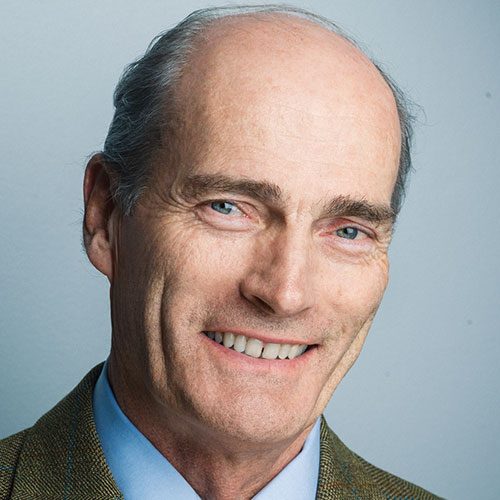

John Butler,

Investment Director, The Fleet Street Letter

Hi, I’m John Butler.

I spent more than two decades working in the City of London, where huge asset managers like Goldman Sachs, Merrill Lynch, and Morgan Stanley turned to me for advice.

I was once even dubbed “Europe’s #1 Investment Strategist” by Institutional Investor magazine.

And I’m speaking to you today on behalf of the most extraordinary group of financial experts in the world – a private network that predicted the 1987 stock market crash, the fall of the Soviet Union, the 2008 financial crisis, the surge in inflation following Covid lockdowns and even the rise of digital cryptocurrencies way back in 1997.

You may never have heard of our work before.

But we’re an independent financial research network first founded nearly a century ago, for people who think independently, who don’t trust the media or big City institutions and who want to manage at least some of their own money.

And… today, we’re stepping forward because we’re worried the mainstream press and most so-called financial “experts” are sending millions of investors down a very dangerous path of complacency.

In short, we believe the coming months could be the most important of your financial life – if we’re right, the wealth and savings you’ve worked for your whole life are at risk.

And not because of anything you’ve done wrong.

In fact, you’ve probably done everything you were told to do… worked hard, paid your taxes and saved your money for the future.

But that could all amount to nothing if you make the wrong moves in the coming weeks…

Simply put, we believe the same “shadow currency” that’s triggered every major financial collapse in the last 50 years is about to blow up again… and make the next few years some of the most difficult in British history.

Please understand… I’m not talking about the pound, the dollar, the euro, gold, or even bitcoin.

It’s far more important than any of these.

And when it blows up, terrible things happen.

- In the 1970s it forced Britain to beg the IMF for a humiliating bailout… triggered a 70% crash in the stock market… and brought the entire country to a standstill.

- In 1992 it triggered the collapse of the pound… forced the bank of England to raise interest rates to 10%... and led to the biggest crash in housing prices in living memory.

- And just two years ago, it almost crashed the entire UK pension system millions of people were just hours away from watching their retirement savings disappear forever.

We believe this currency is about to blow up again.

That means you have a very short period of time to understand what is happening, and how your life could change.

In the next few minutes, I’ll explain how we see this playing out, and the exact steps we believe you should take.

But first… let me explain what’s happening.

The downward spiral has begun...

In the short period of time since the pandemic ended, we’ve seen a “rolling crash” spread to almost every part of the financial system.

Let me explain.

In a little over a year starting in 2021, the AIM index of UK-listed smaller businesses lost 50% of its value as money flooded out of the market…

Then the bond market crashed – a government bond issued in 2022 has already lost 65% of its value.

Then the pound collapsed, crashing to its lowest ever level against the dollar since 1985…

Next… and most troubling of all… the entire pension system itself almost collapsed.

I won't go into the politics of it. Or the technical details.

The basic point is simple. The bond market all but collapsed when the brief government led by Liz Truss proposed a budget that would make the deficit larger.

The spike in interest rates caught pension funds off guard.

The Bank of England had to intervene and pump money.

And what’s scarier still, the entire crisis played out in the space of four hours.

Imagine that. You go for lunch with friends. When you order your starter, everything is normal.

But by the time the coffee comes, the entire financial system is in ruins.

The pound has crashed. People are panic selling. Mortgage rates have spiked. Your pension fund needs an emergency bailout.

That’s how fast events moved in 2022.

No one knows what would have happened, had the Bank of England not stepped in.

But we should be glad it did.

If you think I’m exaggerating, know this…

The Bank’s own officers publicly testified that we were “hours away” from widespread financial collapse.

That’s putting it mildly…

Without that bailout, there’s a very real chance you could have found your entire retirement account at risk of vanishing.

Could you take a hit like that? Or would you have to downgrade your retirement plans… find a part-time job… or ask your children for help?

But what we do know is, it took just a few hours for the system to go from “normal” to “catastrophic collapse”.

In the space of one sunny Friday afternoon, we became an international laughingstock… dubbed a “submerging market”.

City economists began talking of Britain paying an extra “moron premium” to borrow in the bond market.

One taxi driver began accepting dollars instead of pounds, calling it “God’s currency”.

There were no obvious warning signs.

No ominous news reports in the days before.

No time to prepare.

And no one in Westminster or the Bank of England saw it coming.

It just hit – BANG! – out of nowhere.

If it happened once, it could happen again.

And in the time since that collapse, our economy has – if anything –become even more fragile.

Last year, the number of British businesses that went bust hit a 30-year high. It’s now the worst time in decades to run or own a business – 25,000 businesses went to the wall in 2023 alone.

In other words:

We’ve already seen a collapse hit thousands of individual businesses, our stock market and bond markets, the national currency and our pension system.

Today you’re going to see why this is happening… and what’s inevitably coming next.

But first…

Who are we to make a prediction like this?

Let me explain.

I’m speaking to you today on behalf of one of the most extraordinary groups of financial experts in the world.

We’re not part of the military, the intelligence community or any branch of the UK government.

What we do is far more interesting than any of that.

Our group provides private intelligence and advice to people like you – who don’t trust the mainstream media and want unbiased insights and information.

Our organisation was founded by a British agent named Patrick Maitland.

Maitland started his career in the 1930s as a Special Correspondent for The Times… before being recruited by the political intelligence department at the Foreign Office.

He famously avoided three assassination attempts… dodged the Romanian Iron Guard in the Second World War… and escaped from Albania as Italian forces invaded.

But away from his heroics for King and Country, Maitland lived a double life.

He formed a private, independent organisation called The Fleet Street Letter.

It was with readers of this letter that he shared what would become his most famous prediction.

After a private fact-finding mission to Fascist Europe in 1938, Maitland wrote:

On 1 September, Hitler’s tanks invaded Poland and the Second World War began.

It was a remarkably accurate prediction. And it was the first in a series of startlingly accurate predictions.

- In 1987, we predicted that the Soviet Union would collapse. A few years later, that’s exactly what happened as the Berlin Wall fell.

- We also exposed the rising threat of radical Islam in 1993:

- In 1997, two of our experts published one of the most influential books of all time… The Sovereign Individual. In it, Lord Rees-Mogg (former editor of The Times and father of the MP Jacob), and James Dale Davidson (a close friend of Bill Clinton’s) predicted “a new digital form of money [… of…] encrypted sequences… unique, anonymous and verifiable.” In other words: bitcoin. Billionaire founder of PayPal Peter Thiel claims the book has influenced him more than any other.

Peter Thiel

Source: Dan Taylor, Wikimedia - In 2000, we warned that a “day of reckoning” was at hand for the dot-com boom... the very day the Nasdaq began a two-year, 77% decline.

- In 2008, we warned that “The City’s dream run is about to end… and it could trigger our worst recession in 35 years.” Five and a half months later Lehman Brothers collapsed.

Events like these are often called unforeseeable.

But that simply isn’t true.

With the right insights… the right analysis… and with the right contacts… it’s possible to forecast these events.

