Let’s be realists: ruinous tax rises are on the way…

Pensions, investments, homes – nothing will be safe.

And that will likely include what you want to leave your loved ones.

Labour’s October Budget is going “to be painful”.

That’s not me or the opposition talking… those are the words of our Prime Minister, Keir Starmer himself!

Source: Wikimedia

Much has been made of “big asks” for “the long term good”…

How things “will get worse before we get better”.

Put simply, the Government is in desperate need of our cash...

And you and I will likely get fleeced.

As Health Secretary Wes Streeting warned, “The money simply is not there.”

They say they have inherited a nasty death duty of their own:

A £22 BILLION black hole in the public finances.

Of course, that’s not the half of it.

The government debt is actually set to hit £2.7 trillion.

That’s almost double what it was in the 1980s…

And far higher than in the aftermath of the global financial crash in 2008.

The UK is more heavily indebted today than we’ve ever been throughout our nation’s entire history.

Which is why every day there seems to be talk of another “surprise” tax hike on the horizon…

Whether it’s a move to cap tax-free pension lump sums to £100,000 (one that could cost you, as a retiree, more than £70,000)…

Raising fuel duty…

Or, after the union Unite said it was time for “a raid on the super rich”, a wealth tax…

Never mind that Labour promised not to raise taxes…

They have got to get the money from somewhere.

So, even if they stand by their manifesto pledges:

Not to hike income tax…

Not to hike VAT…

Not to raise national insurance…

They will, as Chancellor Rachel Reeves has warned, “have to increase taxes in the Budget".

And there is one tax – renowned as the most hated tax in Britain – that is very much in Labour’s sights.

It’s not a new tax.

In fact, it has a long and lucrative 228-year-old tradition of leaching family wealth.

One that started, believe it or not, to fund the wars against Napoleon.

This year it has already delivered a record breaking £7.5 BILLION to HMRC.

It could deliver a whole lot more...

And it could deliver a lot more pain to grieving families.

Particularly if Labour see it as a way not just to raise a fast buck…

But also as a means to “redistribute wealth” and address “intergenerational inequality”.

Of course, I am talking about Inheritance Tax.

And who on the left doesn’t like an attack on inherited wealth?

Which is where I can help…

Because there are still

8 legal ways to avoid it

John Butler

Investment Director,

My name is John Butler.

I have spent nearly three decades in a career at the very top of high finance.

I have advised clients including, Goldman Sachs, Morgan Stanley and Merrill Lynch, as well as Russia’s Central Bank and the world’s largest insurance firm, Allianz.

And I served as a Managing Director for two of the world’s largest global investment banks on both sides of the Atlantic in research, strategy and asset allocation roles.

During that time, I devised an investment system – still used by the City today - so successful I was awarded the title of “Europe’s No.1 Investment Strategist” by Institutional Investor magazine.

However, I am also a family man with four children.

And while I am not from these shores, as you can no doubt tell from my accent…

I do live here and I have put my children through the English private school system.

(So I sympathise with anyone now having to pay VAT on school fees.)

I believe in giving my family the best start in life...

And while I want them to make their own way, I want to give them the best opportunities to do that…

Which means leaving them a helping hand when I’m gone.

I’ve worked hard all my life, I’ve paid my taxes and if nothing else, I want the option to leave whatever is left to whomever I choose.

And that can be hard.

Because often the system feels like it is rigged against YOU

The government… bankers… fund managers – they’re not in it for you.

They’re in it for themselves – that’s just a fact.

They’ll use you as a means to an end…

And I believe we are going to find out just how hard they will squeeze come Wednesday, 30 October, when Labour releases its new budget.

Which is why I am reaching out to you and all my readers today.

You see, I no longer work for the City or Wall Street.

These days I am the investment director for an extraordinary group of financial experts and advisors who for over 85 years have been helping private investors like you protect and grow their wealth… whatever our governments, the markets and the world throw at it.

For nearly nine decades our global network have correctly warned on everything from the start of World War II, the collapse of the Soviet Union and the 1987 stock market crash… to the 2000 Tech Wreck, the 2008 Global Financial Crisis and, recently, the worst bond market since 1842…

I’ll give you full details on our intelligence network shortly…

But first, I’d like to share with you one of the most important lessons we’ve learned over these many decades of helping and advising private investors just like you.

And that is this:

A failure to plan and a reluctance to talk about money can be catastrophic for your finances

It’s no use ignoring it or hoping it will take care of itself. Life – and money – simply doesn’t work like that.

Now, it is easy to think that Inheritance Tax doesn’t apply to most people.

Well, there are two things you should know.

