Kit Winder, Host, Southbank Investment Research

Ever since this Labour government came into power…

I'd wager there's one question you've been asking yourself:

- How are they planning to stitch me up?

- Will it be a wealth tax?

- Are they going to raid our ISAs, or are they coming for our pensions again?

Well, it turns out life under this Labour government could be far worse than that. What you see in my hand is an official document called the WP 1507.

This document has never been discussed by the talking heads at the BBC.

It's never appeared on Hansard, the Government's official record of Parliament minutes.

In fact, its contents have never been officially signed into law.

And when you see what's inside, it's easy to see why.

That's because this document details what I'm calling a “secret tax” that could take as much as 38% of your wealth out of your hands and into the hands of the government.

What's worse, this secret tax could come into effect in just weeks.

Legendary economist Professor Russell Napier says this tax is a

The FT calls it a new

While the Mises Institute described it as

Nick Hubble,

Editor, The Fleet Street Letter

To explain how this tax could impact your finances, I'm joined by the man bringing it to light.

Nick Hubble is the editor at The Fleet Street Letter, Britain's oldest and longest-published financial newsletter. And a publication that has a proven track record of alerting its readers to some of the most important events in history before they happened.

It predicted the collapse of the Soviet Union…

The 2008 Great Financial Crisis…

And that Britain would choose to leave the European Union.

Each of these events had profound effects on the British people. But Nick believes that the implications of what's inside this document will be far greater.

You see, Nick has calculated that on average…

It's going to cost every person in the UK £14,925 over the next 14 years

That's a shocking statistic.

And believe it or not, he says that this could be just the start of the financial pain.

Because Nick posits this document is about to trigger a brand-new cost of living crisis. One that will eclipse the one we've just been through several times over.

He believes Brits could soon face a nightmare in which energy prices could skyrocket once again…

In which millions of people fall below the poverty line…

Financial markets plunge into chaos…

And in which we witness civil unrest on a scale never seen before in the UK.

Fortunately, Nick says, there is a way to protect yourself from what's about to unfold.

And if you follow the three steps he'll discuss today, you could end up coming out the other side in a better position than when you went in.

Nick, thank you for joining us today.

Thanks for having me, Kit.

Kit Winder:

Nick, these are extraordinary claims you're making.

But they’re claims backed by the extraordinary credibility of The Fleet Street Letter, isn't that right? It's Britain's oldest and longest-published financial newsletter. It's been around for 86 years. And its track record of predicting history's most important events is extraordinary.

Nick Hubble:

After that introduction, I feel the need to say that we don't get everything right, but we have alerted people to the really important issues for almost nine decades now.

For example, over the years, as you've mentioned, my predecessors have alerted the British public to World War Two, the fall of the Soviet Union and the great financial crisis of 2008.

Kit Winder:

Okay, so can we just pause and unpack that for a second? What's the story around predicting World War Two?

Nick Hubble:

Well, that's the one that gets everyone's attention, and rightly so.

So our founder was a British agent. We've also had a few famous communist spies. One of them as editor. But that's another story.

Patrick Maitland started his career in the 1930s as the special correspondent for The Times before he was recruited by the political intelligence department at the Foreign Office.

He famously avoided three assassination attempts, dodged the Romanian Iron Guard in the Second World War and even escaped from Albania as Italian forces invaded.

But away from his heroics for King and country, Maitland lived a sort of double life. He formed a private, independent organisation called The Fleet Street Letter.

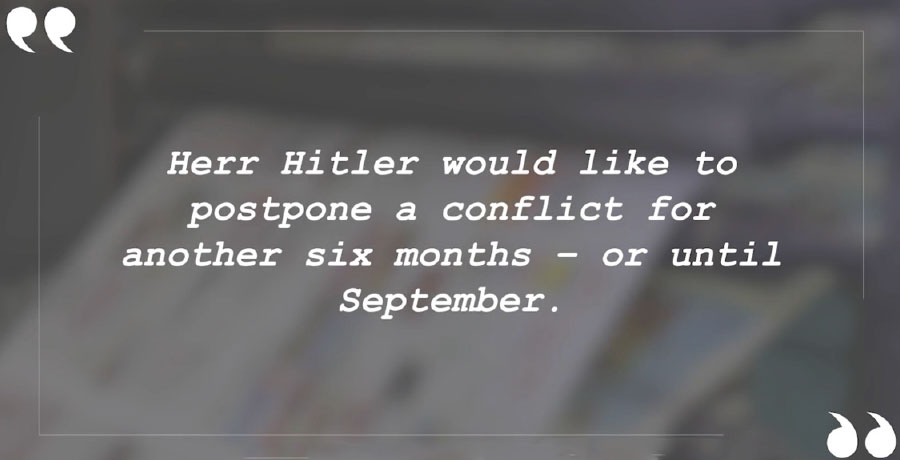

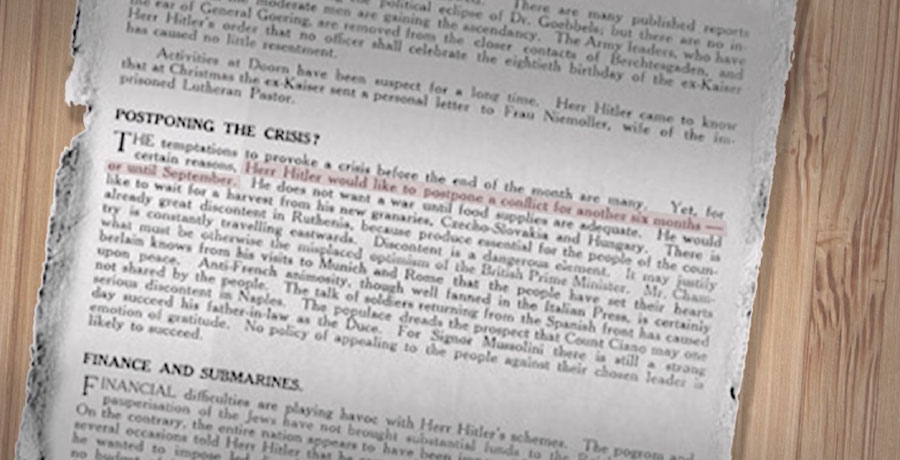

It was with readers of this letter that he shared what would become his most famous prediction after a private fact finding mission to fascist Europe in 1938.

Maitland famously wrote:

As you probably know, on the 1st of September, Hitler's tanks invaded Poland and the Second World War began.

Kit Winder:

And, Nick, you actually have the proof that this happened, don't you?

Nick Hubble:

Yes. So I personally went to the British Library to unearth this particular issue of them, of The Fleet Street Letter. Hopefully, it's on your screen right now.

I apologise for the photocopy. I made that photocopy personally. But at least we've got the proof that we really did make that prediction.

Kit Winder:

Well, I mean, it's a remarkably prescient prediction, but as you alluded to earlier, it wasn't the only one was it?

