In my hand is a 1976 Gold Krugerrand.

It contains exactly one ounce of pure gold.

I bought it on 15 January 2008.

At the time, news had just broke that the Aviva Property Fund had frozen investors’ money.

To me, this wasn’t just a major warning sign of a looming financial crisis...

It was a clear signal that trillions of dollars of “worry money” was about to abandon the stock market…

And flood INTO gold.

As a result, I took a big chunk of my annual bonus and converted it to gold bullion – enough to support my family for an entire year if everything collapsed.

You know what happened next.

On 15 September 2008, Lehman Brothers declared bankruptcy.

Governments around the world embarked on a printing spree north of $12 trillion to prop up an ailing financial system.

And the price of this gold coin rose from the $600 I bought it for... to more than $1,900 dollars in the space of just four years.

I’m speaking to you today because every signal I’m watching is once again pointing to another spectacular run-up in the price of gold.

And I want to do everything in my power to help you profit from it.

The past few months have shown us what this market is capable of.

After years of sideways price action, gold has broken out to brand new all-time highs. It’s currently sitting at just under $3,000 an ounce. It’s trounced the FTSE... it’s beaten the tech-heavy Nasdaq... in fact, it’s on course to have its best year since the 1970s.

Now, to the casual investor it’s easy to see that move and think gold has no more room to run. That all the gains have already been swiped off the table.

But as someone who’s designed gold-investing strategies for central banks and elite institutions like Goldman Sachs and Morgan Stanley...

As someone who got into gold in 2007 – right at the start of the last bull market…

I can tell you: I believe what we’re seeing right now are simply the early stages of a far larger boom.

My own analysis tells me gold’s next stop is $10,000 dollars per ounce.

And by the standards of the world’s foremost gold experts... that’s a conservative estimate.

Wall Street Investment firm, Goehring & Rozencwajg, has forecast gold will one day hit between $12,000 to $15,000 an ounce.

Former investment banker and CIA analyst Jim Rickards believes gold could blow past $27,000.

While Peter Schiff, the renowned forecaster and founder of investment firm Euro Pacific Capital, believes gold is heading to $100,000.

Now, if you’ve been following along the Southbank Gold Summit 2025 so far, you’re already aware of all of this.

You already know that central banks are buying up gold at rates never seen before...

That demand in India and China – the world’s two largest markets for gold – is at near decade highs.

And that, in October, US retail giant Costco sold out of gold in 77% of its stores.

But my sense is that you don’t simply want to be INFORMED about the forces sending gold higher.

You don’t just want to watch as gold soars past all-time high after all-time high.

You want to get IN on the action.

So the simple question is:

What steps can you take to reap maximum possible reward from a NEW gold boom?

Well, before you start buying up gold sovereigns, Krugerrands and jewellery, know this:

I am not here merely to show you how to profit from physical gold as it increases in value.

I want more than that.

And I hope you do, too.

Over the next few minutes I’m going to introduce you to a small portfolio of stocks with “built-in leverage” to the gold price.

For every $1 rise in the price of gold – these stocks could each rise 10, even 20-times higher.

That’s what happened the last time we saw a setup playing out like this.

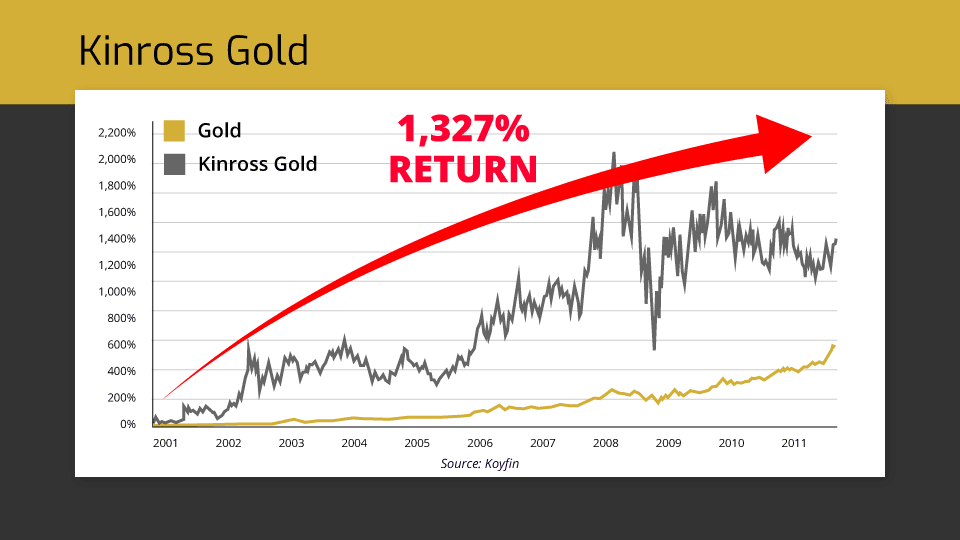

In fact, during the gold bull of the 2000s, the price of physical gold rose six-fold...

But a gold miner by the name of Kinross Gold made a 1,327% gain – more than DOUBLE gold’s return.

Past performance is not a reliable indicator of future results.

Five year performance of Kinross Gold: 2019 +40% | 2020 +52.91% | 2021 -19.8% | 2022 -22.67% | 2023 +48.25% | 2024 (to 30/11) +73%

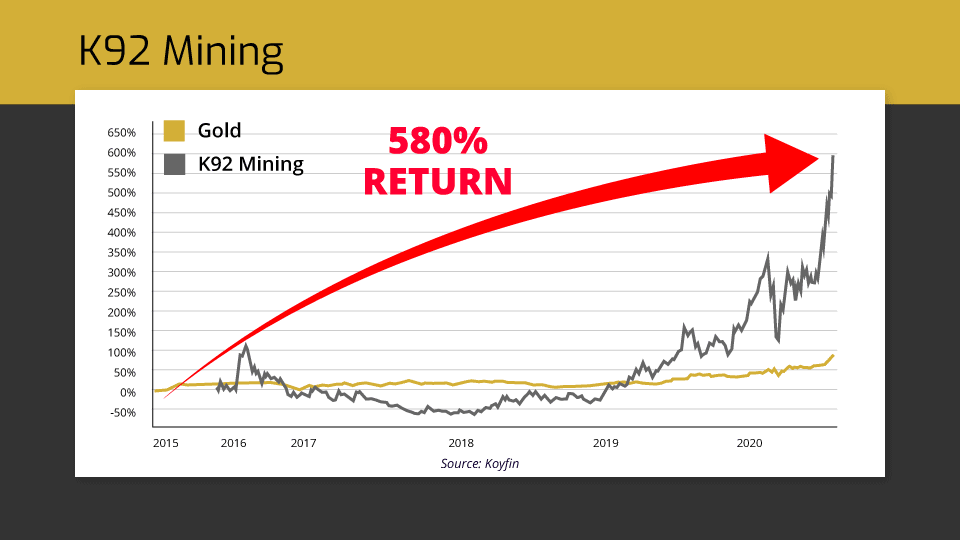

In 2016, the physical gold price took off again, doubling from $1,000 to $2,000 in the space of just four years.

But at the same time K92 Mining soared to a 580% return.

Five year performance of K92 Mining: 2019 +242.86% | 2020 +164.24% | 2021 -5.52% | 2022 +6.68% | 2023 -15.12% 2024 (to 30/11) +40.09%

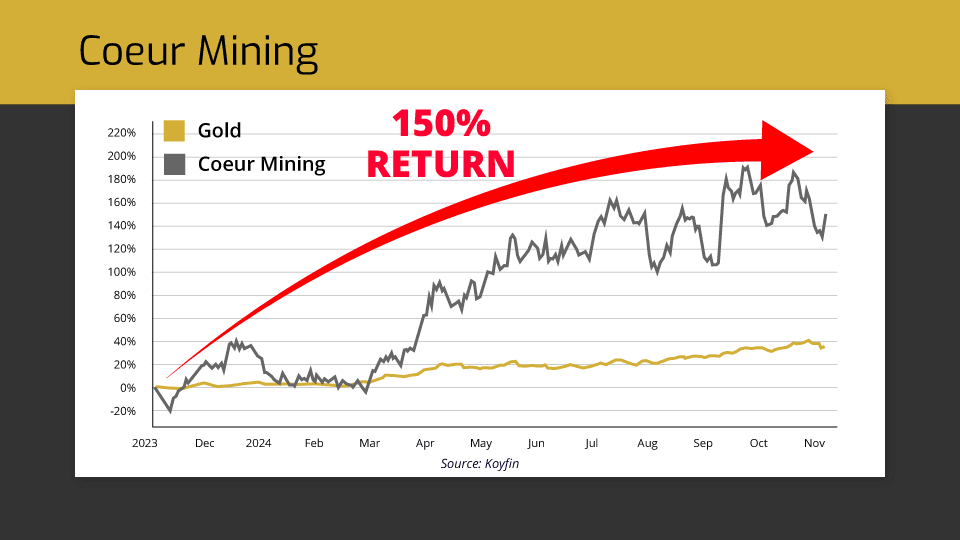

Fast forward to today, and while gold is up 30% year over year...

Coeur Mining is up 5-times that at 150%!

Five year performance of Coeur Mining: 2019 +74.44% | 2020 +10.37% | 2021 -45.89% | 2022 -24.03% | 2023 -7.95% | 2024 (to 30/11) +104.97%

Now, it’s right to say that these are some of the best performers. Not every gold stock performs this way.

My aim is to help you ride the biggest moves – just like these – right to their peak.

But why should you even care about what I think?

Or which stocks I’m predicting to make big returns in the gold market?

The fact is, I’ve been immersed in this market for more than two decades.

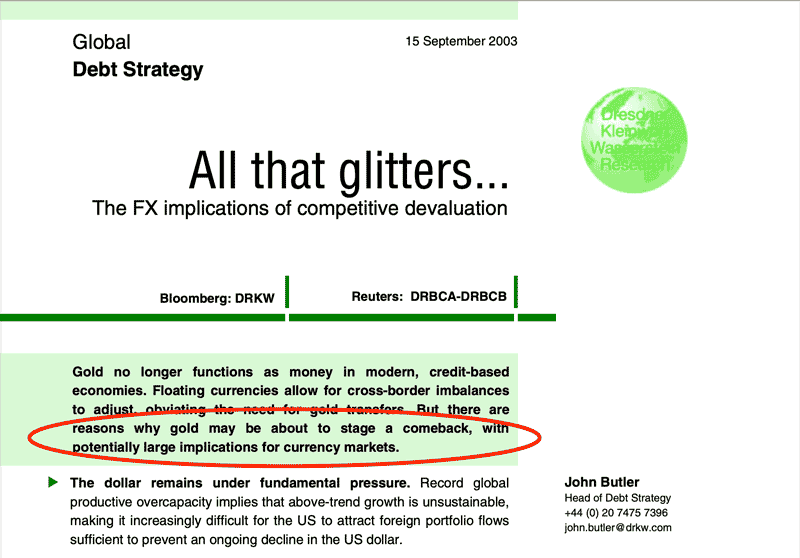

I first started covering gold more than 20 years ago in my role as Head of Debt Strategy for one of the largest investment banks in Germany.

In fact, in 2003, when gold was in the VERY early stages of an epic bull market…

I released THIS report to my institutional clients:

In it, I predicted the price of gold would rise to levels “not seen for years”...