That’s why The Fleet Street Letter has been in publication for more than 80 years, making it Britain’s oldest independent financial newsletter.

Do our experts get it right every time? No. But we’re honest. We’re willing to “think the unthinkable”… to pursue ideas the mainstream media can’t or won’t… and to tell you the truth about what we’ve found.

And today we’re sharing our latest

prediction… our most troubling yet

To understand what’s happening, you need to understand how we got here.

Let me take you back to 1909.

You’re young, free and just starting to make your way in the world.

As you stroll down Piccadilly on your way to the office, the entire world is at your feet.

Britain is the richest nation on the planet.

The British pound is strong. In fact, you can convert the billfold of paper notes in your pocket into gold bullion at any time you like.

A pound in your pocket is “as good as gold”.

And the rest of the world knows it too.

When an international banker – be they German, American or Japanese – wants to do business, he’ll use the pound.

You can travel anywhere you like. You don’t need a passport. You can be sure your money will be accepted.

You can do business where you like. Travel where you like. The whole world is open to you. And you don’t have to pay much for the privilege – even the highest tax rate is just 7.5%, payable only by the very richest.

Sir Winston Churchill

Source: Yousuf Karsh, Wikimedia

As Churchill would famously say, “It is an Englishman’s inalienable right to live wherever the hell he likes.”

Contrast that to today.

The pound has lost 99.33% of its value.

It’s been replaced by the dollar as the world’s reserve currency.

Our elite have racked up trillions of dollars in debt. Our economy has ground to a halt. A “rolling crash” has already seen stocks and bonds nosedive.

Thousands of businesses are failing. And millions of people are struggling to make ends meet as the price of food, energy and other essentials has skyrocketed.

How did we go from the most powerful nation in the world to “Broken Britain”?

Look in a history book and you’ll find all kinds of answers.

War. The end of the Empire. The collapse of industry.

But it was really about money… a change in the way our money system worked.

In 1909 the pound was backed by gold. It was the world’s reserve currency. A staggering 62% of the world’s reserves was held in British pounds.

But that all changed rapidly when Britain abandoned the gold standard.

Aside from a brief period in the 1920s, the pound has never been “as good as gold” again.

On its own, this didn’t have to be a problem. Gold by itself isn’t good or bad. The whole point of a gold standard is that it keeps governments honest.

If it decides to do something stupidly expensive, it runs out of gold… and has to stop.

Without gold, there’s nothing to stop the government from making extravagant promises to the people… with no thought as to where the money will come from.

Consider…

In 1900, we spent just 0.7% of our national income on “social protection” programmes like pensions and other welfare.

Today that figure is more than 15%.

In other words, welfare spending has grown 2,000% in a century.

That’s all well and good… if you have the money.

But the problem is, we don’t. The shortfall is made up with more borrowing.

The political elite can make whatever promises they like – like promising to nationalise the railways, to “level up” our economy or to hit “net zero” carbon emissions by 2030 - because there’s nothing to restrict them.

That’s why every PM for 25 years – Tony Blair, Gordon Brown, David Cameron, Theresa May, Boris Johnson, Liz Truss and Rishi Sunak – have left our even country deeper in debt after leaving office.

Without a gold standard, there’s nothing to keep politicians honest.

No limits on spending or borrowing. Nothing to stop them taking the easy path. And that’s exactly what happened. The elite took the easy route.

They cancelled the link between money and gold… and effectively turned the money in your pocket into “monopoly money”.

That’s why Britain’s more heavily indebted today than it has ever been throughout its entire history.

We’re in a £2.5 trillion hole… and no one has any real idea how we’ll ever get out of it.

The elite have all kinds of excuses for this.

Recessions. Depressions. Banking crises. Pandemics.

But the fact is, the government has only had a balanced budget for five of the last SEVENTY years.

The last time the authorities had a budget surplus was nearly a quarter of a century ago… back in 2001.

Since then our national debt has increased, every single year, without fail.

We can change the political party. We can change the PM. We can even change the policies. One thing remains constant: every single year, the national debt goes UP.

And that’s just the debt the government will admit to!

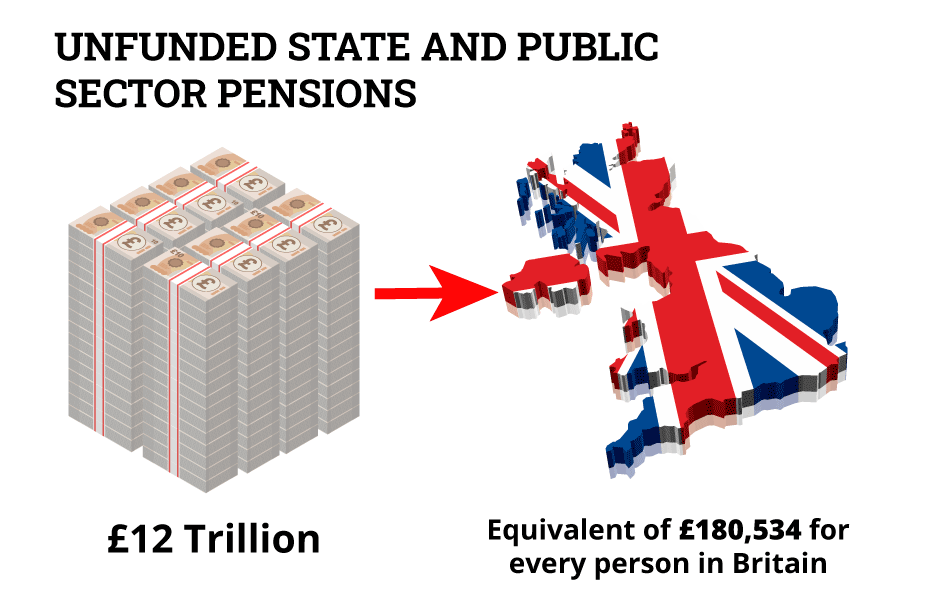

Add in all the promises the authorities have made to everyday people like you and me – such as unfunded state and public sector pensions – and that number skyrockets to £12 TRILLION…

That’s the equivalent of £180,534 for every person in Britain.

Think about that for a second. Every child going to school in the morning. Every teenager sitting their exams. Every new graduate trying to get their first job.

These are the poor kids whose futures are being mortgaged.

And our elite have loaded every single one of them with over £180,000 in debt, before they even get their start in life.

Does that seem fair to you?

Does that seem right?

Or does it seem like a national scandal our political elite should be forced to answer for?

Of course, if you or I were in this situation we’d be broke already. We’d have declared bankruptcy years ago.

But governments – particularly big, powerful, “rich” Western ones – have another option.

They can just print more money. They can devalue the currency. They can dupe the people and pay for their promises in worthless currency.

Which is exactly what’s happening.

Don’t expect the rich to complain. They’re doing better than ever. In the last two years, the richest 1% grew $42 trillion richer. They made more than twice as much money as the other 99% put together.

It’s unfair. But it makes sense. It’s impossible to have an honest society in a world of corrupt money.

Britain’s Secret “Shadow Currency”

You see, when the authorities removed gold from the financial system, they didn’t replace it with anything.

Not anything real, at least.

Not silver, or land, or oil… or any tangible asset whatsoever.

Instead, your money is “backed” with something far less valuable… a promise.

That’s it.

Go look. Take out a £10 banknote. You’ll find these words (the “small print”, as it were):

‘I promise to pay the bearer on demand the sum of ten pounds’

Who exactly is making you that “promise”?

In theory it’s the Bank of England.

But in reality, it’s a political promise.

It relies on the political elite managing our national finances properly and prudently –not to overspend, overborrow or devalue the currency.

The question is, do you trust them?

Because that’s all that backs our money today… trust. There’s nothing else.