Nick Hubble:

Not at all. Our warnings are actually a matter of public record available for you to see at the British Library in St. Pancras.

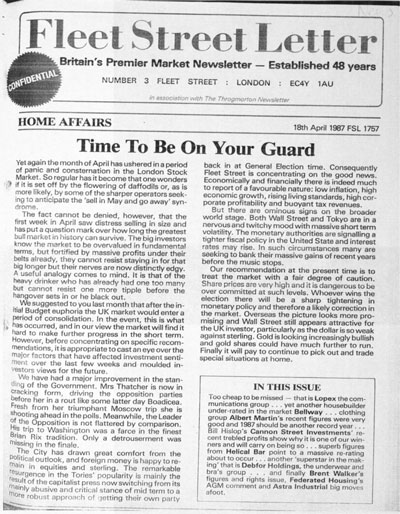

If you take a look as I did, you'll discover that we predicted Black Monday in 1987. We told our readers to be on guard five months before it happened.

We warned of a day of reckoning for the dot com bubble, which resulted in a 77% decline in Nasdaq.

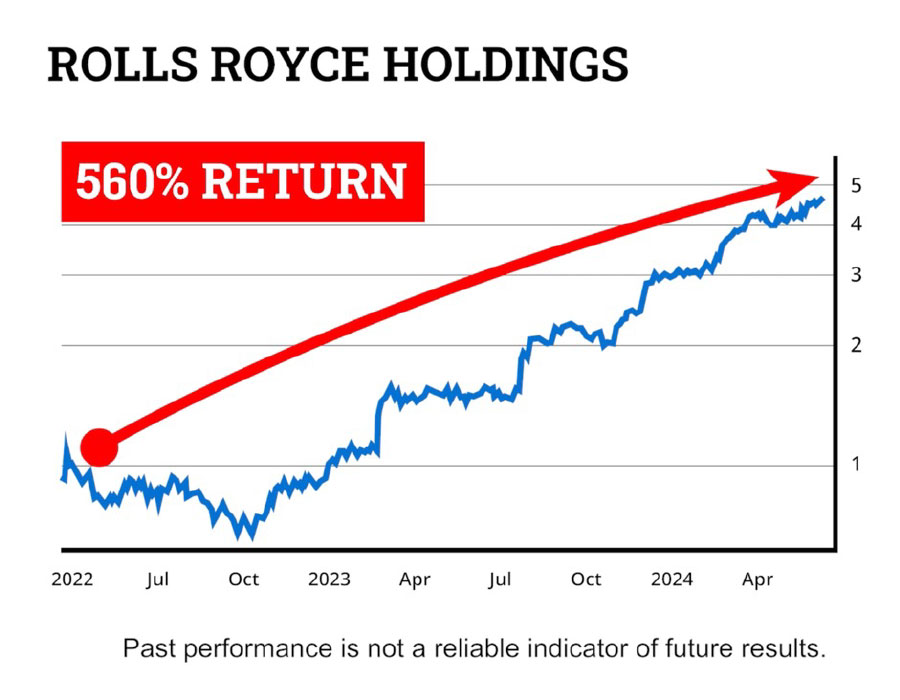

And I personally wrote about nuclear stocks in 2021, and some of my subscribers in Australia are now up 560% on a position in a FTSE100 stock as a result.

5-year performance figures for Rolls Royce Holdings (RR): 2019 -16.28% | 2020 -52.55% | 2021 10.45% | 2022 -24.15% | 2023 221.57%

Kit Winder:

Well, I mean, I think I probably speak for a lot of people watching at home when I ask, how does your team make these predictions?

Nick Hubble:

It's all because of our network at The Fleet Street Letter.

Our reputation means people are willing to work with us. We've built up a sort of a black book of insiders who run deep into the heart of the political and financial establishment.

And the network has included members of the House of Lords, ex-MI5 agents, Soviet spies, former city fund managers, and several of the most influential politicians in British history.

It exists today as what we call the Global Intelligence Network. We actually call it the GIN.

Our mission in that network is to predict the world changing events before they unfold. In fact, two of our own members sent me the very document that you mentioned earlier. I've got my own copy here. They alerted me to what it really means.

Kit Winder:

Okay. So it's referencing this document. What exactly does it prove?

Nick Hubble:

It proves that our government is not led by who you think it is. During the election, you probably heard Sir Keir Starmer's rhetoric. He made a big point of saying that he wouldn't be raising taxes on working people to “fill his budget black hole”.

And that's because Keir Starmer won't be the one raising the taxes. It will be someone else entirely.

Kit, I hope you don’t mind, but for a moment, I want to address the viewers here very directly.

If you're watching at home, I'm going to wager that you've had at least some suspicion that Keir Starmer isn't the one pulling the strings in government.

Well, if that's the case, your suspicions are correct.

Our Labour government has been hijacked by a completely different institution.

In 2015, in Europe, this institution hijacked the Greek government and actually forced it to overturn a referendum.

A referendum concerning austerity and a bailout.

And in doing so, it plunged Greece into a severe recession.

Why? To implement the same tax laid out in the document I'm presenting to you today.

Their debt crisis saw unemployment skyrocket to 28%...

Youth unemployment rise to 50%...

And property prices crashing by 32%...

Not to mention serious nationwide civil unrest…

But it wasn't just Greece.

In 2018, this institution infiltrated a newly elected Eurosceptic government.

At the time, EU supporters were worried that Italy would be the next country to leave the European Union. But this institution co-opted the government and put a stop to that.

It implemented the same tax, triggering the worst period for financial markets since 2008.

Well, I'm here to tell you the document I'm holding in my hand is the playbook this institution has used in each of these countries.

It was written for Greece, used in Italy, and now it's being implemented in the UK.

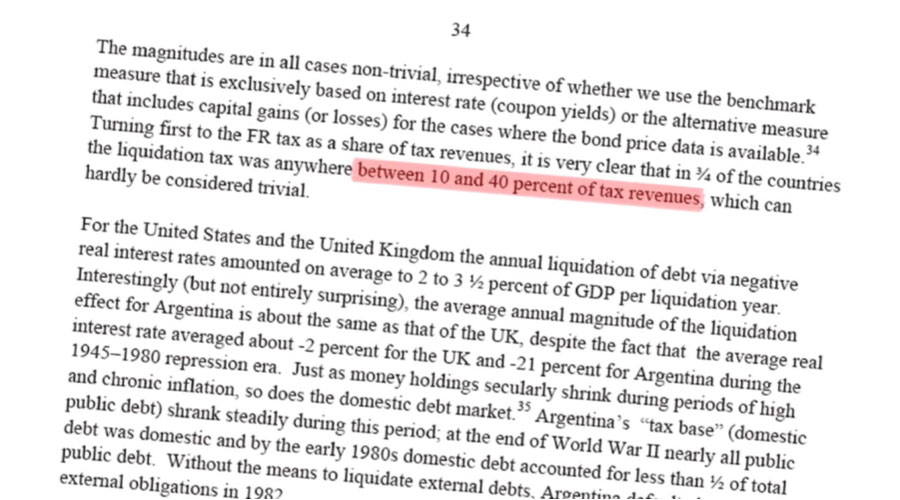

In fact, here's just one quote from this playbook. It says this tax can amount to as much as between ten and 40% of tax revenues.