First, as I mentioned earlier, Inheritance Tax began as a war tax – to fund government debt.

Back in 1796, George III was preparing to wage war with Napoleon.

To raise the money needed for this battle against Bonaparte and the French Revolution, his government passed a controversial new law. Its purpose?

To harvest the capital of every British citizen that dies…

And leach grieving families of what is rightfully theirs.

This levy was the first of its kind in Britain.

You could call it “grave robbing”…

But it proved so lucrative to the British government that 228 years later, this tax law is still in existence.

And secondly, these days Inheritance Tax is not simply the preserve of the super-rich.

You imagine “death duties” are something only owners of huge country estates have to face…

A plotline for Downton Abbey… hardly something that will clobber you.

The truth is, this is a tax that has steadily been increasing its revenue and its reach.

And that’s before Labour start looking at it.

To explain why, let me ask you this question:

How much do you think

you’re worth?

I’m not looking for an exact figure. That’s none of my business.

But just do a quick review in your head.

Tot up your savings…

Your car, a holiday home perhaps…

Any premium bonds you may have…

Or ISAs, pension plans and shares…

Any antiques or art…

It’s all fair game to HMRC. There’s nothing they won’t pilfer.

Then add in the value of your house.

Even if you counted that alone…

My guess is, your personal estate is way over £325,000. For the simple reason that rapidly rising house prices have pushed more and more homeowners into the IHT trap.

Forget Downton Abbey…

It could be as little as assets of £325,000 to make you eligible to pay “death duties”.

Through a combination of a freezing of the tax threshold at £325,000 since 2009 and rising house prices, a record number of estates are being dragged into Inheritance Tax territory.

In some cases, people with assets valued at over £325,000 are subject to a whopping 40% tax rate. That's £40,000 for every £100,000 of assets - straight to the taxman.

Money you have spent a lifetime building. The long hours at work, the effort and sacrifice…

Inheritance Tax attacks your loved ones AFTER you’ve passed away, when you’re powerless to help them.

What’s more, here’s why it really sticks in the craw:

You are being taxed on money

you’ve already paid tax on…

Do you really want to pay tax TWICE?

Let’s just say you’re a basic-rate taxpayer. What you’ll pay in tax accounts for approximately one-third of the money you earn.

Source: Christopher Bill on Unsplash

Around 20% is taken from your income, through National Insurance and PAYE.

But then you get hit with the indirect taxes.

Like your council tax…

I bet that went up recently – yet there still seem to be a lot of potholes, just waiting to shred your car tyres.

Or the cost of filling up your car..

The government is expected to raise £24.7 BILLION from fuel taxes this year.

Heating your home…

The new price cap means the average annual energy bill is set to rise by 10% from October.

Feeding your family…

Food prices are 30% higher than they were three years ago… and you’ve probably noticed in your shopping basket how some items are being sneakily downsized – but, guess what, prices aren’t.

And so it goes on.

Which begs the question: why should you pay all over again, just because you've worked hard and been successful in life?

Not only that, if you do end up owing the taxman – he wants his money FAST.

Don’t leave your family

struggling for money

Make no mistake:

If you do nothing about your potential financial legacy, you could leave those you care about struggling for money.

Take Kathryn Price from Tyne and Wear.

Her father was faced with a bureaucratic nightmare when his mother died.

“My dad recently had to sort out my grandmother’s estate…

“HMRC demanded an enormous amount of money up front - but most of the money was in shares, which were inflated at the time of death. Soon after, many of these dropped significantly in price, especially the one which was the biggest part of the estate…

“Thing is, a large part of this money overall has been allocated to family members – two of whom have significant learning disabilities. Two teenagers, my daughter and my nephew, who will never be able to earn any money to speak about.

Life is never a level playing field – but is this money really better in the hands of a wasteful, profligate government, or in the hands of those who will be lovingly caring for disabled relatives for the rest of their lives.”

Kathryn PriceWhatever your Inheritance Tax liability is…

It needs to be paid to HMRC before your family receives a penny from your estate.

The taxman doesn’t care if those you leave behind are forced to sell the family home… he’ll only wait six months for his money – if it’s not paid by then he’ll start adding on interest.

So, let’s start taking steps to protect your legacy:

SAVE an extra £48,000

right off the bat!

It’s a simple bit of paperwork…

Yet around 7,000 families annually lose money by neglecting to complete it!

The average loss is a staggering £48,000.

Which is why you should check to see if you're making this mistake now.

So, let me ask you: do you have a life insurance policy?

If you do: read this now!

Life insurance policy payouts can amount to hundreds of thousands of pounds.