In fact, our word for “credit” literally comes from the Latin word “to trust”.

The paper currency may say “pound”.

But the value comes from trust.

Without anything real behind it, the pound depends on trust.

Trust is the real currency… the “shadow currency” that underpins everything.

It’s a huge, dangerous flaw. Because when trust and confidence evaporate… the system can collapse faster than you can escape.

That’s what we saw after Liz Truss unveiled her budget.

And we could see it again soon.

Only the next time, trust won't be restored simply by removing the PM. Next time, people will realise that the promises can't be kept... and trust can't be restored.

That's why we're seeing the rise of “populists” in Europe – people are losing trust in their leaders.

It’s why turnout for the 4 July election was so low… and why “anti” political parties like Reform polled so well…

Trust is evaporating

When trust disappears... the whole financial house of cards collapses.

When your economy is so reliant on ever increasing amounts of debt and credit, it only takes one bad move to lose the trust of the markets.

This happened in the 1970s, when the government borrowed so much money to prop up the economy that confidence in our financial system collapsed…

Soon inflation ate into cash savings at a rate of 28%. Yes, 28%. It seemed like every time you turned your back, bank savings lost more of their value. Every single day, you became a little poorer.

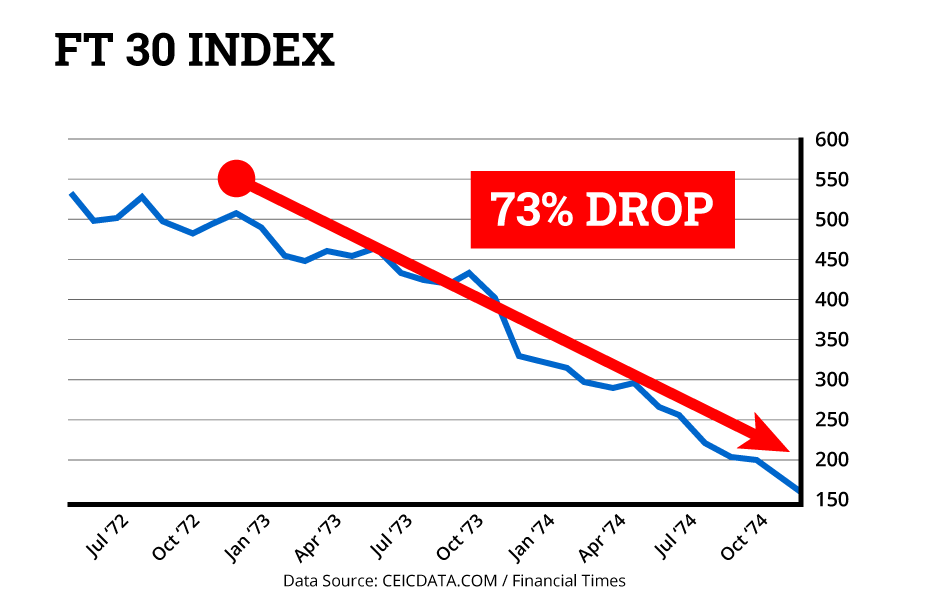

The FT 30 entered the worst bear market in history, falling 73% between 1973 and 1974.

Even gilts – our so-called “safe-haven” – collapsed as interest rates went sky high.

Confidence in the system disappeared. But it went deeper than that. The speed of the social breakdown was frightening…

By 1979, dead bodies went unburied as gravediggers joined the picket line…

Stinking piles of rubbish rotted on the streets, towering inside Leicester Square…

If you were lucky enough to have a job, you had to swallow huge wage-cuts during the infamous “three-day week”. Even putting food on the table became a challenge: you had to scour supermarket shelves by torchlight during blackouts.

That’s not to mention the violent civil unrest, where thousands of the unemployed and strikers clashed with the police. Keeping your money secure was a nightmare. Growing it was near impossible.

As the top rate of income tax peaked at 83% in 1974, foreign investment steered away from Britain as if we were an island colony of lepers.

We were known as the “sick man of Europe”.

In short, life changed dramatically – for the worse. Jobs disappeared, family businesses closed, people had to dig deep into their savings just to make ends meet.

In the end, we had to beg the IMF for a humiliating bailout.

That’s what happens when we see a catastrophic collapse in confidence.

This all happened, right here in Britain. So don’t be under any illusions. It’s happened here. And it will happen again.

It happened before in 1992…

The pound was trading at unsustainable levels. It was backed by nothing but a government guarantee.

When markets lost faith in that guarantee, we saw an epic crisis of confidence.

The pound crashed.

Interest rates spiked to 12%.

The housing market imploded. Property prices crashed. By 1995, prices were 37% below their previous peak.

And it happened again in 2022.

In one “mini” budget from Liz Truss – which took less than an hour to deliver – trust in our financial markets evaporated.

Within four hours, the pound had crashed… the bond market was in meltdown… and 90% of pension funds in Britain were at risk of collapse.

Only the Bank of England’s printing press saved the system.

And that should have been a wakeup call… a final warning for you to protect your savings and your future from disaster.

It showed just how fragile the foundations of the financial system are – and how rapidly everything can collapse.

It took only one small event – a mini budget – to begin an almost uncontrollable landslide. Everything fell quickly.

That's what happens in financial crisis. One second, the ground beneath your feet is solid and stable.

The next, it's gone and you're in free-fall. Or in this case, your money, your hard-earned savings and pension… your hopes and dreams for a comfortable retirement.

Events like these aren’t orderly. You don’t get time to think or prepare. You don’t even hear about them in the press until they’re happening all around you.

And by that time, IT’S FAR TOO LATE TO PUT ON THE BRAKES.

So what’s coming next?

Well as the events of 2022 proved, the UK is only ever one bad day away from a full-blown financial crisis.

And the catalyst for the next crisis is almost upon us.

You are running out of time to take action.

The last time Labour came to power, it took them just 60 days to launch a huge assault on British retirees.

Labour came to power on 1 May 1997.

Just two months later, on 3 July, then Chancellor Gordon Brown robbed 20 million pensioners blind.

He slashed tax relief on millions of pensioners… taking an estimated £118 billion out of savers’ pockets.

We saw another Labour budget in October.

Except this time, the stakes are much, much higher…

Britain’s debts are roughly eight times higher than they were in 1997. Our economy is much more fragile.

We’ve already seen how quickly a “bad budget” can become a sudden and terrifying crisis of confidence, triggering a collapse of the currency, bond and pension systems.

Now we’re heading towards the NEXT budget… potentially the most dangerous and catastrophic in our history.

That’s not just some number I’ve plucked from the air to try to scare you. It’s what the history shows.

Of course, Labour’s plans are largely public already.

You might expect the markets to already “price in” everything that’s coming.

But the same thing was true in September 2022. Most of what Liz Truss wanted to do was already public.

And the bond market was stable in the week before the budget.

There were no major warning signs.

Then… the collapse hit.

That’s the problem in a system built on nothing but debt, credit and trust.

It can all fall apart in a matter of hours.

We’re only ever one misstep… one bad day… one terrible idea… away from a terrifying panic.

Very soon, Keir Starmer and his Chancellor Rachel Reeves will lay out their economic plans for Britain’s future.

No one really knows what Starmer stands for or what he wants to do.

But what we DO know isn’t exactly all that comforting.

We do know he’s part of a political system that has racked up trillions of pounds of debt – with no concern whatsoever about the long-term consequences.

We know we have a prime minister who once happily sat on the editorial boards of magazines like Socialist Alternatives and Socialist Lawyer. (These are publications that blasted left-wing Neil Kinnock for being “too centrist.”)

We know Starmer plans to bring back into British law a raid on investors with new capital gains taxes, in a policy that is known as “socialism in one clause”.