Now, no government in their right mind would impose an additional 40% tax on its people, at least not a democratically elected one, even with the 246 seat majority.

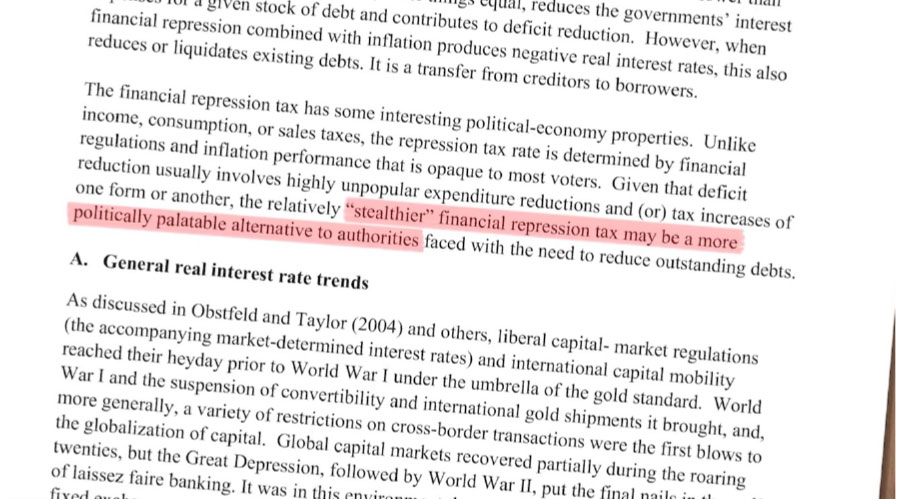

That's why the report goes on to say “the relatively stealthier financial repression tax may be a more politically palatable alternative to authorities.”

Now, these alphabet agencies like to use that doublespeak.

So, let me just spell out exactly what this really means.

It means the powers that be have a way to tax you that will generate up to 40% of their tax revenues without ever having to sign a tax into law.

It's incredible, isn't it?

In fact, as the document states, most people, including politicians, don't even notice that this is a tax at all.

They don't know who levies it, nor who to blame for the devastation it causes.

My mission today is to show you at home the man that's really pulling the strings of this government,exactly what this tax is and how to protect yourself from it.

I also want to detail some investments that could actually profit off of the back of it.

Kit Winder:

Okay, Nick, so let's get into it then. Firstly, who really holds the power in our country?

Nick Hubble:

That's easy. It's the governor of the Bank of England, Andrew Bailey.

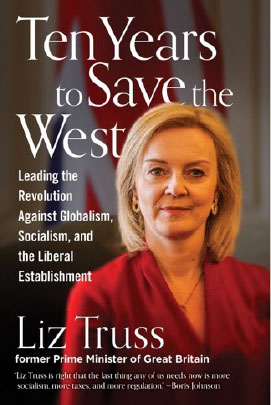

A few months after she resigned, Liz Truss began to claim she'd been undermined by the Bank of England.

She even published her claims in a book. She wrote…

“I knew the [Bank of England] would resent being challenged… I had not appreciated just how ruthless they would be”

It became a question of who had more power of economic and fiscal policy. The elected politicians or the unelected technocrats. As I soon discovered, the answer was worryingly clear. It was them”

– Liz Truss, Ten Years to Save the West

Of course. We all thought she'd turned into a bit of a conspiracy theorist.

In fact, her own former chancellor, Kwasi Kwarteng, called it a conspiracy on a podcast with Alastair Campbell and Rory Stewart.

But I did some digging out of curiosity, and I'm still shocked by what I found. Lately, Liz Truss's view has become increasingly credible. Mainstream media have stopped ridiculing Truss and started to ask some awkward questions.

Kit Winder:

Yes, I mean, I think we all had a laugh at the time when the book came out and we saw that claim. But you're saying that she was more right than she realises?

Nick Hubble:

Exactly. And it's not just a case of a stopped clock being right twice a day.

She's referring to the bond market crisis of September 2022.

If you can remember, Liz Truss's leadership campaign was based on promises of economic growth, tax cuts and reform of the Bank of England, who she blamed for inflation. So there was always going to be some sort of standoff here between the two.

Truss and Kwarteng tried to release a budget, delivering on those promises.

But when they did, all hell broke loose. Bond markets crashed.

My claim is that the Bank of England either engineered or allowed the bond crash in order to oust Liz Truss.

Kit Winder:

Okay. Can we just pause for one second here? Is it possible to explain to our viewers why the bond market crashed and why that's even important?

Nick Hubble:

Sure. So, let me first define exactly what the bond market is.

It's where the government borrows money.

It does so by issuing bonds.

Just as companies issue shares on the stock market to raise money, investors who buy government bonds are effectively lending government’s money. This is because bonds are considered safe investments, they have become the foundation of the financial system.

They’re held as investments by our country's most important institutions: pension funds, banks, big corporations, that sort of thing.

Because of this, if the value of the bond falls, it can trigger a chain reaction in the financial system.

Kit Winder:

And over the past two years, we've learned that bonds are not risk free at all, right?

Nick Hubble:

Right. So, some major U.S. banks actually went bust in 2023 because the value of their government bonds crashed.

There are two ways bonds can get into trouble.

One is a default. If the government refuses to pay back the loan, and that hasn't really happened.

The other is inflation, which has happened a lot lately. Bonds are promises to pay back money in the future, but the value of that money can fall in the meantime.