That cash is received by loved ones free of income tax and capital gains tax.

However, there's a catch.

If the value of the life policy payout pushes your total assets above the nil-rate threshold, it may become subject to Inheritance Tax.

The error lies in not placing your life insurance policy into trust.

To avoid it, all you have to do is complete a trust form.

This can be obtained at no cost from your insurer.

Yet sadly, many families fail to take this step.

It highlights how many of us could leave behind a much smaller financial legacy than we intend to… simply by sleepwalking into an Inheritance Tax bill.

Because, as of this writing, there are steps you can take.

As the former Chancellor of the Exchequer Nigel Lawson once said:

“Inheritance Tax is a voluntary tax – you can either do nothing and volunteer (for your beneficiaries) to pay it, or you can take steps to avoid it”.

For the time being, you can still employ legal exemptions and loopholes to virtually eliminate all of your IHT liability…

As you will discover in a special report I have put together for you.

It’s called 8 Legal Ways to Sidestep Inheritance Tax.

You’ll discover how you could legally sidestep these devastating taxes and hold on to more of what’s rightfully yours!

- For example: did you know if you aren’t careful, you could be charged IHT pre-emptively, even though you haven’t died yet!

- It pays to be generous when giving your other half gifts… getting hitched could be a very profitable way to say “I don’t” to the taxman

- How to feel philanthropic – and yet leave your loved ones more! Discover the simple act of charity that can slash the IHT bill on the rest of your estate…

- Why living the good life could not just give you home grown crops – but a landed legacy you can pass on FREE of IHT

I don’t have room to list all the details here.

You can read about them in greater detail in your free report.

In short, you’ll see the various loopholes, exemptions and little-known tricks HM Revenue and Customs will allow for legally slashing your tax burden.

I urge you to read it as soon as you possibly can.

Because there is no doubt about it:

The government is coming after your wealth.

And time is running out.

Protecting private investors

since 1938

As I’ve said, my name is John Butler.

Today I represent an elite group of financial experts and advisors – a global intelligence network who work privately behind the scenes… and out of the limelight.

We do not publish our work in the City. Nor do we want to.

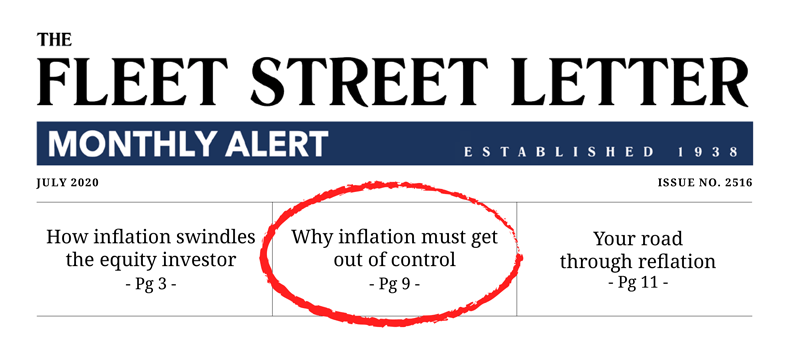

Instead, we share our research through a little-known, but widely-circulated publication called The Fleet Street Letter…

The Fleet Street Letter is Britain’s longest-running investment newsletter.

Since its foundation, it has established an incredible track record for helping its readers pinpoint and profit from “the news behind the news” – the threats and opportunities you won’t find published in the mainstream media: until it is too late.

Let me highlight just a few:

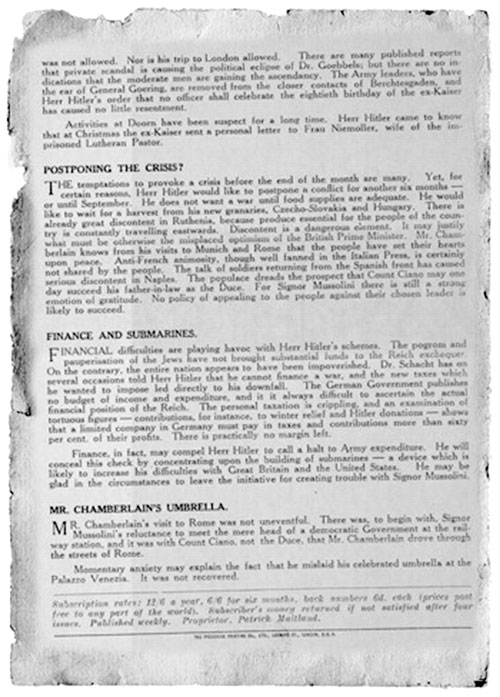

In 1938, our founding editor, Patrick Maitland, 17th Earl of Lauderdale, spent several weeks in Rome, gathering intelligence on Fascist movements there. He looked into troop movements in Germany. He studied Central Power armament plans. And he overlaid this against the backdrop of political and economic tension in Europe.