We know internal Labour Party documents show Labour’s plan to introduce a wealth “equality test.”

And we know Labour MP Richard Burgon is already petitioning parliament to implement a wealth tax across the board.

Remember, all it takes is one wrong move… and there’s every chance we’ll see a repeat of 2022.

A crashing pound… the bond market in meltdown… mortgage rates spiking… a scramble to bail out the system again...

It all happened. It could all happen again.

In other words…

We could be on the cusp of a catastrophic loss of confidence in our public finances.

That means the short window of time between now and the next budget could be the most important period of your financial life… your last chance to prepare for the next leg of the crisis.

Do you want to place your retirement, your savings and your financial future in the hands of a power-hungry politician?

Do you really want to take that risk?

Are you prepared to survive if things go wrong?

- How would you cope when another wave of price rises hits Britain? Imagine a world where food and energy costs increase by 50%-100% in short order… and keep rising. It’s far more likely than anyone wants you to know. The problems that caused the inflation of 2021 and 2022 haven’t gone away. They’ve got worse.

- How would you cope if you woke up to find every penny you’ve saved for your retirement has suddenly… and mysteriously… disappeared. It’s gone. And so has the retirement you had planned. It almost happened under Liz Truss. It could still happen.

- How would you cope if more banks collapse, including yours? If depositors at your bank started demanding their money back… standing in line through the night in a desperate attempt to access their savings… would you know what to do? It’s already happened in America, with the collapse of Silicon Valley Bank and First Republic Bank. It happened here in 2008. It could happen again.

- Would you know what to do if Britain’s authorities closed the banks in an emergency bank holiday, as Harold Wilson did when he devalued the pound in 1968, or as Roosevelt did in America in 1933?

- How would you cope if the authorities seized your bank’s assets, forcibly moving your savings to another bank… or even to a government-controlled account… without giving you a choice in the matter? It happened to Silicon Valley Bank depositors in the US in 2023. It could happen here too.

- How would you cope if you could only withdraw £50 from a cashpoint, no matter how much money you had in your account? Would you have enough to cover your expenses, buy food, or fill up your car? (This is far more likely than you’d think… it’s exactly what happened in the Greek banking crisis less than ten years ago.)

This might all sound extreme.

And it is.

That’s why 99% of people watching this presentation will simply ignore this warning.

They’ll say, “There’s no way that could happen… not here, not in Britain.”

But we believe you’re different.

You know it can happen.

You can see it’s already happening. You see it in the price rises. In the spiking cost of energy. In the banking failures. In the near collapse of the pension system.

Deep down, you already know that these are warning signs. The first tremors of a much bigger earthquake.

And yes, some people will consider this language alarmist, or even fear mongering. People don’t like to be scared. It's not a good feeling.

But all of our research is based on events that have actually happened.

We’re not speculating. We’re observing.

Instead of being scared, we suggest your best route is to be prepared.

And part of being prepared means analysing the facts as they are and being honest about what they tell you.

The question is… what should you do right now to prepare yourself in the event that the unthinkable starts to happen?

The single best trade of all time

Think back to February 2020.

Covid is spreading rapidly. No one quite knows what it means. But one by one, countries are closing their borders… shutting down their economies… and preparing to lock people in their homes.

It was perhaps the most confusing and scary few weeks in modern history.

And the markets responded by crashing into their fastest bear market in history.

Bill Ackman

Source: Senate Democrats, Wikimedia

That’s when hedge fund manager Bill Ackman made what’s gone down as the greatest trade of all time.

Publicly, the Pershing Square manager predicted that “hell is coming” on TV.

Privately, he placed a $27 million trade.

He bet on the market falling.

Just a few months later, he cashed out a $2.6 billion profit.

Roughly speaking that’s a 100-fold return… in a few months… while the rest of the world crashed.

And it’s an important reminder:

Even when the system is collapsing around you – someone is always making money.

Wealth is like energy. It’s never truly destroyed. It moves… it flows… it changes hands. The key is knowing where it’s likely to go in advance, so you can prepare.

Because in a crisis, wealth flows from the unprepared to the prepared.

Take the Great Depression, for instance.

Everyone knows the Wall Street crash ruined millions.

As the Dow Jones collapsed 73%, money flowed into gold mining stocks.

The two you’d have wanted to own were Dome Mines and Homestake Mining. Both went up more than 400%... while the Dow Jones crashed.

Those are exactly the kind of stocks you want to own in a crash – the stocks that go up when others collapse.

By the way, the same thing happened in the 1970s.

When inflation took off, the stock and bond markets crashed into a decade-long downward spiral.

What happened?

Money moved into gold once again.

It shot up 2,300% inside a decade, while the stock market went nowhere.

And finally… a real speculative frenzy began in the gold market.

It was mostly focused around junior gold stocks in the Canadian and American stock markets… smaller, mostly unknown gold stocks.

But in the right conditions, at least seven different stocks went up more than 1,000%.

In fact, the average return in that one-year “melt-up” period was 1,548%.

If you don’t think millionaires can be made in a crisis…

meet Hugo Stinnes

Hugo Stinnes

Source: Wikimedia

History remembers him as the “Inflation King” of Weimar Germany.

A man who didn’t just thrive as the money system failed – he made a fortune.

And he did it in the worst possible economic conditions.

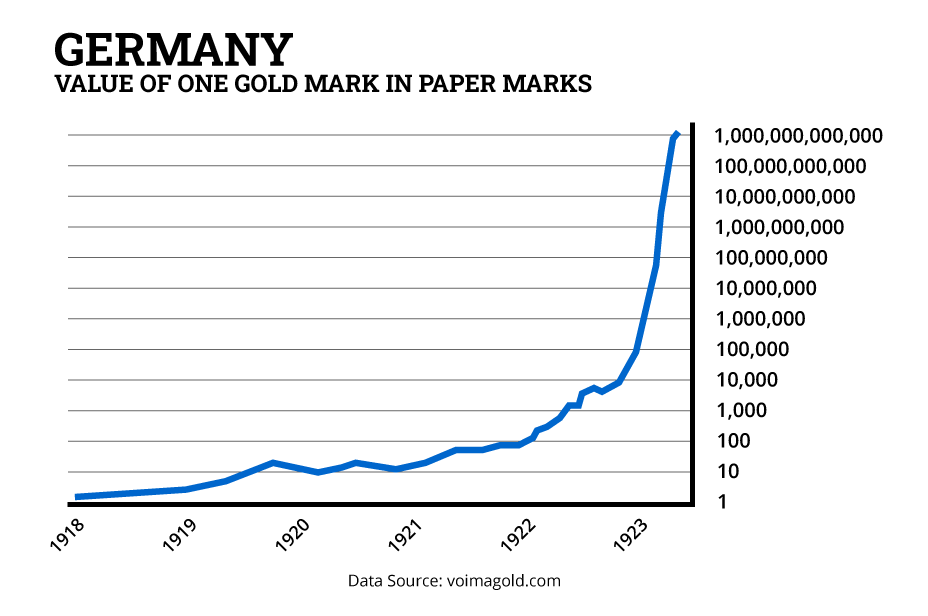

As you know, the Weimar Republic printed money until its currency collapsed.

Prices doubled every 3.7 days. Millions of people lost everything they’d worked and saved for.

It was such a crazy situation that psychologists identified a new disorder. They called it “Zero Stroke”. It was brought on by people having to deal with adding and subtracting so many zeros at the shops.

But Stinnes didn’t go mad. He knew what to do.

He became the richest man in Germany during a time when most people were living through a nightmare.

And he did it by borrowing as much as he could in the rapidly inflating German mark, and using it to buy hard assets – land, commodities, coal mines. Anything real.

He made a fortune. And by the way, the rich are taking a similar approach today. Why else does Bill Gates own 242,000 acres of farmland?