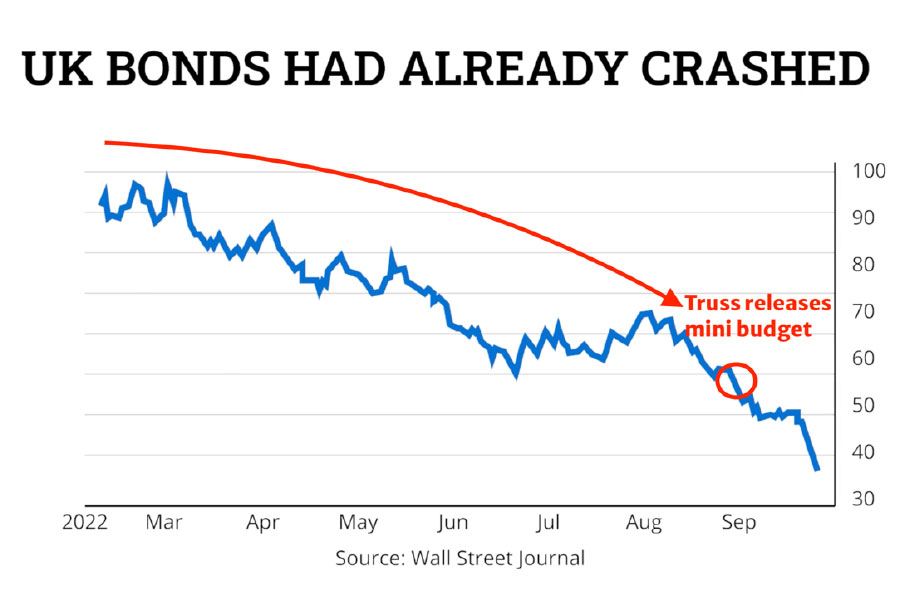

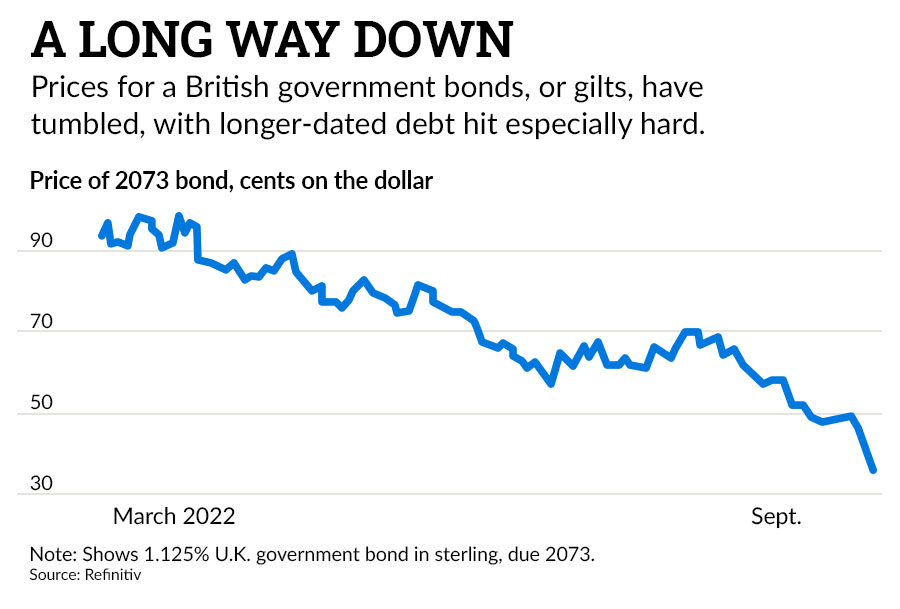

So when investors get a whiff of any inflation, they start panic-selling bonds. That's why the price of some UK government bonds fell about 60% starting at the beginning of 202 panic sell 2.

Kit Winder:

Okay. But most people probably thought that the mini budget crashed the bond market.

Nick Hubble:

No, the bond market had already crashed by the time the mini-budget was revealed in September.

And that's the key. The market was teetering on the edge when Truss and Kwarteng released their budget. But let me give you the official version of what happened first.

As a result of crashing bond prices, all those big institutions holding safe bonds were sitting on whopping losses.

And then came the shock that Liz Truss and Kwasi Kwarteng budget caused.

It pledged to increase government spending, even more, which means issuing even more bonds.

It was the straw that broke the camel's back. There just weren’t going to be enough investors to buy all these bonds. The additional plunge in price triggered a chain reaction that almost brought our pension system to its knees.

They were forced to sell bonds at a whopping loss.

Kit Winder:

And what implications did that have?

Nick Hubble:

Well, it had several implications. First, it meant that the pension system came within hours of collapse.

This forced the government to reverse all of the pledges in its mini budget.

And then the government had to take additional measures to please the bond market. It did that first by firing Kwasi Kwarteng, our Chancellor.

And second, by forcing Liz Truss herself to resign.

Kit Winder:

I actually remember around that time seeing the headlines about the bond market following Liz Truss. But that still doesn't explain why Liz Truss is saying that Andrew Bailey fired her?

Nick Hubble:

Well, the media are only half right.

They were right about the fact that the bond market controls the government. But the Bank of England controls the bond market. It does so in two different ways:

The first way is interest rates. Just like people, the government is subject to interest rates. And interest rates have gone up a lot.

Mortgage payments on the average home in the southeast of England have risen by about £500 per month.

People are cutting back on things, vacations, eating out their subscriptions.

It's exactly the same for the government. When interest rates rise, it squeezes the rest of the budget.

This allows the Bank of England to squeeze the government financially by raising interest rates as it did the day before the mini-Budget.

And the government's interest payments have gone through the roof as a result of the higher rates.

The second way is more direct.

As part of its monetary policy, the Bank of England buys and sells government bonds.

This obviously has an impact on their price, allowing the Bank of England to manipulate government bond prices.

But it goes deeper.

You see, the government has to remortgage or refinance a small share of its debt almost every single week.

But if it fails, the whole bond market crashes. In a crisis, The Bank of England is supposed to support the government by buying bonds.

It did so in 2009 after the financial crisis and after the pandemic in 2020.

And of course, it did so in 2022, eventually.

But it's a choice.

That is the Bank of England's power. And it's a big threat.

It can refuse to buy bonds during a crisis, leaving the government high and dry.

Or it can choose to support the government during a crisis.

Liz Truss, in a recent interview, said she resigned because of the threat that the Government would not be able to finance itself.

That threat is not supposed to even occur in the first place because the Bank of England is supposed to act as a backstop.

There's a simple analogy that explains all of this a bit simpler.

A drug dealer has no control over their customer until they're addicted. Once the customer's addicted to the drug, the drug dealer can charge any price and demand anything by threatening to withhold supply.

That's the relationship between the Bank of England and the government. The Bank of England prints money and sets interest rates.

It can demand anything of the government because the government is addicted to cheap interest rates and money printing. And that's how the Bank of England controls the government.

Kit Winder:

Okay, so that's a great explanation and I like the analogy, but can you take us through what actually happened then?

Nick Hubble:

Yeah, it's the actual sequence of events that makes it obvious what really happened to Liz Truss. And creating a timeline is how I realised what the real story was.

22nd September 2022

- Bank of England holds monetary policy meeting

- Raises interest rates from 1.75% to 2.25%

- Announces sell off of £80 billion bonds

So, the day before the mini budget, the Bank of England held its monetary policy meeting. At the time it already knew what the government's radical mini-Budget would do the next day. But it decided to tighten monetary policy dramatically, anyway.

It decided to raise interest rates by half a percent to 2.25%, the highest level since November 2008 – despite declining GDP.

It also announced the Bank of England will be selling £80 billion worth of government bonds it had bought during the pandemic.

This combination made the bond market incredibly fragile.

The Bank of England's higher interest rates…

The Bank of England's announcement that it would be selling bonds…

And the fact that bond markets had already been crashing at an all-time record pace for months….

