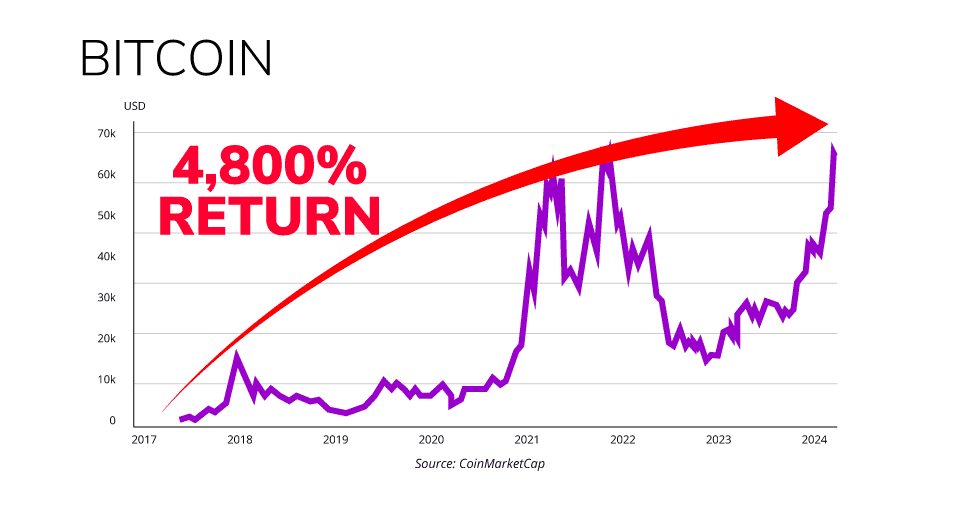

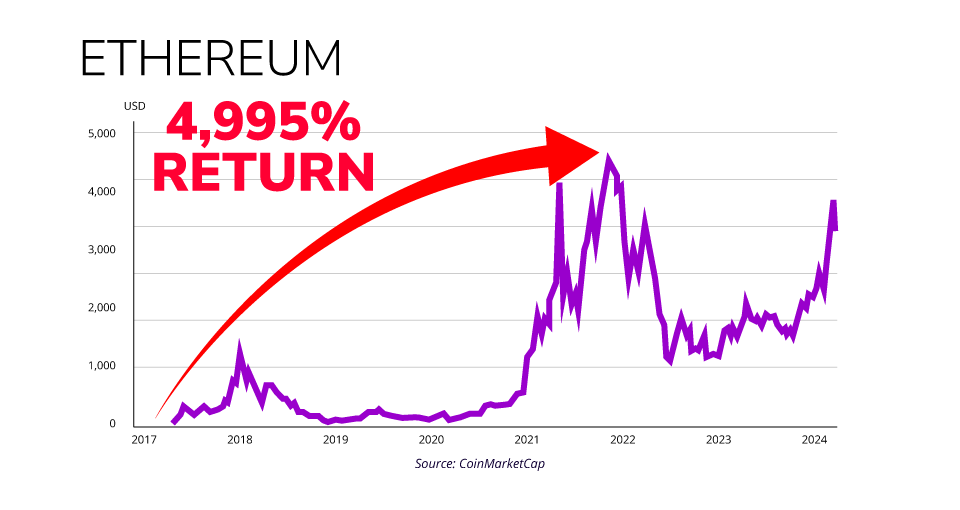

7 Southbank Investment Research – Crypto Profits Extreme Portfolio

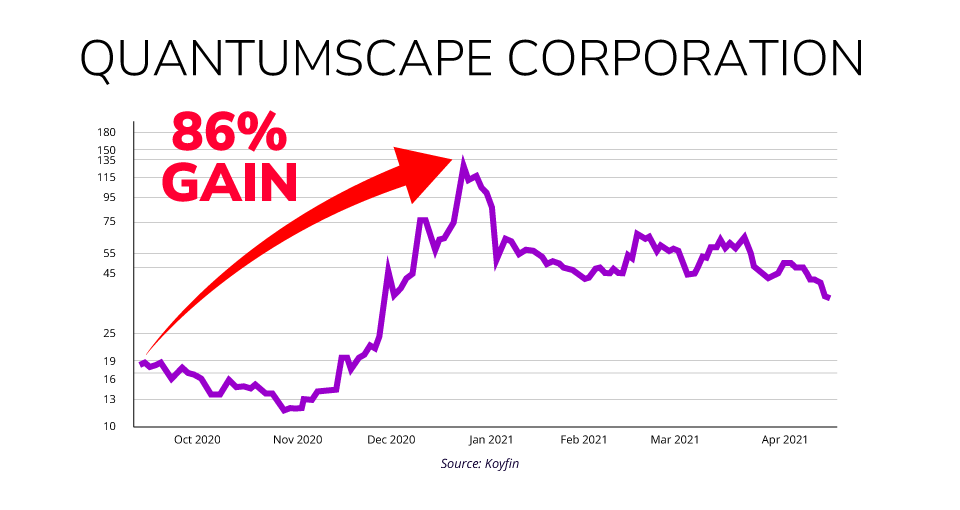

8 Southbank Investment Research – Revolutionary Trend Investor Portfolio

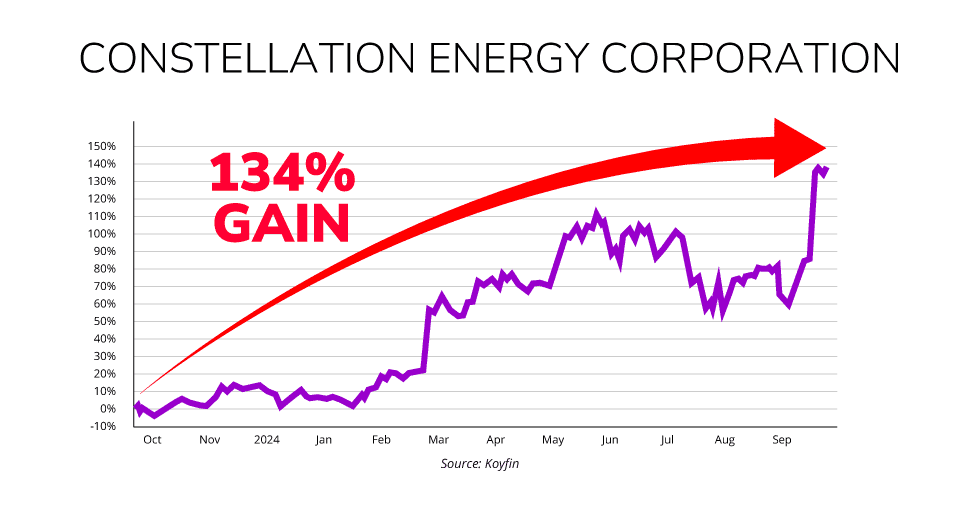

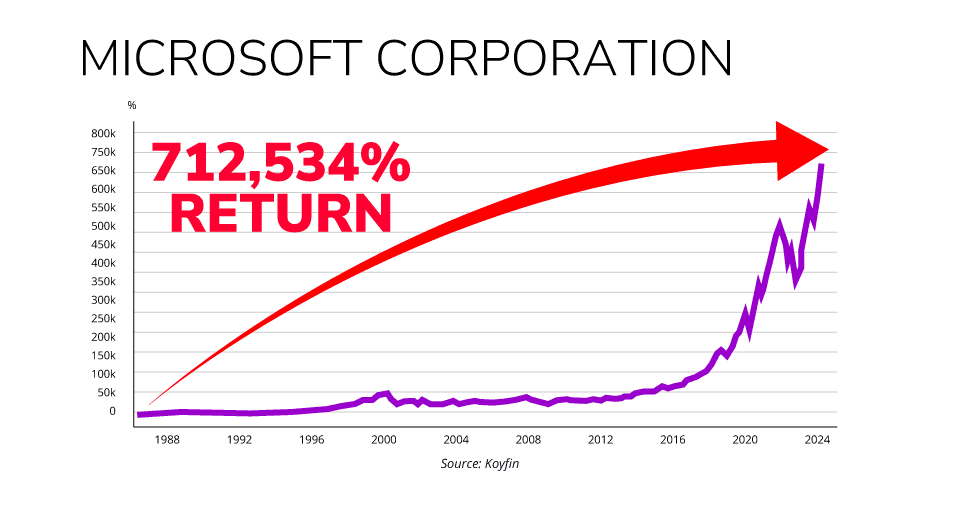

9 Koyfin – Microsoft Corporation

10 Wikipedia – Microsoft

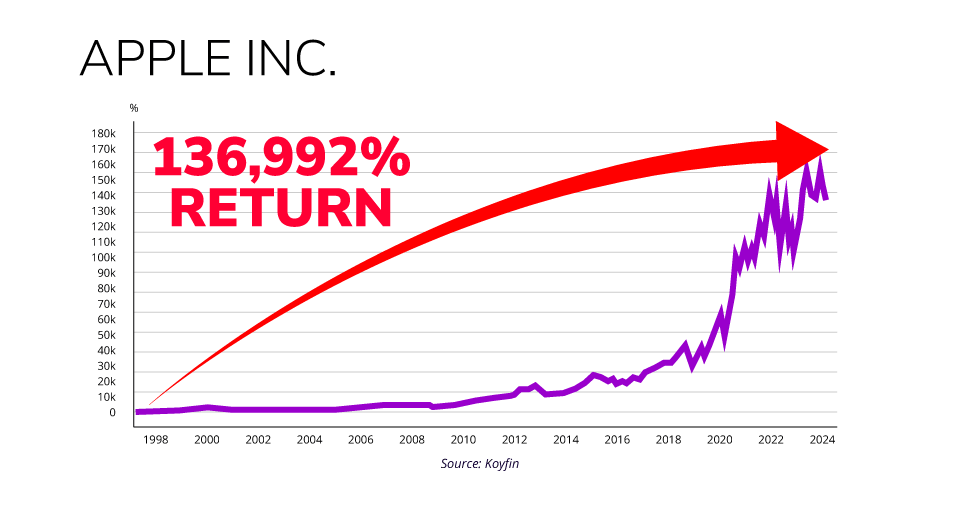

11 Koyfin – Apple Inc.

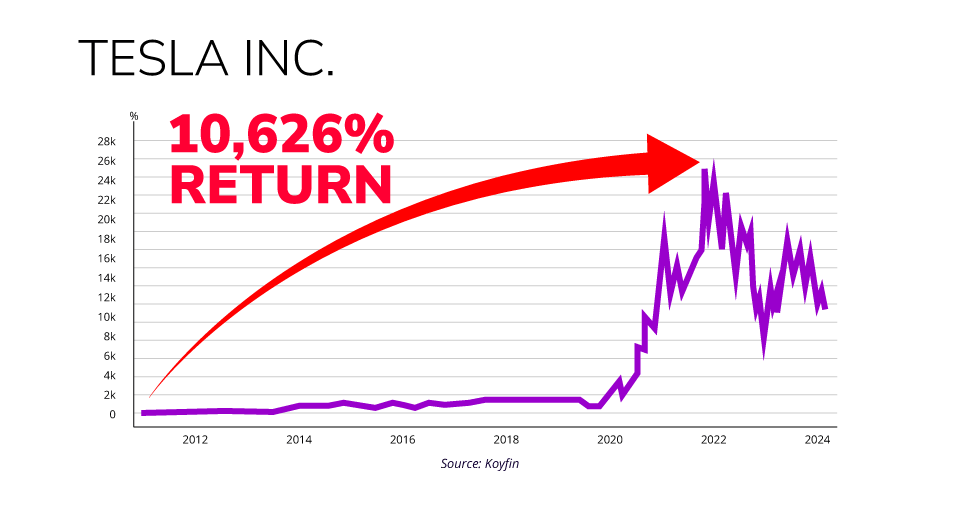

12 Koyfin – Tesla, Inc.

13 Wikipedia – Sam Altman

14 X.com – Sam Altman – 30 November 2022

15 Social Shepherd - 32 Essential AI Statistics You Need to Know in 2024 – 26 February 2024