The problem is, that strategy is hard to actually execute unless you’ve got millions to invest.

And the reality is, simply holding GOLD in the Weimar Republic would have seen you come out on top.

That’s why you need to download the latest report from the experts at The Fleet Street Letter called “The 21st Century Stinnes Plan”.

Open it up and you’ll discover the future doesn’t have to be bleak. Not for you, at least.

For others it may hold price rises… instability… and all-out collapse.

But not for you. You can make different choices – and use what’s coming to your advantage.

Is this all too extreme? Our critics might say so.

But that doesn’t mean it won’t happen.

In fact, The Fleet Street Letter specialises in radical, life-changing events like this – what you might call low-probability, high-impact situations. The kind of events that no one expects – but which change life for everyone when they inevitably arrive.

And it hasn’t always made us a lot of friends in the mainstream media.

Bill Bonner,

Founder and Best-selling Author

In the early 1990s, our Publisher – the New York Times best-selling author Bill Bonner – went for a private meeting with the authorities here in London.

The topic?

The powers that be had taken issue at a prediction we’d made.

We’ve never claimed to be right all the time. And we don’t make judgements as to what’s right or wrong. We don’t want anything bad to happen. We simply say it as we see it, even if that makes us unpopular.

Bill made his case directly to the authorities.

“Imagine,” he said, “it’s 1938 and someone warns you that a terrible war is about to begin.

“Millions of people are going to die. Whole cities will be reduced to mere ruins. There will be terrible suffering and slaughter on a scale never before seen in human history.

“By the end of it – just a few years from now – the world and your world will be completely and radically different.”

An extreme prediction, yes.

But a correct one.

Are predictions like that, Bill asked, “too extreme” to share with the public?

The response Bill received from the authorities has gone down in history, inside our organisation.

“We expect you to conduct yourselves as gentlemen.”

So we will.

The rest of this presentation is about how your life is going to change and what you can do to protect yourself, your family and your assets, so you come out on top.

That’s it.

We have no hidden agenda. No political party backing us. No advertisers or media partners (no one will work with us, anyway).

We’re beholden to no one. And we like it that way. Because it gives us the freedom to tell the truth.

That’s why we’re inviting you get the latest report that our team here at The Fleet Street Letter have put together – “The 21st Century Stinnes Plan”.

Inside, you'll find:

- A detailed analysis of why our current financial system is a fragile “confidence game”

- The surprising history of global currency resets over the past century

- Why we may be on the cusp of another major monetary system change

- 5 potential scenarios for the next global currency regime

Don't be caught unprepared when the rules of the game suddenly change.

Get ahead of the curve with our “21st Century Stinnes Plan” and position yourself to prosper, just as Hugo Stinnes did a century ago.

But as you may have guessed, this invitation is much bigger than one research report.

Today, we’re inviting you to be a part of The Fleet Street Letter network and hear from our experts and insiders on a regular basis, to make The Fleet Street Letter part of your regular reading.

Please understand, our work is unlike anything else you’ll find in Britain.

It’s not a “tipsheet”. It won’t tell you about the latest hot stocks or small caps. And there’s no speculating on cryptocurrencies.

It’s a serious publication for people who are serious about their money.

Is that you?

We think so.

The fact that you’ve read this far suggests we’re right about you – that you’re as worried as we are.

You know that corrupt and dishonest money leads to a corrupt and dishonest society.

You know that all debts have to be repaid in the end.

Most of all, you know that no one else is coming to save you.

Don’t expect the City fund managers to care about any of this. They don’t get paid to tell you the truth. They’re only interested in “Assets Under Management” – they want to manage your money for you.

Don’t expect the media to tell you what’s really going on. It won’t. It’s too conflicted… it has too many competing interests with advertisers and corporate partners… too much invested in the status quo.

And don’t expect the government to help. Politicians are the ones who got us here! They’re out for themselves. They’re a part of a broken and corrupt system…and only interested in their own political survival.

But again: chances are you already know all of this.

And you know the only real way through a crisis is to take control of your own money and your own fate.

If that’s you – and we think it is – you’ll love The Fleet Street Letter.

This is one of those rare chances in life to be a part of something bigger than yourself.

As you’ll see when you join us, we believe there are patterns to just about everything.

There is a deep and powerful Gulf Stream, for example; it takes warm water from the Gulf of Mexico, carries it across the North Atlantic, and makes Northern Europe inhabitable. But looking only at the surface waves, you wouldn’t see it.

Likewise, you can’t tell much from the day-to-day market action. But there are still hidden trends. The most important of them is what we call the Primary Trend. It marks the basic direction of prices, perhaps for decades.

Wealth is created by people who produce goods and services for each other. Anything the government does to interfere with this makes things worse.

A fundamental part of our analysis is understanding that the world of money doesn’t work the way you think it does.

The Bank of England cannot actually know what the “correct” interest rate is for Britain, for example.

We believe that the City and Wall Street seriously and episodically misprice assets as investors get caught up in fads and the “madness of crowds”.

We further believe that the switch to a gold-free money system in 1971 was a mistake. It made it much easier to distort the value of the world’s reserve currency and thereby allowed and actually promoted large distortions throughout the global financial system.

In short, most of what you hear from economists, the City

or the government is likely to be wrong.

The trick to successful wealth-building is to get on the right side of the major trend… and stay there.

Every study shows that asset allocation (being in the right place at the right time) is more effective than specific investment selection.

We’ll explain this in great detail when you join us.

When you sign up you’ll get instant access to a whole series of highly valuable research reports our team have created for you.

For instance, you’ll get a copy of “The Gold Report: Why Every Investor Should Own Gold Now” – an in-depth guide to investing in the world’s oldest currency.

Right now, the elite are turning to gold in a big way.

The signs of this are obvious, if you know where to look.

For instance, late last year the Dutch Central Bank in Amsterdam added this message to its website:

Ask yourself:

Why is a central bank – a guardian of the monetary system – talking about how it will survive when the system collapses?

That’s not the kind of thing central bankers normally talk about.

Not in public, anyway.

Do they know something we don’t?

Whatever they know, the Dutch are guarding their gold carefully – building a new storage facility on a military base at Zeist.

And they’re not alone.

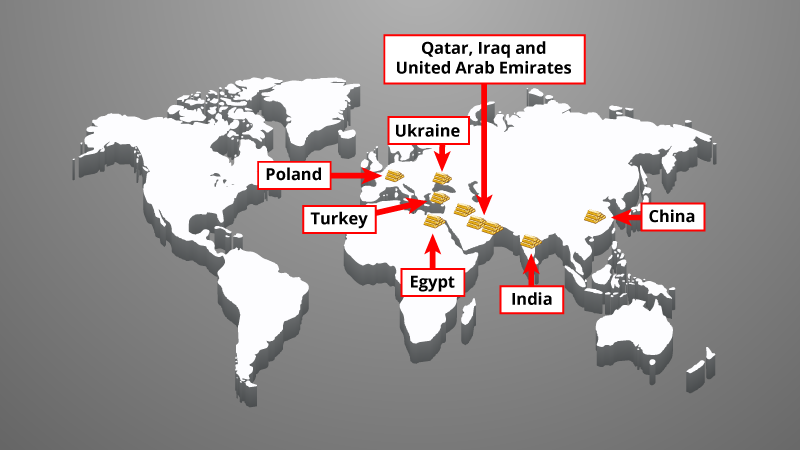

The world’s central banks have been buying vast amounts of gold in recent years. In the first quarter of 2024, they purchased more gold than any other period in history.

For most of the 1990s and 2000s, they were selling gold. Gordon Brown sold hundreds of tonnes of our bullion in 1999. Now central banks are buying more gold than at any time since the days of the gold standard.