It all had the bond markets on the ropes.

23rd September 2022

- Truss announces mini budget tax cuts

- Bond market continues to crash

- Andrew Bailey doesn’t intervene to stop the crash

And then the government announced its mini budget tax cuts, which would mean even more borrowing by issuing even more bonds.

That's the final straw that broke the camel's back.

But it was only the final straw after the bank of England had weakened the bond markets by allowing inflation to spike out of control…

And then by tightening monetary policy rapidly, the day before a new government's budget.

Kit Winder:

Are you saying that this was a deliberate act of sabotage, Nick? Did the Bank of England deliberately weaken the bond market in advance of a controversial government budget in order to try and discredit that government?

Nick Hubble:

We don't know that for sure. I thought it was an absurd idea until I spent time researching what actually happened and took a close look at the specific sequence of events.

But that's only the start anyway. Perhaps more importantly, Andrew Bailey didn't intervene to stop the crash for five very long, very stressful days. This is an extraordinary thing.

For more than 300 years it was the Bank of England's job to keep the bond market functioning smoothly. They did so countless times in the UK's history.

But they allowed it to fall apart on the day their biggest critic, who was threatening to reform the Bank of England, released her first budget. Then something happened that they didn't expect.

27th September 2022

- Pension funds start to go broke

Pension funds started to go broke. These funds owned a lot of government bonds and they'd lost too much money on them.

28th September 2022

- Bank of England is forced to rescue bond market

This forced the Bank of England to intervene and rescue the bond market because something other than the government that they were trying to undermine was in trouble.

But the damage to the government had, of course, been done.

3rd October 2022

- Truss and Kwarteng reverse tax cuts

By then in an attempt to keep their jobs trust and Kwarteng reversed all of the tax cuts, but it was too little too late.

Then came another big hint that it's the Bank of England who's in control of the government.

14th October 2022

- Liz Truss fires Kwasi Kwarteng

Truss fired Kwarteng the very day the Bank of England's bond market rescue programme was set to end. A clear signal that Truss was bending the knee to the Bank of England.

But then the pressure on her to resign became too great as well.

20th October 2022

- After just 45 days in office, Liz Truss resigns

After just 45 days in office, she handed in her notice.

This headline from the Wall Street Journal couldn't make it any clearer.

Kit Winder:

Okay. So obviously, this is a pretty worrying state of affairs. It looks like our politicians are beholden to unelected bureaucrats. But if this is the case, why wasn't it true five or ten years ago?

Nick Hubble:

Because governments weren't addicted to low interest rates and money printing.

Yet when governments borrowed too much money, they begin to rely on the central bank to keep them funded in a crisis. Central banks can create an infinite amount of money and buy government bonds.

They're not supposed to do this because it causes inflation. But during a war, pandemic or financial crisis, it's considered acceptable.

Over time, our government debt has grown so large that we're constantly on the cusp of a crisis as the Kwasi Kwarteng budget demonstrated.

And so central banks are constantly having to back governments by buying their government bonds. It's like a recreational drug user who's become completely addicted. The government is now completely beholden to the Bank of England because it relies on the Bank of England to bail it out.

Nick Hubble:

We don't know at which point we cross the line of the government becoming an addict. But the trust moment proves that we have crossed that line at some point.

Kit Winder:

Okay, understood. Now, I just wanted to recap what we've gone over for our viewers. As I understand things:

- The British government has taken on so much debt that it is now reliant on, and therefore beholden to, the Bank of England for financial support.

- The Bank of England can choose to support or refuse to support the government depending on whether it approves of the government's policies.

- And the most glaring example of this we've seen was in September 2022, when the Bank of England forced Liz Truss and Kwasi Kwarteng to U-turn on their fiscally expensive policies, not to mention the threat to reform the Bank of England. Am I correct?

Nick Hubble:

That's right. You nailed it.

And of course, they managed to get rid of Truss and Kwarten as well. This is now the status quo in the UK.

The Bank of England has the ultimate say on what the government can and can't do on financial policies.

And in a moment, I'm going to show you the Bank of England is about to implement what we're calling an invisible 38% tax on the British people.

But first, I just want to mention that it's not just me who's realised all of this. For example, I want you to read some quotes from the journalist Camilla Tominey, two days before we recorded this:

“The Bank of England is selling bonds at a loss and actually costing us the taxpayer money. And yet there seems to be no accountability by the Bank of England for doing this.

So what's happened here? Is the Bank of England out of control. It's now setting fiscal policy independence, a spiralled beyond what was originally intended.”

Camilla Tominey, associate editor of The Daily TelegraphAnd the second quote:

“Is there a finger of blame to be pointed at Andrew Bailey & co? It seems to me that the Bank of England has extended its reach far beyond its original remit.”

Camilla Tominey, associate editor of The Daily TelegraphAnd I want to mention another quote here from Sir John Redwood. He's a former cabinet minister, also from two days before we recorded.

“It was mainly the Bank of England that destabilised the market and they knew how to stabilise it.”

Sir John Redwood, Former Cabinet MinisterWhen I first pointed all of this out just a month ago, it was highly controversial. These days, not so much.

Kit Winder:

I mean, this is all quite so ordinary, and all these other people are noticing as well. The momentum is clearly building behind the idea.

But you mentioned earlier that this situation has actually happened before. Is it is it possible to elaborate on those examples?

Nick Hubble:

Yeah, it's happened several times. It's almost tradition in Europe at this point because of all that government debt.

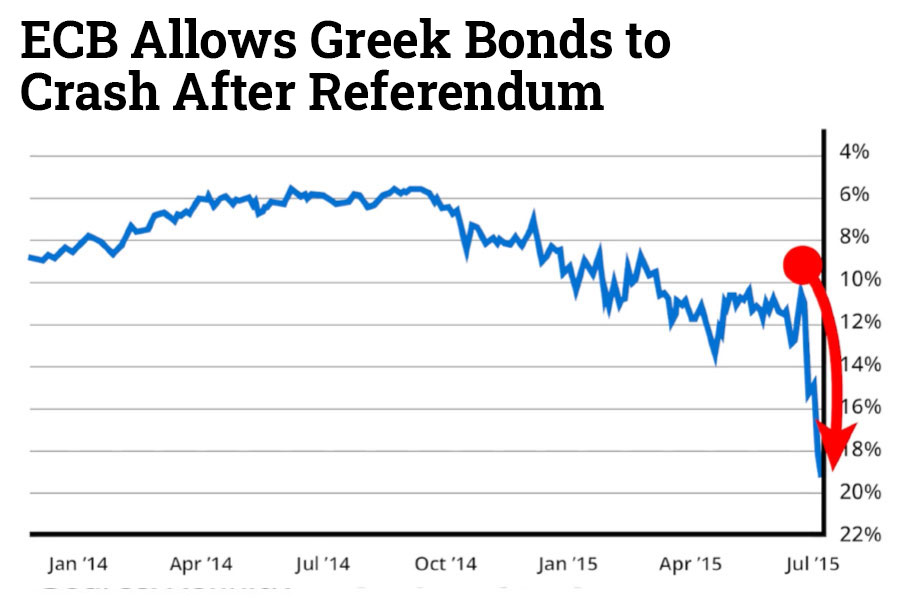

It all started in 2015. The central bank overturned a referendum in Greece.