It was back in 2003, that I first started accumulating the yellow metal myself, before making that BIG investment with my own personal wealth ahead of the Great Financial Crisis.

Now, I’m not German. Nor am I British.

I originally hail from San Francisco.

But my work in financial markets has taken me across the globe.

From New York... to Frankfurt’s Bankenviertel... and ultimately to the City of London. Where I served as Managing Director of two of the largest investment banks on the planet.

It was right here in London in 2006 when Institutional Investor magazine ranked me the #1 Investment Strategist in Europe. And that was due in large part to my work on gold.

Throughout my time in the industry, I’ve had private meetings with some of the most powerful players in the business. People like Pierre Lassonde, former chairman of Newmont, the world’s largest mining corporation. And Peter Hambro, former Managing Director of another former mining giant – Petropavlovsk.

I’ve also written two top-selling books on the subject.

The Golden Revolution, which I wrote in 2012, has been cited numerous times publications. And it’s been widely praised by many of the world’s foremost gold experts.

Summit speaker Jim Rickards called it “an indispensable reference on the subject of gold as money”. While Peter Schiff called it “a necessary light to keep you headed in the right direction.”

I followed up in 2017, with The Golden Revolution, Revisited, which is currently rated 4.5 stars on Amazon.

My deep analysis in those books has earned me invitations to speak at some of the most important gold-investing events in the industry, such as Mines and Money in London and the Sydney Gold Symposium.

Bottom line: I know a gold bull market when I see one. I know exactly how they play out.

I know how to make money from them.

And let me tell you: I have never in my life been as bullish about the situation playing out in the gold market as I am right now.

And it appears I’m not the only one.

Stanley Druckenmiller, George Soros’ former right-hand man, is selling his holdings of Amazon, Alphabet and Alibaba. And in its place buying up over $50 million worth of gold-mining stocks.

Ray Dalio, founder of the world’s largest hedge fund, has added gold to his personal investment portfolio.

Billionaire investor David Einhorn has bought $74 million worth of exposure to gold, through his hedge fund Greenlight Capital.

Paul Tudor Jones, renowned as one of the most successful hedge fund managers in history, has told interviewers at CNBC that he’s “Long gold”…

Make no mistake. These guys aren’t investing in the yellow metal on a whim. They’re positioning themselves ahead of something BIG brewing in the gold market.

And today, you can position your money ahead, too.

But I must make you aware...

If you want to make as much money as possible from the coming run-up in gold...

There’s simply no time to waste.

Fact is, this market is JUST BEGINNING to take off.

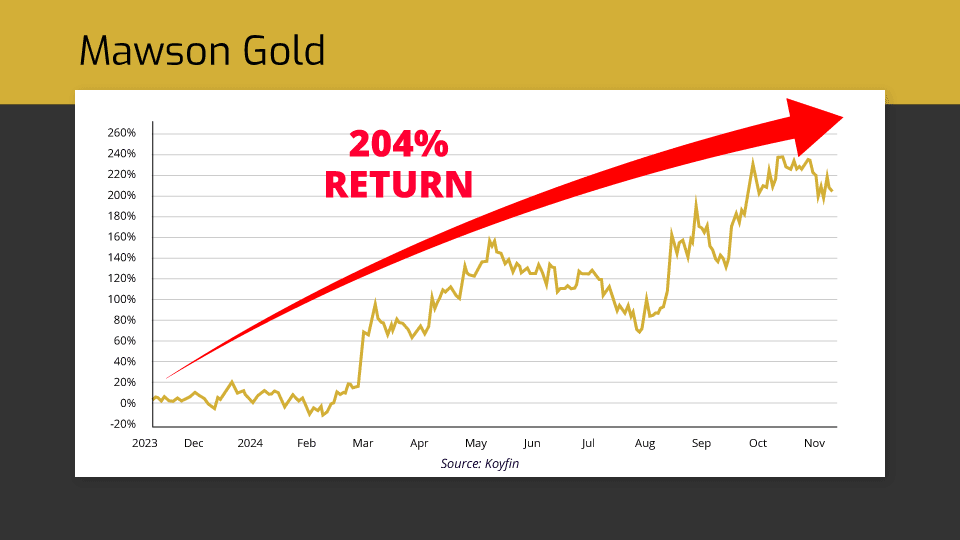

Gold explorer Mawson Gold is up 204% this year...

Past performance is not a reliable indicator of future results.

Five year performance of Mawson Gold Ltd: 2019 -18.12% | 2020 +92.9% | 2021 -51.26% | 2022 +22.4% | 2023 +80.93% | 2024 (to 30/11) +159.69%

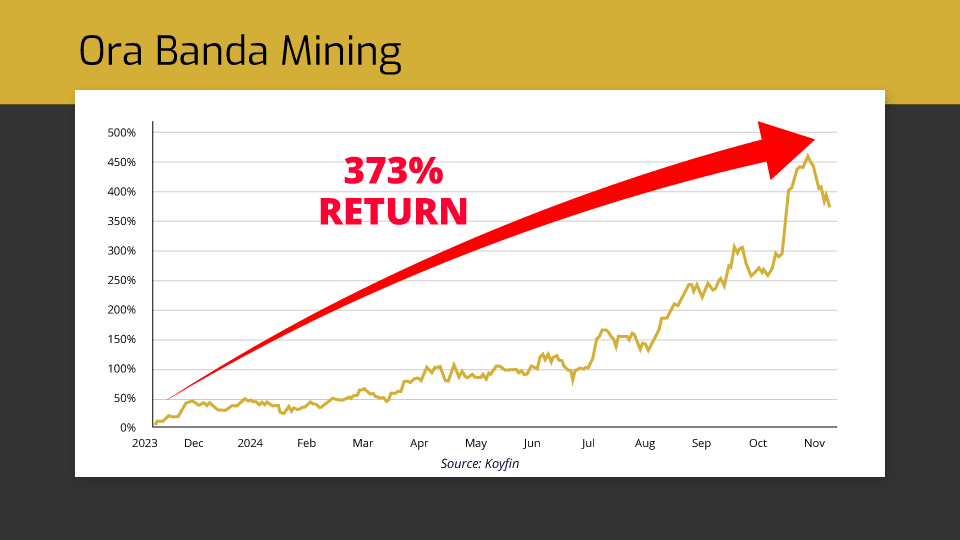

Australian gold miner Ora Banda Mining is up 373%.

Five year performance of Ora Banda Mining Ltd: 2019 -80.27% | 2020 +66.5% | 2021 -78.36% | 2022 +38.72% | 2023 +185.71% | 2024 (to 30/11) +202.08%

Canadian gold producer Founders Metals is up 381%!

Five year performance of Founders Metals Inc: 2019-23 unavailable | 2024 (to 30/11) +138.66%

Again, these are some of the market’s best performers. And while past performance isn’t indicative of future returns, these examples show you the outsized potential this market has to offer.

I fully expect a lot of investors to see the money already being made in this market...

And to simply stand on the sidelines...

They’ll watch on as OTHER investors position themselves for potential profits.

And they’ll let this opportunity pass them by.

Then, there will be those who possess the decisiveness required to hunt for gains from what’s playing out in the gold market right now.

If I’ve pegged you right, you fall into the second category.

You’ve already done the hard work.

You’ve looked into ways to profit from this situation.

You’ve taken the time to sign up to our Southbank Gold Summit 2025.

You’ve already heard from the experts we’ve brought together to share their inside intelligence on the gold market.

Now I’m going to make it incredibly simple for you to take the final step.

If you want the chance to make 2025 the best year of your financial life...

All you have to do is stay right here.

In just a moment, I’m going to share details of my top 3 stocks I believe are best placed to take advantage of the rising gold price.

But first, I want to leave you in ZERO doubt about what happens during the NEXT phase of this gold boom.

Because as I speak, a convergence of 3 unstoppable forces is conspiring that could send the price of gold to VERTICAL.

Let’s run through them now:

Unstoppable Force #1:

The Cobra Effect

To explain the first unstoppable force, I need to take you back to 19th Century British-controlled Delhi in India.

Picture the scene:

The streets of Delhi teemed with life. Market vendors called out their wares. The air hung thick with spices.

But beneath this bustling facade of colonial life, a deadly problem was slithering through the city streets.

Because at the time, colonial officials in Delhi faced a deadly crisis: their city was overrun with venomous cobras.

Their solution seemed perfectly logical – offer a generous bounty for every dead cobra brought to their offices.

At first, it worked exactly as planned. Dead cobras poured in by the hundreds. The officials congratulated themselves on their clever solution...

Until they discovered something that made their blood run cold.

Enterprising locals had started breeding cobras in their homes. The very incentive designed to solve the problem was now making it exponentially worse.

When officials frantically cancelled the bounty programme, those cobra breeders did the only logical thing – they released their now-worthless snakes into the streets. Delhi ended up with more cobras than when they started.

Source: wikimedia

This story came to epitomise a principle known as the “cobra effect”...

The idea that government policy-making can often have hugely consequential and unintended second-order effects.

And I’m here to tell you that one of these devastating cobra effects is playing out right now.

It’s triggered an unstoppable chain reaction across the financial system. And sent the world’s most powerful investors rushing into gold at a pace we haven’t seen in half a century.

Who are these investors exactly? I’m talking about central banks.

You’ve no doubt heard of the sanctions the West has imposed on Russia as a result of its invasion of Ukraine.

But there’s one specific action the US and its allies have taken that’s changed the very make-up of our financial system.

They froze over $300 billion worth of Russia’s US dollar foreign currency reserves... seized them... and then used those frozen assets to back a massive aid package to Ukraine.

And that has meant, for any nation not firmly in the Western alliance, a stark reality has emerged:

Your US dollar reserves – long considered the world’s safest assets – are only as secure as your relationship with Washington...

The result? Central banks across the world are dumping their dollars in favour of the greatest financial insurance policy known to man: GOLD.

In fact, after decades of being net sellers of gold...

Central banks are now buying gold at the greatest rate since the 1970s.

Who’s buying?

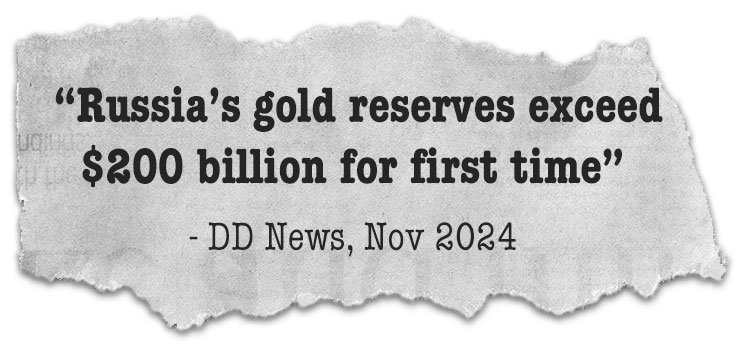

Well, it’s probably no surprise that Russia is leading the charge. In the wake of the sanctions, Russia has begun buying $54 million dollars’ worth of gold – EVERY SINGLE DAY.

That means that Russia’s gold reserves recently exceeded $200 billion for the first time in history. And its share of gold amongst other currency reserves is the highest it has been this century.