This started in 2022, right after the invasion of Ukraine.

Turkey bought 147 tonnes.

Egypt and India bought too. Qatar, Iraq, and the United Arab Emirates all followed suit.

As a report from Swiss asset manager Incrementum put it:

And those trends continued in 2023.

China bought more gold last year than at any time since 1977.

Poland’s national bank increased its gold holdings by 57%.

This has already driven the price of gold to a new all-time high above $2,400. Which makes right now a great time to learn everything you can about investing in gold.

Download your copy of “The Gold Report: Why Every Investor Should Own Gold Now” and you’ll see how to do exactly that.

You’ll also get a copy of our newest report, “What to Do With Your Money Right Now”.

This report does exactly what it says on the tin – it shows you, in specific detail:

- The exact stocks you need to avoid like the plague as this shadow currency crash plays out.

- The only FTSE 100 companies you should even consider owning in a crisis of confidence.

- The exact asset allocation strategy we’re recommending all serious investors use right now.

- How much of your portfolio should be tied up in property and other real estate.

But that’s not all. There’s another report we’ve prepared for you. It’s called “The Trade of the Decade”.

Inside, you'll learn about the world’s most essential industry, the one on which all others depend, and in which the world has chronically underfunded and poorly managed for decades.

That industry is energy, and we have three specific recommendations for how investors can profit from both turmoil and transformational advances in the global energy economy.

You’ll get copies of all of these special reports as soon as you become a member of The Fleet Street Letter.

So who exactly will you hear from?

Well, we don’t name all our sources publicly.

That’s private. To meet our team of experts in full, you’ll need to become one of our members.

But there are two people who head up our research in the UK who we can tell you about…

Meet the team

John Butler,

Investment Director, The Fleet Street Letter

There’s me, course. I’m the Investment Director here at The Fleet Street Letter.

I started my career on Wall Street working for Bankers Trust and then Lehman Brothers, advising elite financial institutions about macro trends.

My clients included the investment banks Goldman Sachs, Merrill Lynch and Morgan Stanley, as well as the ultra-conservative Harvard Endowment.

I also advised the world’s largest insurance company – Allianz – with $2.14 trillion in assets under management… plus the hedge funds Moore Capital Management, Brevan Howard and Tudor Investments.

I’ve spent my entire career moving in the world of “high finance”.

In 2007, Sergey Ignatyev, chairman of the Russian Central Bank, invited me to Moscow… to the bank’s HQ, just off Red Square.

Ignatyev wanted advice.

Specifically, he wanted my take on which foreign currency he thought Russia should add to its reserves.

I told him an American banking collapse was just around the corner… and told Ignatyev to hold Japanese yen.

Sure enough, the US banking system collapsed the next year – exactly as I’d predicted. Very few other analysts out there saw this coming.

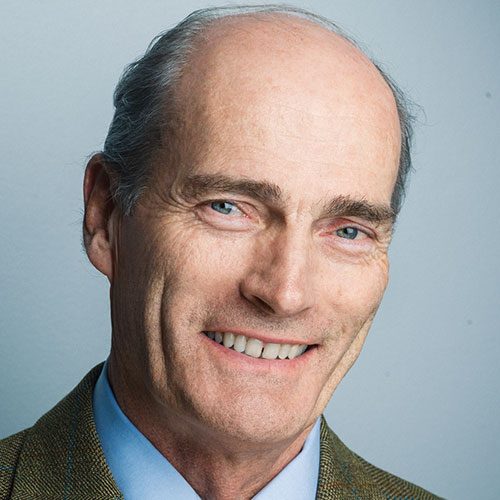

Nick Hubble,

Editor, The Fleet Street Letter

After advising the Russian Central Bank, Deutsche Bank head-hunted me to build an investment system for its asset managers.

The system I built worked so well that Institutional Investor magazine awarded me the prestigious title of “Europe’s #1 Investment Strategist”.

And then there’s our editor… Nick Hubble.

Nick has an incredible track record of making big, controversial calls that turn out to be right on the money.

As far back as July 2020 he predicted a historic surge in inflation was coming.

At the time, central banks were saying inflation was “transitory”. But Nick was right. Inflation soared to a 30-year high… with food and energy up more than 50%.

In July 2020, Nick warned inflation would cause trouble in the bond market…

He wrote:

“The stakes couldn’t be higher for investors. Especially with the alternative – bonds – faring even worse.”

He was right. Bonds crashed into their worst bear market since the 1800s, with some UK government bonds losing 65% of their value in less than two years.

Together, Nick and I steer the ship at The Fleet Street Letter.

And we’re backed up by a global intelligence network which includes many of the world’s leading financial and political experts.

Just to give you a peek behind the curtain as a Fleet Street Letter member you’ll hear from:

Global Intelligence Network

Godfrey Bloom

Godfrey Bloom worked in the City of London where he won an international prize for fixed interest fund management with Mercury Asset Management.

He represented Yorkshire and Lincolnshire in the European Parliament and was a staunch campaigner for Brexit for 25 years.

What’s more, he’s a former officer in the British Army, having graduated Sandhurst in 1976. He is an Associate Member of the Royal College of Defence Studies and has presented papers and lectures to the RCDS, Joint Services Staff College, National Defence University Washington and too many universities to list. His speciality is procurement geopolitical military strategy.

Global Intelligence Network

Nigel Farage

Nigel Farage is probably the single most important British politician of the 21st century. He may divide opinion. But as the recent election showed, his ideas and style are widely popular amongst millions of Brits.

He took on the political establishment – and won. But before his political career, he spent 20 years in the City of London as a broker in the metals markets, like his father and grandfather before him.

Nigel brings all of those connections – political and financial – to his role as a member of the Fleet Steet Letter global intelligence network.

Global Intelligence Network

Daniel Lacalle Fernández

Currently based in Madrid, Daniel Lacalle is Chief Economist at Tressis S.V., Professor of Global Economics at IE University and IEB. He is also an investment fund manager.

Daniel graduated in Business Sciences from the Autónoma University of Madrid and has a PhD Cum Laude from the Catholic University of Valencia.

His career in portfolio management and investing began at the Citadel hedge fund and continued at Ecofin Ltd. and at PIMCO, in the United States and London.

He appears at number 5 in the ranking of the most influential economists in the world, according to Richtopia.

Daniel writes a weekly column in the Spanish newspaper El Español, and collaborates regularly with CNBC, Fox Business and Bloomberg TV, as well as BBN Times, World Economic Forum, Zero Hedge, Hedge Eye, Epoch Times and Mises Wire, among others.

Global Intelligence Network

Federico Tessore

Federico Tessore is our “man on the ground” in Argentina. He’s a serial entrepreneur, investor, author and founder of our sister publishing company in Argentina, Inversor Global. Federico started working in the financial world in 1996, at the brokerage firm Capital Markets Argentina and later worked for Citibank in Buenos Aires. In 2002, he rounded Inversor Global magazine, the first personal investment magazine in Argentina

Today Inversor Global is a multinational company focused on publishing content related to personal finance and economics, with more than 500,000 readers throughout the Spanish-speaking world. In addition to his many career accomplishments, Fede played an unseen role in the election of Argentine President Javier Milei.

Global Intelligence Network

Jayant Bhandari

Jayant Bhandari spent six years working with US Global Investors in San Antonio, Texas, a boutique natural resource investment firm, and one year with Casey Research, a global natural resources research firm. Before emigrating from India, he founded and ran Indian subsidiary operations of two European companies.

He has written on political, economic and cultural issues for the Liberty magazine, the Mises Institute (US), Mises Institute (Canada), Mises Institute (India), Casey Research, Acting Man, International Man, Mining Journal, Zero Hedge, Lew Rockwell, Fraser Institute, Le Québécois Libre, Mauldin Economics, Northern Miner, Mining Markets etc. He is a contributing editor of the Liberty magazine.