You'll probably remember the Greek government was in too much debt. So the ECB wanted to impose austerity. The Greeks held a referendum on austerity and rejected it. And so the ECB allowed the Greek bond market to crash, basically pulling the financial plug on the Greek government.

So the government gave in and had to enforce austerity measures.

Anyway, the point is, by selectively supporting or refusing to support Greek government bonds, the European Central Bank was able to co-opt the Greek government into doing whatever it wanted.

And we can see the consequences of this and how it played out in this chart of Greek government bonds crashing.

Kit Winder:

Okay. And long time readers of your research, Nick, will be well aware of everything you've written about Italy in the past.

And that's also a pretty extraordinary case, am I right?

Nick Hubble:

Yes. This is the textbook case.

A Eurosceptic government came to power in Italy in 2018.

It wanted to spend money and cut taxes. The ECB rejected this and allowed the bond market to crash.

The Italian government folded on all of their demands and gave in to the European Union. In this case, the process of negotiations and bond market crashes repeated several times.

Italian politicians eventually realised what was going on and accused the European Central Bank of blackmail. Italian politician Claudio Borghi explained it in 2008:

“In a way I'm very happy because we finally write the bull**** off the table. We know that it is a choice between democracy or comfortable government bond spreads. We can't have a government that displaces the markets or the spread club.

“The ECB and the Eurogroup will use this to crush your economy. You are lucky in the United Kingdom that you still live in a free country.”

Claudio Borghi, Italian politician and businessmanRemember the Borghi said that in 2018, before the UK government became reliant on the Bank of England for its funding.

The result of all this instability in Italy was the worst year for stocks since 2008.

So, here's the key point.

Central banks are manufacturing bond crises so that they can implement their own policies.

As you'll see in a moment, the Bank of England has its own policy laid out in the document – WP 1507 – that will affect the lives of everyone in the UK negatively.

Kit Winder:

Okay, so we've seen Greece, Italy. I mean, are there any other examples?

Nick Hubble:

Yeah, it's just happened in France, actually. You'll probably remember, bond markets crashed after the first round of elections when it looked like the National Rally Party would win.

Then bonds magically recovered when France ended up with a hung parliament after round two. The first crash was the central banks warning: “Do not vote for a right wing government or you’ll face the same consequences as Greece and Italy did”. So the French didn't vote for a right wing government.

They listened to the warning.

It's also worth pointing out that the reason Japan is able to sustain a debt to GDP ratio of 260% is because the government sticks to what the Bank of Japan wants it to do.

And so the Bank of Japan is willing to buy the government bonds. So as long as you do what your central bankers want, they're happy to fund your deficits.

But if you diverge like Liz Truss did and like the Italians did and like the Greeks, did, you get into financial trouble as the bond market suddenly crashes?

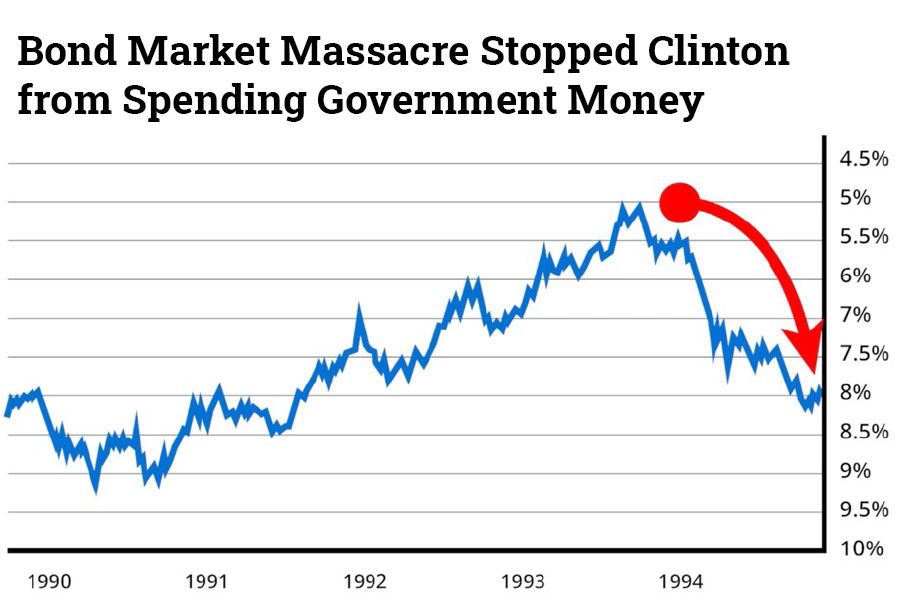

It's also actually happened to the world's largest superpower, the U.S.. President Bill Clinton was elected to spend a lot of money. That was his election platform. But he was forced to become a fiscal conservative because the bond market crashed.

It lost 1.5 trillion U.S. dollars. They called it the great bond market massacre.

There's a famous quote about all of this from Clinton strategist James Carville. He said:

Kit Winder:

Nice quote, Nick. So the Bank of England has taken control of the government. But how do you know that they're going to impose a hidden tax?

Nick Hubble:

So, we've got to go back to 1944 here before the end of the war.

44 national leaders got together in a room, to lay out what the post-war monetary system would look like.

They called it the Bretton Woods system because that's where they met to come up with a system. It made the US dollar the reserve currency.

But they also made another little known decision the creation of the IMF.

Its mission is to oversee the International Monetary System.

And that's what they're doing today. It's giving central banks their marching orders by laying out what policies they should implement.

They're all laid out in that report from the IMF in 2015. The Fleet Street Letter’s investment director John Butler recently interviewed a member of our Global Intelligence Network, Godfrey Bloom, who's a former MEP.

Godfrey Bloom:

So that committee had no more idea about economic strategy, the fly to the moon. But then, of course, neither do the central banks. So, all the leaders of the central banks and I mentioned this at the time when the new man took over from Carney, he was a box to at that box tickers. They're told what to do by the IMF and the Bank of International Settlements, all part of the U.N. It's all part of the WEF program.

Nick Hubble:

He confirmed exactly what I'm saying.

Kit Winder:

Okay. But why are they doing this?

Nick Hubble:

Well, the Bank of England's job is financial stability.

And right now, the biggest risk to the UK is the government's debt.

Now, politicians have no hope of solving this problem. Nobody wants to hear a word austerity. And so the Bank of England is taking matters into its own hands. It is forcing the government to impose the policies that will help the country pay down its debts.