Then there’s China. It’s is in the midst of what InternationalBanker.com calls a “gold buying frenzy”.

It’s reeling off the back of purchasing gold for 17 months in a row...

In fact, it has purchased 2,800 tonnes of the stuff – more than all the metal-backing ETFs around the world. And more gold than it has purchased the last 50 years.

As my friend Ross Norman, Chief Executive of MetalsDaily.com, states...

But remarkably, neither China nor Russia are the largest buyers. In fact, it’s India.

Earlier this year, India set in motion an operation to move one hundred tonnes of its gold from the United Kingdom back to Mumbai.

The Thai Central Bank has DOUBLED its gold reserves to $15.6 billion.

The Turkish Central Bank has bought gold for 12 straight months.

Then you’ve got Saudi Arabia...

Jan Nieuwenhuis, analyst at Money Metals

Summit speaker and analyst at Money Metals – Jan Nieuwenhuis – recently exposed the Saudi Arabian central bank covertly buying 160 tonnes of gold.

And it’s NOT just America’s adversaries dumping US dollars in favour of gold.

The Bank of England as has recently become a net importer of gold once again.

Poland just bought 130 tonnes of the stuff – increasing its holding by 57%.

Czech Republic has increased its holdings by 32 tonnes – a 141% increase.

Hungary has added 107 tonnes which is – get this – a 3,376% increase...

Heck, even the European Central Bank became a net importer of gold in 2023.

Please understand: central banks around the world aren’t buying up gold to make a quick buck a few months down the road.

They’re buying because a major structural change has occurred in global financial markets.

What we’re seeing here is a landmark reversal of a 40-year mega trend.

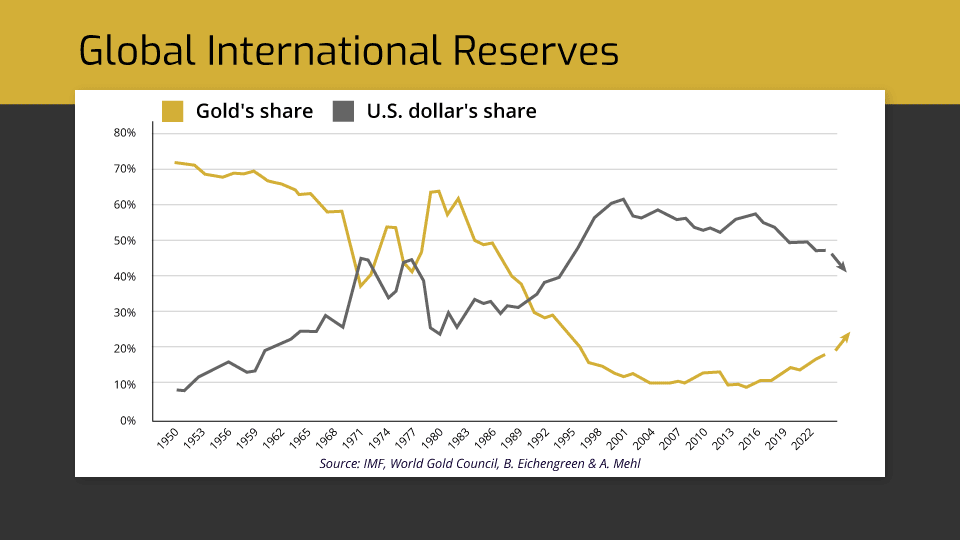

The chart below illustrates that perfectly.

A shift of TRILLIONS of dollars in capital out of the dollar and INTO gold.

As you can see, from 1980 right up until 2022, gold’s share of global international reserves plummeted from 65% to around 10%.

But that trend is now unwinding.

This is why analysts at ANZ Bank said they expect central bank purchases to “remain hot” for the next six years.

It’s why central bankers from Mexico, Mongolia and Czech Republic recently announced they’re likely to increase their country’s reserves in the years ahead.

It’s why just last month, India made its biggest increase in gold purchases since 2009.

And it’s why Russia announced in September that it planned to increase its gold buying by 600%!

In fact, right now many gold experts are speculating that simply buying gold could be just the start of their plans.

They believe we are now watching the first stage of a plan to move AWAY from the dollar... and establish an alternate gold-backed currency.

Now I’m well aware that gold bugs have been saying that there will be a return to the gold standard since Nixon ended it in 1971.

But for the first time in decades, this now appears to be a serious possibility.

What you’re looking at right now is something called The Unit.

It is a prototype banknote of a new currency. One which Vladimir Putin recently unveiled at the 2024 BRICS conference.

Now you might have heard of the BRICS before. This term first gained traction in the early 2000s to describe 4 emerging economies.

Namely, Brazil, Russia, India and China.

But that moniker has now morphed into an intergovernmental organisation that includes many US adversaries. Countries such as Iran, Egypt, the United Arab Emirates, Ethiopia, Cuba, Kazakhstan, Uzbekistan and a host of others.

In fact, together, they now account for MORE global trade than all of the G7 countries put together.

And given the hostile economic environment that many of their members are now facing…

They are now ploughing full steam ahead with a plan to create an alternate currency – other than the US dollar – to transact with each other.

And here’s the thing: that currency is going to be backed by gold.

According to a recent announcement from New Development Bank President, Dilma Rousseff, there is an agreement in principle for The Unit to be backed 40% by gold and 60% by local currencies.

There’s no doubt about it.

Should this come to pass, BRICS countries would be required to kick their gold buying up to an even higher gear...

Adding rocket fuel to an already soaring gold price.

In a moment, I’m going to give you EXACT steps to potentially profit from central banks’ insatiable demand for gold.

But first, I want to tell you about the second force driving gold higher...

Unstoppable Force #2:

Return of The Money Printers

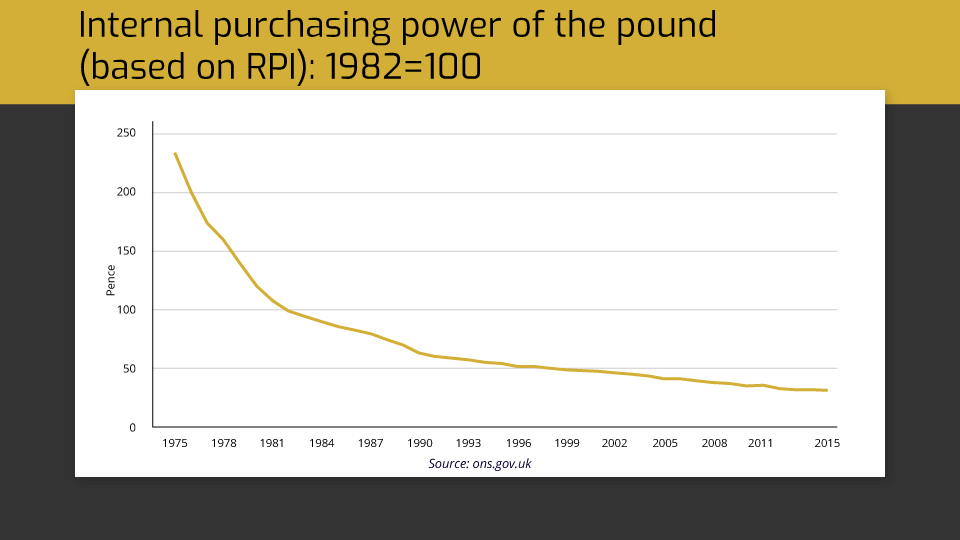

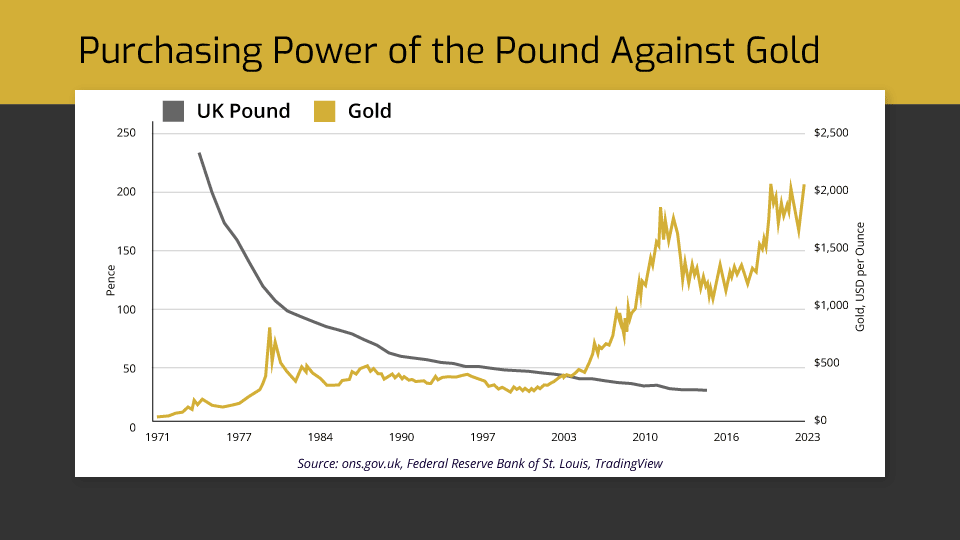

To illustrate the second force sending gold higher, there’s only one chart you need to see:

This is a chart from the Office for National Statistics. It shows the purchasing power of the British pound over time.

In the last 50 years, the pound has lost 87% of its value.

Let me put that into perspective:

In 1971, £1,000 would have bought you a brand-new Ford Cortina. Today, that same £1,000 wouldn’t even cover the cost of the car’s windscreen.

Of course, I don’t have to tell you this.

In recent years, this destruction of our purchasing power has accelerated at a frightening pace:

- The average family energy bill has exploded from £1,042 in 2020 to £2,500 today...

- A basic weekly grocery shop that cost £60 in 2020 now sets you back over £90...

- Even a morning coffee that cost £2.50 before the pandemic now costs nearly £4...

- Train ticket prices have shot up 40% in just three years...

Now, politicians LOVE to blame this on anything else but the actual cause.

They’ll say it’s because of supply chain issues... or the war in Ukraine... or corporate greed.

But these are in large part just excuses.

The prime driver behind all of this is one thing: Money printing.

Simply put, by increasing the money supply and slashing interest rates, governments increase the amount of money in the economy. The knock-on effect is more money chasing the same amount of goods and services. Which, in turn, causes the price of goods and services to rise. It’s the classic definition of inflation.

This has two major impacts.

First, it means the pound in your pocket no longer goes as far as it used to. Your wealth is effectively being eroded.

Second, it transfers that wealth into the hands of those creating the money: governments.

As Nobel Prize-winning economist Milton Friedman said, “Inflation is taxation without legislation”...

Renowned free market economist Thomas Sowell echoes those same sentiments. He says, inflation, “is a way to take people’s wealth from them without having to openly raise taxes. Inflation is the most universal tax of all.”

And even John Maynard Keynes, the man largely responsible for the economic regime we live in today, agrees. He said, “by a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Of course, inflating away the value of citizens’ currency through money printing isn’t new.

The Romans gradually reduced the silver content in their denarius from 97% to just 0.5% – until their coins became literally worthless...

The Spanish Empire flooded Europe with so much New World silver that it destroyed their own economy...

The Chinese Ming Dynasty printed so much paper money that farmers refused to sell their rice for it...

Our leaders of today are merely repeating the same pattern played out by every major empire in history.