This enabled him to share an incredibly valuable insight with Fleet Street Letter readers 6 months before this world-altering event happened: Germany would make war, but not before September 1939.

Sure enough, Germany invaded Poland in September, 1939.

In fact, here you can see the actual pages from that specific warning 86 years ago.

It might be a bit hard to see because the document was 80 years old when I photocopied it. But founder Patrick Maitland said:

Maitland looked at the “news behind the news”. And found a “truth” that went completely against the official line that “appeasement” would work. He had identified a deep change.

This warning is a matter of public record available for you to see in the British Library at St Pancras.

It was a remarkably accurate prediction. And it was the first in a series of startlingly accurate predictions.

- In 1987, we predicted that the Soviet Union would collapse. A few years later, that’s exactly what happened as the Berlin Wall fell.

- We also exposed the rising threat of radical Islam in 1993:

- In 1997, two of our experts published one of the most influential books of all time… The Sovereign Individual. In it, Lord Rees-Mogg (former editor of the Times and father of the MP Jacob), and James Dale Davidson (a close friend of Bill Clinton’s) predicted “a new digital form of money [… of…] encrypted sequences… unique, anonymous and verifiable.” In other words: bitcoin. Billionaire founder of PayPal Peter Thiel claims the book has influenced him more than any other.

- In 2000, we warned that a “day of reckoning” was at hand for the dot-com boom... the very day the Nasdaq began a two-year, 77% decline.

- In 2008, we warned that “The City’s dream run is about to end… and it could trigger our worst recession in 35 years.” Five and a half months later, Lehman Brothers collapsed.

Events like these are often called unforeseeable.

But that simply isn’t true.

With the right insights… the right analysis… and with the right contacts… it’s possible to forecast these events.

Nick Hubble

Editor, The Fleet Street Letter

For instance, in 2021, our current editor Nick Hubble also told readers that clean energy stocks would falter despite seemingly endless government assistance.

His advice not to invest in the green bubble was published the exact month that green energy stocks topped and plunged 60%.

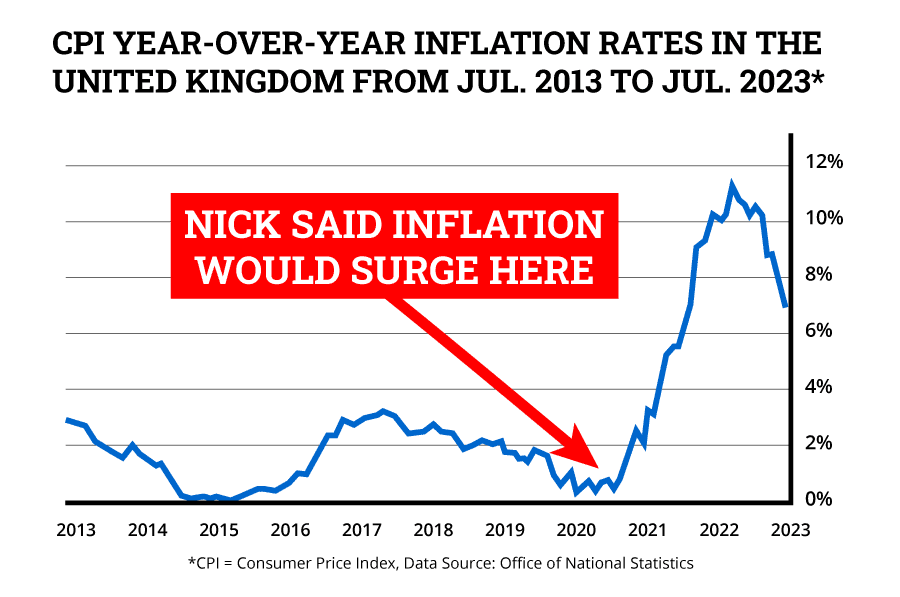

In 2020 and 2021, we told readers that an historic surge in inflation was just around the corner despite what central bankers were saying.

At the time, it seemed like an unusual claim. After all, inflation had averaged less than 2% per year for the 12 years prior.

And, of course, I don't need to tell you what happened next. We all felt the gut-punch of inflation at 40-year highs.