And it's using what we've named a hidden tax laid out in this document to do so.

Kit Winder:

And what is detailed inside this document, then?

Nick Hubble:

They call it a “liquidation tax” because it liquidates the government's debt.

The trouble is the government's debt is also your asset.

Your pension fund probably invests in government bonds. So if those bonds get liquidated, there is a likely chance that you will become poorer.

That's why we're saying that this is a tax. It's a transfer of wealth from you to the government.

It gets even worse.The liquidation tax is actually a combination of high inflation and low interest rates.

This means your investments are an artificially low interest returns. While the value of those investments falls adjusted for inflation. If inflation is 5% but interest rates are also 5%, then you're breaking even as an investor.

But the liquidation tax is all about keeping those interest rates below inflation.

So the value of your investments falls while you don't earn enough returns to compensate you for it. The inflation reduces the government's debt by making it worth less over time.

Not many people understand how inflation does this. But anyone with a mortgage will have benefited from it over the past decade. Inflation eroded the value of your mortgage over time.

It's the same for the government, and it's the one thing that all economists from all ideologies can agree on.

For example, I'll give you some quotes. Thomas Sowell said:

Milton Friedman famously said:

And John Maynard Keynes said:

The liquidation tax has already worked in Greece, Portugal and Spain.

Inflation cut the debt enormously in those countries.

I think it cut it by 25% in the case of Greece in just one year.

In fact, this process actually worked in the UK.

It's just that the government spent so much money, it masked the debt-cutting effect of the liquidation tax. The liquidation tax can be so powerful that it becomes more important than other taxes.

As the IMF's research paper makes clear:

All this can be engineered by the institution that is responsible for inflation and interest rates.

The Bank of England, which is completely out of the government and voters’ control.

And the IMF research report points out this is actually a strength because it can be imposed over and above the government's will.

Kit Winder:

Okay, Nick, so how is this actually going to affect people's lives here in the UK?

Nick Hubble:

Well, if you think the pain from the cost of living crisis is over, think again.

I'm sure you can recall the inflation we just went through.

Food, fuel and insurance bills went berserk, far worse than the official statistics would suggest. Stocks and bonds crashed as well.

Pensions almost went bust altogether as a result. In the U.S., several banks did go bust.

What I'm predicting, based on the IMF report, is that the Bank of England will engineer repeated waves of inflation like the one we just experienced.

That might sound controversial, but the Bank of England has done it several times before.

The IMF report details and analyses those episodes because they were a success. A liquidation tax paid down government debts to manageable levels.

It did so after the Napoleonic Wars and the World Wars, and the Bank of England is far from the only one.

The liquidation tax has been used many times before by many different countries when they faced too much government debt on average, according to the IMF.

The liquidation tax takes 17 and a half years to bring down government debt levels.

You might have noticed that this tends to occur after a war.

That's because of how much debt governments borrowed during a war. A pandemic is, of course, quite similar.

But over the last few weeks, I've become convinced that the liquidation tax is most likely to be imposed again when Labour pledges huge spending for net zero.

It'll be the Bank of England's excuse to trigger the liquidation tax because they are firm supporters of action on climate change.

Kit Winder:

Am I right in thinking that this isn't actually the first time you've made these claims?

Nick Hubble:

That's right. I first started warning about it in July of 2020. I warned my readers of The Fleet Street Letter: “Inflation is back with a vengeance.”

And I also explained: “why inflation must get out of control on purpose.”

The reason, of course, being “inflation is the only way out of this much debt.”

I specifically warned that “inflation's effect on the bond market, where much of Britain's pension assets are invested, is of course disastrous.”

And it was. What I'm doing today is warning that a second wave of this inflation is about to begin in the same way for the same reasons with the same outcomes.

Kit Winder:

Okay, so Nick, it's clear that the powers that be are bent on unleashing another wave of inflation.

But I'm hoping you've got some thoughts on what could actually help our viewers.

Nick Hubble:

Yeah. So first off, they should get their hands on a guide I've put together.

It's called The Bank of England is Coming for your Savings.

It's a comprehensive guide to understanding the situation and what's in the IMF working paper.

If you read it, everything we've been talking about will be completely clear, and you'll understand what the Bank of England has planned for you over the next decade.

Kit Winder:

It seems like the most important thing might be what not to invest in?

Nick Hubble:

Yeah, so not all investments get liquidated evenly under a liquidation tax.

That's why I've prepared a report called Five Toxic Timebomb Investments to Sell Now. It reveals which investments will get hit the hardest.

Kit Winder:

Okay. And I'm sure viewers are going to want to go away and read about those. But would you maybe be willing to reveal one of those for us now?

Nick Hubble:

Yeah, sure. I'll give away a simple one here. For the liquidation tax to work, it has to trap investors in government bonds.

It has to force us or our financial institutions to own government bonds despite their value plunging and the interest returns being too low.

I believe the government will pressure or even force pension funds to own government bonds.

So I recommend people own their investments outside of the big major funds where they have little control over how their money is invested.

They should instead use means of investing that gives them control over what they own.

You'll find out how to download this report and learn about our other four toxic timebomb investments in a moment.

But there's also a third report actually called Age of Inflation Attack Plan.

In that report, the investment director of The Fleet Street Letter reveals which investments you should own if you agree with us that the liquidation tax is coming.

Of course, The Fleet Street Letter’s track record is not perfect.

This is just what we believe is the most likely outcome of the government's debt over the next few years. And please remember the full investing has risk.

Kit Winder:

Okay, so there really is quite a lot out there for viewers to get their teeth into in terms of understanding the depth of material and evidence behind all this.

And for everyone watching at home, all of this is available to you when you take up subscription to The Fleet Street Letter.

The Fleet Street Letter is where Nick shares his insights about markets.

It exists for one sole reason.

To help you understand the deep changes happening in the world before everyone else and to show you how to benefit from them financially.

As we've said, in the past, that deep change has included World War Two, the Black Monday market crash, the rise of crypto and the great financial crisis of 2008, all of which we've mentioned today.

But the change that we've discussed today is the shift in power from politicians to central bankers.

Over the years, our organisation has included employees, members of the House of Lords, ex-MI5, Soviet spies and a former city fund manager of global Intelligence.

That network today includes the leader of the Reform Party, Nigel Farage.

Former MEP Godfrey Bloom

Former Citadel fund manager Daniel Lacalle Fernandez.

And the man said to have played an unseen role in the election of Argentine president, Federico Tessore.

Finally, there's Goldmoney’s head of Research, Alasdair MacLeod.

And the founder of Southbank Investment Research himself, Bill Bonner.

So Nick, can you just quickly give us some detail on the publishing schedule of The Fleet Street Letter?

Nick Hubble:

Sure. We don't usually issue three reports on just one topic, but this is the biggest warning we've given investors since that famous warning about World War Two way back in 1939.

Our publishing schedule usually looks like this.