Global Intelligence Network

Alasdair Macleod

Alasdair Macleod started his City career as a stockbroker in 1970. Since then, he has fulfilled a number of roles at director level in investment management, corporate finance and banking.

He has been Head of Research for Goldmoney Inc. since 2011. He currently writes a Substack newsletter focusing on money, credit, economics and geopolitics.

Global Intelligence Network

Bill Bonner

Bill Bonner is the co-author of The New York Times bestselling books Financial Reckoning Day: Surviving the Soft Depression of the 21st Century, Empire of Debt: The Rise of an Epic Financial Crisis, and Mobs, Messiahs, and Markets: Surviving the Public Spectacle in Finance and Politics.

In his latest book, A Modest Theory of Civilization: Win-Win or Lose, he explores the progress of society through all its peaks and valleys. Along the way, he reveals the one rule society must follow if it hopes to progress… and shows what happens to those who ignore it.

Bill has started businesses all over the world… employs thousands of people… has made investments on five continents… has acquired more than two dozen businesses… owns hundreds of thousands of acres of land… travels about 100,000 air miles every year… and has launched more than 1,000 advisories with his partners.

In short, Bill opens a window to the world of money and wealth that you won’t find anywhere else.

Global Intelligence Network

Dan Denning

Dan Denning’s belief in free markets, sound money, personal liberty and small government have underpinned everything he’s done during 18 years in the financial publishing industry.

In 1999, he began working remotely with Lord William Rees-Mogg to publish his work in America. In 2004-5 he had the privilege of working directly with him in London.

After writing a book, The Bull Hunter, in 2005, he built a publishing business in Melbourne. It’s now Australia’s biggest and most respected independent financial publishing house.

He returned to London in 2015, founding Southbank Investment Research as the leading independent financial publication in the UK.

Nick and I, along with our global intelligence network, have a very simple mission. We arm you with:

Honest analysis… in-depth research… and advice you can act on

In a world of social media personalities shouting about cryptos and “stonks” that can make you 10x your money, this might sound like an old-fashioned mission.

And in many ways it is.

But after 80 years, we know it’s just about the most valuable offer anyone can make you.

It’s what really makes the difference – between profits and losses, between success and failure, even between life and death.

Our mission at The Fleet Street Letter is to give you good guidance, good advice and good, honest information to help you manage your money.

That’s it. There is no other mission. That’s all we do. It’s all we’ve ever done. And we’re good at it.

We’re not running for office. We’re not celebrities, whose remarks will be taken out of context by the tabloids. We don’t appear on Twitter or on talk shows.

We answer only to you. And we give it to you straight.

Right now we think you need our advice more than ever. The threats we see today are bigger and more dangerous than at any time since the late 1930s.

We’re taking the exceptional measure of reaching out to you today… because we want to help you master the changes we see coming.

Here’s how you join us

Today I’m inviting you to become a member of The Fleet Street Letter.

When you sign up you’ll get access to the reports I’ve told you about:

- “The 21st Century Stinnes Plan”

- “What to Do With Your Money Right Now”

- “The Gold Report: Why Every Investor Should Own Gold Now”

- “The Trade of the Decade”

You’ll also get:

- Regular weekly bulletins from the Fleet Street Letter team.

As you’ve seen, the stakes right now couldn’t be higher.

To make good decisions with your money, you need to know what’s happening in the financial world… and how it will impact you.

That’s why you’ll get regular, to-the-point analysis from the team – to help you “decode” what’s going on in the markets and understand what you need to do about it.

These updates will be delivered by email. You’ll get one every time something you need to know about or act on happens. And they’ll contain everything you need to know to make the right decisions with your money.

- 12 issues of The Fleet Street Letter a year

These longer, in-depth reports take our analysis even deeper.

The financial world moves fast. New trends and threats develop. Old ones die. There’s no one single “set and forget” approach you can take to thrive in the modern financial world.

That’s why our monthly deep-dive reports are so valuable.

They’re your way of staying up to date with the latest thinking, ideas, threats and opportunities.

That might be a new risk developing… a new money-making opportunity… a new position for your portfolio. It depends on what’s happening in the world.

But whatever IS going on… we’ll be there, on your side and in your corner.

You’ll also get:

- Full access to the The Fleet Street Letter portfolio

This is what REALLY sets our work apart from the mainstream.

We’re not just here to explain what’s happening.

We translate that into an entire portfolio of investment ideas you can use to turn that knowledge into action.

Generally speaking, the recommendations we share with you will involve the stock market. That involves risk – as all investing does.

Some of our recommendations may be listed abroad. That may involve foreign currency risk as stocks listed overseas may have the added risk of forex movements.

Every recommendation is for your risk capital only – that’s money you can afford to lose.

We’ll explain this to you clearly with every new recommendation.

In fact, EVERY SINGLE idea we share with you will contain a full write-up of the potential risks and rewards, everything you need to know to make an informed decision and take control of your wealth.

That’s huge.

Think about it.

You can pay £700 for a subscription to The Financial Times...

But NOWHERE in those pages of news will you find a single investment recommendation.

It’s all fluff. All noise. It doesn’t matter how many PhDs the editorial teams have. They’re not sharing anything you can ACT ON.

The Fleet Street Letter is different.

You’ll walk away from almost every issue with a fully researched investment recommendation that ties into our worldview.

And you’ll be in good company.

The Fleet Street Letter has a committed readership of serious investors – some of whom have been following our work for decades.

And, in that time, we have received messages of appreciation for our work, like this note from James Muir, one of our longest-serving members:

I regard it as my investment bible.

James MuirOr this note from Barbara, another satisfied member…

I know I am with an excellent group of experts giving advice for me to then reflect and make my own decisions. I also appreciate and understand the relevance of the historical perspective and intellect documented of previous major historical events and their overall relevance on today’s world. New Investors most certainly try it. It provides independent, forthright information - a sound basis for investment.

BarbaraOur inbox is full of such praise for our research and recommendations:

It’s well written. It's easy to understand. It’s not over adventurous and it talks sense.

John SeamanOf all your titles over about 15 years The Fleet Street Letter is my favourite. It does the research that I'd never have time for.

Colin ByattI based my mortgage decision on The Fleet Street Letter’s forecast and it proved to be remarkably accurate.

lan CarringtonYou have given me the big picture of everything, which Financial Advisors do not discuss – all of the information is valuable to me.

Glenis KelletThe Fleet Street Letter often provides clear insightful analysis of what is going on behind the scenes in both the political and economic arenas. This is critical information for anybody who wishes to successfully navigate the tricky investment waters of today. Keep up the good work and thank you to all the team.

Glyn WilliamsNow it’s your turn to become a part of The Fleet Street Letter.

The cost?

It’s not cheap.

This is serious research and market intelligence designed to help you make good decisions with your wealth and savings.

Quality research doesn’t come cheap.

That’s why a one-year subscription to The Fleet Street Letter costs £249.

That’s a fair price for a team of world-class financial analysts sharing their most valuable ideas AND investment recommendations.

But today you can get your first year for as little as £79 – as part of a special introductory offer.

Just click on the button to get started.

Click here to take up your special introductory offer to The Fleet Street Letter

It’s decision time

In 1938, The Fleet Street Letter published “the scoop of the century”.

Our founder, Patrick Maitland, saw what the authorities couldn’t, or wouldn’t, see for themselves.

He warned about the coming of the Second World War six months before Nazi tanks invaded Poland.

You can go look it up. It’s all on the public record, available at the British Library archives in St Pancras, London.

Over the 86 years that followed, we’ve continued to make one remarkable forecast after another.