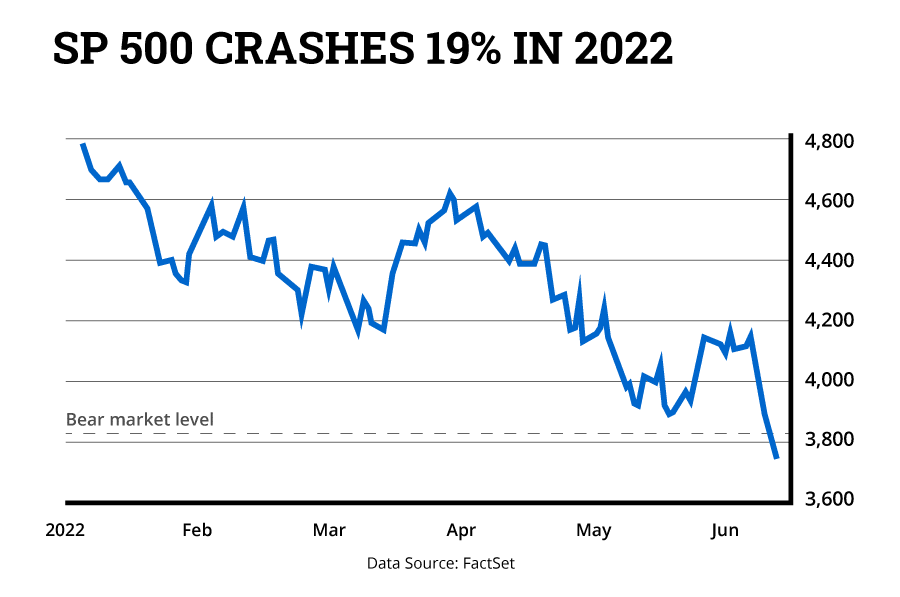

Our second big warning was of an imminent crash in the real returns of stocks, and we all saw what came next.

2022 was the worst year for stocks since the 2008 financial crisis.

Thirdly, back in 2021, our current editor Nick Hubble warned that the bond market was in for a world of pain:

"Holding bonds during a reflation will be financially devastating. Although inflation-protected bonds may offer some reprieve."Not long after, we started seeing headlines like this:

Nick also said:

“Inflation’s effect on the bond market, where much of Britain’s pension assets are invested, is of course disastrous.”

He specifically identified the bond market collapse 2 years before it happened.

On the three most financially pressing questions of the 2020s so far – 40-year high inflation, a bond market meltdown the likes of which we hadn't seen in centuries, and a punishing bear market in stocks –our team was spot on.

Three dire warnings, three calamities soon after. And anyone who listened was able to sidestep a lot of pain.

Do we get it right every time? No. But we’re honest.

We’re willing to “think the unthinkable”… to pursue ideas the mainstream media can’t or won’t… and to tell you the truth about what we’ve found.

The power of

private information

In the past, our network has included members of the House of Lords, ex MI5 operatives, multi-millionaire businessmen, press magnates, private wealth gurus and City fund managers…

Today our global intelligence network is stronger and more wide-reaching than it has ever been…

But the goals remain the same:

To arm you with the intelligence and insights to stay one step ahead of the big financial and geopolitical trends shaping our world…

And to show you what to actually DO with your money in light of those trends.

On the team with me are a host of experts and insiders from the worlds of finance, politics, business, economics, all of whom are working with one aim – your prosperity.

They include our editor, Nick Hubble…

Nick has degrees in finance and law, and for over a decade he has specialised in investigating financial markets to predict crises and opportunities for private investors. From exposing the sub-prime practices of Australian banks and the “Bloody October” crash in 2018, to UK inflation and the bonds crisis more recently.

From the world of politics, we have ex-army officer and investor Godfrey Bloom.

Godfrey won a prize for fixed-interest fund management but his military background and 25 years as an MP have made him an expert in procurement and geopolitical military strategy.

Alongside Godfrey is a man with an unparalleled contacts book, Nigel Farage.

Nigel is probably the most influential British politician of the last 50 years, but before he took on the EU (and won), he spent two decades as a commodities trader on the London Metal Exchange. Nigel alerted our readers to the dangers of rampant inflation in early 2021, long before the mainstream (and the Bank of England) took it seriously.

From the world of business – and across the pond in America – we have acclaimed author and publisher Bill Bonner.

As well as being a New York Times bestselling writer, Bill has started businesses all over the world… employs thousands of people… has made investments on five continents… has acquired more than two dozen businesses… and has launched more than 1,000 advisories with his partners. He opens a window to the world of money and wealth that you won’t find anywhere else.

You’ll also be advised by former stockbroker and Gold expert Alasdair Macleod – who brings over 50 years of investment acumen to the table…

And Jayant Bhandari. Jayant spent six years working with US Global Investors in San Antonio, Texas. His area of expertise is natural resource investments: assets which derive from nature such as agriculture, oil and gas, and metals. Jayant is also expert at joining the political, economic and cultural dots. His advice is invaluable.