16 NDTV World - ChatGPT Creator's Valuation Triples In 10 Months After Latest Deal: Report – 18 February 2024

17 Energy – Sam Altman – 28 June 2015

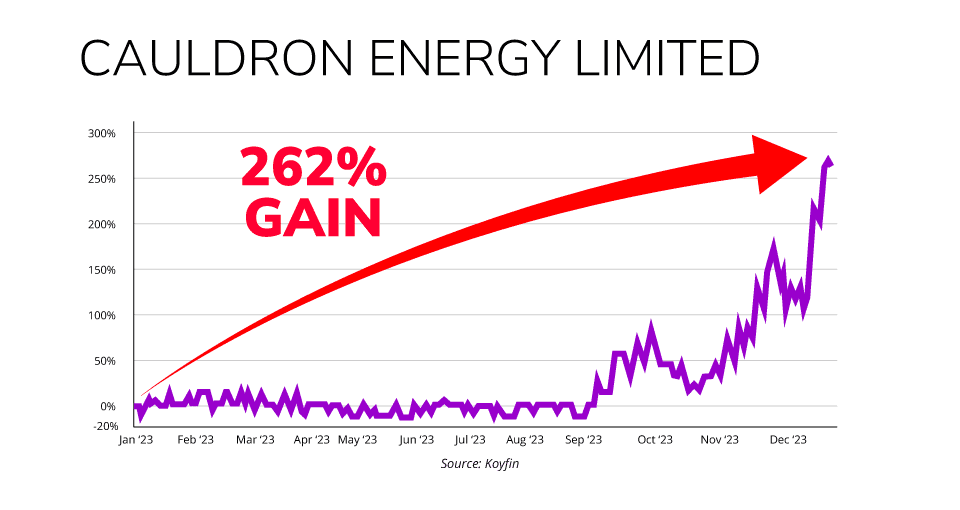

18 Koyfin – Cauldron Energy Limited

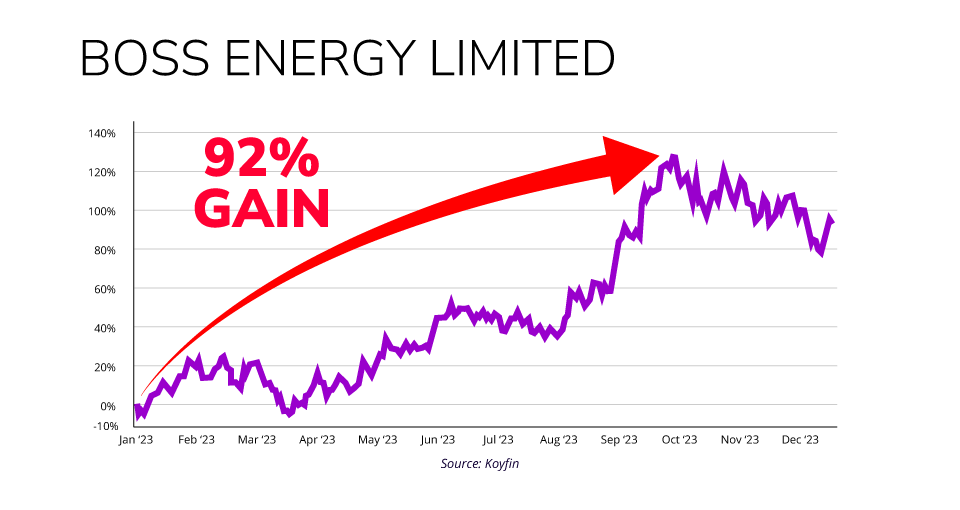

19 Koyfin – Boss Energy Limited

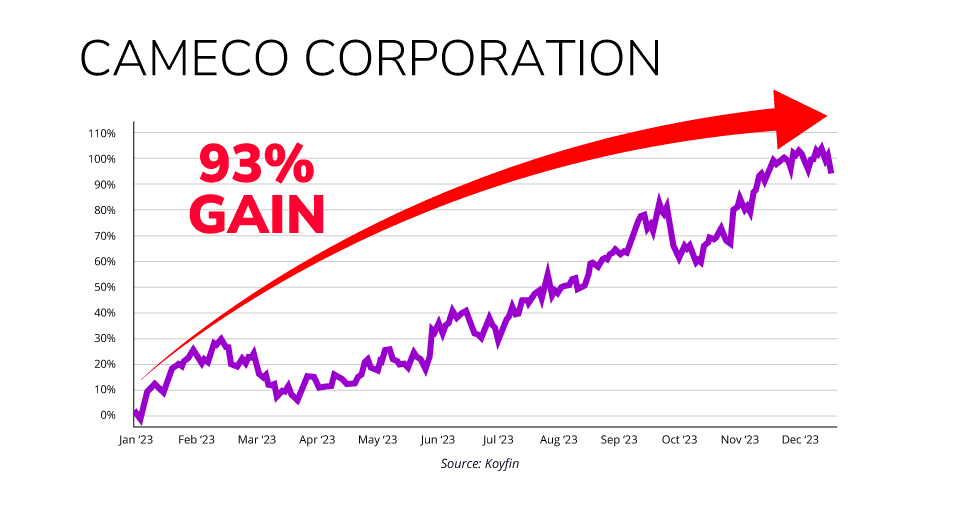

20 Koyfin – Cameco Corporation

21 TIME - Oklo Aurora Powerhouse: The 200 Best Inventions of 2023 – 24 October 2023

22 Oil Price - Energy Costs in UK Still Double the Historic Average – 10 January 2024

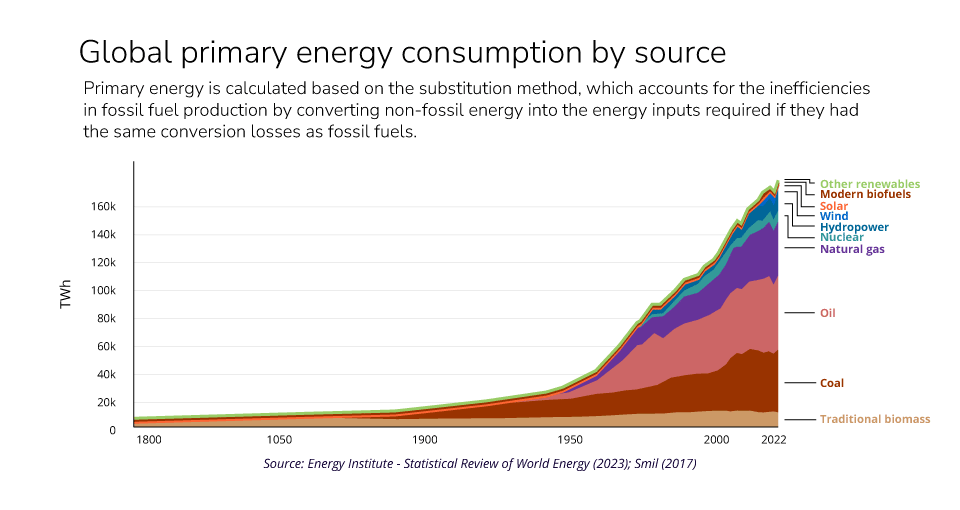

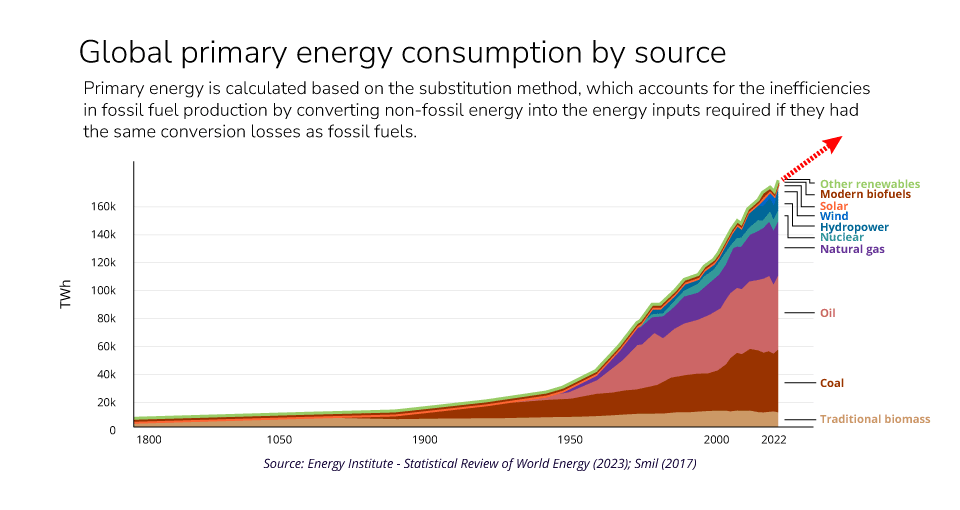