And if you think that pattern is going to magically cease, you’ve got another thing coming.

Because after a brief pause, all signs point to a return to an era of cheap money and wealth destruction.

Case in point, the European Central Bank has issued back-to-back interest rate cuts, bringing the rate down from 4.5% to 3.4%.

The US Federal Reserve has also implemented back-to-back rate cuts...

As has the Bank of England.

Canada has cut its interest rate four times in the last year.

China has implemented four interest rate cuts.

In fact, no less than 12 major central banks worldwide are entering rate-cutting cycles.

What’s more, while central banks are lowering interest rates, governments are once again spending money like their lives depend on it.

You only have to look at the new Labour government to see that.

Off the back of £8 billion in pay rises to train drivers...

Chancellor Rachel Reeves has unveiled £380 BILLION in spending, aimed at “putting more pounds in people’s pockets.”

The government’s spending plans exceed their ability to fund them through current means.

According to the Office for Budget Responsibility, this will lead to a DOUBLING of government borrowing.

On top of that, to accommodate these extensive spending plans, Reeves has taken the extraordinary step of changing the very rules designed to keep government borrowing in check – essentially moving the goalposts when spending exceeds the safety limits.

As MoneyWeek reported in October, “Rachel Reeves has confirmed she will change the UK’s fiscal rules in her Budget next week, which will free up billions of pounds for infrastructure spending.”

The upshot of all this is government spending at a rate never seen before.

And the UK isn’t alone...

The EU has just unlocked €392 billion to allocate towards military spending. And that’s along with half a trillion more to spend as part of its “Covid recovery fund”.

India is increasing its capital expenditure by 33%. It’s due to spend approximately $118 billion to stimulate economic growth.

Ireland has announced an additional €8.3 billion in its budget.

Nigeria plans to spend an additional $28 billion.

Russia’s defence budget has increased by 30%.

Germany is also looking likely to be loosening it purse strings once again, too. After its coalition government collapsed in November, markets are now pricing in a victory for the Christian Democrat Union – who have hinted at more government spending in the future.

And then there’s the big kahuna – China.

With its economy on the ropes, China has just announced a colossal $839 billion spending plan over the next three years to help local governments refinance their hidden debts and boost the slowing economy.

It doesn’t take a genius to work out the inevitable result:

A savaging of currencies all across the world.

This isn’t guess work.

The Treasury recently admitted that in the lead-up to Rachel Reeves’ budget, she sought advice from leading City figures. Her goal: to guard against a “Liz Truss-style” meltdown of the UK bond market. And in turn, the pound.

In fact, with inflation ticking up once again, we’re ALREADY starting to see the effects of this filter through to the economy.

The good news is: situations like these are precisely what gold is meant for.

Unlike every single government-backed currency, you cannot print gold into existence. It cannot be diluted. And it cannot be manipulated.

THIS is why, as the value of currencies around the world has been decimated over the last 50 years...

Gold has done this.

If you want to help protect your wealth from nuclear-powered money printing...

Then gold is the logical and smart choice.

I really hope you are beginning to see the sheer size and scale of the opportunity in front of you right now.

Because as governments continue to destroy trust in their own currencies...

And as central banks continue to pile into the market.

I believe it’s obvious that gold will continue to hit all-time high after all-time high.

In just a second, I’m going to reveal to you my private plan for making a fortune from this situation.

I’m going to give you the key details of 3 gold stocks with natural, built-in leverage to the gold price. For every dollar rise in the price of gold, these could rise FAR more.

But first, I need to tell you about the final force driving gold higher...

Unstoppable Force #3:

The Global Powder Keg

There’s an old saying in financial markets: “In times of crisis, money moves.”

But that phrase is missing two crucial words in my view.

The full truth is: “In times of crisis, money moves into GOLD.”

You see, there’s a reason why gold has earned the title of the ultimate safe haven.

Its independence from governments, finite supply, and physical nature have preserved wealth through countless wars and economic collapses.

Which brings me to a sobering reality:

The world today is more dangerous – and loaded with more risk – than at any time in the past 70 years.

Look around...

Russia’s ongoing war in Ukraine is escalating by the day...

China is looking increasingly more likely to wage war on Taiwan...

North Korea continues missile tests with nuclear ambitions, threatening South Korea, Japan, and US territories.

Iran is nearing nuclear weapons capability, increasing the likelihood of a pre-emptive strike by Israel or its allies.

India and Pakistan remain locked in a decades-long conflict over Kashmir, both nations possessing nuclear weapons.

The Arctic has become a new battleground for territorial claims as Russia militarises the region.

Global arms races are escalating, with hypersonic missile systems making traditional defences obsolete.

Proxy wars are spreading in the likes of Yemen, Libya and Syria, as global powers compete for influence in Africa and the Middle East.

Turkey’s aggressive posturing in the Eastern Mediterranean over gas reserves has sparked tensions with Greece and NATO.

Energy infrastructure is coming under attack.

The US is more politically divided than it has ever been, with trust in its institutions at an all-time low.

Developing nations are struggling to service their debts, increasing the risk of widespread defaults.

China’s property sector crisis could trigger a global financial contagion.

Think of the world right now as a room filled with gas.

Not just a leak from one pipe... but gas seeping in from dozens of sources. Each crisis I’ve mentioned is adding more fuel to that room. And all it takes is one spark – one miscalculation, one desperate act, one wrong move – to ignite the whole thing...

And send an exodus of money out of global markets... and into GOLD.

I hope you are beginning to understand the scale of the opportunity you’re faced with today.

You’ve seen how central banks are bidding up the price of the yellow metal at rates never seen before.

How governments are once again unleashing cheap, easy money into the economy.

And how, with two land conflicts, in Ukraine and the Middle East that could escalate any minute...

Along with talk of major recession in China, the US, the eurozone and right here in the UK...

I believe it’s not a matter of IF people are on the cusp of turning to history’s greatest financial insurance policy – en masse.

It’s a matter of WHEN they begin to drive the price of gold past $10,000 over the coming years...

And crucially WHAT to buy to take maximum financial advantage of this colossal wealth shift, even as others see their own finances decimated.

And that’s why I’m speaking to you today.

Because when gold is in the ascendancy...

When the danger signs I’ve shown you are flashing red...

History has proven that, time and time again, ONE type of stock rules the market...

A type of stock that’s capable of multiplying your wealth many times over.

The Supply Kings

Look, owning hold-in-your-hand gold is a great way to benefit from booming prices, no question.

And it is a great means of wealth protection in turbulent times.

By now, I think you agree with that.

But I want to take things up a level for you.

And that means using a small amount of risk capital – that’s money you can afford to lose – on the gold investments that have the potential to shoot the absolute highest during gold booms.

I’m talking about gold miners.

Believe me, owning the right miners in a gold boom can be outrageously profitable.

That’s why I call them “Supply Kings”. Because in the right conditions – gold producers can reign supreme.

Yes, it’s great to own the physical stuff, without a doubt.

But when gold miners begin to take off during gold booms…

You can amplify the gains that physical gold makes you many times over.

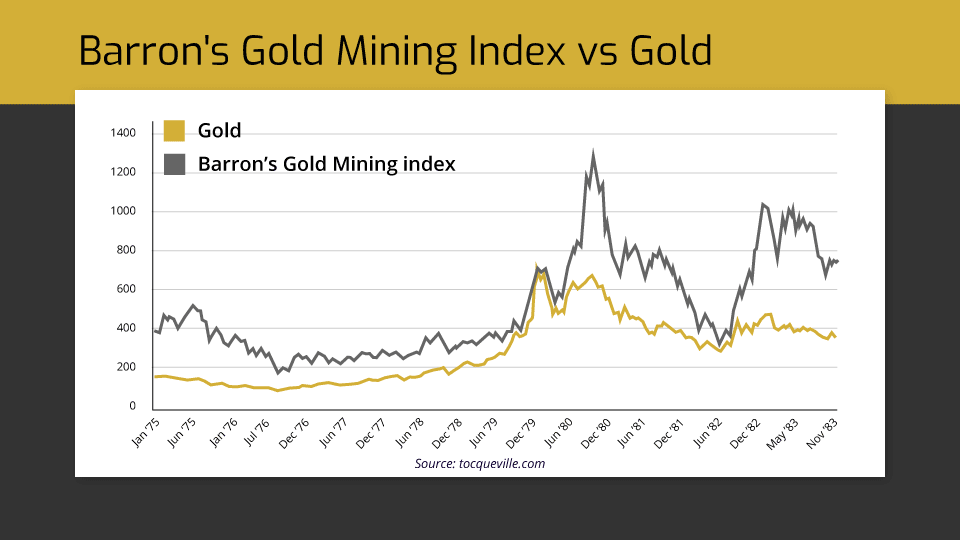

For example, take the iconic gold bull of the 1970s.

In 1979 the price of gold more than doubled.

But had you diversified into a portfolio of gold miners, just look at how much money you would have made – on average 2,313% – more than 10-TIMES the return on gold itself.

Those are insane returns. And a clear sign as any, that if you’re gunning for maximum gains in a gold bull market... the best way to play it is by investing in gold miners.

But as amazing as these returns sound…

Please know, winning big from a gold boom is not as easy as just buying any mining stock and watching it soar.

You need to understand HOW gold bull markets truly work... and WHEN these monster profits are most likely to occur.

You see, every major gold bull market in modern history follows a very specific pattern. One that unfolds in two distinct phases.

Let me explain...

In Phase One, institutional money – the kind controlled by central banks, sovereign wealth funds, and major financial institutions – floods into physical gold. This drives the price of gold dramatically higher, just like we’re seeing right now.

But here’s the fascinating part:

During this first phase, gold mining stocks don’t tend to make anywhere NEAR the blockbuster moves I just showed you.

Let me show you what I mean.

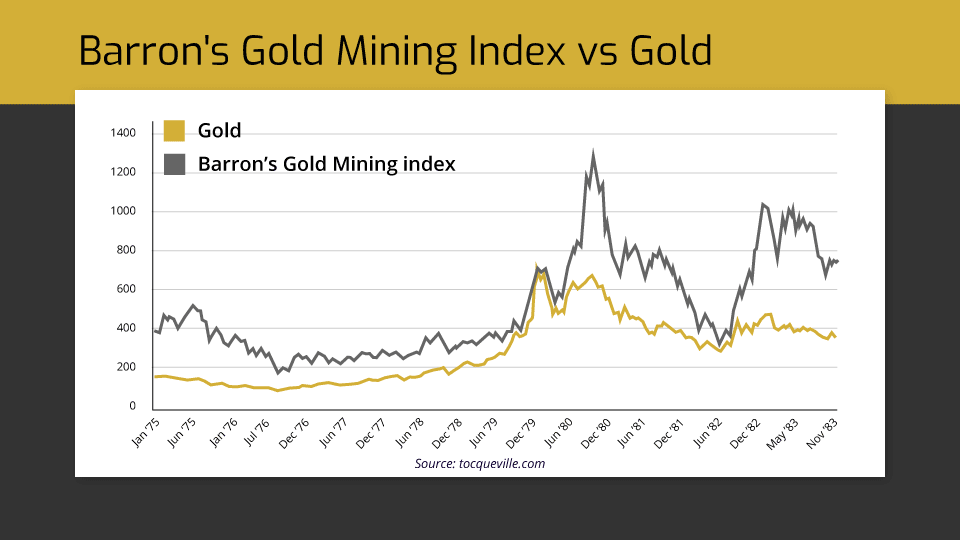

Take a look at this chart from the iconic gold bull market of the 1970s.