We provide regular weekly updates to keep you up to date on our predictions and themes that we're following…

A monthly issue which gives investment recommendations…

And please note that all this investing carries risk and may not be for everyone. You have to decide for yourself whether you want to follow our recommendations or not.

And we also issue some occasional ad hoc updates and alerts, should anything urgent happen.

Kit Winder:

Thank you, Nick. And if the testimonials that the readers sent you are of any indication, they're incredibly happy with your work. I think you should be able to see some of those on the screen now.

So just to recap, here's a reminder of everything that you get when you take out your no obligation to The Fleet Street Letter.

Firstly, the Bank of England is Coming for Your Savings.

The first report, which lays out the Bank of England’s 17-and-a-half-year plan to liquidate your pensions and pay off the national debt.

Then there's Five Toxic Time Bombs to Sell Now.

These five toxic assets are especially vulnerable as this invisible tax roils markets. But if you sell them now, you should be able to sidestep that collapse.

Finally, you'll get the Age of Inflation Attack Plan, a report which reveals the special kind of stocks that can thrive amid high inflation.

The key question now is how much does it cost?

In the city, this type of investment grade research would cost thousands of pounds. But at Southbank Investment Research, we want to lower the barriers for entry for everyday people.

That's why today, the retail price for a one-year subscription to The Fleet Street Letter is just £249.

But given the urgent significance of everything you've seen and heard today for a very limited time; we're offering The Fleet Street Letterfor just £99 per year and a 60% discount.

If you'd like to take us up on that offer, simply click the button below.

And you'll be taken to a secure order form where you can review everything that's on the table.

Forecasts are not reliable indicators of future results.

Given this policy could come into effect in just weeks. We feel there's an urgent opportunity for investors to profit and protect their wealth, and that's why we're offering this short term discount.

Click here to join The Fleet Street Letter.There you have it, everyone.

Nick has just shown us examples from all over the world of central bankers pulling the strings of politicians in the UK. The US, Italy, France, Greece and elsewhere. Now they're getting ready to do it in the UK once again.

The proof to my mind is incredibly compelling and the only question that remains is will you be prepared in as little as a few weeks?

Will you be caught off guard by the next bounce of inflation?

Andrew Bailey will insist no one could have foreseen all. When the bond market is reeling again, will you be among those looking at your pension fund with a sinking feeling?

We hope not. And that's why, in addition to revealing free and actionable insights today, we want to make your decision to join The Fleet Street Letter as easy as possible.

Join today and you’ll be backed by our 30-day 100% money back guarantee

Join today and not only will you receive all of the professional research we've described today for just £99 – or a 60% discount from the retail price and well below the thousands, you'd be charged in the city – but you'll also be covered by our ironclad 30 day money back guarantee.

What that means is you'll have 30 days to peruse the research…

The full Fleet Street letter archive at your leisure…

Decide if it's right for you...

And if not, simply call our friendly customer support team for a full and prompt refund.

You'll get your £99 back, no questions asked.

And you'll be able to keep all the research we've sent you today for free, forever. Why are we doing this? Two reasons, really.

Firstly, because we know that you have to try our work first to see if it's the right fit for you. A no obligation 30-day trial is the right way to do that.

But more importantly, as you've seen, we're at a unique moment in British history, arguably a once in a century moment.

And those who don't act in the next 30 days could fall prey to the IMF's invisible tax that Nic is so brilliantly laid out for us.

So don't delay. You can secure all of the research reports we've covered today in seconds by clicking the button below now and entering your information in the secure order form.

Click here to join The Fleet Street Letter.Remember, you'll get instant access to the three reports:

The Bank of England is coming for your savings…

Five Time Bombs to Sell Now…

And the Age of Inflation Attack Plan.

But, Nick, I'll turn it over to you before we sign off. Any parting words for anyone watching tonight?

Nick Hubble:

Yeah. The last thing anyone expects right now is for inflation to make a big comeback and for the new government to be completely powerless.

That's why you need to join us before this dawns on the rest of the country, just as it did in 2022.

The same information back then could have seen you sidestep some disastrous crashes in markets and understand precisely what was going on.

Kit Winder:

Nick, thank you so much.

I think you've given everyone a hugely easy decision to make today.

It's definitely been enlightening for me and I'd like to give everyone watching at home one last chance to join The Fleet Street Letter.

Forecasts are not reliable indicators of future results.

Take advantage of everything that's been described tonight, especially our full briefing on the IMF's plans. What you stand to lose, how you protect yourself and even how you could profit.

So once again, click the button below and you'll be able to take up your trial membership and download your special reports with no obligation whatsoever.

That's all for tonight. To everyone watching, I hope to see you on the other side. Thank you very much indeed.

Please replace with a version that doesn’t have kit in the background

Waiting on Bhav’s updated version of this chart

Click here to take up your 30-day trial to The Fleet Street Letter

That's all for tonight. To everyone watching, I hope to see you on the other side. Thanks very much.

Click here to take up your 30-day trial to The Fleet Street Letter

Important Risk Warning:

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General – Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get backless that you paid. This makes them riskier than other investments.

Overseas investments - Some shares may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Funds – Fund performance relies on the performance of the underlying investments and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Investment Director: John Butler. Editor: Nick Hubble. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

The Fleet Street Letter contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Ltd.

Source List:

1 Financial Times - Is financial repression coming? – 19 May 2011

2 Mises Institute – The Meaning of Financial Repression – 6 January 2015

3 Wikipedia 2015 Greek bailout referendum

4 The Guardian - Greek general strike: Petrol bombs and teargas during anti-austerity protest - as it happened – 12 November 2015

5 Economics Help - UK Debt Interest Payments – 3 June 2023

6 UK Debt Management Office – Gilt Market Issuance Calendar for 2024-2025

7 Wall Street Journal - How Britain’s Andrew Bailey Got His Man – 18 October 2022

8 Office for National Statistics – UK debt nearly 100% of GDP

9 The Telegraph - Europe's soft coup d'etat in Italy is a watershed moment – 28 May 2018

10 Bloomberg - The Daily Prophet: Carville Was Right About the Bond Market – 29 January 2018

11 IMF – The Liquidation of Government Debt

12 IMF – About the IMF History

13 Brainy Quote – Thomas Sowell Quotes

14 Financial Foresight - “Inflation is the one form of taxation that can be imposed without legislation.” – Milton Friedman

15 Econlib - The Economic Consequences of the Weimar Hyperinflation – 14 November 2023

16 Zoopla - Mortgage repayments up 60% since 2021 – 29 April 2024

17 The Guardian - How legitimate are the claims in Liz Truss’s 4,000-word Telegraph essay? – 9 February 2023

18 CNBC - Bank of England says pension funds were hours from disaster before it intervened – 6 October 2022

19 IMF Working Paper - The Liquidation of Government Debt

20 Bloomberg – FT30 Crash

21 Ceicdata – UK Stock Market Crash 1972-1974