Then there’s investment fund manager Daniel Lacalle, Chief Economist at Tressis S.V., and Professor of Global Economics at IE University. Daniel also just happens to be one of the world’s top 5, most influential economists in the world, according to Richtopia.

Our contributors are based all over the world, from the UK and Europe, to Australia and the Americas. Indeed, our man on the ground in Argentina is Federico Tessore.

Federico is a serial entrepreneur, financial publisher and investor. After working within the system for the brokerage firm Capital Markets Argentina and Citibank, he now devotes all his energy to helping ordinary, private investors.

Finally, there’s Dan Denning, the man who helped weave this current global network together, working alongside legendary Times editor and investor, Lord William Rees-Mogg. Dan’s belief in free markets, sound money, personal liberty and small government underpins everything The Fleet Street Letter stands for.

An impressive cast list, all working to help protect your wealth.

And to get started, we’d like to send you this special report right away…

8 Legal Ways to Sidestep

Inheritance Tax

I’ve already talked about how you’re taxed on your income… taxed with VAT when you spend what’s left… and even taxed in death.

You’ll discover how you could legally sidestep these devastating taxes and hold on to more of what’s rightfully yours!

8 Legal Ways to Sidestep Inheritance Tax is yours to download, FREE of charge, when you take up my invitation to join The Fleet Street Letter today.

And as we are talking about tax and how to protect your wealth, I’d like to share with you 3 additional BONUS reports with you. Like Inheritance Tax, they all tackle the issue of an unfair tax.

BONUS REPORT #1

“The Bank Of England Is Coming For Your Savings”

It’s not just taxes such as Inheritance Tax you need to be mindful of.

There are “stealth taxes” too.

And right now you face a secret, “LIQUIDATION TAX” that could cost every person in the UK £14,925 over the next 14 years.

Like Inheritance Tax, this is not new.

It was in fact implemented after the Napoleonic Wars to help the government bring debt down to more manageable levels.

It was also used after World War II in this country – and has been used by many other countries since to write off government debt…

Right now, as we have talked about, the biggest risk to the UK is the government's staggering debt pile. Given nobody wants to hear the word austerity, the Bank of England is forcing the government to impose policies that will help the country pay down its debts. And guess what - you’ll be footing the bill.

In our report The Bank of England is Coming for your Savings, we explain exactly what this liquidation tax is, how it will be implemented and how you can stay one step ahead.

It’s just another way the team at The Fleet Street Letter are helping their readers protect, preserve and even grow their wealth – whatever the world and our governments throw at us.

Because what sets us apart is that not only do we pinpoint and predict potential crises… we offer ways in which you can take actions to protect your money.

Which is why I would also like to include a second bonus report:

BONUS REPORT #2

“Five Toxic Timebombs To Sell Now”

In this report, we outline which investments could get hit the hardest as the Bank of England attempts to bring down the national debt.

Firstly, you’ll see how Japan’s lost era gives us a perfect road map for avoiding “liquidation tax”…

Secondly, which investments you should avoid…

And thirdly, which government bonds have become “certificates of confiscation”.

BONUS REPORT #3

“Age of Inflation Attack Plan”

Finally, I’d like to include a third bonus report that I’ve written as investment director for The Fleet Street Letter. It’s called “Age of Inflation Attack Plan” and in it, I reveal which investments you should own to counter the liquidation tax that I very much believe is coming.

Bear in mind, I am doing this with my global investment banking hat on – the one that helped earn my the rating of “Europe’s No.1 Investment Strategist” by Institutional Investor magazine.

In this report, you’ll discover:

- How the traditional 60/40 portfolio investment model could be a potential disaster in such a repressive financial environment

- Why you need to own companies “low on the value chain”

- A complete roadmap for prospering despite the Bank of England’s plans

When it comes to protecting your wealth for you and your family, it’s all about being prepared.

That means not reacting to the financial headlines after they have become news…

But anticipating threats and opportunities ahead of the mainstream and acting FIRST.

Remember, in times of crisis, money migrates.

We can help you follow it.

Of course, The Fleet Street Letter’s track record is not perfect.

And please remember that all investing has risk.

But I think we have a pretty good record of getting the big themes right.

You can see it for yourself at the British Library, St Pancras – in 73 volumes!

INSTANT ACCESS: STARTING TODAY

86 years of wealth-building and wealth-protections secrets…

The Fleet Street Letter is a serious publication for people who are serious about their money.