The orange line you’re seeing is the price of gold itself. As you can see, it’s moving steadily higher – exactly what you’d expect in a bull market.

But now look at the grey line. This is the Barron’s Gold Mining Index – tracking the performance of the largest gold miners at the time.

Notice something strange?

Despite gold marching higher and higher, the mining stocks are barely keeping pace. There’s none of those astronomical 1,000%+ returns I showed you earlier.

In fact, for much of this period, these mining stocks were actually UNDERPERFORMING the metal itself.

This is what I call Phase One of every gold bull market

And it makes perfect sense when you think about it...

When people first sense trouble in the financial system – when they first start to worry about their currencies being devalued – physical gold is the natural first move.

It’s the most logical place to park your money. The safest way to play the trend.

But then something interesting happens...

As the price of gold moves higher and higher, investors grow more confident in the trend. They see the profits being made. And naturally, they start hunting for ways to make even BIGGER returns.

They begin moving along the risk curve...

And that’s when they discover gold mining stocks.

When PHASE 2 of a gold bull market begins.

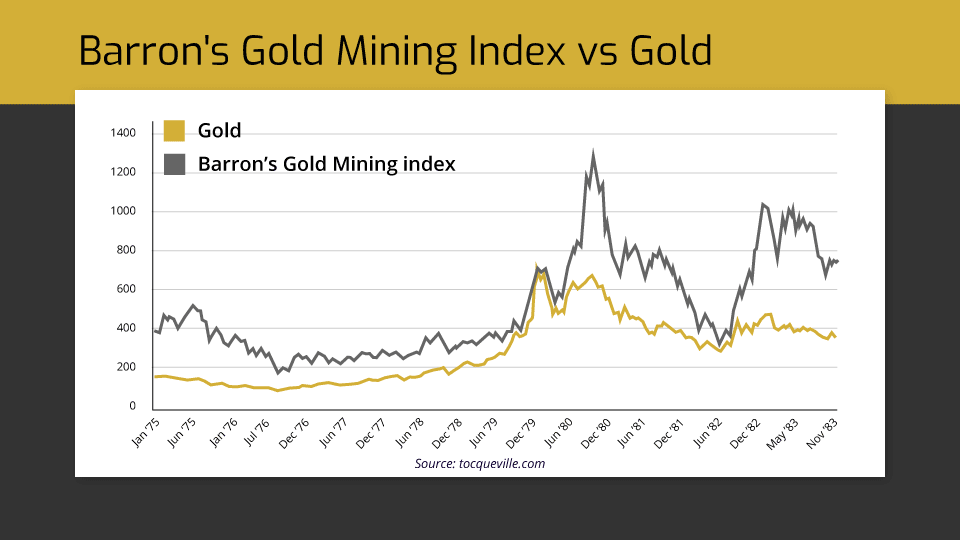

They’re easy to spot after the fact, because that’s when the price of gold mining stocks does THIS:

As you can see, months AFTER the price of gold has begun to rise, that’s when gold miners began to absolutely take off!

Just look at that grey line shoot vertical...

This is what happens when the flood of investors – now confident in gold’s upward trend – start piling into mining stocks.

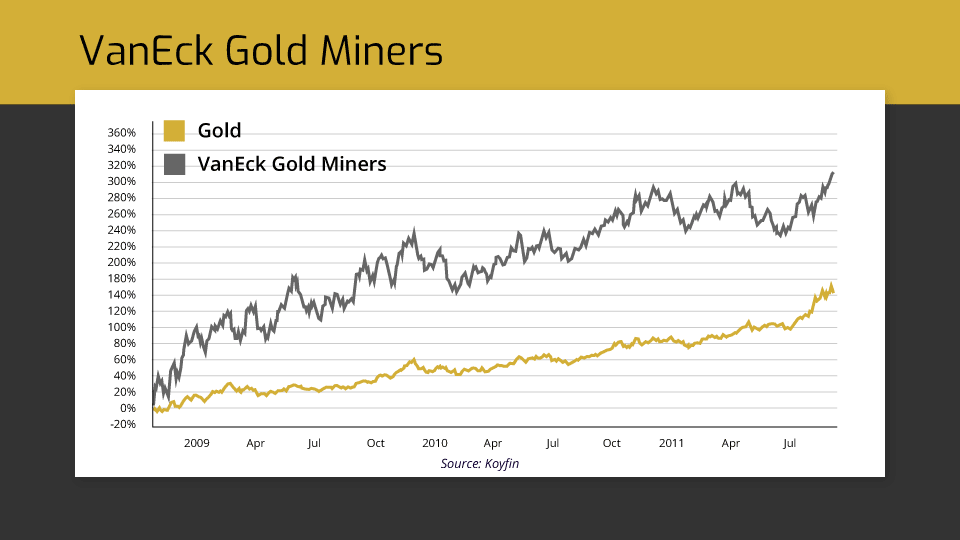

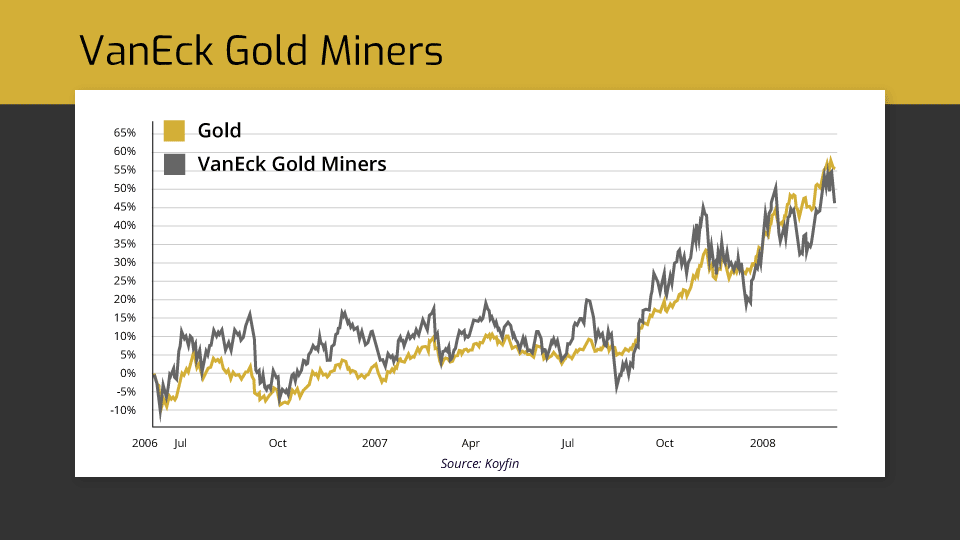

We saw EXACTLY the same thing happen in the gold bull market of the late 2000s.

As you can see, in the early stage of the bull market, gold and miners were neck and neck.

But then gold miners – those with proven reserves cashing in on their new, fat margins – started reporting on the insane profits they’d been making…

And that’s when phase 2 began in earnest.

Gold continued to make fantastic returns, more than doubling.

But gold MINERS blew those returns completely out of the water – more than TRIPLING between October 2008 and September 2011.

That begs the question: where are we now in the current bull market?

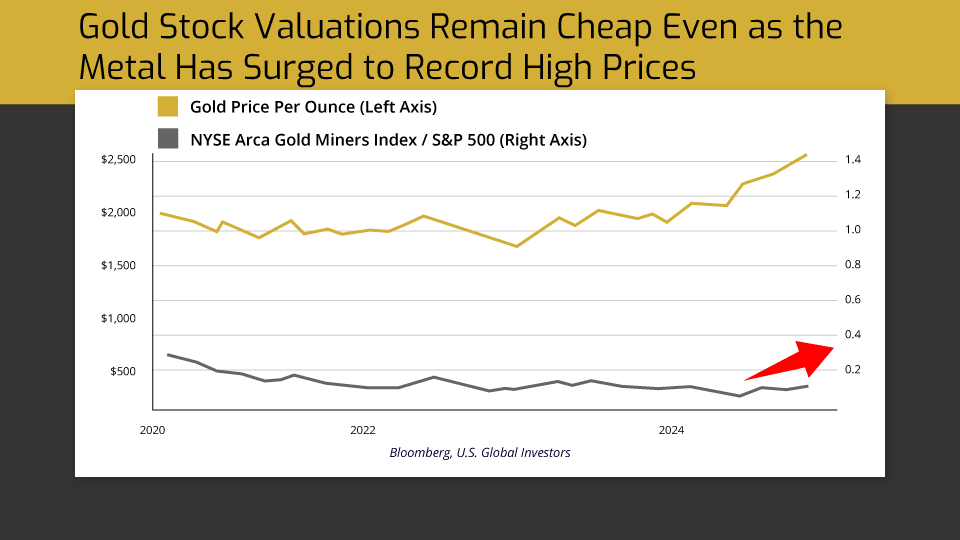

To tell you everything you need to know – you ONLY need to look at this chart:

What you’re looking at is the valuation of gold mining stocks compared to the price of gold itself.

And it tells an extraordinary story...

As you can see, up until very recently, gold miners have been trading at their lowest valuations in over two decades. They’ve been completely ignored by the market – despite gold breaking out to all-time highs.

But look closely at the far right of that chart...

Mining stocks are JUST starting to tick up.

This is absolutely crucial to understand...

Because right now, I believe you have the rare opportunity to do something that hardly ANY investor ever gets to do:

Buy into a market just BEFORE it begins to boom.

Frankly, as investors, we are very lucky to have this rare convergence of events fall in our laps.

Not only are central banks RAMPING UP their purchases of gold, driving unprecedented demand for the precious metal...

Not only are governments around the world devaluing their currencies putting more and more upward pressure on the price of gold...

But proven gold producers are on the cusp of posting blockbuster profits – igniting the SECOND phase of the gold bull market.

Now is your chance to stake your claim and reap MAXIMUM profit from the situation.

But the question remains. Which gold stocks do I buy?

You see, when it comes to deciding WHICH gold stocks to buy…

To ensure I only pick the cream of the crop, I’ve developed my own checklist. A gold miner must meet every criteria on this checklist for it to be added to my buy list.

- 1: Operations in politically stable jurisdictions with a narrow geographical focus

The mines must be located in countries with strong rule of law, clear mining regulations, and low risk of political disruption. Additionally, having mines concentrated in only a few regions reduces operational complexity and management overhead, leading to better cost control. And ultimately, more profits for us as investors.

- 2: Strong institutional ownership

Having significant backing from institutional investors is a powerful validation of a company’s potential. These institutions manage billions of dollars and employ teams of specialised analysts to conduct exhaustive due diligence – effectively doing the heavy lifting of separating the wheat from the chaff. When multiple institutions are building significant positions in a mining company, it serves as a valuable sanity check on your own investment thesis.

- 3: High quality ore grade

The higher the grade (grams of gold per tonne of ore), the more economical the operation. High-grade deposits mean less ore needs to be processed to produce the same amount of gold, resulting in lower processing costs, less energy consumption, and smaller environmental footprint. This directly impacts profit margins and makes the operation more resilient during price downturns.