- We forecast the collapse of the Soviet Union and the 1987 stock market crash…

- We predicted the rise and success of bitcoin as early as 1997…

- We foresaw the rise of Islamic terrorism before 9/11…

- We warned ahead of both the 2000 Tech Wreck and 2008 Global Financial Crisis…

- … and predicted that Britain would leave the European Union, long before the 2016 referendum.

Today, we’re reaching out to you because we predict something big is about to happen.

And if we’re right, it could have dramatic consequences – for you, and for everyone you know.

In this briefing, you’ve seen what this change means for you… for your money and your retirement… for your business, if you own one… and for your way of life.

But more importantly…

You’ve seen that you, personally, don’t have to suffer.

The research our experts have prepared for you details exactly what you can do with your money right now – simple investment tactics designed to stop you from losing money.

Compared to most people, you will probably become much richer.

But the only way to access our research is to become a member of The Fleet Street Letter.

We don’t post our recommendations online for free. We don’t tweet about them. We don’t publish them in the newspaper.

The only way you can access the research we’ve prepared for you is to become a subscriber today.

Our advice is: Don’t delay.

Don’t wait for something to go wrong before you take action.

Move now.

Prepare.

If we’re right, you’ll be glad you did.

I can guarantee you a very warm welcome from the whole Fleet Street Letter team as soon as you join us.

Simply click on the button below to get started.

Click here to take up your special introductory offer to The Fleet Street Letter

Thank you – and goodbye for now.

John Butler

Investment Director, The Fleet Street Letter

P.S. Don’t be on the wrong side of history when the Shadow Currency blows up again. Click the button below to join us at The Fleet Street Letter today. We look forward to welcoming you.

Click here to take up your special introductory offer to The Fleet Street Letter

Important Risk Warning:

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General – Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get backless that you paid. This makes them riskier than other investments.

Overseas investments - Some shares may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Funds – Fund performance relies on the performance of the underlying investments and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Investment Director: John Butler. Editor: Nick Hubble. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

The Fleet Street Letter contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Ltd.

Source List:

1 Wikipedia – 1976 Sterling Crisis

2 Wikipedia – Black Wednesday

3 Wikipedia - September 2022 United Kingdom mini-budget

4 Gold Eagle - Gold Stocks Were Financial Saviors During The 1930s – 25 October 2008

5 Hargreaves Lansdown - FTSE AIM 100: MARKET OVERVIEW – July 2024

6 Interactive Investor - Benstead on Bonds: the bond crash has broken records – is it finally time to buy? – 18 October 2023

7 Bloomberg UK - Worst Bond Rout in Decades Intensifies with UK Losing 27% - 27 September 2022

8 Financial Times - Pound hits 37-year low against dollar as UK recession fears mount – 16 September 2022

9 How Kwasi Kwarteng’s mini-Budget broke the UK bond market – 28 September 2022

10 Investment Week - Mini Budget: 'The straw that broke the camel's back' - 13 October 2022

11 Metro - UK economy was ‘hours away from potential meltdown’ after Liz Truss’ mini-budget – 4 November 2022

12 CNBC - Bank of England says pension funds were hours from disaster before it intervened – 6 October 2022

13 The Guardian - The mini-budget that broke Britain – and Liz Truss – 20 October 2022

14 BBC News - Number of companies going bust hits 30-year high – 30 January 2024

15 Wikipedia - Patrick Maitland, 17th Earl of Lauderdale

16 The Guardian – Obituary - The Earl of Lauderdale – 8 December 2008

17 The Guardian - How to explain Jacob Rees-Mogg? Start with his father's books – 9 November 2018

18 Payne Hicks Beach - A brief history of the most hated tax in Britain – 3 October 2023

19 CPI Inflation Calculator - The British pound has lost 99.330% of its value since 1909 – 11 July 2024

20 Visual Capitalist - Here’s How Reserve Currencies Have Evolved Over 120 Years – 8 December 2021

21 CPI Inflation Calculator - The British pound has lost 98% its value since 1920

22 UK Public Spending - UK Public Spending Since 1900

23 UK Public Spending - UK National Debt Charts

24 UK Parliament, House of Commons Library - The budget deficit: a short guide – 21 May 2024

25 Tax Payers’ Alliance - Real national debt hits £180,534 per person – 8 March 2024

26 OXFAM International - Richest 1% bag nearly twice as much wealth as the rest of the world put together over the past two years – 16 January 2023

27 Bank of England – Credit is Trust – 14 September 2009

28 Financial Times - What I learnt from three banking crises – 6 April 2023

29 Harvard Business Review - Crisis of Faith in the Financial System – 17 January 2012

30 Statista - Voter turnout in general elections and in the Brexit referendum in the United Kingdom from 1918 to 2024

31 Wikipedia - 1973–1974 stock market crash

32 The Guardian - National archives: Fear of fights at cemetery gates during 1979 winter of discontent – 30 December 2009

33 Wikipedia - Taxation in the United Kingdom

34 The Economics Review - How Soros Broke the British Pound – 16 October 2018

35 University of Portsmouth - Why Black Wednesday still matters – it was the start of markets telling politicians what to do – 15 September 2022

36 Savills - A brief history of the UK housing market 1952 – 2022

37 CNN Business - How meltdown in a $1 trillion market brought the UK to the brink of a financial crisis – 8 October 2022

38 The Standard - Brown 'has raided £100 billion from pension funds' – 13 April 2012

39 Bloomberg – UK government borrowing costs

40 The Telegraph - The accidental PM: Keir Starmer will tax the rich first, and the middle class later – 14 October 2023

41 The Telegraph - Labour plots tax raid on savings and investments – 24 March 2023

42 Mail Online - Labour's CLASS WAR on middle Britain: Secret plan by Starmer to hit the well-off by cutting their access to GPs, libraries and bin collections – 3 June 2023

43 Bright Green - Richard Burgon presents 38k strong petition in parliament calling for wealth tax – 14 March 2023

44 Fortune - Silicon Valley Bank has officially failed after less than a day of panicked selling as the federal government takes it over – 10 March 2023

45 Federal Reserve Bank of New York - Why Did FDR’s Bank Holiday Succeed? – July 2009

46 Business Insider - Greece ATM and Capital Controls Update: Reasons Behind Queue – 10 July 2015

47 The New York Times – Opinion | Who’s Profiting from the Coronavirus Crisis? – 29 April 2020

48 Gold Silver - Surviving the Crash of 1929: How Gold Stocks Defied the Great Depression – 30 October 2023

49 Business Insider - Today's Gold Market Looks a Lot Like the Crazy 1970s – 18 July 2016

50 Gold Silver - The Effect of a Stock Market Collapse on Silver & Gold – 30 January 2024

51 Katusa Research - Junior Gold Stocks Soar, Even When Gold Doesn’t

52 Britannica Money - Hugo Stinnes | Business Magnate, Coal Tycoon, Media Mogul

53 CNBC - The Worst Hyperinflation Situations of All Time – 14 February 2011

54 JVM Lending - Richest Man in Germany Got Rich FROM INFLATION; You Can Too! – 1 November 2021

55 Wealth Playbook - Inflation: Who was Hugo 'The Inflation King of1920's Germany' Stinnes? – 5 February 2022

56 Voima - Gold in crises part 1: German hyperinflation – 24 October 2022

57 Small Caps - China keeps its gold reserves at home — is this a lesson for the rest of the world? – 7 July 2020

58 X.com – The Kobeissi Letter - BREAKING: World central banks' net gold purchases set a new record in Q1 2024 – 8 May 2024

59 Reuters - Central banks bought the most gold on record last year, WGC says – 8 February 2023

60 Nasdaq - Which Central Banks Bought the Most Gold in 2022? – 19 April 2023

61 Incrementum – In Gold We Trust Report – 24 May 2023

62 Incrementum Home Page