Our mission is very simple:

- To help you understand what’s coming next in the world of money and markets

- To show you what that means for you, your money and your family

- And to share specific investment recommendations to help you protect yourself or profit

We want to arm you with the intelligence and insights to stay one step ahead of the big financial and geopolitical trends shaping your world…

To show you what to actually DO with your money in light of those trends – or any threats they might pose.

Like the upcoming tax raid our new government is planning even as you read this.

Email updates, analysis

and alerts

That’s why you’ll get regular, to-the-point analysis from the team – to help you “decode” what’s going on in the markets and understand what you need to do about it.

These updates and alerts will be delivered by email.

You’ll get one every time something you need to know about or act on happens.

And they’ll contain everything you need to know to make the right decisions with your money. You’ll also get…

12 issues of The Fleet Street Letter

per year

These longer, in-depth reports take our analysis even deeper.

The financial world moves fast. New trends and threats develop. Old ones die. There’s no one single “set and forget” approach you can take to thrive in the modern financial world.

That’s why our monthly deep-dive reports are so valuable.

They’re your way of staying up to date with the latest thinking, ideas, threats and opportunities.

That might be a new risk developing… a new money-making opportunity… a new position for your portfolio. It depends on what’s happening in the world.

But whatever IS going on… we’ll be there, on your side and in your corner.

And there’s more…

Full access to

The Fleet Street Letter portfolio

This is what REALLY sets our work apart from the mainstream.

We’re not just here to explain what’s happening.

We translate that into an entire portfolio of investment ideas you can use to turn that knowledge into action.

Generally speaking, the recommendations we share with you will involve the stock market. That involves risk – as all investing does.

Some of our recommendations may be listed abroad. That may involve foreign currency risk as stocks listed overseas may have the added risk of forex movements.

Every recommendation is for your risk capital only – that’s money you can afford to lose.

We’ll explain this to you clearly with every new recommendation.

In fact, EVERY SINGLE idea we share with you will contain a full write-up of the potential risks and rewards, everything you need to know to make an informed decision and take control of your wealth.

That’s huge.

Think about it.

You can pay £700 for a subscription to The Financial Times...

But NOWHERE in those pages of news will you find a single investment recommendation.

It’s all fluff. All noise. It doesn’t matter how many PhDs the editorial teams have. They’re not sharing anything you can ACT ON.

The Fleet Street Letter is different.

You’ll walk away from almost every issue with a fully researched investment recommendation that ties into our worldview.

And you’ll be in good company.

The Fleet Street Letter has a committed readership of serious investors – some of whom have been following our work for decades.

And, in that time, we have received messages of appreciation for our work,

Or this note from Barbara, another satisfied member…

I know I am with an excellent group of experts giving advice for me to then reflect and make my own decisions. I also appreciate and understand the relevance of the historical perspective and intellect documented of previous major historical events and their overall relevance on today’s world. New Investors most certainly try it. It provides independent, forthright information - a sound basis for investment.

BarbaraOur inbox is full of such praise for our research and recommendations:

It’s well written. It's easy to understand. It’s not over adventurous and it talks sense.

JohnOf all your titles over about 15 years The Fleet Street Letter is my favourite. It does the research that I'd never have time for.

ColinYou have given me the big picture of everything, which Financial Advisors do not discuss – all of the information is valuable to me.

GlenisThe Fleet Street Letter often provides clear insightful analysis of what is going on behind the scenes in both the political and economic arenas. This is critical information for anybody who wishes to successfully navigate the tricky investment waters of today. Keep up the good work and thank you to all the team.

GlynNow it’s your turn to become a part of The Fleet Street Letter.

UNLOCK YOUR NEW MEMBER DISCOUNT TODAY

The cost?

It’s not cheap.

This is serious research and market intelligence designed to help you make good decisions with your wealth and savings.

Quality research doesn’t come cheap.

That’s why a one-year subscription to The Fleet Street Letter costs £249.

That’s a fair price for a team of world-class financial analysts sharing their most valuable ideas AND investment recommendations.

But today you can get your first year for just £99 – as part of our limited special introductory offer.

That’s a savings of £150…

Or 60% OFF the normal subscription price.

Better still, I have arranged a way for you to test drive the service…

You have a 30-DAY

money-back guarantee

Yes, you can try Britain’s longest-running financial newsletter – obligation-FREE.

This is your new member, all-access pass.

Use it to spend the next 30 days reviewing everything The Fleet Street Letter has to offer.