- 4: Low debt – and a good debt plan

Miners always acquire at least some debt. I need to know how much and what they plan to do with it.

Now, I am pleased to inform you that I have uncovered “The Ideal Gold Miner”. One that ticks each of these boxes with flying colours.

So let’s look at how this ideal gold mining stock – what I believe could be the single best way to play the gold boom of 2025 – stacks up against my criteria:

- First up – Political stability

Unlike so many miners gambling their futures in unstable regions, this company has masterfully positioned 70% of its production in the Americas. In today’s uncertain world, that’s pure gold in itself.

- Next – Institutional backing

When I dug into the ownership structure, what I found stopped me in my tracks: a staggering 71% of shares are held by institutional heavyweights. We’re talking VanEck, Vanguard and BlackRock Group. These titans don’t deploy billions without exhaustive due diligence. Their massive stake tells you everything you need to know about this company’s quality.

- High-grade ore

This is where it gets really interesting. Its two flagship projects – strategically positioned in Canada and Alaska – aren’t just good. They’re exceptional. The ore grades at both sites absolutely dwarf what’s being processed at the Fort Knox mill – one of the largest gold processors in North America. In the mining world, grade is king – and these deposits are wearing the crown.

- The debt position

Now, any serious mining operation requires capital, but here’s what sets this company apart: it’s sitting on $2 billion in liquidity, including $465 million in cash. Yes, it has $800 million in debt – but it’s mapped out a crystal-clear path to wipe it clean by 2025. With gold prices where they are now, that’s looking to me like an absolute certainty.

This is exactly the kind of opportunity I’ve been hunting for. A rock-solid mining operation with best-in-class assets, institutional backing, and a history of exceeding expectations – all perfectly positioned to capitalise on the coming gold boom.

Now, it’s fair to say investing in this type of gold mining stock is riskier than investing in physical gold itself. And that greater risk also results in greater potential for reward, but it’s important to remember that should you decide to invest in such stocks that your money is at risk. Only ever invest what you can afford to lose.

You can learn everything you need to know about this stock in a special report I’ve put together called: 3 Essential Stocks for Your Precious Metals Portfolio.

Inside, I do an even deeper dive on “the ideal gold miner”. And why I believe it’s set to be one of the blockbuster mining stocks of this gold bull market. You’ll learn its name... its ticker symbol... and detailed instructions on how to buy it.

I’ll show you how to get your hands on this report in just a second.

But first, I want to tell you about the second stock I want to send your way.

I want to tell you about…

My Gold ‘Skimming’ Play

The next stock I want to share with you may come as a surprise.

It’s not a miner, it’s not an ETF, and it’s certainly not tied to any obscure type of gold bullion. Instead, it’s built around an incredibly smart business model – one that most investors have never even heard of.

I’m talking about gold royalty companies.

See, when most people think about making money from gold mining, they picture the companies doing the actual mining. The ones spending billions on equipment, hiring thousands of workers, and dealing with endless permits and regulations.

But royalty companies work differently.

Instead of mining gold themselves, they essentially “skim” profits from the gold industry in a brilliant way...

They provide funding to a host of different mining companies. In exchange, they get the right to purchase the gold produced at a heavily discounted fixed price – often for the entire life of those mines.

Think about how brilliant this is:

These companies operate with minimal overhead – often just a handful of employees in a small office. They have zero operating costs to worry about. No expensive equipment to maintain. No workers to manage.

But there are two things that make this business model truly special:

First, as I mentioned, they lock in incredibly low purchase prices for their gold. When gold prices rise, as they are now, that means they’re enjoying profit margins that most businesses can only dream of. And if gold hits $10,000 like I expect? Those margins will become absolutely astronomical.

Second – and this is crucial – they’ve found a way to virtually eliminate the biggest risk in gold mining.

You see, they let the mining companies handle ALL of the operational risk and expense. They’re the ones buying the equipment, hiring the workers, dealing with permits, and hoping they find enough gold to make it worthwhile.

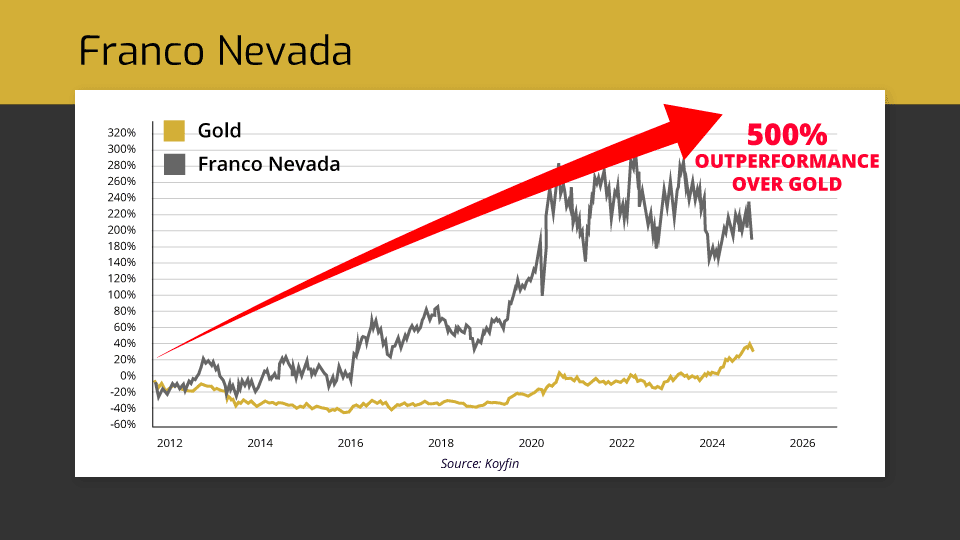

Take Franco-Nevada – one of the largest royalty companies on the market. It has 118 producing mines in its portfolio. If one mine runs into problems and stops producing? It still has 117 others bringing in money. That kind of diversification is simply impossible to achieve with traditional mining stocks.

And that approach has translated into serious stock market returns.

Past performance is not a reliable indicator of future results.

Five year performance of Franco-Nevada Corp: 2019 +48.8% | 2020 +14.69% | 2021 +16.29% | 2022 +8.61% | 2023 -20.72% | 2024 (to 30/11) +17.08%

As you can see, while gold itself has performed admirably, Franco-Nevada has absolutely crushed it – delivering more than five times the returns of the metal itself.

And it’s not the only mining company that’s delivered serious returns for its investors.

Royal Gold, another top 5 gold royalty company, is up more than 7,000% since the year 2000!

Past performance is not a reliable indicator of future results.

Five year performance of Royal Gold Inc: 2019 +43.97% | 2020 -12.08% | 2021 +0.05% | 2022 +8.47% | 2023 +8.64% | 2024 (to 30/11) +22.24%

But here’s what’s really exciting...

I’ve identified what I believe could be the number one gold royalty company in the world right now.

While companies like Franco-Nevada and Royal Gold pioneered this business model, I believe this company has perfected it.

Let me explain why:

First, it’s built its business on an incredibly solid foundation. A staggering 93-94% of its current production comes from mines in the bottom half of the cost curve. What does that mean? When a mine sits in the bottom half of the cost curve, it can typically produce gold profitably even when prices fall to $900 or below. This ensures steady, reliable cash flow no matter what happens in the broader market.

Second – and this is particularly telling – institutional investors own 63% of this company. When the smartest money in the world, the kind that has armies of analysts at its disposal, takes such a large position in a company, it’s usually a testament to the outsized potential.

Third, it’s structured its business to capture maximum profits. It’s locked in some of the most attractive purchase prices possible. We’re talking about operating margins between 75% and 80% – among the highest in the entire mining sector. To put that in perspective: for every £1 million worth of gold it produces, it keep £800,000 as pure profit. That’s the kind of margin most businesses can only dream about.

You can learn everything you need to know about this remarkable company in my special report: 3 Essential Stocks for Your Precious Metals Portfolio.

I want to hand you this report as soon as possible.

But – and forgive my frankness – I have spent too much time researching this opportunity to simply give these companies away in an open forum.

I’d like to give you this report in a much more discreet way…

Introducing...

I’m willing to send you this free report right away if you’re willing to take up a no-obligation trial to my monthly newsletter – The Fleet Street Letter.

This is a way I can talk to you “behind closed doors” and exchange my valuable report privately.

There’s no pressure to continue beyond your trial. You are free to take a look around, download your urgent gold investing report and see the other opportunities in my exclusive Fleet Street Letter portfolio.

Let me share a little about our methods.

Here at The Fleet Street Letter, we focus on something I like to call deep change.

This is very different to the way most so-called “experts” look at the world. Read most mainstream financial commentators’ work, and you’ll see it’s packed with superficial – and often downright wrong – analysis.

I’m sure you know the kind of thing I’m talking about: “The markets will go up in September. get out of Tesla – it’s going down this week.”

It’s all nonsense. It’s all superficial change. And it’s all entirely impossible, and therefore futile, to try and predict.

Deep change is different.

It’s shaped by the big, powerful forces or trends that nobody can control and 999 out of 1,000 people don’t even see. It’s based on demographic, political, economic and environmental trends... the slow moving but intensely powerful forces that impact everything and everyone.

The Fleet Street Letter isn’t just about the forces shaping the gold market. It’s about the forces shaping all of financial markets.

Let me share a little about our methods...

The Fleet Street Letter was founded by a remarkable British intelligence agent named Patrick Maitland.

In the 1930s, Maitland began as a Special Correspondent for The Times before being recruited into the political intelligence department at the Foreign Office. His career reads like a spy novel – surviving three assassination attempts, evading the Romanian Iron Guard during World War II, and escaping Albania as Italian forces invaded.

But alongside his work for King and Country, Maitland lived a double life.

He operated a private intelligence network through an independent organisation he called The Fleet Street Letter. It was this network that enabled him to make such extraordinary predictions.

In 1938, while most of Britain still clung to hopes of peace, Maitland’s intelligence sources helped him see the truth. He warned subscribers that war was inevitable, even predicting its timing: “Herr Hitler would like to postpone a conflict for another six months or until September.”

This warning, still preserved in the British Library, of course proved tragically accurate when German tanks rolled into Poland on 1 September 1939.

This tradition of prescient warnings continued through the decades.

In 1987, when most investors were caught completely off guard by Black Monday – one of the most devastating market crashes in history – Fleet Street Letter readers had been alerted to the danger five months in advance.

In 1997, two of our most celebrated experts – Lord William Rees-Mogg, former editor of The Times and father of MP Jacob Rees-Mogg, and James Dale Davidson, a close confidant of Bill Clinton – published The Sovereign Individual.

In it, they predicted “a new digital form of money... of encrypted sequences... unique, anonymous and verifiable” – effectively describing Bitcoin over a decade before its invention.

This prescient work so profoundly influenced PayPal founder Peter Thiel that he calls it his most influential book.

Our track record of foresight continued into the new millennium. On the exact day the Nasdaq began its devastating 77% decline in 2000, we warned subscribers that a “day of reckoning” was at hand for the dot-com boom.

Of course, we don’t have a crystal ball. Not all of our predictions are correct.

Eight years later, we alerted readers that “The City’s dream run is about to end... and it could trigger our worst recession in 35 years.” Just five and a half months later, Lehman Brothers collapsed.

While many call such events “unforeseeable,” the truth is different.