23 Our World Data - Global primary energy consumption by source

24 Our World in Data - The death of UK coal in five charts – 28 January 2019

25 IEEE Xplore - Miniaturized electronic circuits [US Patent No. 3,138, 743]

26 Investopedia - What Is Moore's Law and Is It Still True? – 11 February 2024

27 History Tools - Computers in the 1950s: The Dawn of the Information Age – 11 November 2023

28 E Week - IBM Water-Cooling Technology Helps Computers Beat the Heat, Energy Costs – 2 January 2013

29 Electricity Plans - What Is a Kilowatt-hour(kWh) And What Can It Power?

30 X.c0m – Misha da Vinci – 9 April 2023

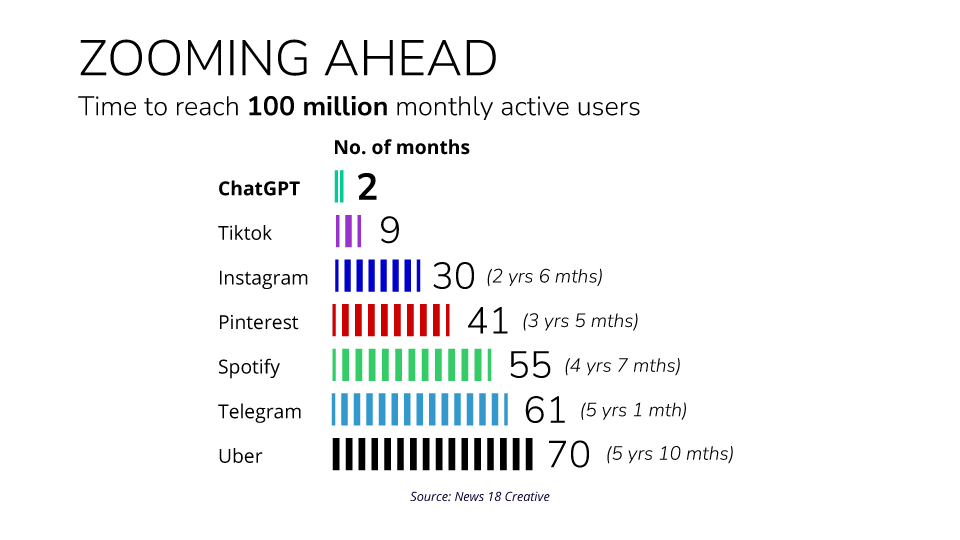