Check out the website, the portfolio…

Download your special report, 8 Legal Ways To Sidestep Inheritance Tax, and your 3 FREE BONUS reports – The Bank of England is Coming for Your Savings, 5 Toxic Time Bombs to Sell Now, and Age of Inflation Attack Plan

And if you’re unhappy for any reason, simply contact our member services team within this period, and cancel your membership. You will receive a prompt refund of the membership fee you pay today.

Plus, you’ll get to keep any reports and briefings you access during your trial run, whether you decide to stay beyond your 30-day pass or not. A win-win, just for giving us a try.

Just to recap, here's a reminder of everything that you get when you take out your no obligation trial to The Fleet Street Letter.

- 8 Legal Ways to Sidestep Inheritance Tax

- The Bank of England is Coming for Your Savings

- 5 Toxic Time Bombs to Sell Now

- Age of Inflation Attack Plan

- 12 monthly issues of The Fleet Street Letter

- Regular email updates, analysis and alerts

- Full access to The Fleet Street Letter portfolio

- Exclusive new member 60% discount

- 30-day money-back guarantee

So, what have you got to lose?

Click this button to get started.After all, times are tough for you, and your money.

And come Wednesday, 30 October, they are likely to get a whole lot tougher.

THE GOVERNMENT IS COMING FOR YOUR MONEY!

They have admitted it.

They just haven’t admitted the full extent.

And what you might want to leave your loved ones after you are gone is very much fair game.

Inheritance Tax is a proven money spinner…

It pleases those who like to mock hard work and personal success…

And it could be used to redistribute your well-earned wealth away from your family.

To me it proves a simple point:

Can you trust the government or the financial services industry to look after you personally?

Or do you need a plan B? An alternative source of advice that has proved itself successful for thousands of investors through the biggest test of all – time.

Today you have the chance to join an elite and rarefied club…

A network of intellectuals and investment veterans who, for over 85 years, have helped private, hard-working Brits protect and grow their wealth…

Click this button to get started.I look forward to welcoming you on board.

Best,

John Butler,

Investment Director, The Fleet Street Letter

PS If you want to leave your family a financial legacy, not a tax bill…take these 8 LEGAL STEPS – as fast as you can!

Click this button to get started.Important Risk Warning

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General – Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get backless that you paid. This makes them riskier than other investments.

Overseas investments - Some shares may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Funds – Fund performance relies on the performance of the underlying investments and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Investment Director: John Butler. Editor: Nick Hubble. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

The Fleet Street Letter contains regulated content and is issued by Southbank Investment Research Limited. Registered in England and Wales No 9539630. VAT No GB629728794.Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No706697 https://register.fca.org.uk/

© 2024 Southbank Investment Research Ltd.

Source List:

Sources:

1 FT Adviser - Keir Starmer warns of 'painful' autumn Budget – 27 August 2024

2 The Spectator - Just how ‘painful’ will Starmer’s October Budget be? – 27 August 2024

3 Financial Times - Labour faces £7bn bill to fund public sector pay deals if it wins election – 23 June 2024

4 POLITICO - 5 ways Labour says Britain is broken – 29 July 2024

5 Daily Express - Move to cap tax-free pension lump sum to £100,000 could cost retirees more than £70,000 – 28 August 2024

6 Daily Express - ‘Where will it end!?' Doom-mongering Starmer looking to wallop drivers with £2bn tax grab – 29 August 2024

7 The Telegraph - Wednesday evening news briefing: Wealth tax looms amid pressure from Labour’s union paymasters – 28 August 2024

8 BBC News - Rachel Reeves: We'll have to increase taxes in the Budget – 31 July 2024

9 Cityam - Everyone hates inheritance tax. But what are the best arguments against it? – 22 November 2025

10 Southbank Investment Research - The Shadow Currency That Triggered EVERY Major Panic For Half A Century Is Blowing Up Again

11 This is Money - Sonia's £196,000 bill after inheriting Dot Cotton's house in BBC soap EastEnders is fiction... but a big death tax grab is REAL for millions – 5 February 2023

12 Office for Budget Responsibility – Fuel duties

13 The Guardian - What is the energy price cap and can I cut my bill?

14 Which? - See how food prices compare to 30 years ago and you might be surprised – 23 November 2019

15 Aljazeera - 31%: The surge in food prices irking voters in the UK election – 3 July 2024

16 The Guardian - The curse of shrinkflation: how food is being sneakily downsized – but prices aren’t – 1 August 2023

17 Stoke on Trent Live - HMRC warning as 7,000 families make simple mistake costing them thousands – 15 August 2024

18 Tax Payers Alliance - Inflation is the ultimate stealth tax – 3 April 2021

19 Reuters - BOJ policymaker signals readiness to raise rates if inflation on track – 11 September 2024