With the right insights, analysis and – most critically – the right contacts, it’s possible to see these momentous shifts before they happen.

Over the years, our organisation has included MPs, members of the House of Lords, ex MI5, Soviet spies, and a former Citi fund manager.

Today, our organisation works in much the same way. It’s comprised of leading financial and political experts the world over. Many of whom prefer not to have their names known in public. Some do. And I’ll introduce you to them in just a second.

So what do you get when you become a member of The Fleet Street Letter?

First off, you’ll get immediate access to your special report, 3 Essential Stocks for Your Precious Metals Portfolio…

That report includes the full details on “the perfect gold miner” and my “gold skimming play”.

You’ll also get access to one more opportunity I’m yet to tell you about.

And boy, is it a humdinger.

Now, you’ll notice the name of your special report isn’t “The Essential Gold Stocks” for your portfolio, but rather 3 Essential Stocks for Your Precious Metals Portfolio.

And that’s because the third investment opportunity I want to send your way isn’t a gold stock at all. It’s an investment into its little brother: silver.

You see, silver also looks primed to soar – for 3 simple but powerful reasons.

Let me quickly run through them...

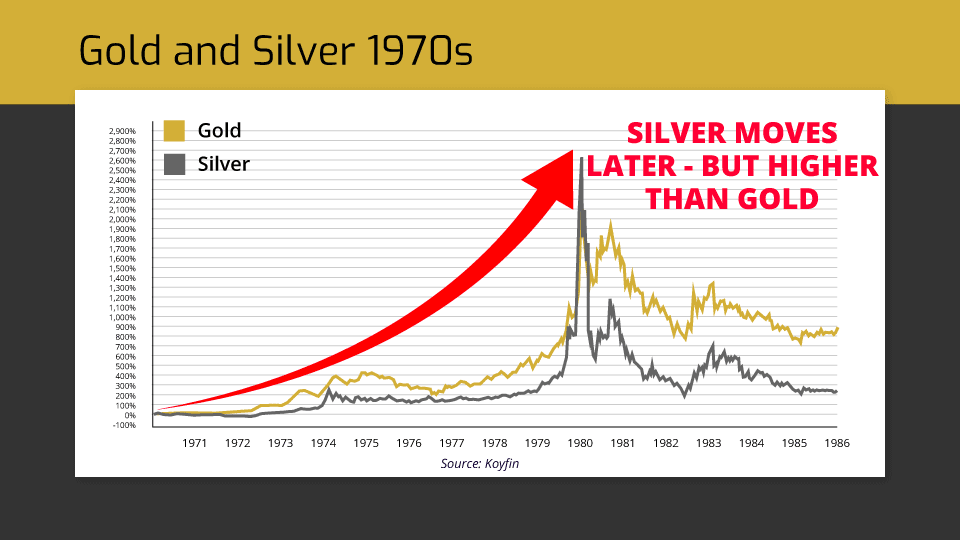

First, as you may know, in a secular gold bull market, silver also tends to rocket.

But much like gold miners, silver tends to move later – and even higher – than gold itself.

As you can see from this chart, during the 1970s bull market, gold takes off first.

But it’s shortly followed by silver, whose gains spike right through the gold chart.

This same phenomenon was even more pronounced in the bull market of the 2000s...

While gold rose in value by more than 5 times... silver massively outperformed – rising 8 times in value.

It’s a compelling pattern, no doubt.

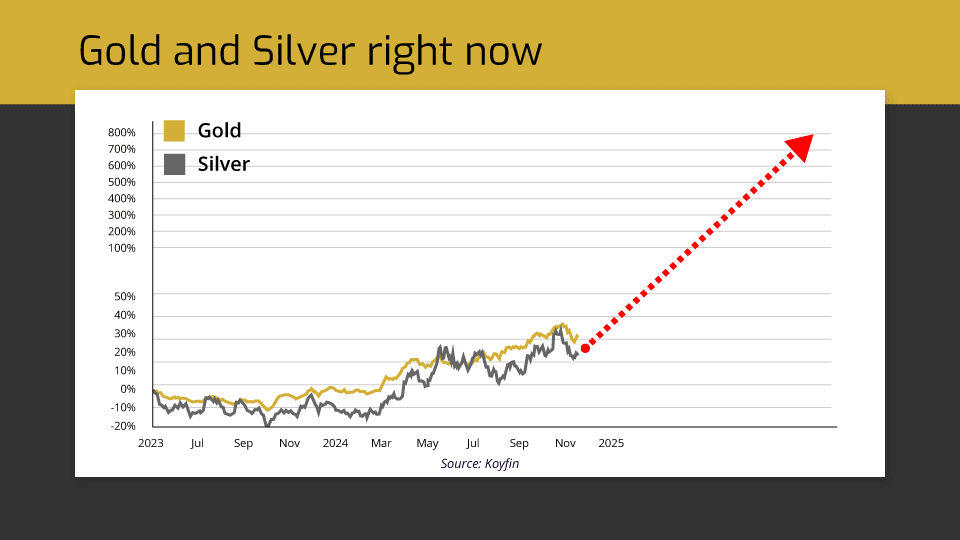

But how is the price of silver tracking to gold right now?

As you can see, silver is moving up. It’s slightly lagging behind gold in keeping with the pattern.. and that means the next step could be for silver to outperform in a massive way.

This alone is a flashing GREEN LIGHT to get some exposure to silver.

But silver has another major tailwind in its sails that makes this opportunity all the more compelling.

And it all boils down to the first law of economics: supply and demand.

As you may know, the AI boom has created a massive shortage of semiconductors. As a result, tech companies are scrambling to buy up every chip they can get their hands on.

Well, it just so happens that silver is a critical material in the manufacture of semiconductor chips.

Silver is the best conductor of electricity on the periodic table. It enables semiconductors to be more energy efficient and creates faster processing times. Ultimately leading to smaller and more powerful computer chips.

As you can imagine, this situation has only one outcome:

An explosive surge in silver demand.

As Money Metals Exchange recently stated, “Silver demand could deplete global inventories as early as next year...

Mining.com says that “Silver miners are struggling to keep up with demand”...

And International Banker recently reported that silver is experiencing “soaring industrial demand”.

And here’s the best part: while demand for silver is skyrocketing...

Miners’ hands are somewhat tied in their ability to produce it...

What am I talking about?

Well, as you probably learnt in O-Level economics, when the demand of something goes up, the supply usually rises to meet that demand. This brings the supply imbalance back into equilibrium. And stops the price rising higher.

But crucially that isn’t the case with silver.

You see, despite silver’s critical importance, only two mines in the world exist SOLELY to produce it.

There’s a reason for this...

Silver is usually produced as a by-product of other metals, like copper, zinc and lead, which have markets that are far larger than the one for silver. The market for copper, for example, is 33-TIMES larger than that of silver.

That means, unless silver were to rise to truly astronomical levels, the supply will remain somewhat capped. And the price only has one way to go: UP!

This is terrible news for the likes of Apple, OpenAI, Nvidia and Microsoft.

But it’s great news for precious metal investors like us.

As Crux Investor states, “Surging Industrial Demand and Constrained Supply Set Stage for Silver Bull Market”...

Investing.com echoes that sentiment, saying “Silver is set to soar”.

While Kitco says the coming silver bull will be like the 1970s.

In your special report, 3 Essential Stocks for Your Precious Metals Portfolio, I’ve identified what I believe is the perfect silver stock to capitalise on silver’s coming surge.

It’s UK based. So you can buy it with just a few clicks of your mouse through your brokerage account. And it flies through my 5-point checklist with flying colours.

That’s all I can say about this company for now – revealing any more details could compromise the opportunity for our current members. But I’ll show you how you can get your hands on that report in just a second.

As you can see, my aim in The Fleet Street Letter is to get you ahead – and profiting from – the most lucrative and impactful changes taking place in the world today.

And it doesn’t stop with this report.

Over the course of the year, we’ll send you 12 issues of The Fleet Street Letter.

In these monthly reports, we dive deep.

The financial world moves fast. New trends and threats develop. Old ones die. There’s no one single “set and forget” approach you can take to thrive in the modern financial world.

That’s why our monthly deep-dive reports are so valuable.

They’re your way of staying up to date with the latest thinking, ideas, threats and opportunities.

That might be a new risk developing... a new money-making opportunity... a new position for your portfolio. It depends on what’s happening in the world.

But whatever IS going on... we’ll be there, on your side and in your corner.

You’ll also get a copy of our newest report, What to Do With Your Money Right Now.

This report does exactly what it says on the tin – it shows you, in specific detail:

- The exact stocks you need to avoid like the plague as the shift away from the dollar and currencies around the world continue to be devalued.

- The only FTSE 100 companies you should even consider owning in a crisis of confidence.

- The exact asset allocation strategy we’re recommending all serious investors use right now.

- How much of your portfolio should be tied up in property and other real estate.

But that’s not all. There’s another report we’ve prepared for you. It’s called The Trade of the Decade.

Inside, you’ll learn about the world’s most essential industry, the one on which all others depend, and in which the world has chronically underfunded and poorly managed for decades.

That industry is energy, and we have three specific recommendations for how investors can profit from both turmoil and transformational advances in the global energy economy.

You’ll get copies of all of these special reports as soon as you become a member of The Fleet Street Letter.

Nick Hubble,

Editor, The Fleet Street Letter

Each and every one of these reports are put together by myself and my esteemed colleague Nick Hubble. You likely know Nick already from the interviews he’s conducted for this very summit.

Nick has an incredible track record of making big, controversial calls that turn out to be right on the money.

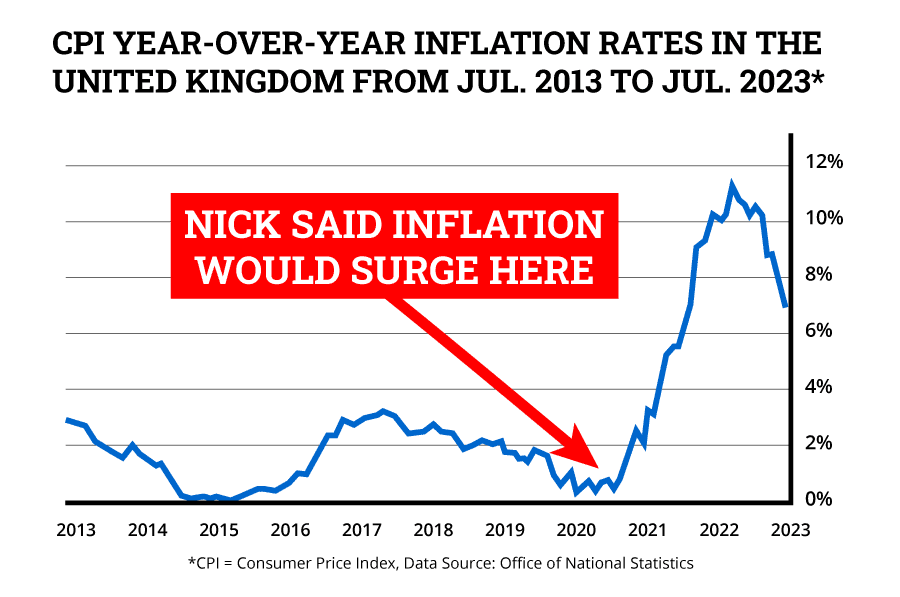

As far back as July 2020 he predicted a historic surge in inflation was coming.