31 Exploding Topics - Number of ChatGPT Users (Mar 2024)

32 New Scientist - Should we be worried about AI's growing energy use? – 10 October 2023

33 Enterprise Tech News EM360 - Google’s AI Could Eat as Much Energy as Ireland, Experts Warn – 12 October 2023

34 McKinsey Sustainability - Yes, nuclear can help answer the climate and energy security challenge – May 2023

35 Statista - Number of housing units and annual percentage increase in the United States from1975 to 2022

36 Department of Energy - DOE Establishes $6 Billion Program to Preserve America’s Clean Nuclear Energy Infrastructure – 11 February 2022

37 VOA News - White House Cautiously Embraces Nuclear Power to Meet Green Goals – 7 June 2021

38 CGTN - China takes world's crown in nuclear power units under construction – 26 April 2023

39 Seneca ESG - India to Have Nine Operational Nuclear Powerplants by 2024 – 20 September 2023

40 World Nuclear News - South Korea aims to resume reactor construction by 2024 – 12 July 2022

41 World Nuclear News - UK releases roadmap to quadruple nuclear energy capacity – 13 January 2024

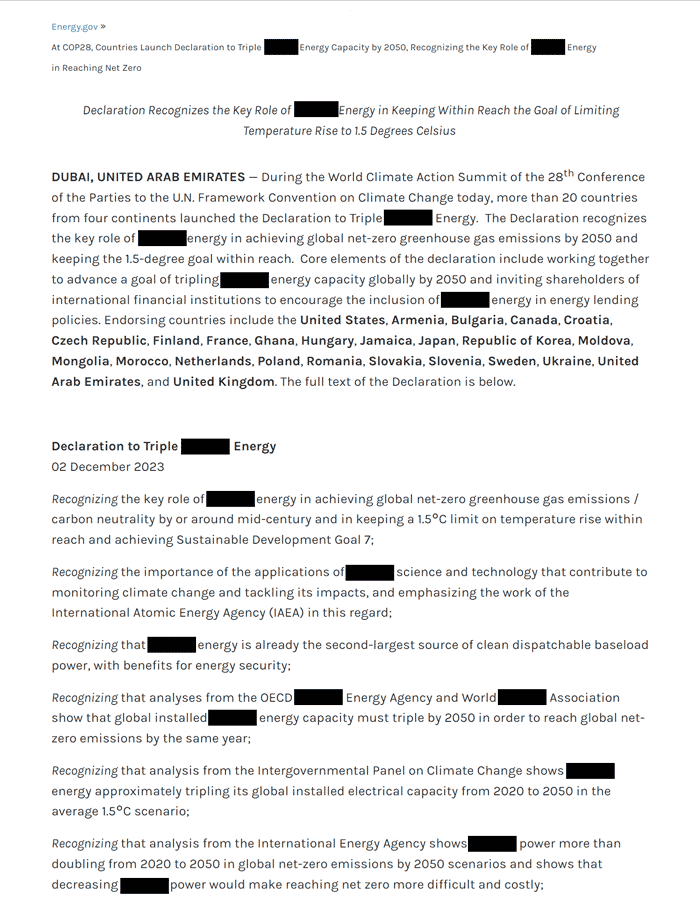

42 Department of Energy - At COP28, Countries Launch Declaration to Triple Nuclear Energy Capacity by 2050, Recognizing the Key Role of Nuclear Energy in Reaching Net Zero – 1 December 2023

43 World Nuclear Association - Plans for New Reactors Worldwide – March 2024

44 The Guardian - Timeline: Nuclear power in the United Kingdom – 27 May 2008

45 European Nuclear Society – Fuel comparison

46 Solar Reviews - What is a solar farm? Costs, land needs & more – February 2024

47 Sky Sports - Will the bigger Wembley pitch affect Tottenham this season? – 16 August 2017

48 The Eco Experts - Complete Guide to Solar Farms | Everything You Need to Know – 2 December 2022

49 Just Energy – How is Oil Needed for Gas and Electricity – 4 January 2023

50 US Energy Information Administration - How much coal, natural gas, or petroleum is used to generate a kilowatthour of electricity?