At the time, central banks were saying inflation was “transitory”. But Nick was right. Inflation soared to a 30-year high... with food and energy up more than 50%.

In July 2020, Nick warned inflation would cause trouble in the bond market...

He wrote:

“The stakes couldn’t be higher for investors. Especially with the alternative – bonds – faring even worse.”

He was right. Bonds crashed into their worst bear market since the 1800s, with some UK government bonds losing 65% of their value in less than two years.

When you sign up to the service, you’ll receive a new issue from us every month – diving deep into the unforeseen forces shaping the world.

You’ll also get:

- Full access to the The Fleet Street Letter portfolio

This is what REALLY sets our work apart from the mainstream.

We’re not just here to explain what’s happening.

We translate that into an entire portfolio of investment ideas you can use to turn that knowledge into action.

Generally speaking, the recommendations we share with you will involve the stock market. That involves risk – as all investing does.

Some of our recommendations may be listed abroad. That may involve foreign currency risk as stocks listed overseas may have the added risk of forex movements. And the funds we may recommend have a counterparty risk.

Every recommendation is for your risk capital only – that’s money you can afford to lose.

We’ll explain this to you clearly with every new recommendation. In fact, EVERY SINGLE idea we share with you will contain a full write-up of the potential risks and rewards, everything you need to know to make an informed decision and take control of your wealth.

That’s huge.

Think about it.

You can pay £700 for a subscription to The Financial Times...

But NOWHERE in those pages of news will you find a single investment recommendation.

It’s all fluff. All noise. It doesn’t matter how many PhDs the editorial teams have. They’re not sharing anything you can ACT ON.

The Fleet Street Letter is different.

You’ll walk away from almost every issue with a fully researched investment recommendation that ties into our worldview.

And you’ll be in good company.

The Fleet Street Letter has a committed readership of serious investors – some of whom have been following our work for decades.

And, in that time, we have received messages of appreciation for our work, like this note from James Muir, one of our longest-serving members:

I regard it as my investment bible.

– James MOr this note from Barbara, another satisfied member…

I know I am with an excellent group of experts giving advice for me to then reflect and make my own decisions. I also appreciate and understand the relevance of the historical perspective and intellect documented of previous major historical events and their overall relevance on today’s world. New Investors most certainly try it. It provides independent, forthright information - a sound basis for investment.

– BarbaraOur inbox is full of such praise for our research and recommendations:

It’s well written. It’s easy to understand. It’s not over adventurous and it talks sense.

– John SOf all your titles over about 15 years The Fleet Street Letter is my favourite. It does the research that I’d never have time for.

– Colin BI based my mortgage decision on The Fleet Street Letter’s forecast and it proved to be remarkably accurate.

– Ian CYou have given me the big picture of everything, which Financial Advisors do not discuss – all of the information is valuable to me.

– Glenis KThe Fleet Street Letter often provides clear insightful analysis of what is going on behind the scenes in both the political and economic arenas. This is critical information for anybody who wishes to successfully navigate the tricky investment waters of today. Keep up the good work and thank you to all the team.

– Glyn WIt makes me feel incredibly proud to get this sort of feedback.

These investors now have a jump on the rest of the market. They are getting my regular intelligence and insight on how the deep changes happening in the world today. And how to position their money to profit from it.

Now it’s your turn to become a part of The Fleet Street Letter.

The cost?

It’s not cheap.

This is serious research and market intelligence designed to help you make good decisions with your wealth and savings.

Quality research doesn’t come cheap.

That’s why a one-year subscription to The Fleet Street Letter costs £249.

That’s a fair price for a team of world-class financial analysts sharing their most valuable ideas AND investment recommendations.

But today you can get your first year for as little as £99 – as part of a special introductory offer only for Gold Summit attendees.

It’s fully endorsed by my 90-day money back guarantee. So if you don’t like what you see, you can simply call our Customer Service team any time in the first 90 days, and we’ll refund every penny you paid.

Now it’s worth noting this is TRIPLE the standard guarantee period we offer on our services. And it’s a testament to just how much confidence I have that you’ll love the service when you try it.

Just click on the button to get started.

Click here to take up your special introductory offer to The Fleet Street LetterIt really has been my honour to host the Southbank Gold Summit 2025.

I hope I have shown you how serious I am about helping you understand why now looks like such a great time to get into gold...

And into the RIGHT gold stocks.

I just hope you can see that NOW is the time for action.

Gold is experiencing its best year since the 1970s...

Central banks are reversing a 50-year trend. They’re once again the biggest buyers of gold on the market – driving gold demand higher and higher...

Governments around the world are returning to their agenda of currency debasement...

Geopolitical events are threatening to send trillions of dollars into gold at a moment’s notice...

And all this while gold stocks – trading at all-time lows – are just beginning to embark on a rapid and steep rise.

We’re slap bang in the middle of a perfect storm for the gold market here.

This is a situation that gold investors have been DREAMING about.

And it’s one you can put yourself in today – for what amounts to just 27p a day.

Investing in the right gold stocks could be the most lucrative decision you ever make. Don’t be left wondering.

Join the The Fleet Street Letter and get the names and ticker symbols of my top gold stock picks today.

Click here to take up your 90-day no obligation trial to The Fleet Street LetterI’ve done what I can to bring you in on this opportunity, and in a way that works for you.

I’ve taken £150 off the price of a membership.

And I’ve taken all of the pressure off your decision by extending the usual 30-day money-back guarantee period to 90 days.

Now it’s over to you.

Don’t leave room for regret.

Grab this gold opportunity with both hands.

Click the link below to sign up to The Fleet Street Letter and get the names of my top 3 stocks for in the NEW boom in gold.

Yours sincerely,

John Butler

Investment Director, The Fleet Street Letter

Forecasts are not a reliable indicator or future results.

Important Risk Warning

Advice in The Fleet Street Letter does not constitute a personal recommendation. Any recommendation should be considered in relation to your own circumstances, risk tolerance and investment objectives. Before investing you should consider carefully the risks involved, including those described below. If you have any doubt as to suitability or taxation implications, seek independent financial advice.

General – Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Small cap shares - Shares recommended may be small company shares. These can be relatively illiquid meaning they are hard to trade and can have a large bid/offer spread. If you need to sell soon after you bought, you might get backless that you paid. This makes them riskier than other investments.

Overseas investments - Some shares may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Taxation – Profits from share dealing are a form of income and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change.

Funds – Fund performance relies on the performance of the underlying investments and there is counterparty default risk which could result in a loss not represented by the underlying investment.

Investment Director: John Butler. Editor: Nick Hubble. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Ltd. Full details of our complaints procedure and terms and conditions can be found at, www.southbankresearch.com.

The Fleet Street Letter contains regulated content and is issued by Southbank Investment Research Limited.

Registered in England and Wales No 9539630. VAT No GB629728794. Registered Office: Basement, 95 Southwark Street, London SE1 0HX.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No706697. https://register.fca.org.uk/.

© 2024 Southbank Investment Research Ltd.

Sources:

1 Mining.com - Gold price could hit $12,000-$15,000 long term as it enters new bull phase, says analyst – 5 July 2023

2 Money wise - Peter Schiff says gold could skyrocket to $100,000 an ounce and ‘there’s no limit.’ Here’s why – 17 November 2024

3 Gulte - US: 77% Costco Outlets Were Sold Out of Gold, Why? – 16 October 2024

4 CBS News - Why are Costco's gold bars selling out? – 15 October 2024

5 Kitco News - Druckenmiller bets on the world’s two largest gold producers – 15 February 2024

6 Markets Insider - Ray Dalio Says He's Owning Gold to Hedge Debt, Inflation Crisis – 19 April 2024

7 Kitco News - Sohn conference: David Einhorn’s Greenlight Capital hold gold as a defensive asset – 4 April 2024

8 CoinDesk - Paul Tudor Jones: 'All Roads Lead to Inflation;' He's Long Bitcoin and Gold – 22 October 2024

9 The Jerusalem Post - Russia's Gold Reserves Hit Historic $207.7 Billion Mark – 10 November 2024

10 The Jerusalem Post - Russia to Increase Daily Currency and Gold Purchases by 35.5% - 8 November 2024

11 International Baker - What’s Behind China’s Gold-Buying Spree? – 14 August 2024

12 The New York Times - China Is Buying Gold, Sending Prices to Record Highs – 5 May 2024

13 LinkedIn - Saudi Central Bank Caught Secretly Buying 160 Tons of Gold in Switzerland – 12 September 2024

14 Money Metals - Europe Is Finalizing Preparations for a Gold Standard – 8 November 2024

15 Money Metals - Nations in the mBridge Project Are Stockpiling Gold, Driving Up Prices – 23 September 2024

16 Bloomberg - Central Bankers Make Rare Comments in Favor of Bigger Gold Stash – 14 October 2024

17 X – Krishaun Gopaul – 8 November 2024

18 The Jerusalem Post - Gold's Biggest "Buy Season" Could Be Here – 7 September 2024

19 Youtube – The New York Order of Finance – 11 November 2024

20 Nasdaq - How Would a New BRICS Currency Affect the US Dollar? – 6 November 2024

21 Office for National Statistics - Internal purchasing power of the pound (based on RPI): 1982=100

22 Retrowow - How much did cars cost in the 70s?

23 Trading Economics - Euro Area Interest Rate

24 Trading Economics – Canada Interest Rate

25 Trading Economics – China Loan Prime Rate

26 Trading Economics – Interest Rate Countries List

27 The Telegraph - Train drivers offered bumper pay rise from Starmer to end strikes – 14 August 2024

28 This is Money - What the Autumn Budget 2024 means for you: How Rachel Reeves' £40bn tax rises will hit – 1 November 2024

29 MoneyWeek - Rachel Reeves announces major change to fiscal rules to free up billions of pounds – 25 October 2024

30 Bloomberg - Brussels to free up billions of euros for defence and security from EU budget – 11 November 2024

31 POLITICO - €500B remains unspent from EU’s Covid recovery fund – 8 April 2024

32 The Economic Times - PM Budget capex: India's Budget 2024-25 focuses on ambitious capital expenditure, decarbonisation initiatives – 24 July 2024

33 The Irish Sun - Major boost as thousands of Irish to benefit from extra €8.3bn in Budget 2025 amid tax cut & public spending plot – 9 July 2024

34 Reuters - Nigeria plans $28 billion spending for 2025 budget, minister says – 14 November 2024

35 Le Monde - Russia increases defense budget by 30% - 1 October 2024

36 Reuters - German government collapse could have silver lining for Europe's markets – 13 November 2024

37 AP News - China approves $840B plan to refinance local government debt, boost slowing economy – 8 November 2024

38 The Guardian - Treasury installs ‘guard rails’ to avoid Liz Truss-style budget meltdown | Autumn budget 2024 – 18 October 2024

39 FXStreet - Surging Silver demand could deplete global inventories as early as next year – 13 August 2024

40 International Banker - Does Soaring Industrial Demand in 2024 Signal a New Era of Higher Silver Prices? – 15 August 2024

41 Research and Markets - Copper, Nickel, Lead, And Zinc Global Market Report 2024

42 Kitco News - Why the gold & silver bull will be like 1970s – 23 September 2024