51 Freeing Energy - How many pounds of uranium are needed to generated a MWh in a nuclear plant?

52 The National News - Nuclear power helps bring down electricity prices by 75% in Finland – 14 May 2023

53 NEI - Bill Gates Talks About the Potential of Nuclear Innovation on ‘60 Minutes’ – 17 February 2021

54 Elements - The Advantages of Nuclear Energy in the Clean Energy Shift – 7 June 2021

55 Forbes - California Can Reliably Hit 85% Clean Energy By 2030 Without Risking Outages – En Route To A 100% Clean Grid – 11 May 2022

56 Bloom Energy - How Power Outages Are Affecting California

57 Los Angeles Times - California averts rolling blackouts amid heat wave – 6 September 2022

58 California Public Utilities Commission - Take Actions to Reduce Your Electricity Use

59 Comptroller.Texas.Gov - Wind Power: Energy is Good for Texas

60 TIME - Texas Power Outage: 5 million Affected After Winter Storm – 15 February 2021

61 The Texas Tribune - Texas winter storm official death toll now put at 246 – 2 January 2022

62 Forbes - The 13,000 Wind Turbines in Texas Can Be Winterized, But Should They? – 2 March 2021

63 Youtube - Inside the New Micro Nuclear Reactor that Could Power the Future – 5 October 2022

64 Youtube - Global Macro: Is the Green Transition at a Crossroads? – 16 November 2023

65 The Spectator World - Nuclear power is the answer to our energy woes – 16 October 2022

66 TIME - Nuclear Power Is the Only Solution – 4 December 2023

67 CNBC - Bezos, Microsoft bet on a $10 trillion energy fix for the planet – 6 March 2019

68 McKinsey & Company - What will it take for nuclear power to meet the climate challenge? – March 2023

69 Great British Nuclear Blog - Three months into the year, and three big steps forward – 22 March 2024

70 GOV.UK - Biggest expansion of nuclear power for 70 years to create jobs, reduce bills and strengthen Britain’s energy security – 11 January 2024

71 The Guardian - Biden launches $6bn effort to save America’s distressed nuclear plants – 20 April 2022

72 Bloomberg - Canada Plans World's Biggest Nuclear Power Plant in Ontario – 5 July 2023

73 CNET - Gigawatt: The Solar Energy Term You Should Know About – 22 March 2024

74 The Wire - How India Is Shifting Its Nuclear Power Plans into High Gear – 13 November 2023

75 World Economic Forum - Nuclear power’s comeback is down to small modular reactors – 6 October 2022

76 Wikipedia – List of largest power stations

77 Euronews – Energy crisis in Europe: Which countries have the cheapest and most expensive electricity and gas? – 29 March 2023

78 Statista – Median construction time for nuclear reactors 2022 – 9 January 2024

79 Nuclear Engineering International - Cost-effective delivery of nuclear new build – 22 November 2023

80 ANSTO - What are small modular reactors and what makes them different? – 17 July 2020

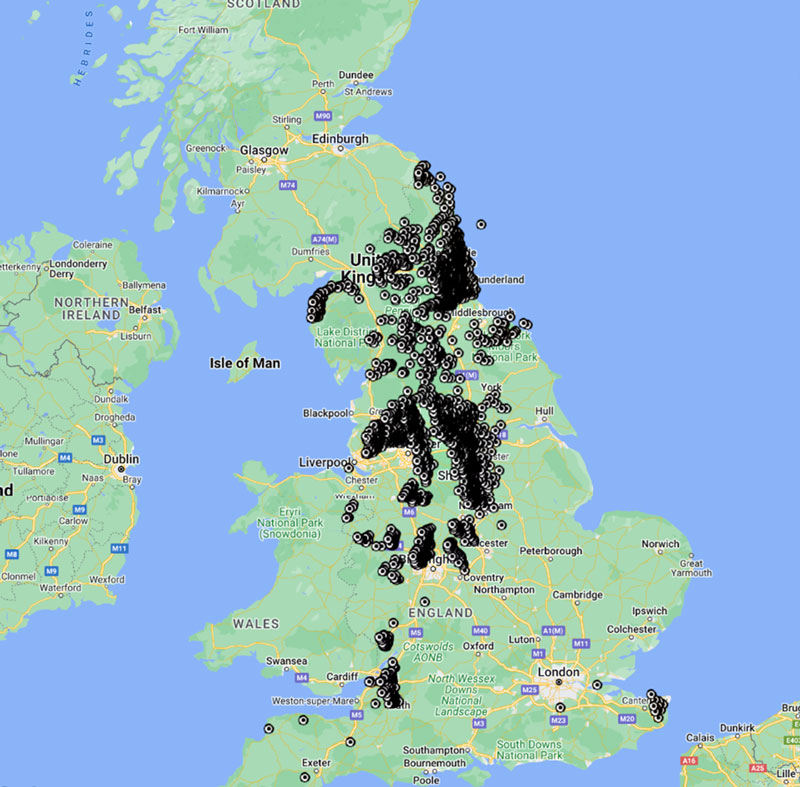

81 Northern Mine Research Society – Coal Mines England

82 Oil Price - Small Modular Nuclear Reactors Are a Game Changer For Clean Power – 29 January 2023

83 World Economic Forum - Small reactors could make nuclear energy big again. How do they work, and are they safe? – 6 October 2022

84 Nuclear News - The U.K.’s Goldilocks Moment for Nuclear Power – 17 September 2023

85 Office of Nuclear Energy - NRC Certifies First U.S. Small Modular Reactor Design – 20 January 2023

86 The Telegraph - First ‘private’ nuclear reactor to power 2m British homes – 8 February 2024

87 World Nuclear News – Agreement signed for planned UK fleet of AP300 reactors – 8 February 2024

88 Canadian Energy News - SMRs - Canada emerging as nuclear leader in development of small modular reactors

89 Atalayar - France calls for half a trillion euros to be invested in nuclear power in Europe by 2050 – 10 January 2022

90 European Commission - European Industrial Alliance on Small Modular Reactors

91 World Nuclear News - Core module completed for Chinese SMR – 14 July 2023

92 World Nuclear News - Collaboration for Rolls-Royce SMR deployment in the Netherlands – 25 August 2022

93 International Atomic Energy Agency – SMR Platform: New Web Portal Facilitates Technical Support – 17 August 2022

94 This is Money.co.uk - Around £88bn of pension savers' cash is invested in fossil fuels - putting £3k per pot at risk of big losses, claim campaigners – 30 June 2023

95 Professional Pensions - Nine in ten pension funds intend to increase renewable energy investments – 23 January 2024

96 The Guardian - Bill Gates and Warren Buffett to build new kind of nuclear reactor in Wyoming – 30 June 2021

97 Forbes – Chase Coleman III

98 Yahoo Finance – AltC Acquisition Corp. (ALCC)

99 SEC.gov - Oklo, an Advanced Fission Technology Company, to Go Public via Merger with AltC Acquisition Corp.

100 UK Business Angels Association - What is a certified HNWI and a certified sophisticated investor?

101 Oklo Inc. - Oklo Announces Historic Acceptance of Combined License Application – 15 June 2020

102 Oklo Inc. - Oklo Tentatively Selected to Provide Clean and Resilient Power to Eielson Air Force Base – 31 August 2023

103 Oklo Inc. - Oklo and Centrus Energy Sign Memorandum of Understanding for Fuel, Components, and Power Procurement to Support the Deployment of Advanced Fission Technologies in Southern Ohio – 28 August 2023

104 Android Authority - iPhone price history: How Apple's pricing changes (inflation included)

105 Markets Insider - Uranium's "Third Bull Market" Set to Shine in 2024 – 11 January 2024

106 Finnotes – Lobo Tiggre

107 Investopedia - S&P 500 Average Return and Historical Performance – 3 January 2024

108 Investing News - Lobo Tiggre: The Next Bull Market Will be One for the Record Books

109 Youtube - Uranium is headed higher for 2024 | Lobo Tiggre – 28 February 2024

110 BNN Bloomberg – Rick Rule’s Top Picks – 12 October 2023

111 Bacchus Capital - YELLOW CAKE PLC Results of Placing

112 Yellow Cake plc – Annual Report 2023

113 Yahoo Finance – Aura Energy Limited (AURA.L)

114 LinkedIn - How Jeff Bezos Found Risky Startup Capital for Amazon – 9 January 2024

115 Google – Warren Buffet Companies

116 France24 - COP28: More than 110 nations commit to tripling renewable energy capacity by 2030 – 2 December 2023

117 CNBC - MIT research on ChatGPT shows ‘Industrial Revolution level large’ leap for workers, says AI CEO – 10 May 2023

118 CNBC - This 34-year-old’s start-up backed by Bill Gates and Jeff Bezos aims to make nearly unlimited clean energy – 12 February 2021

119 The New York Times - Nuclear Power Can Save the World – 6 April 2019

120 WIRED - Silicon Valley’s Most Powerful ‘Mafia’ Gets a New Boss – 2 September 2022

121 International Monetary Fund – Nuclear Resurgence | The energy security case for nuclear power is building

122 Research Gate - Typical timeline of a nuclear plant construction and start-up project

123 The Atlantic - The Real Obstacle to Nuclear Power – 7 February 2023

124 Proactive Investors - Aura Energy set to benefit at Häggån Project as Sweden weighs up scrapping uranium ban in pursuit of net zero – 25 February 2024

125 Yahoo Finance – The Truth about Warren Buffet’s investment track record – 1 March 2021

126 Southbank Investment Research – Small Cap Investigator Portfolio

127 Wylfa nuclear power station, from above - UK government agencies, OGL 3 , via Wikimedia Commons